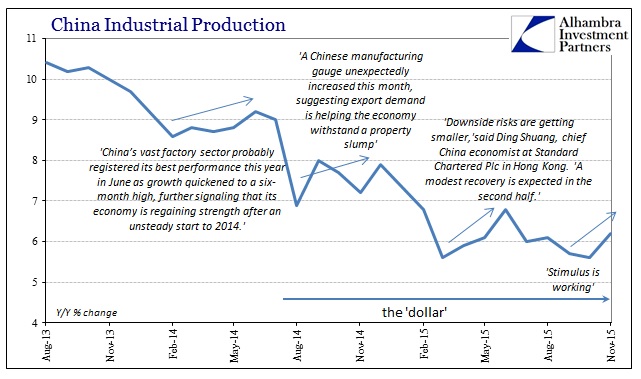

Industrial production in China accelerated in November to 6.2% from an abysmal 5.6% in October. As per usual, any similar change is met with assurances that this time, unlike all prior, everything is working. It has become a regular game of ill-considered contention, as every single move in IP or some other factor that stops declining is immediately and confidently declared definitive in extrapolation. This has been true of variability lasting just one month or several months, as every time it is “proof” “stimulus” is performing and every time it fails to continue along the extrapolation.

“It’s pretty good news in a way, that the stimulus is finally working,” said Mizuho Securities Asia economist Shen Jianguang. “It’s definitely not a major turnaround. But it is good to have a reversal of the downward trend.”

Saturday’s industrial-production data, the indicator’s first acceleration in four months, suggests that stimulus policies are gaining traction. Over the past year, Beijing has cut interest rates six times, pushed through hundreds of infrastructure projects and cut required bank reserves several times, freeing up more money to lend.

The problem with the “stimulus” view is basic central bank and eurodollar math (subscription required), a factor that nobody seems to consider. That isn’t all that surprising since orthodox views on such things demands little actual scrutiny other than saying or writing the word “stimulus.”

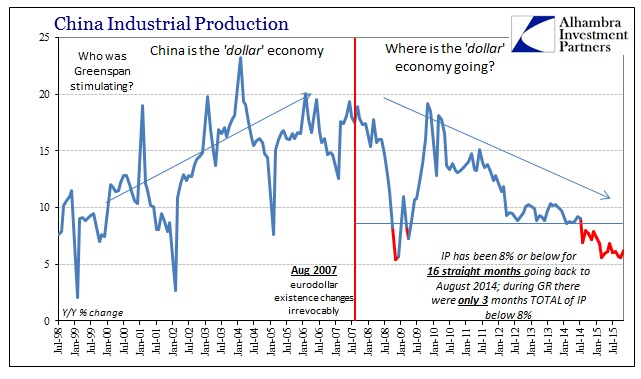

Beyond the raw monetarism, there is the larger economic context for 6.2%; in truth, 6.2% isn’t different from 5.6% as both are almost equally atrocious. Industrial production has been at or below 8% for sixteen straight months, a lingering depravity of volume not seen since the 1990’s. November’s “hopeful” acceleration would qualify as the third worst month of the Great Recession where only three months in total, and not consecutively, had IP been less than 8%.

To declare that “stimulus” works in even close to its assumed manner would be to see an uninterruptable and obvious path not from 5.6% to 6.2% but rather from 5.6% to 15.6%. November’s variation counts as barely noticeable on the chart immediately above, marking again normal volatility rather than some suddenly effective catalyst. That is the problem with assigning monetary efforts to this minor uptick, as “stimulus” has been the common theme (in commentary) going back to last November; a full year of interest rate cuts and reserve requirement reductions and nary a suggestion of any durable rebound.

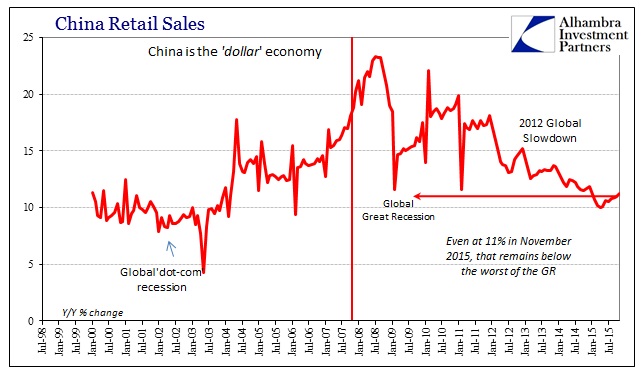

In other words, when the PBOC started over a year ago industrial production was closer to 8%, and now something barely 6% is cause for optimism? That comparative view is applicable not just to IP but to retail sales that have accelerated for four straight months (and five out of the past six) and yet that rise is no different than those of the recent past (such as the nine months of acceleration in 2013), still leaving the series historically depressed.

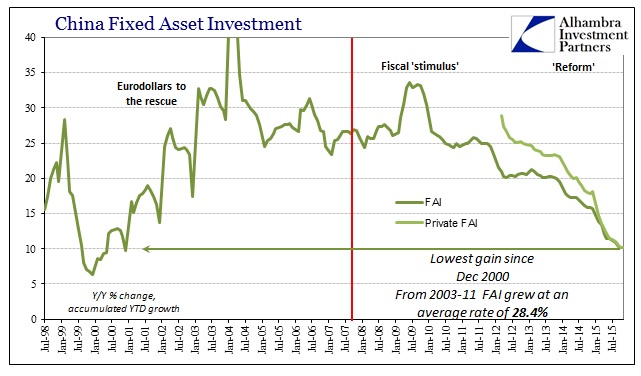

For all the fuss about individual months and even short-term periods of multiple months, the obvious trends remain completely intact. Tracing back to 2012 and really 2007, the economic trajectory in China is painfully clear and painfully unalterable. For all the talk about “stimulus” in 2015 it pales in comparison to that which was unleashed in 2012 – and still the economic trend has been unmistakably opposite unconditionally since then. There is, again, a much deeper math at work here that just isn’t factored in all these narrowed, orthodox assurances.

Nothing economic or financial moves in a straight line, but China’s economic existence in the past few years comes close to challenging that assertion. Within a surprisingly narrow volatility corridor, the slowdown across the Pacific has been disastrously dependable. Until something radically alters that paradigm, there is no reason to expect monthly variation will be anything but that. Once more, the math just doesn’t add up to anything close to possible for it, as China’s defining monetary condition remains.

Like the ECB and the European economy, the PBOC has been an almost constant presence on the historical series shown above, and yet leaves no trace that it was. If central banks are some powerful monetary force, then we can only conclude that one far greater has swallowed it up.

Stay In Touch