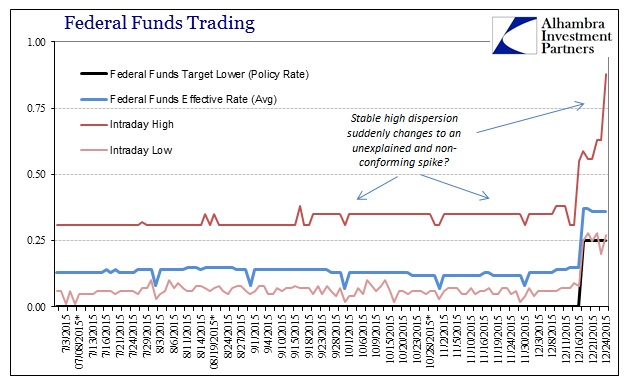

The federal funds rate applies to a range of actual trades in unsecured overnight lending. What you see as the calculated “effective” rate is an average of those trades. Under the ZIRP/QE paradigm, there has been very little dispersion since there isn’t much volume in that corner of the money market. By theoretical definition, repo rates should come in under federal funds though not necessarily the effective rate depending on the actual spectrum of trades. The reason is straightforward since repo is collateralized at the same maturity, and thus contains (theoretically) less risk.

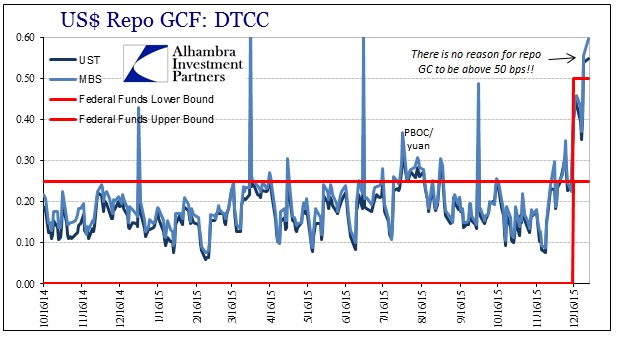

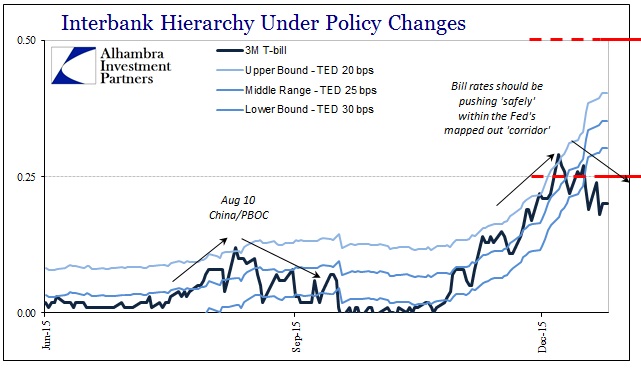

In trading close to the Christmas holiday last week, GC repo rates shot upward far more than was expected. Then on the 24th, the GC rates were elevated above the Fed’s upper boundary for federal funds, the intended “ceiling” of its corridor – a very curious and potentially significant violation of money market hierarchy. I waited until today’s fixes before reporting because it was remotely possible that last week’s repo surge was just a holiday cash crunch. However, the repo rates released this afternoon by DTCC (which is only, again, a snapshot of exchange repos, leaving out the majority which are bilateral and bespoke) are actually above last Thursday’s: in MBS, the GC rate was 55.6 bps on the 24th and 59.6 bps today; the UST GC rate was 53.9 bps last week and 54.9 bps today.

Even more curious, the dispersion in federal funds reported a similar surge at the upper end. As of this writing, FRBNY has not released the federal funds figures for today but on Thursday the high bid was an astounding 88 bps. If that extension recurs then it in many ways validates the upper track of repo since it would suggest the secured/unsecured trade-off taking place actually above the “ceiling” of the FOMC’s federal funds target/corridor.

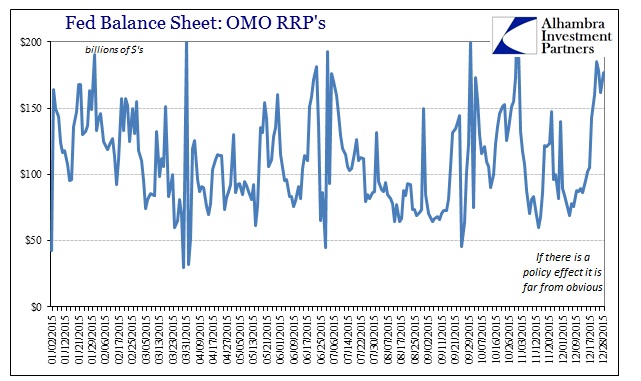

It gives us at least the initial indication that perhaps money markets in overshooting this “tightening” remain especially and functionally fragmented. Given that the Fed’s RRP continues to be stable and relatively unused, an outcome predicted by the failure of RRP in the past to contain these kinds of illiquidity breakouts (notably last October), breakup remains a very real possibility. It is entirely possible that these are just the initial “bugs” in the new policy framework as it is given real world conditions, and that over time money markets will coalesce and settle down. However, with central banks very ill-suited to performing the kinds of intermediation necessary to create money market harmony and fluidity, there is also the developing danger of the Fed losing control everywhere.

I’ll have more on this tomorrow when the complete federal funds data is updated and to see if T-bills continue to be so shallow (as they were again today).

Stay In Touch