Economists had noticed by the mid-1970’s that what they thought were steady money relationships with the economy had broken down. This divergence was not slight; how could it be given that the era still stands today as the Great Inflation? Ostensibly, a great deal of research on the topic was devoted to monetary policy implications which is a direct assault on any idea of monetarism as some static and universal set of laws by which to guide economic management for all time. More and more through the worst part of the Great Inflation, the later 1970’s, this became a search for “missing money.”

What was in many ways frustrating was that this “money” was never really missing at all. Almost everyone knew where it was and what it was; the problem was that economists resisted and resisted declaring the products of financial innovation as “money.” While technology and originality had created NOW accounts, surplused repos and, yes, eurodollars, the mainstay of economics continued to assert them as nothing more than exotic forms of assets. It didn’t matter that they were being used in practice as transactionable substitutes, what mattered to them was that quantity theory was never truly jeopardized.

In 1976, the Brookings Institute published a paper by three staff members of the Board of Governors of the Federal Reserve System, Jared Enzler, Lewis Johnson, and John Paulus, titled Some Problems With Money Demand. It declared:

The current economic upturn has been characterized by unusually low rates of money growth relative to the increase in nominal gross national product. Even more surprising, the unusual rise in velocity has occurred while short-term interest rates have remained largely unchanged or even fallen slightly (see table 1). This development contradicts much of the supposed knowledge about the public’s demand for money and its determinants.

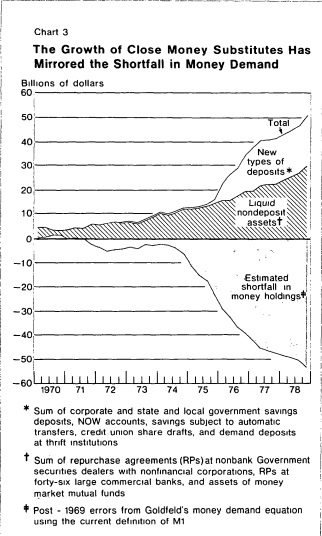

There were drafts on credit union shares, money market funds, and foreign-owned demand deposits (eurodollars). In money market funds, for instance, there were practically none in early 1974; the Brookings Paper estimated $174 million in MMF’s and $143 million of NOW balances in January 1974. Only two years later, however, MMF’s had exploded to $3.6 billion while NOW balances had accumulated to $839 million. Neither of those was included in the aggregate money statistics of that time.

The conclusion of the paper was rather stark in that it detected the first hints of a permanent rupture in the assumed stability of money that had dominated since the Great Depression.

At this point it seems unlikely that we can develop a simple, reliable, money-demand equation. Our best efforts so far, using published demand deposit data, overestimate by about 6 percent in the first quarter of 1976.

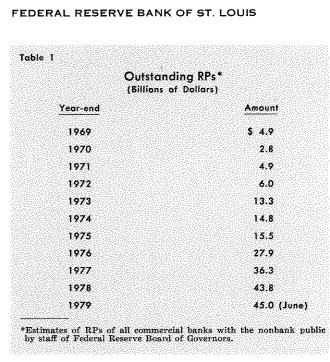

Part of the problem was repos. Even by 1979, there was still no consensus on what repos actually were – were they repurchase agreements, separate buys and sells in full exchange of ownership of the security; or were they collateralized short-term loans where ownership never changed hands at all? The truth was that they were both and that the exact structure of any repo was treated as idiosyncratic. The litter of court cases (usually suit brought for tax purposes) only made matters worse, as some courts suggested actual purchases and sales, while other rulings determined collateralized lending. The confusion only aided the resistance of accepting monetary purposes for repos.

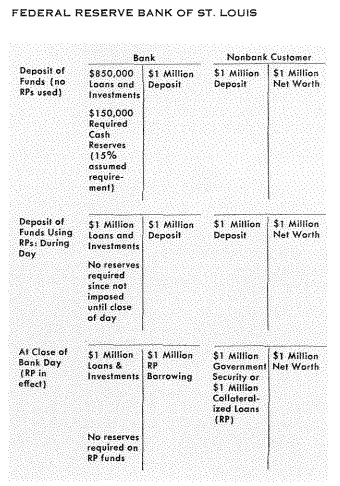

No matter what a repo was or was not, it was becoming likewise a similar substitute for a demand deposit. Because of the way repos were structured in most circumstances, corporate customers, the largest segment of repo users, could and did write checks against repo balances knowing full well that the checks would clear after the repo had expired and federal funds had been delivered (making them available immediately). As this 1979 article in the Federal Reserve Bank of St. Louis Bulletin suggested, no matter what economists determined about repos as money they were being treated as such on both sides of banking:

Preliminary analyses suggest that the apparent shift in the money demand function would have been somewhat smaller if RPs are included in the stock of money. The evidence does not settle the conceptual issue of whether RPs are money, but the studies do provide some empirical support for including RPs in the definition of money for policy purposes. Even if RPs are not judged to be money, they are closer substitutes to it than other near monies and help explain the problems in estimating the money demand function.

Part of the measurement problem, and thus “missing money”, were that many repos were being used exclusively within the network of “borrowed reserves” that had arisen toward the end of the 1960’s. Thus, interbank repos were like double counting in this static monetary aggregate model, but still missing the point about vehicles in which monetary resources flow on both sides of the banking divide. It was as revolutionary for banks as for bank customers, as that 1979 article demonstrates:

A bank using repos for funding had the advantage of avoiding reserve requirements because repos were classified as non-reservable borrowed funds. It was an elegantly more efficient manner for what was becoming the growing trend toward liability-based management, shedding the strictures of traditional custodial banking in favor of almost purely financialized systems. In other words, economists were almost exclusively hung up on money as facing the public, they never appreciated interbank conduits as separate monetary channels for servicing public money. As commercial banks pioneered this movement in the later 1960’s and early 1970’s, it would soon seep down into even thrifts and conventional banks (and deliver the S&L Crisis but a decade later).

In a Spring 1979 article for FRBNY’s Quarterly Review magazine, the totality of at least these transactional money changes were compelling in finding the “missing money.” Plugged into the Goldfeld econometric model for money demand, the financial innovations of the 1970’s appeared to answer quite well the monetary shortfall assumed by the stale money aggregates in operation then.

Again, this “missing money” occurred during the worst parts of the Great Inflation, where traditional economists in monetary policy settings refused any evidence that their static, modeled assumptions were long since outdated. The money was only missing in the orthodox conception; it was right there all the time. Worse, the implications of this trend in financial innovation were drastic since money would not only potentially exceed quantitative assessment but, more importantly, qualitative understanding as well. That part we know very well from history since that time, even if economists refused (and still refuse) the intellectual license.

The idea of “missing money” was not just an academic exercise in trying to understand ethereal constructs of indirect or even irrelevant systems; it was an attempt to further clarify great failure. In many ways, it was more backward looking since the appearance of monetary disaster had erupted many years before; the Great Inflation was more than a decade old by the time Enzler, Johnson, and Paulus wrote their paper for Brookings. Consumer prices had already detached from modeled expectations, forced already into two serious recessions, with another two just around the corner, and each deeper than the last.

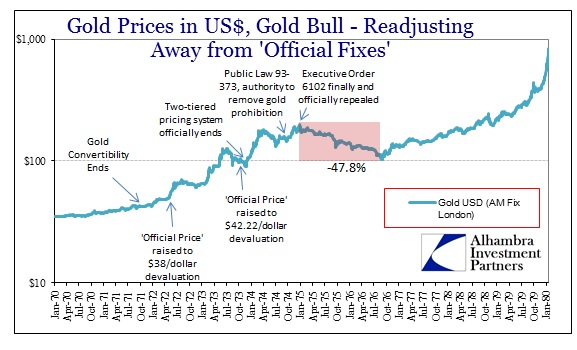

The idea of monetary disequilibrium (such that something like that actually exists) was explained very well in the behavior of gold – a factor missing entirely in all these papers and especially at the monetary policy table. Gold prices started the 1970’s officially fixed but only under the by-then nearly destroyed Bretton Woods mechanism of gold exchange via official channels. Banks had become quite proficient, as did central banks it needs to be pointed out, in using eurodollars to settle covered or uncovered.

Gold finally set free from artificial restraint did in its first act declare monetarism itself the problem. By the time Executive Order 6102 was finally repealed, gold was trading at just about $200. After suffering a nearly 50% collapse as money started to go “missing”, gold prices ended the 1970’s heading toward $800. It was the bright signal of monetary disarray, a conclusion that wasn’t shared in policy circles until long after the Great Inflation ended (and one reason why Keynesianism had become so thoroughly discredited under the “exploitable Phillips Curve”).

Gold prices would again rise starting around the millennial turn. Prices bottomed in late 1999 but really took off in 2001; despite no equivalent change in the CPI or other measures of consumer inflation. It was a warning of “missing money” that none of the shredded, surviving monetary aggregates had found. Indeed, the Fed confirmed as much by discontinuing M3 in early 2006. That it kept going on through the Great Recession and did not peak until 2011, I think, tells us the potential structure of this “missing money” return. The eurodollar standard, which had become seriously destabilizing by the late 1990’s had reached its end. It wasn’t until 2011 that it became clearer that the wounds of the 2007 and 2008 panic were mortal.

No matter LTRO’s, QE3 and then QE4, or whatever any central bank was to do since 2011, gold prices have fallen as if to bookend the 1970’s rise of this “missing money.” Economists took this as a sign of something like the 1980’s where the new money had produced something like stability (if only temporarily) when instead it was a signal of great and systemic monetary decay (the exact mechanism is in “dollar” collateral substitutes). It was a warning that “missing money” was to be missing again, only this time in “deflation” rather than “inflation”; as it unwinds just as it sprung up in the Great Inflation of the 1970’s.

The timing is again, as noted yesterday, not coincidental. We know from bank balance sheets and income statements that there was a huge change in their resource commitments in the 2011 crisis and then again in 2013 that speeded up the withdrawal. That such “money tightening” would be picked up via gold channels is unsurprising even if the mechanism is difficult to grasp – it gets back to the simplest views on gold as an “inflation” hedge. Gold was falling in a “deflationary” signal of “dollar” decay. Economists missed the warning because they are still, to this day, missing money. NOW accounts and credit union drafts were some of the early symptoms, but repos and eurodollars are truly what came to define the drawing edge of the modern system after 1995 (math as money and the currency-like strains of dark leverage).

It isn’t just gold, however, as we see the same financial behavior replicated time and again; commodities, credit curves including eurodollar money curves and the UST curve, the credit cycle as envisioned by junk bonds, etc. Everywhere these financial indications proclaim one unifying factor – the death of money. It isn’t, obviously, the death of all money or money as the concept that helped drive human economic achievement and civilization, but rather the death of the prevailing global monetary standard in operation since Bretton Woods was fatally injured itself in 1960 – the eurodollar standard, or, specifically as governing dynamics, what PBOC governor Zhou Xiaochuan correctly observed as gold exchange’s successor, the credit-based reserve currency.

The problem is that it is possible to separate those terms, though it would be a fool’s errand. In other words, should economists finally be alerted to this chapter of “missing money” they might assume it was the “dollar” that failed, muffing the more important observation that the eurodollar standard is itself just a variant of credit-based currency. The problem is not the eurodollar but rather that the eurodollar is a bank fiction; to correct the decay in the eurodollar would mean not replacing credit-based eurodollars with credit-based IMF SDR’s or credit-based RMB, but rather removing “credit-based” in its entirety.

Unfortunately, we are totally unprepared for this, an assessment that seems increasingly to apply given the unsettled state of the world and its central banks right now. If there had been more appreciation for what was occurring and more readiness in planning for the end, the eurodollar decay would be great cause for celebration and true economic optimism. As it is, economists and policymakers are still in the “missing money” phase some four decades later. They will be shocked and dismayed (one more time) that their world of the dollar with the Federal Reserve at its center or its pivot isn’t anything like that. As I wrote last May, based on the increasing death signs in financial prices, there was little reason to expect an orderly return to pre-2007 conditions and function that the Fed still thinks is a reasonable and achievable goal:

While I respectfully disagree about the RRP providing a floor (repo fails, specials and all that), I think his suggestion about the IOER going up with “no consequence for other money market rates” is likely correct. But I also think the fact that some money rates, including the dead federal funds rate (effective), have already taken flight also suggests another scenario altogether – that B to C could or will be a total mess. This is essentially the same scenario that I think has been acting out since November 20, 2013. In other words, there will not be any normalcy, and any attempt to go backward undertakes what amounts to incalculable risk of being disastrous (that is why, I believe, credit market bearishness, flattening yield and money/eurdollar curves, and any number of paradigm inflections in various markets all date back to around November 20; that “something” occurred as a consequence of the taper selloff that more than suggested getting out of QE’s and such was nigh impossible. That such a sentiment has lasted now almost two years forms the basis of what I have called the Fed’s suicidal tendencies toward ending ZIRP).

I personally find way too much complacency in blindly believing that going from B to C will be only a minor inconvenience. It would be dangerous even under the circumstances where the system shifted from the dealers to the Fed and back to the dealers, with an infinite series of potential dangers even there. But to undertake a total and complete money market reformation from dealers to the Fed to money funds? There are no tests or history with which to suggest this is even doable under current intentions. Poszar and Mehrling’s contributions more than suggest that difficulty, but I think that still understates whether or not we ever get that far.

In short, the Fed took over money dealing in some forms in 2008 as money dealers (the heart of the eurodollar system) took flight and left nothing behind to support everything (panic). Now, the Fed feeling good about its efforts in large part due to the same type of monetary misunderstanding its predecessor format made, is preparing to return money market dealing to private hands. Some expect that money market funds and other non-bank vehicles will pick up the slack where dealers used to exhibit supply. Dealer activities were far more robust and ranging than “cash” trading in repo and even eurodollars or federal funds; dealers provided a full-range of balance sheet resources that are (were) an integral part of the global monetary and credit system. You cannot take bank credit out of credit-based currency; a fact that is not just a trick of semantics.

As they continue to retreat in that respect, it doesn’t matter who or what is left to undertake “money dealing” because that remnant is still “missing money.” That is what markets are and have been claiming in increasing intensity, now including stocks. It is the death of the eurodollar, but will it be the death of credit-based currency? That is a choice, one that economists must not be allowed to make again. If they do, they will choose to try once again for an untenable status quo and make us Japan in the process – the truly visible carcass of dead money.

Stay In Touch