It doesn’t work as the math is surprisingly simple. That is why “sweeping” changes and reform have to be considered at each point of escalation. Taking account of what has occurred only damages further the credibility and faith that is supposed to be the keystone for everything that happens. Instead, the only way to solve the historical deficit is to appeal to acceleration and intensification so as to make everyone forget that it didn’t work – a reluctant ratchet effect.

It’s unfortunate that I could use that paragraph as an opening for any number of economic systems spread throughout the world – an alarm in and of itself. In the latest version, the Chinese are back again threatening more “stimulus”, only this time they mean it. From the Wall Street Journal:

China’s central bank succumbed to political and market pressure and cut interest rates for the first time in more than two years, in a sign that the country’s leadership is leaning toward more sweeping measures to bolster flagging economic growth…

The bank’s move contributed to a surge in global stock markets as well as a strengthening of the currencies against the U.S. dollar in countries anticipating higher demand from China.

From Bloomberg:

China cut benchmark interest rates for the first time since July 2012 as leaders step up support for the world’s second-largest economy, sending global shares, oil and metals prices higher…

“Targeted relaxation wasn’t strong enough to boost the real economy so now they realized they have to relax policy overall,” said Xu Gao, chief economist with Everbright Securities Co. in Beijing, who formerly worked for the World Bank. “The economic reason for the rate cut is very strong.”

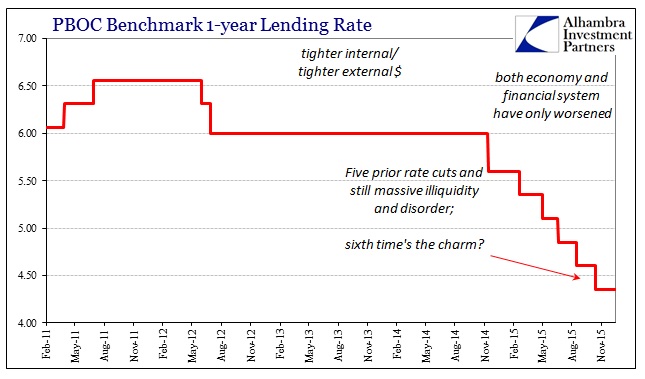

You would be forgiven for thinking either of those quoted passages is current, but they are not. Those were both written in late November 2014, one of the prior installations of “sweeping changes” and increased effort from the PBOC that “shocked” economists and financial markets with escalation. It set about a continuous period of more and more “stimulus” which resulted in less and less actual liquidity and order. For all the positive commentary about last November, it should be remembered now that the yuan blew up anyway along with any number of open monetary breakouts (ongoing) of quite serious disarray.

Having cut rates six times to no effect, the PBOC is ready to do something else because what else is there at this point?

Chinese government officials have cleared the way for fresh stimulus measures to halt the worsening economic slowdown in the World’s second largest economy, sending stock markets around the world higher.

At the close of a key meeting of China’s Communist leadership yesterday, the government announced a series of reforms, including plans to make China’s monetary policy more flexible and to expand the government’s budget deficit next year. [emphasis added]

And again:

Monetary policy must be more “flexible” and fiscal policy more “forceful” as leaders create “appropriate monetary conditions for structural reforms,” according to statements released at the end of the government’s Central Economic Work Conference by the official Xinhua News Agency on Monday. [emphasis added]

You get the feeling that the message has been sent out about post hoc rigidity apparently to be cured by non-specific but more “flexible” monetary policy. It’s a very curious and interesting progression, last year to this one. They pulled out six rate hikes and 300 bps in reserve requirement reductions but now the PBOC must become “flexible?” It’s another way of saying it didn’t work, a position of more obvious desperation.

Toward that direction on the economic front, apparently the small and medium business PMI, the Minxin version, will not be released as scheduled. Without any warning or explanation, the PMI’s sponsors have released a statement that the calculation is suddenly in need of serious overhaul:

Publishers of the China Minxin purchasing managers index said they will stop updating the gauge of manufacturing to make a “major adjustment” to their calculations, dealing a second setback in recent months to investors looking for an early read on the economy.

Release of the unofficial purchasing managers index jointly compiled by China Minsheng Banking Corp. and the China Academy of New Supply-side Economics will be suspended starting this month, the Beijing-based academy said in an e-mailed statement Monday, about six hours before the latest monthly data were scheduled for release.

That’s the second PMI to be scrapped, as Markit’s Caixin “flash” version was halted and then discontinued back in October. Perhaps this is simply an effort to get more accurate measurement on economic performance, something that is obviously difficult to do via PMI’s (that don’t amount to what they are taken for). However, you cannot so easily deny the potential for economic account “flexibility” here, as both PMI’s were far more negative than the “official” account of industrial activity in China.

The Minxin last month was actually downright disastrous:

The manufacturing PMI declined to 42.4 in November from 43.3 in October, while the non-manufacturing reading fell to 42.9 from 44.2, according to reports jointly compiled by China Minsheng Banking Corp. and the China Academy of New Supply-side Economics. Numbers below 50 signal deteriorating conditions.

“China’s economy hasn’t bottomed yet and downward pressures are mounting,” Jia Kang, director of the Beijing-based academy and former head of the finance ministry’s research institute, wrote in an e-mail. “We expect authorities to step up growth stabilization measures.”

The Minxin PMIs are based on a monthly survey covering more than 4,000 companies, about 70 percent of which are smaller enterprises. The private gauges have shown a more volatile picture than the official PMIs in the past year.

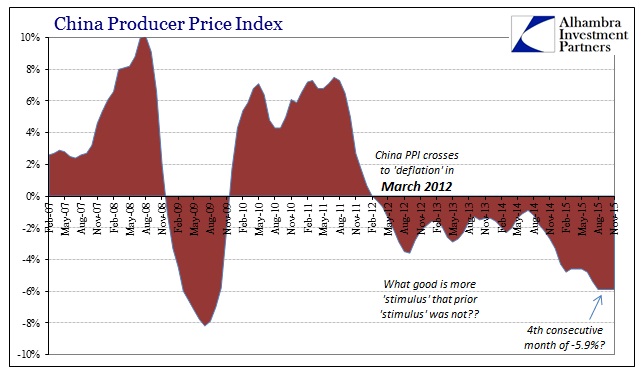

So far, the Minxin services PMI has escaped calculation error as the suspension only affects the manufacturing version. China has been criticized this year for its GDP calculations and dubious treatment of “inflation” measures, which include, apparently, the official PPI figures. When released earlier this month, the PPI sat at 5.9% for the fourth consecutive month. At that point I wondered:

China’s inflation estimates, then, show at the very least nothing has changed in November except the possibility of “something” perhaps forcing the Chinese officials toward some view of soft suppression. It is at least possible, since I find it extremely unlikely that -5.9% would repeat four straight times, that the financial and now economic turn has been heightened so that, given the official proclivity to subdue troublesome data and prices elsewhere of late, there might have been an obvious effort to “cushion” it. Add to that the very sensitive condition of China’s financial markets and position overall right now and what is reasonable conjecture turns quite understandable.

After suppressing the CNY/US$ exchange and then SHIBOR, to find the PPI suddenly also without variability raised the possibility. The continuation in economic accounts now toward less-than-friendly PMI’s heightens the suggestions of “flexibility” not just of monetary policy but in framing from inside how the Chinese economy and financial system might look to the outside. It’s not a good look, nor really a positive commentary about the state of the economy, either.

On the monetary front, as noted right at the start here, the math is very simple and it steadily appears more and more out of control (subscription required) – thus, “flexibility.” On every account and side, the Chinese are indicating indirectly, at least, how bad it might truly be. The more that gets suppressed and questionable, the more that gives away.

Stay In Touch