Given that Black Friday weekend, including Thanksgiving itself, was uninspiring, the fact that the Commerce Department’s estimates for retail sales for all of November were again among the worst shows that Black Friday actually remains a pivotal part of the holiday setup. The trend has been to dismiss the traditional Christmas buying season kickoff as if earlier discounts might have the effect of boosting overall spending; spend less on Black Friday and the days around it so you can spend more in total?

Cannibalizing Black Friday weekend is just that, not a positive multiplier. Expecting otherwise just doesn’t make sense because people are going to spend what they are able, and the timing of the spending is incidental to their ability. Thus, the rather atrocious (yet again) spending estimates for November are commentary on that ability.

That is why there has been such a rush to “color” as much as possible any interpretations using the word “strong” or “solid” repeatedly, especially this year since retail and consumer spending didn’t just start to be recessionary in November. As an example, the National Retail Federation circulated its press release this morning, in light of the damning retail sales figures, which included internal contraction right at the start:

The first half of the holiday season is officially under wraps and it appears holiday shoppers in November were out in full force according to the National Retail Federation’s latest retail sales data, though on the surface, trends may appear softer than expected. However, according to NRF Chief Economist, the rise in November retail sales is actually very much in line with the events that are shaping the 2015 holiday shopping season. [emphasis added]

The title of the release is “First Half of the Holiday Season Shows Solid Growth.” Even the usual credentialed economist had to be careful in picking “solid” interpretations – after placing that description in the most benign-sounding context possible.

All in all, the growth in November really does point to a healthy consumer who at the end of the day will help retailers see solid growth, despite the economic and environmental challenges. Retailers are well-prepared for these challenges and are keen to continue to offer their shoppers a worth-while holiday shopping experience. [emphasis added]

In short, retail sales for November kicked off the Christmas shopping season with solidly atrocious results because of some unspecified “economic and environmental challenges” (assuming that he is referring, of course, to November weather, apparently now self-conscious about using snow and cold for the third straight winter). The problem with that kind of analysis is its blatant skewing since this year was supposed to be completely free from any “challenges”, snow, income or otherwise. If the FOMC is itching to raise rates that means, without qualification, that they feel the economic risks are leaning toward “overheating.” Weather isn’t supposed to weigh on such circumstances, nor are consumers supposed to be reticent for any reason, specified or not.

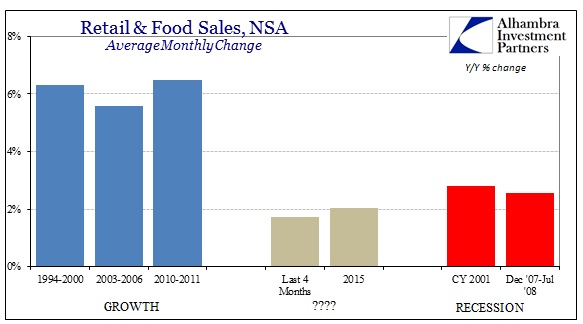

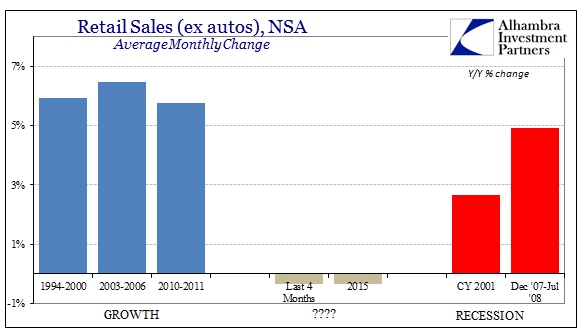

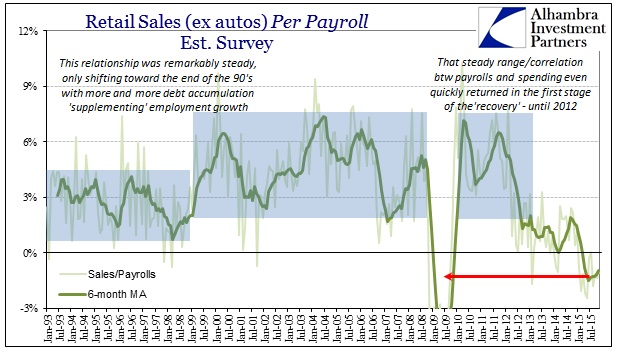

Further, “solid” economic growth contains at least a qualitatively testable assumption. Historically speaking, we know “solid” growth when we see it because it, obviously, appears in close relation to past periods where “solid” was undeniable on almost every count. In retail sales, that number is 6%. In fact, that average is so repetitive across “boom” periods in the economy as to be almost the only constant feature. If the economy (at least the financialized version of the past few decades, the same one that Janet Yellen is suggesting of “overheating”) is performing then “solid” retail sales mean at least something close to 6%.

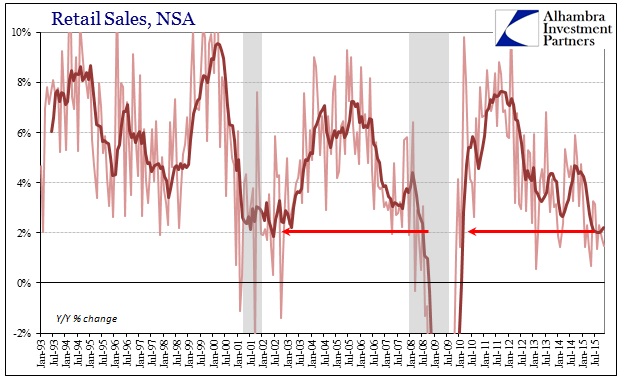

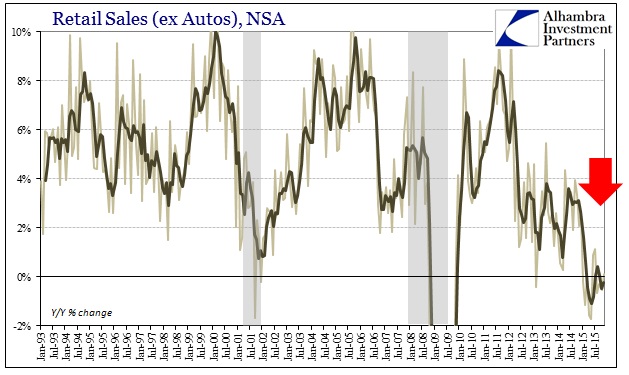

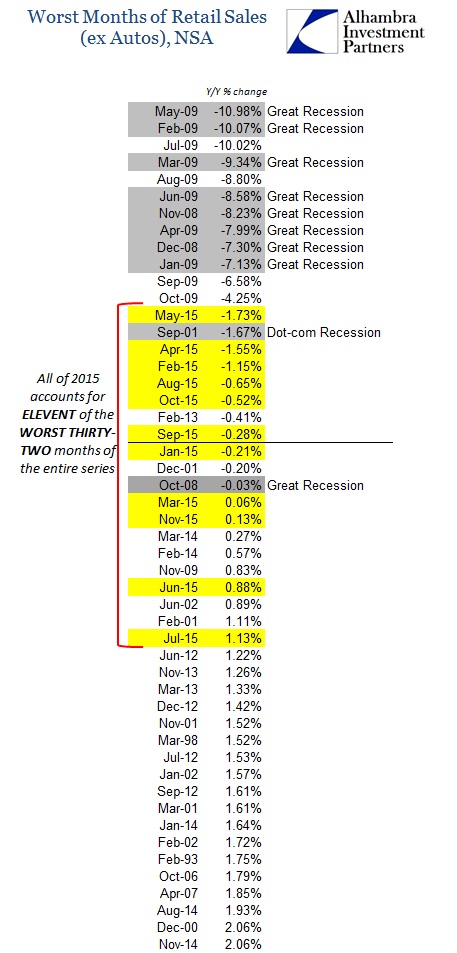

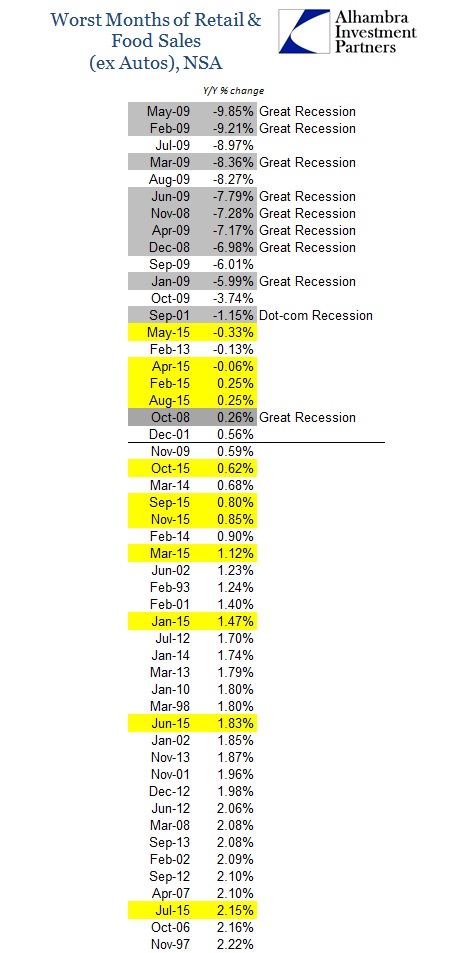

So by reasonable test, retail sales are actually and “solidly” recessionary of late; a time period that is expressed more than the past four months, instead containing the whole of this year. Overall retail sales (including everything, autos, food, the whole consumer) have been less than 2.5% year-over-year for the past four months straight (including three less than 2%), as well as eight of the past ten months. Ex autos, retail sales have been less than 1% in each of the past four months and less than 1.5% in nine of the past eleven. Not only is consumer spending dreadful, it has remained so for an extended period.

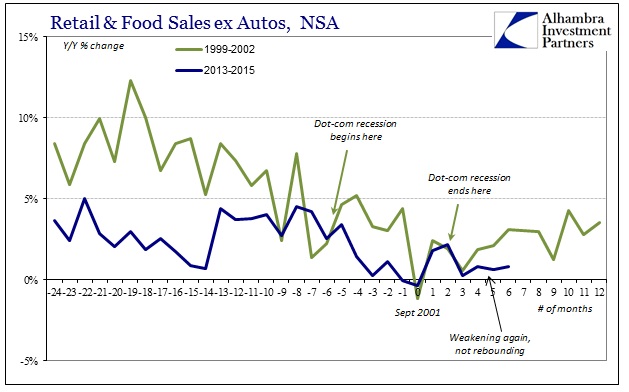

By every judicious standard, retail sales show at least consumers within the throes of recession already. Even by direct comparison with the dot-com recession, the current period is already worse and in that position for longer.

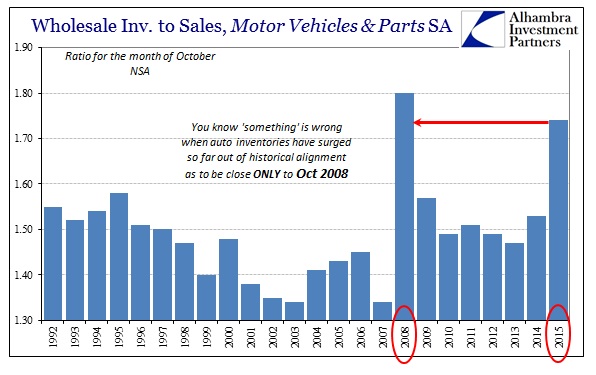

Even auto sales have slowed of late, with auto sales up last month “just” 4.8% over November 2014. That was the slowest growth since the Polar Vortex “environment” of early 2014. Given the already alarming auto inventory levels from October’s wholesale estimates, the inventory imbalance isn’t likely to have been any better and could possibly have already turned out worse. Such interpretation applies across the entire “goods economy” as inventory piles up everywhere while solidly atrocious top level sales continue on.

This deficiency in spending continues no matter what the mainstream assessment of the labor market. As noted at the last payroll report, spending and jobs had consistently demonstrated a close correlation, as you would expect. That changed in 2012, as retail sales suddenly, significantly and persistently weakened just as the BLS somehow found an accelerating payroll environment. In 2015, that correlation surrendered even more even though the labor market has softened in the major statistics. This is the reason, more than anything, that economists are so enamored with snow and winter as the once-durable relationship between jobs and spending has so spectacularly diverged.

In economic terms, it presents almost a completely binary interpretative choice – either the payroll figures are correct or the spending estimates are. If you believe the former, then extraordinary conditions, even meteorology, have to apply. However, given the massive inventory buildup and accumulation along with the spreading “manufacturing recession” (and all sorts of anecdotes on shipping and freight, not to mention commodities) the idea of the economy as the BLS tells it in the Establishment Survey and the unemployment rate bends more and more implausible by the month.

That leaves retail sales and the consumer as “solid” only in comparison to some truly ugly circumstances, but “it could be worse” isn’t much of a rallying cry. Instead, “overheating” is the farthest concern from the actual economy as it is right now, especially as inventory, manufacturing and shipping all suggest in unison that it could, actually, be worse, and quite likely will be.

Stay In Touch