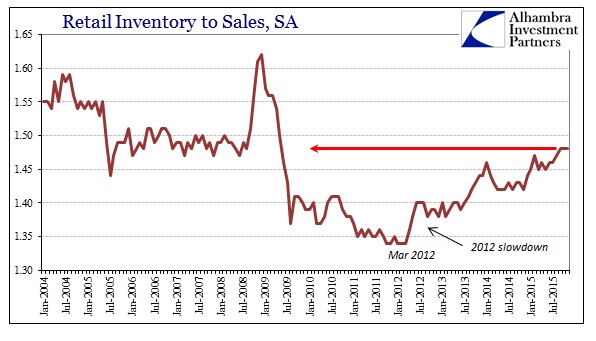

Despite continued cuts in production and supply chain activity, inventory through November persists in great imbalance. With December retail sales demonstrating a Christmas sales season only worse in 2008 and 2009, that isn’t like to have changed. It’s not as if manufacturers and imports have been robust to build that much inventory; production is already in clear recession. The only way to equalize is to force even greater production cuts, which is why I think we are starting to get the hints of full-blown recessionary forces.

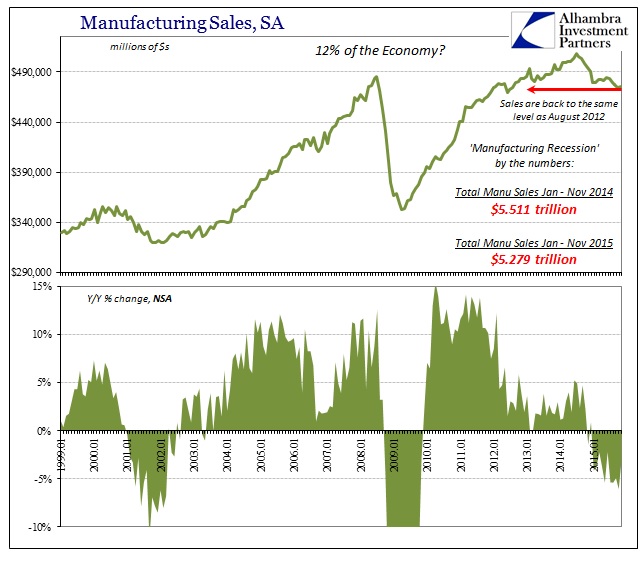

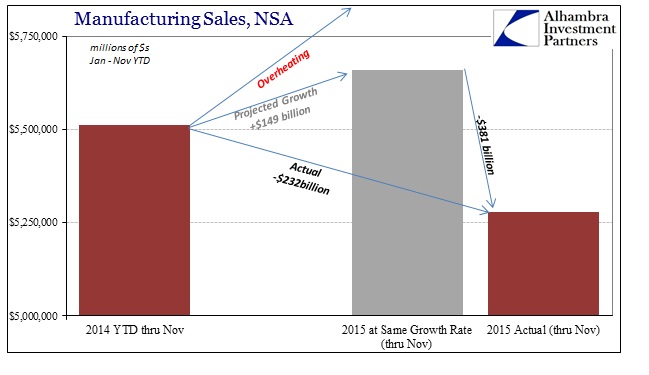

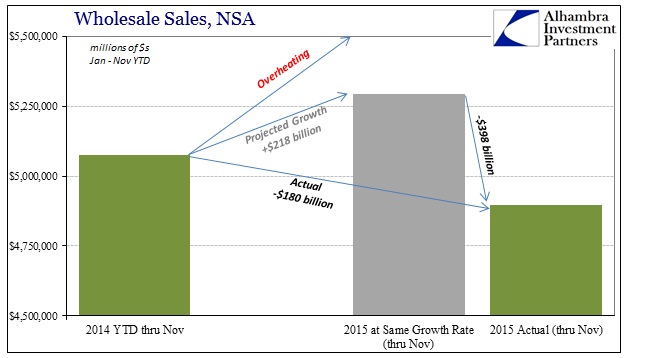

As those wisps of suggestion penetrate further into financial markets, the less likely holdouts awaiting Janet Yellen’s version will be able to do so. That seems to have been the economic theme in manufacturing for the past year, so it is unlikely to be repeated this one. In terms of manufacturing sales, for the year (through November) sales are off about 4.2%. But even -4% or so is equivalent to about a $400 billion hole.

That scale is almost identical to the estimate I produced for wholesale sales, one level up on the supply chain. The only way to manufacture such great harmony is for inventory to accumulate there and above in the retail segment – which it has.

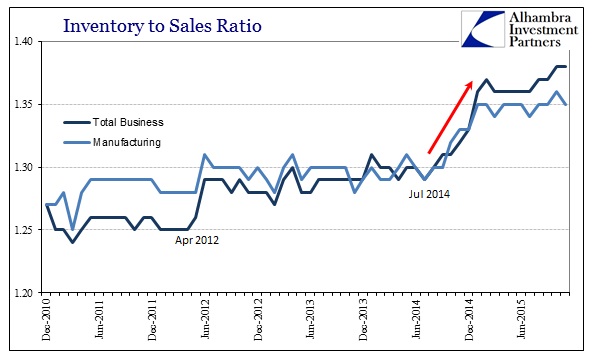

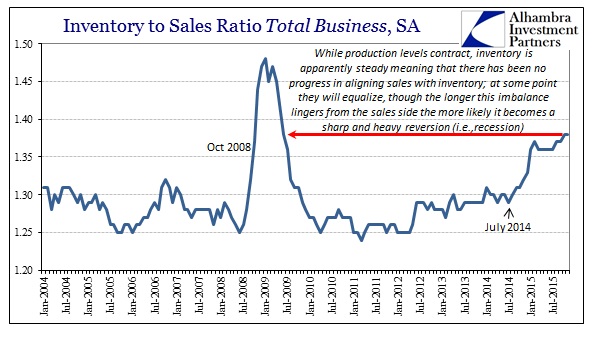

Total business inventory-to-sales ratios remained extended in the extreme in November, reflecting the imbalance up and down the supply chain. Again, with topline sales in retail more than disappointing in December, all that is left is the cleanup in reversion. That may or may not produce a full and deep recession, but markets (“dollar” and credit, in particular) seem increasingly to price a deeper and deeper worst case.

They really have no choice on that count as this imbalance can no longer be tempted as temporary or “transitory.” The first big move in inventory, as sales fell initially, was in the summer of 2014 (not 2015) with the first “dollar” blowup. This is a negative economic process that has already accumulated about a year and a half and still shows no sign of being addressed; leaving little doubt as to the ultimate disposition.

Stay In Touch