When Janet Yellen testified to Congress last week, she was as usual careful with her words. Alan Greenspan once called it “mumbling with incoherence” but there is very little left to rambling in Yellen’s predicament. Where Greenspan was once the “maestro” and Bernanke the “hero” Yellen is stuck holding the bag, and I think she knows it. In truth, there isn’t the faintest difference between any of them, which is exactly the problem and her source of frustration. The Fed is in grave danger of being unquestionably revealed for the backward, incompetent institution it always was.

As to the recent stumble, it makes for the most uncomfortable juxtaposition between what the Fed did in December and what the economy and markets have continued to do since mid-year last year. To continue on in that contradiction leaves her no choice but to blame again “overseas.”

“Financial conditions in the United States have recently become less supportive of growth,” she told the House Financial Services Committee. “These developments, if they prove persistent, could weigh on the outlook for economic activity.”

She meant that convulsions in the stock markets could harm the economy…

Ms. Yellen argued on Wednesday that the rest of the world was to blame. She said the crucial question confronting the Fed was whether the domestic economy is strong enough to keep growing modestly even as the global economy struggles.

As always, it has to be “overseas” because the BLS says so.

Ms. Yellen highlighted the “solid improvement” of the United States labor market. The unemployment rate fell to 4.9 percent in January from 5.7 percent a year ago, while the economy added an average of 222,000 jobs a month. Wages also rose more quickly.

Whether she actually believes the BLS figures or not is another question altogether. If this is still part of the “best jobs market in decades”, where is all the spending? Not only was the Christmas shopping season atrocious, the first estimates for 2016 were even more so. While seasonal adjustments “saved” the retail sales report for January, actual store receipts bury them by agreeing with the unadjusted version.

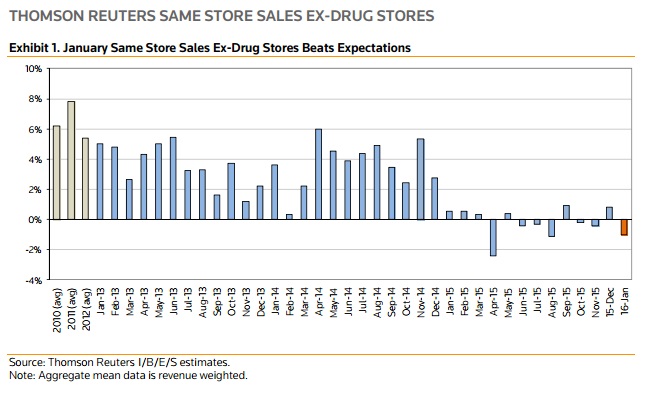

Excluding the drug stores, the Thomson Reuters Same Store Sales Index registered a -1.0% comp for January, beating its flat final estimate. Including the Drug Store sector, SSS drops to a -1.1% comp, missing its final flat estimate. 75% of retailers missed their SSS estimate…The blizzard in January kept shoppers at home instead of the shopping mall that weekend. As a result, holiday clearance has not been selling well. As inventory piles up, retailers missed their SSS estimates and blamed the weather and a weak consumer spending environment.

In last year’s “unexpected” snows of January, the SSSI gained slightly, while in the Polar Vortex of 2014 the SSSI grew by nearly 4%. From +3.8% to +0.6% to -1.1% all in the frozen confines of three straight bracing January’s leaves out any “residual seasonality” and permits only an all-too-well-defined trajectory. Yellen claims the problem is overseas but, as I write constantly, everyone overseas is pointing right back at US consumers and US “demand.”

It sure looks like a sustained period of contraction (above) and surely “unusual” weakness. Whether or not any economist wants to admit the slightest hint of recession doesn’t really matter, retailers themselves are already filling in that commentary. Walmart missed big, forecasting no sales growth in 2016 instead of 3% to 4% in its past guidance, while Nordstrom set back further the economic narrative with heavy discounting and inventory.

Analysts considered the best-in-class department store a casualty of the overall sluggish retail environment, particularly as it pertained to discounting across the sector.

Even as the high-end store held the line on storewide promotions, its commitment to matching other stores’ prices contributed to a 1.8 percent dent in its gross margin — a hit that was exacerbated by its need to mark down merchandise to clear inventory.

Paired with a conservative outlook for 2016, Nordstrom’s second-straight quarter of disappointing results reignited investor concern that its exposure to the high-end consumer could translate into softness this year, particularly as the stock market continues to fluctuate.

But perhaps more importantly, its discount Rack stores — which have fueled much of the company’s revenue growth over the past few years — posted their third same-store sales decline for the year.

High end, low end, the store chain suffered at all ends even though the unemployment rate suggests to orthodox economists the economy is so very close to booming. This disconnect is not even much of one, since the only indication of that kind of possibility, the one that sustains Yellen in public, is increasingly isolated; bringing to mind closer and closer only logical fallacy. Even if it were just retailers, that might be enough of a recession hint, but it is far beyond “just” retailers or the 12% manufacturing economy.

Corporate America is in the thick of the “worst quarter for profits growth” in the past five years.

In Q4 2015, blended earnings have seen an overall decrease of 3.6 percent and will likely bottom out at 4.2 percent. If earnings continue on their downward trajectory, it will be the first time the S&P 500 has seen three consecutive quarters of year-over-year declines in earnings since Q3 2009.

Prospects are not likely to improve anytime soon, with 381 S&P 500 companies, about 87 percent of the index, having already released earnings updates. The remaining companies (mostly retailers and utility companies) will report updates over February and early March.

With retailers yet to report, perhaps -4.2% might actually prove quite optimistic. Whatever ultimately the case, three straight quarters of negative earnings is a particularly difficult digression and, as much as economists want to rest all that upon just the dollar, it is, in fact, much, much more serious than earnings. Giving EPS problems the “rising dollar” makes it sound artificial, as if it is just number translations on reported ledgers. What actual businesses are finding, however, is quite real and more so disturbing in just a recession sort of way.

In 2015, equity investors looking for yield suffered death by 394 cuts.

Last year, the number of dividend reductions far surpassed 2008, according to Bespoke Investment Group, citing data from Standard & Poor’s.

The ratcheting down of payouts to shareholders is a function of weak commodity prices, sluggish growth dampening corporate profits, and a tightening of credit conditions.

How is that last paragraph immediately above any different from one? The fact that dividends are being dropped on a widespread basis is an open invitation to just that potential. There is a very real cash problem here, front to back, against which the FOMC and economists place the BLS’s various and sundry imputations and statistical models? The amount of corroborative evidence is overwhelming against them, including “overseas” which, again, easily traces back to the sudden and sustained drop in actual consumer activity no matter how low the unemployment drops.

If it looks like a recession from so many different angles, chances are very good that it is. It is so consistent that even the stock market has finally awoken. The problem, the real problem, is as Nordstrom’s struggles suggest with inventory – it is only beginning. And that point is echoed in “tightening of credit conditions” which haven’t truly tightened in any relatively meaningful way yet. The OECD, for one, is right to be suddenly alarmed, though, as usual, it would have been far more helpful and relevant last year instead of further fostering the absurd notion of “transitory.” Like Bernanke was in his turn, Yellen will be the last to admit it. Sadly for her, she can’t eat the unemployment rate.

Stay In Touch