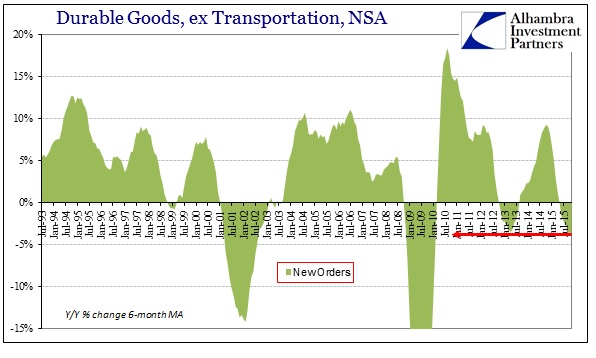

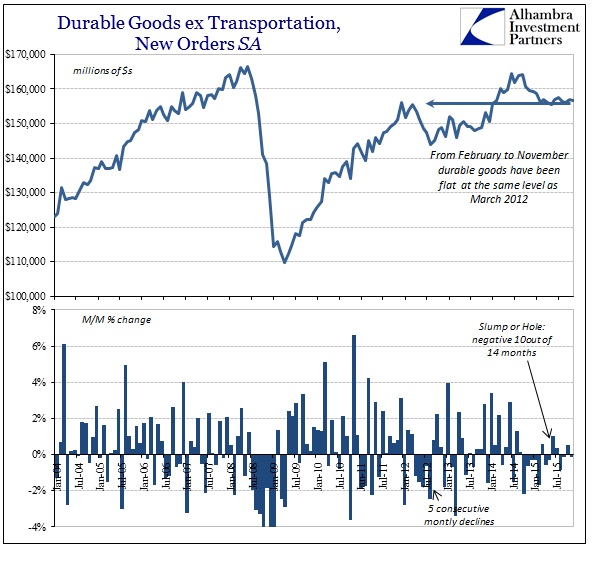

Durable goods estimates were somewhat better in November than they have been in recent months. Year-over-year, orders contracted by less than 1% in the latest month after contracting more than 2.7% in each of the prior six. In September, durable goods orders (ex transportation) were down almost 5.5%. While that counts as improvement it may not count as meaningful. The slump in manufacturing has continued, engulfing all of 2015 so far. While there is variability in the monthly numbers, as expected, durable goods orders have contracted in each of the past ten months leaving only January’s +0.04% on the growth side.

This has forced media commentary all over the place throughout the year as orthodox economics doesn’t know how to consider such a slump. In the past few months, that has coalesced into a reduction for manufacturing into just overseas weakness (the dollar) and 12%. From the Wall Street Journal:

“Unless we see a big rebound in December or upward revisions, it appears that investment in equipment contracted in the fourth quarter,” said Paul Ashworth, chief U.S. economist at Capital Economics, in a note to clients.

The manufacturing sector, which accounts for roughly 12% of the nation’s economic output, has slumped in the last year as low oil and gas prices squeeze domestic energy producers while weakness overseas and a strong dollar reduce demand for U.S. exports. A strong dollar also makes imported goods cheaper.

CNBC:

Manufacturing, which accounts for 12 percent of the economy, has also been hit by efforts by businesses to reduce an inventory bloat, which has curtailed new orders growth.

The dollar has gained almost 20 percent against the currencies of the United States’ main trading partners over the last 18 months.

ABC:

Durable goods orders have tumbled 3.7 percent year-to-date. Slow economic growth among major U.S. trading partners — including Europe, China and Japan — has caused the dollar to rise in value, making U.S. goods more expensive overseas and less competitive. Lower oil prices have also squeezed demand for pipelines and equipment by energy companies.

“The manufacturing sector still looks fairly weak — weaker than non-manufacturing, reflecting more exposure to declining exports, a plunge in oil-related investment and an inventory cycle” where wholesalers are reducing their stockpiles, said Jim O’Sullivan, chief U.S. economist at High Frequency Economics.

These almost coordinated narratives set up really heavy internal contradictions that are left unexplained. If there is “inventory bloat” and “an inventory cycle”, then you would expect some reasons as to why and how those might have come about. Such great imbalance as to push manufacturing into its own recession cannot originate with manufacturing alone. On some level, manufacturers, as wholesalers, are not keeping up with their expected sales, leaving the manufacturing slump as a matter of pure spending.

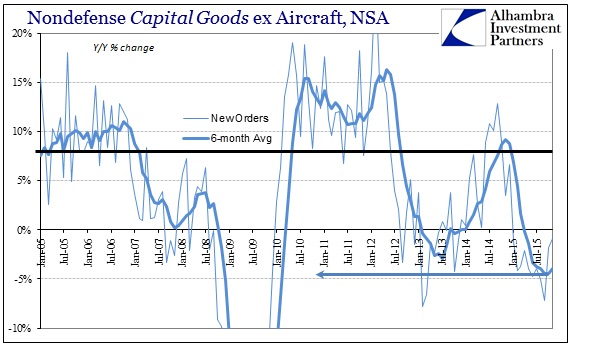

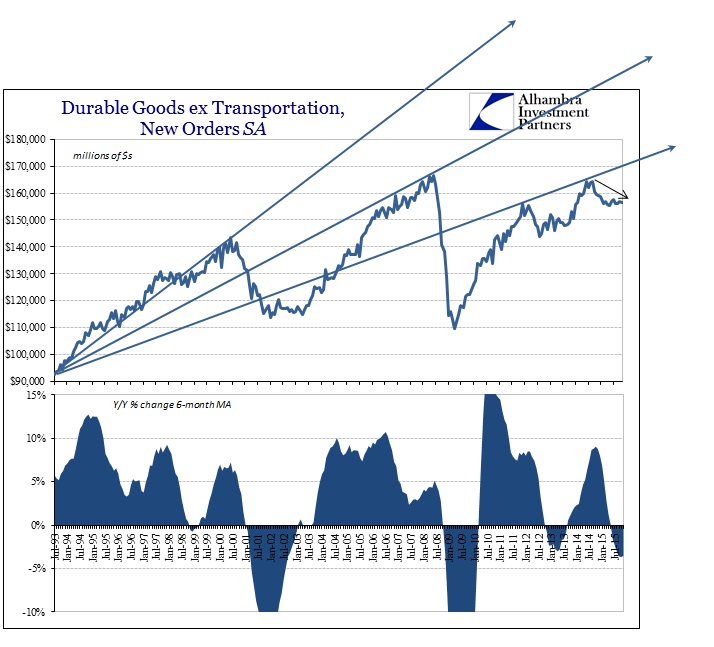

That is why the generic appeal more and more to the dollar as an explanation, to make it seem as if the US manufacturing problem originates only elsewhere. It is a view that doesn’t survive much scrutiny, particularly since manufacturing (viewed through durable goods and elsewhere) has been slowing far longer than the dollar has been in the news. By any reasonable definition, durable and capital goods have been defining a downward trend for years.

Dating back to 2012 there has only been a one-year window (in 2014, which is itself questionable) interrupting an otherwise serious shift in total manufacturing and capex activity. That point is revealed by historical comparison of what actual and sustained growth had looked like in the past.

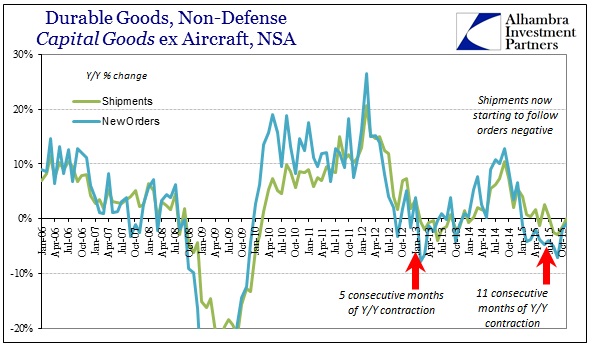

If there is “something” wrong with US manufacturing, it far predates the dollar and the 12% maligning. The primary problem with viewing the current weakness in isolation is that it fails to account for what US factories ought to be producing in a steady growth state. The fact that November’s durable goods estimate is about the same as March 2012, and having remained at that level since February, is both cyclical and structural commentary.

An economic hole of that size and duration is not usually associated with strong consumers and a healthy economy. It is, however, associated with an inventory cycle moving into a terminal stage as much more an issue than simply exports and overseas economics. In other words, four or even five months of contraction would be an adjustment; eleven or more is something altogether redefining. That point is simply emphasized by the inventory “bloat” that remains despite this already lengthy curtailment in manufacturing, the central focus of which has nothing to do with exports and the dollar.

If the economy were in the main healthy and moving in the right direction despite inventory, then we would see that in manufacturing being itself more sprightly than the sales baseline. That is clearly not the case, as manufacturing and durable goods have been underperforming for quite some time. Thus, if inventory is building it cannot be the case of the production side as even these subdued levels of activity yield that huge imbalance. This is clearly a domestic sales problem.

Stay In Touch