Unfortunately for Treasury Secretary Lew, the world keeps skewing closer and closer to the version suggested by “markets”, moving further and further from the one he and Janet Yellen declare the only valid possibility. The order and transmission of excuses has been entirely predictable, starting right with his “strong dollar.”

1. Dollar doesn’t matter, indicates strong economy relative to the world

2. Dollar matters for oil, but lower oil prices mean stronger consumer

3. Manufacturing slump doesn’t matter, only temporary

4. Manufacturing declines are consumer spending, but only a small part

5. Manufacturing declines are becoming serious, but only from overseas

6. Maybe domestic manufacturing recession too, but the rest of the economy is strong

7. Rest of the economy might not be as strong as thought, but only an “earnings recession.”

8. Maybe full recession, but only a small probability.

9. …

For much of the mainstream, they have been stuck on #6 – begrudgingly acknowledging the “manufacturing recession” but then dismissing it as only 12% of GDP. The services sector is supposed to be the foundation anyway, and there was to convention no indication that manufacturing weakness was anything other than isolated or, dare I write, “contained.” That expectation just didn’t make sense and doesn’t now:

Economists continue to claim that manufacturing just doesn’t matter and that the service economy is more than fine. Setting aside the obvious link between services and goods to begin with (since so many services are dedicated to managing, moving and especially selling goods), it just doesn’t add up; if consumers are freely spending on services then why would they so eschew goods? If it were just a minor slowing in manufacturing (which has spread to our trade partners, no less) it would be far more plausible in that manner, but the global goods economy, which remains the bedrock core association, is already showing up in recession form. Just in America, manufacturing hasn’t hit a speedbump but rather a conspicuous wall.

I wrote that in November when indications about “services” were more arguable especially in comparison to manufacturing weakness. They are becoming less so in 2016.

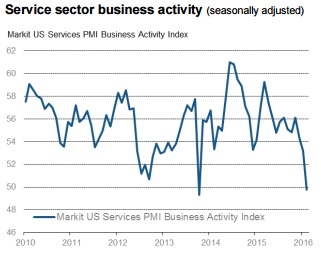

U.S. service providers indicated that overall business activity declined slightly in February, thereby ending a 27-month period of sustained growth. At 49.8, the seasonally adjusted Markit Flash U.S. Services PMI™ Business Activity Index1 was down sharply from 53.2 in January, but only fractionally below the crucial 50.0 no-change threshold.

In reality, February’s sub-50 estimate is the lowest of this cycle – only October 2013 was worse on extenuating and unrelated circumstances of the debt ceiling/government shutdown. This latest measure was lower than at any point during the 2012 slowdown that was itself very close to its own recession.

The usual caveats apply, particularly about PMI’s. However, what is significant isn’t necessary the 49.8 but rather the sharpness of the slowdown – the trend. In November, the PMI was above 56, meaning it has dropped more than six points in just three months. Even Markit’s Chief Economist is sounding the alarm:

The PMI survey data show a significant risk of the US economy falling into contraction in the first quarter. The flash PMI for February shows business activity stagnating as growth slowed for a third successive month. Slumping business confidence and an increased downturn in order book backlogs suggest there’s worse to come.

In other words, it conforms again to the overall economic picture that is now accompanied all-too-enthusiastically by market turmoil. As I wrote earlier this month, technical definition of recession is the least of the worries:

Whether or not this leads the NBER to consider a recession dating is beside the point right now; what is relevant is what IP renders in especially the wider historical context about past recession and how that relates to our current circumstances. It suggests, with very little room for argument, that the US economy is already in truly dire condition and increasingly so at the same time as market indications suggest and price the very same.

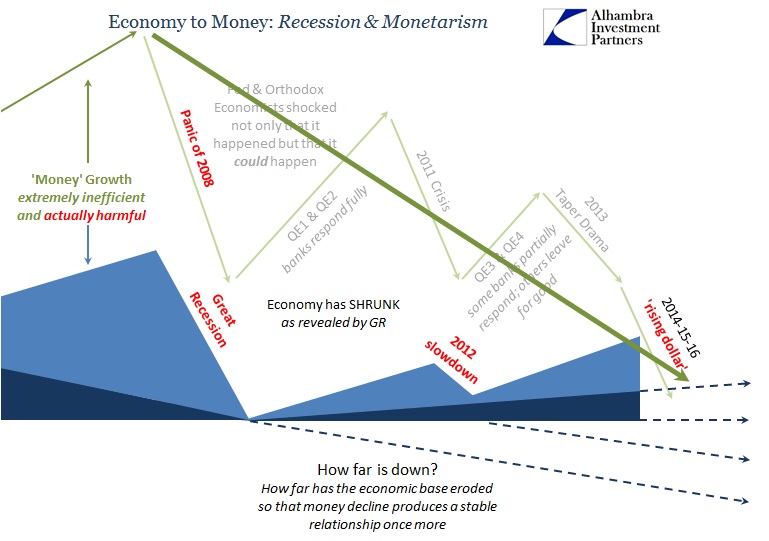

There are so very few pillars of this recovery left. As noted this morning, even stocks have abandoned what seemed so certain just a year ago. Inventory, exhausted faith in “stimulus”, and the small matter of never having recovered from the last one; it all adds up quite neatly to further confirmation of the same downward arch lurching toward what might really be the economic foundation or potential.

Stay In Touch