Ben Bernanke has shown a singular capacity from his entire time as Chairman of the Federal Reserve, one that he has clearly held onto and even nurtured in the nearly two years since he left office. Unlike many other notable economists, Bernanke still has the ability to astound, to produce an uneven marvel at how the man ever got so far. The only pathway which could possibly lead to his career is one where ceteris paribus and academia so unfortunately transformed into real world capacity.

In Asia today, at the same time as China’s troubling economic data, he managed to claim:

Bernanke said the correlation between different markets is higher than that between markets and the economy. He pointed out that worldwide market selloffs in times of distress was natural due to global asset allocations. “The U.S. and China are not as closely tied as the market thinks,” Bernanke said.

The entire world seems to go in and out of synchronized tailspins, with more frequent and intense versions of late, but there is no concern because there is no global economy in Bernanke’s academic world. The US economy, in orthodox economics, is a separate entity all its own; just as China is China’s. The links between them are, in this conception, tangential and casual. If the “market” were as effective as Bernanke is in his 1950’s understanding, nobody would be bothered outside of China.

For the former Fed Chair, the world’s true problem is still the “global savings glut.” Seriously:

Bernanke argued that the global economy was more troubled by a global savings glut, which had long been a drag on investments.

It was that basis for monetary policy and economic worldview that produced the Panic of 2008 and the Great Recession, both of which occurred during a period where Bernanke, in office, claimed they were impossible. Now that the world is appearing with the exact same strains and symptoms, Bernanke proves that economists don’t learn. Ideology comes first.

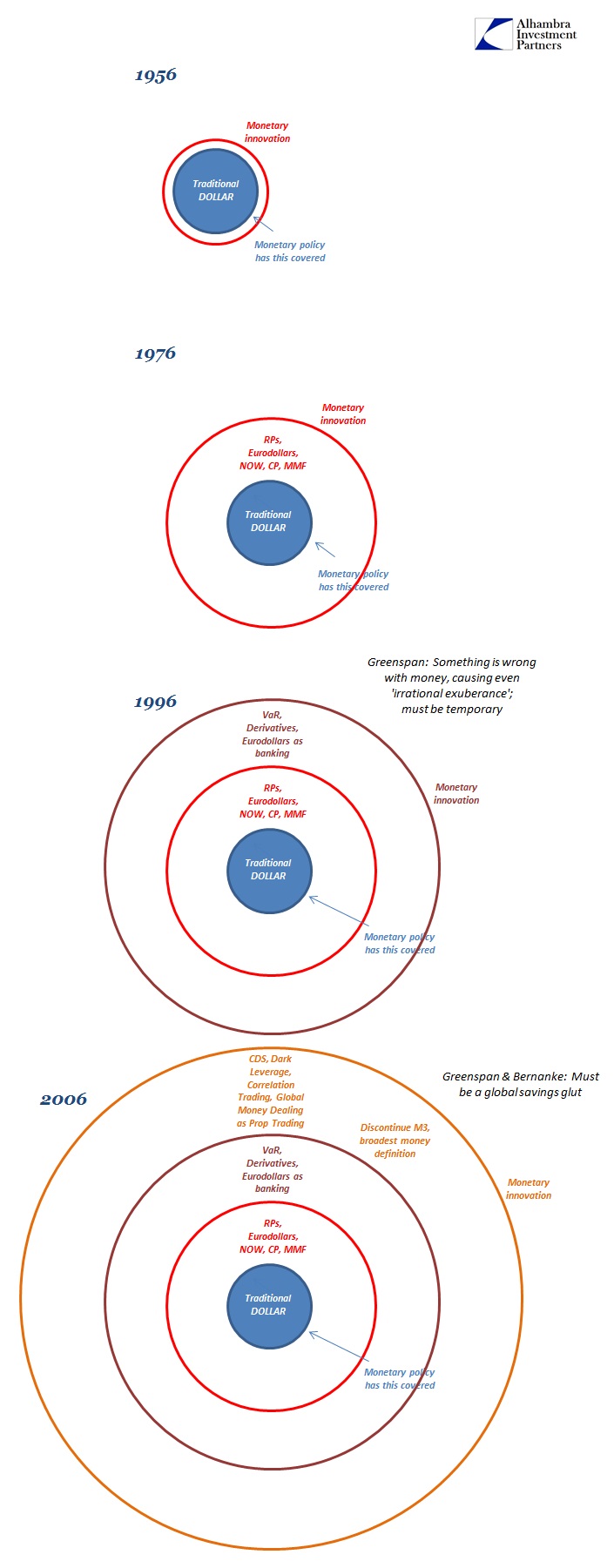

That point has tragically been proven time and again, especially since parts of the Federal Reserve had been warning that this “closed system” theory was if not totally wrong by the 1970’s then at least it would be completely so in due course. The open architecture of the eurodollar and wholesale merger obliterated such anachronistic distinctions. Just a little exploration of the history of the “dollar” proves that only an open mind was required to appreciate the significance – and thus the global implications as financial ties became only stronger and thus cementing economic correlations.

From the BIS in 1964:

Some observers have stressed certain adverse consequences which the market may have and it would seem that these observations have their element of truth. From the standpoint of official policy, however, it does not seem that the possible dangers of Euro-currency credit are of a different order from those of other movements of short-term funds. Maybe, because of its efficiency, the Euro-currency market has an exceptional potential for expansion which may create a special problem for monetary authorities in the future.

Charles Coombs, Open Market Manager in 1969:

The situation could be particularly serious because the Euro-dollar market had become an increasingly important source of financing for industrial and commercial enterprises not only in Europe but in the whole world. One bankruptcy could attract a lot of attention, and if it led the European commercial banks that had been supplying funds to the market to reassess the credit risks they faced, the result might be a sudden scramble for liquidity. The chances of such a development were enhanced by the fact that no central bank had formal responsibility for the behavior of the Euro-dollar market.

FRBNY literature 1979:

It has long been recognized that a shift of deposits from a domestic banking system to the corresponding Euromarket (say from the United States to the Euro-dollar market) usually results in a net increase in bank liabilities worldwide. This occurs because reserves held against domestic bank liabilities are not diminished by such a transaction, and there are no reserve requirements on Eurodeposits. Hence, existing reserves support the same amount of domestic liabilities as before the transaction. However, new Euromarket liabilities have been created, and world credit availability has been expanded.

Repeating Coombs’ 1969 warning just ten years later:

One of the traditional responsibilities of any central bank is to act as lender of last resort – to supply funds to a solvent bank or to the banking system generally in an emergency that threatens a sharp contraction of liquidity. This role normally has been framed with respect to commercial banks in the domestic banking system. But the emergence of the extraterritorial Euromarket created ambiguities about which central bank would be responsible for providing lender-of-last-resort support for overseas operations.

Alan Greenspan in 1996’s “irrational exuberance” tellingly describing the term in relevant context:

Thus, during the decades of the 1970s and 1980s, trends in money supply, first M1, then M2, were useful guides. We could convey the thrust of our policy with money supply targets, though we felt free to deviate from those targets for good reason. This presumably helped the Congress, after the fact, to monitor our contribution to the performance of the economy. I should add that during this period we maintained a fully detailed analysis of the economy, in part, to make sure that money supply was still emitting reliable signals about the state of the economy.

Unfortunately, money supply trends veered off path several years ago as a useful summary of the overall economy. Thus, to keep the Congress informed on what we are doing, we have been required to explain the full complexity of the substance of our deliberations, and how we see economic relationships and evolving trends.

How about Ben Bernanke in 2006?

In 1960, William J. Abbott of the Federal Reserve Bank of St. Louis led a project that resulted in a revamping of the Fed’s money supply statistics, which were subsequently published semimonthly. Even in those early years, however, financial innovation posed problems for monetary measurement, as banks introduced new types of accounts that blurred the distinction between transaction deposits and other types of deposits. To accommodate these innovations, alternative definitions of money were created; by 1971, the Federal Reserve published data for five definitions of money, denoted M1 through M5.

That speech was less than a year after the Fed announced it was shutting down the last surviving broad money measure, M3 – for the very reasons Alan Greenspan was suggesting in 1996. It was Greenspan in his speech that offered such conceited confidence that “money supply” was only temporarily divorced from the economy even though that deviation had by then already lasted decades; the discontinuation of M3 a decade further on proved him disastrously wrong. Instead, all he (and Bernanke) could come up with was this pusillanimous “global savings glut.” Such childish conjuring is all that is left by which orthodox economics can claim to be relevant to the 21st century. Economics demands a closed system to be effective; nothing has worked, QED.

It’s difficult to maintain after all that has happened on his watch: panic, global recession and no recovery despite QE’s that were promised with no uncertainties (and undoubtedly there were none on his part when they were first planned and installed). Now, increasingly, a rerun looks to be forming so no comfort should be derived from his understanding that has remained so conspicuously constant all these years no matter what “unexpected.”

If you think the Federal Reserve is the only source of dollars in the world, then a “glut” of someone else’s is all you’ll find. But you would think after decades of all these monetary innovations someone presiding over unmitigated disaster, in the same office which supposedly provided unending tools of mitigation, mind you, might be at least somewhat inquisitive about the basis for all those assumptions. The world does not stand so still; nowhere is that more evident than perhaps banking and finance since the 1960’s. We have monetary policy crafted for not even 1956 and still there is amazement about where we are. I do hope that whatever happens this year the global savings glut survives; it performs a very useful service, an inarguable highlight of ideology above all else and an indelible explanation of the dangers of the pretense of knowledge.

Stay In Touch