For an economy that is supposed to be on the verge of overheating, or at least moving decisively in that direction, there are an inordinate number of indications of a cyclical stall and termination rather than some beginning (or ripening). I’m not referring exclusively to economic indications, either, such as the Federal Reserve’s own industrial production figure that just showed up yesterday fully and completely within recession territory. A survey of even stock market indications suggest more end times and exhaustion than those that might occasion FOMC confidence.

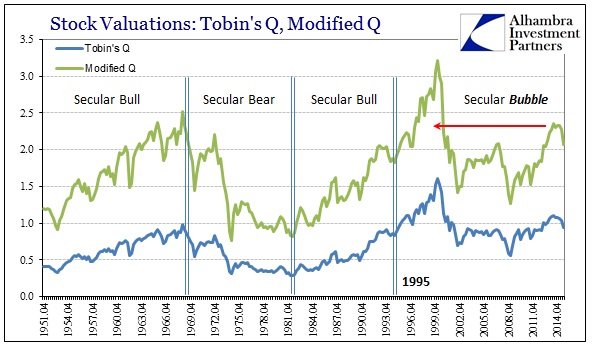

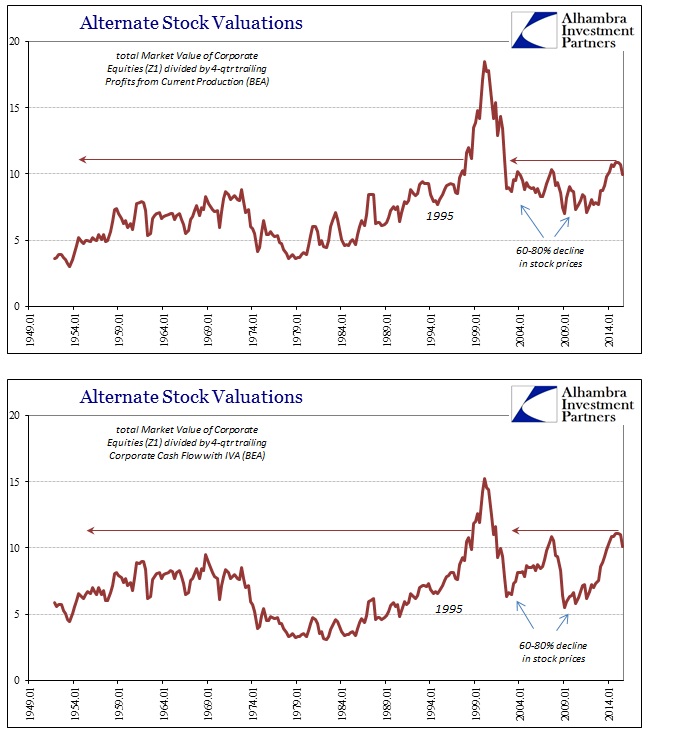

From a valuation standpoint, many calculations have turned over given the August liquidations. Tobin’s Q, for example, fell from 1.04 all the way to .934. Some of that was due to the Fed’s revisions and updates in the Financial Accounts of the United States Z1 (formerly Flow of Funds) regarding corporate net worth, but given that Tobin’s Q peaked at 1.107 at the end of the second quarter of 2014 you can’t help but notice the “dollar” effect. In other words, outside of the major indices that increasingly move on fewer and fewer stocks, the broader stock market has hit a pause if not a wall (given that this sideways to lower activity has lasted now more than a year).

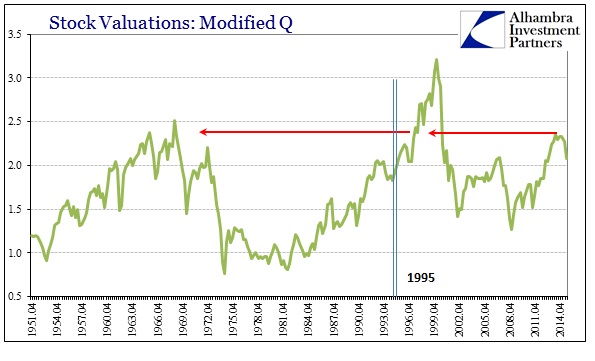

Even with that in mind, valuations remain at historical extremes. Just like the historic inventory imbalance that hasn’t been dented despite an obvious and deepening slowdown in production, the potential inflection in stock prices hasn’t yet reached serious enough (even away from the major averages) to quite yet bring down extreme valuations. In my modified Q ratio, where I subtract the market value of real estate from non-financial corporate net worth so that one bubble (real estate) does not support the valuation of another (stocks), that is perhaps most evident and clear. The crash in August, which remains the numerator in that ratio since the Z1 data is through the end of Q3, only brought the valuation level down to slightly above where it was at 2007’s peak – and -60% on the S&P 500 from there.

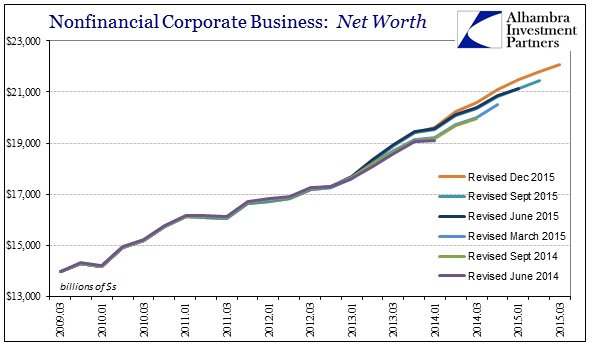

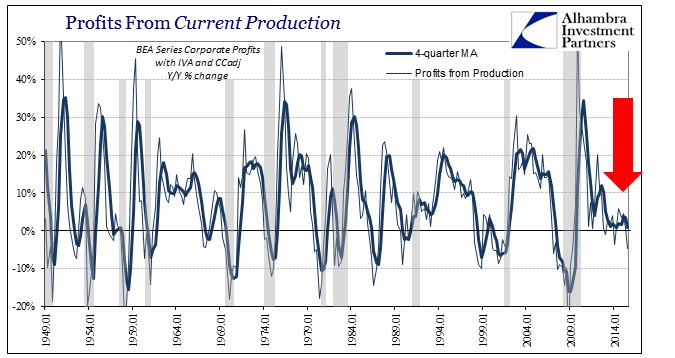

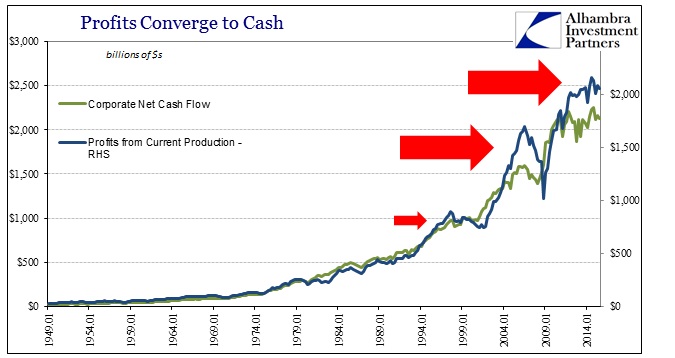

While Z1 finds nothing but increasing (and increasingly upward revised) corporate net worth, it isn’t clear as to what is driving that in real terms outside of the accounting. In other words, if net worth were truly rising steadily there should be at least an enterprise entry into that equation – cash flow and profits. Instead, departing Z1 for the BEA’s GDP figures, we find enterprise cash flow and profits to be highly lacking. In fact, corporate profits from current production (operational profits) fell by nearly 5% year-over-year in Q3; the worst decline in this “cycle” so far. For three full years now, profits from current production have basically stagnated in what is clearly lingering after effects of the 2012 slowdown.

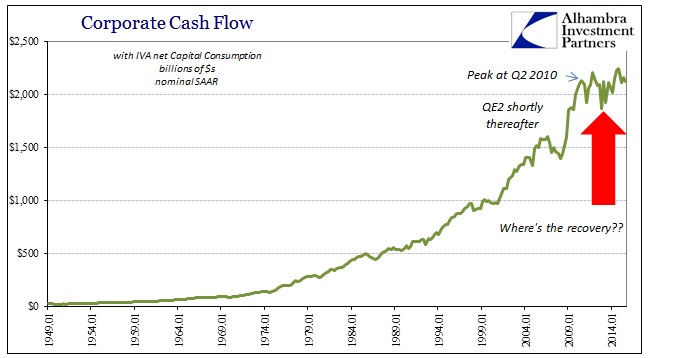

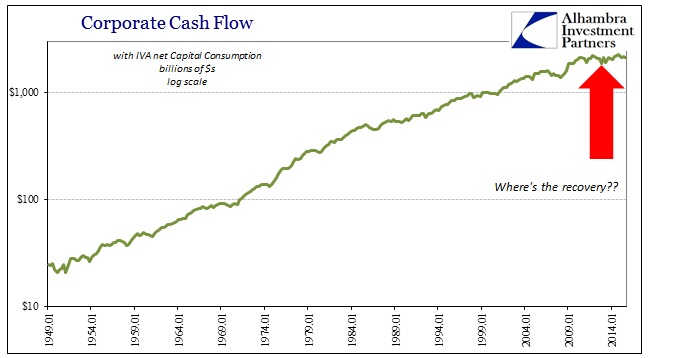

That point is further emphasized in the BEA’s version of corporate cash flow, the true measure and nature of economic business enterprise. On a nominal scale, cash flows appear to be just as stagnant but that actually understates the severity (and timing) of the problem. On a log scale, the deficiency in cash flow is stark and alarming, more than suggesting why the economy hasn’t truly picked up since 2012 (while simultaneously contradicting the BLS’s employment statistics that suggest this cash flow deficiency would lead to a greatly accelerating labor environment; it confounds common sense as to why businesses without any cash flow growth or even stability might suddenly decide to increase, greatly, their expense ledger). These past few years since the slowdown in cash flow is unprecedented.

While some might try to call this a “productivity problem”, in truth it is a revenue problem, or one of strictly output more broadly. That it is being transferred into both cash flow and profits offers good reason as to the stock market’s resistance to further gains after the middle of 2014.

In fact, if we take cash flow and this broad, economic measure of profits from current production as a valuation basis we can appreciate more so any potential change in risk perception and standing. In other words, it is again the combination of high valuations, historically so, along with what looks to be an extended slump toward, or even past, a cycle peak.

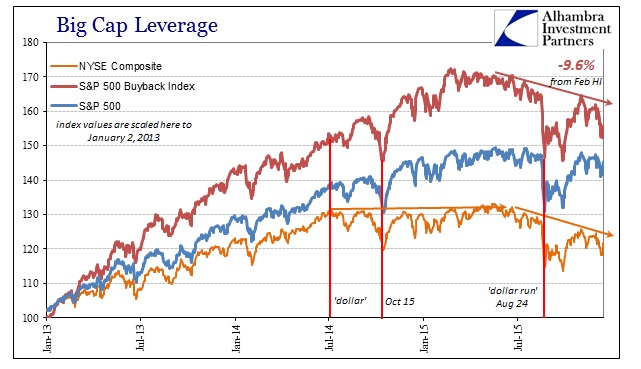

This is not strictly a construction of just more esoteric views on stocks; the same trend can be found in the major averages and indices. Perhaps most notable among those is the S&P Buyback Index which has reversed this year from tremendous outperformance into what looks to be purposeful and mostly steady decline (outside of the crash in August). Given the financial elements of credit and “dollar” liquidity alongside these enterprise considerations, it does appear as if stock investors have become suddenly more attuned to how such buyback giants are going to be funding such buybacks where there are only two choices; debt or cash flow. What goes up must eventually come down, usually after such cyclical credit changes.

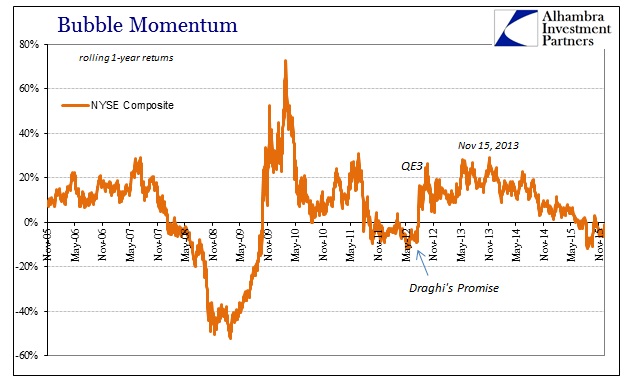

This is not contained to just heavy buyback businesses, however, as broader market indices such as the NYSE Composite register the same difficulty dating back to the “dollar” turn in the middle of last year. At first mostly sideways, the NYSE is, like the Buyback index, on a steady course lower (with August standing as what looks like a warning).

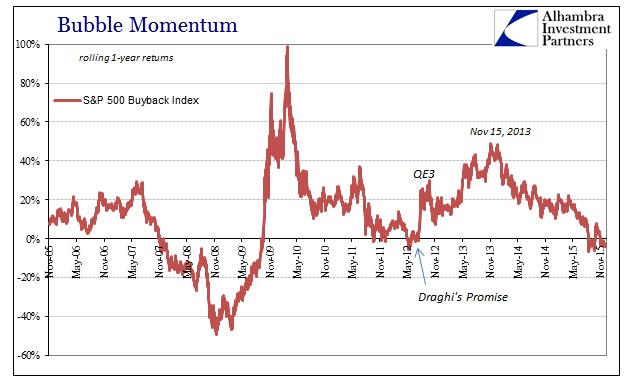

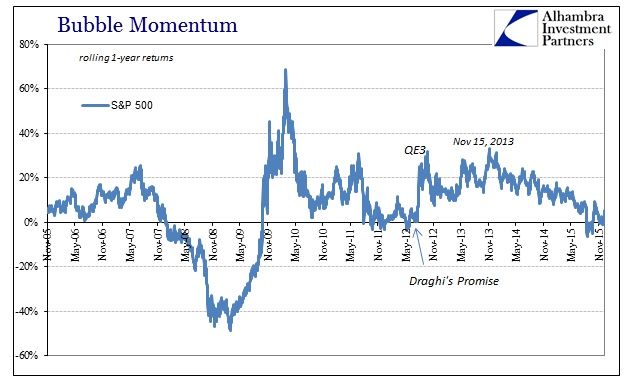

In terms of momentum, each index has exhausted theirs some time ago. Rolling 1-year returns confirm that upside isn’t the dominant setting. You can assign any number of factors as to why that may have changed, including the end of QE and stated central bank support, but close timing matched with these economic and broader “money” issues seems most relevant.

That leaves an awful lot, if not all, of the survey of markets looking more and more exhausted and rolling over than prepared for a sprightly rebound into the future economy Janet Yellen is so sure is just around the corner. If the economy is almost in danger of overheating, it is very difficult to find evidence of it even in the internals of the stock market that had once been about the only source of comfort for policymakers searching for QE’s influence. If QE pushed stocks up, and the removal of QE leaves stocks so vulnerable, then QE didn’t really do anything outside of the usual bubble behavior, leaving very little (none?) actual foundation with which to overheat.

Stay In Touch