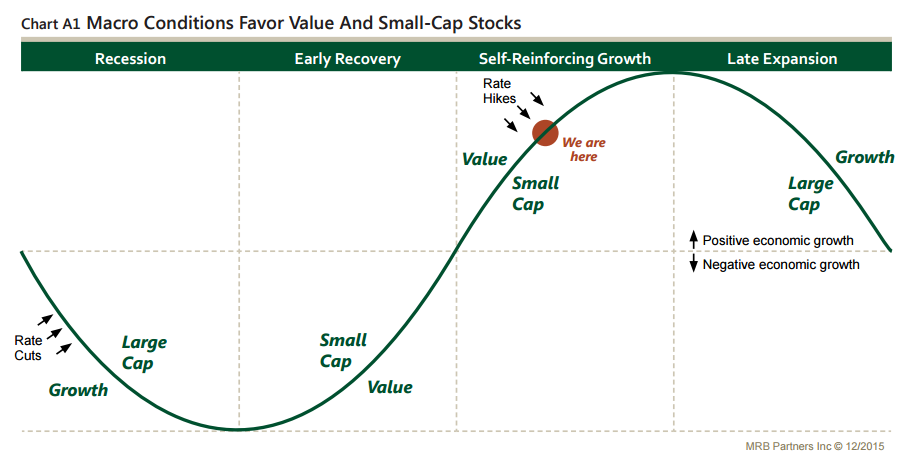

The graph below shows where to, historically, find out-performance given our likely position in the economic cycle.

Some caveats of note to the generalized history shown. One is wise to consider both interest rate manipulation and behavioral factors stemming from and contributing to the extreme markets of the last 2 decades before blindly accepting this style and size equation. These factors give us reason to believe that the growth/value equation may be out of synch with this historic view.

Value was shunned during the exuberance of the late 90’s. The losses suffered in the dot.com crash of 2000-2001 left investors with little appetite for high flying growth stocks. The subsequent recovery, 2002-08, was characterized by a weak dollar and a commodity bull. These 2 factors set the stage for value stocks to out-perform to an extreme during the last bull market and be poorly valued at the onset of this reecent bull.

This same commentary could also be written about small and large cap stocks. Large cap names were the rage in the late 90’s and small cap stocks performed well from 2002-2008.

Recent struggles in the energy and materials sector have extended the drag on value plays. At the same time, credit conditions have not favored small caps. Hot money has fed public, large cap growth names. And, growth has been the darling of the recent rally.

But, should this “tentative recovery” shift to a state of “self-reinforcing growth” from continued strength in areas like employment, we could see greater investor confidence and a larger appetite for risk. Small caps and value plays should benefit from this change in investor outlook and provide leadership in the next leg up.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@alhambrapartners.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch