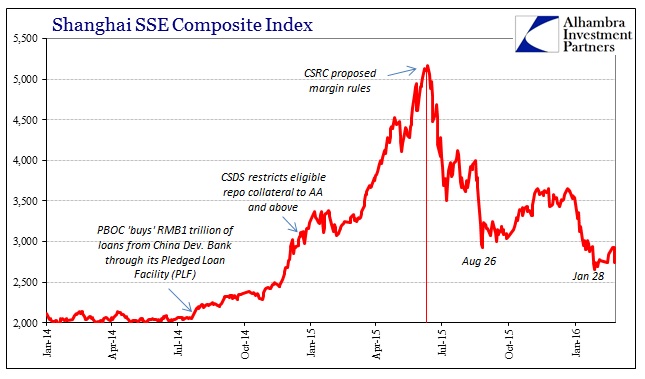

All the warning signs were there, especially the backup in the CNY exchange rate. Chinese stocks had stood for a good run while the PBOC had flooded internal channels, but how much of that was real liquidity versus the appearance of stuffing funding into the narrow coffers of the largest state run banks? Increasingly it seemed far more the latter as the first shots of volatility appeared last week and only grew from there. That was expected on both artificiality and the regular hangover after the Lunar New Year fades.

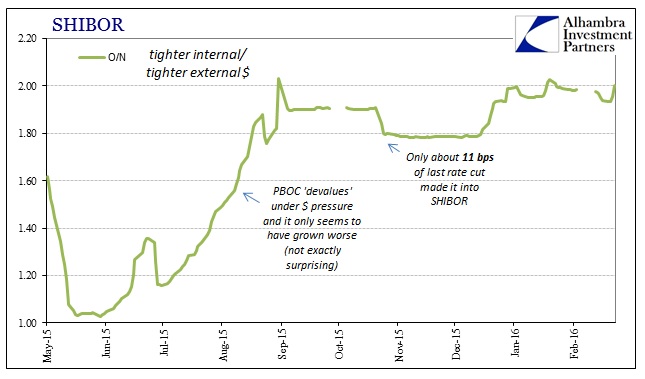

What was interesting and much more significant was the eurodollar market trading in almost perfect concert to CNY yesterday. It suggested once more this overall global funding environment that is and has been the PBOC’s most dangerous financial enemy. As I wrote yesterday (subscription required):

Before this morning’s sharp reversal, it was clear that the Chinese/”dollar” connection was the driving force in the selloff. The CNY exchange rate has struggled to maintain closer to 6.50 and this morning it finally moved sharply lower; trading at almost 6.54 at one point before staging a modest recovery. Almost everything else seemed to move in tandem, including eurodollar futures.

The CNY middle rate was set at almost 6.54 this morning, with the selling rate nearly 6.55 and the lowest since President’s Day. In addition, O/N SHIBOR jumped over 2%, which seems something of an obsession with the PBOC in maintaining the overnight rate a few pips below that level; perhaps with very good reason.

Stocks in China plunged Thursday amid heightened worries about market liquidity, just as leaders of the world’s largest economies are preparing to meet in Shanghai.

The Shanghai Composite Index SHCOMP, -6.41% tumbled throughout the trading session to finish down 6.4% at 2,741.25. That was the worst percentage drop for China’s leading benchmark since Jan. 26 and took the benchmark down to a 47% loss since last summer.

The sudden selloff appeared to be due to several reasons, from worries about tighter liquidity in the market to withdrawal of money by investors who have been hammered by months of volatile trading in China…

By the close, the Shenzhen Composite Index 399106, -7.34% had dropped 7.3%, and China’s Nasdaq-style ChiNext board was down 7.6%. More than 1,300 stocks in Shanghai and Shenzhen fell by 10% — the maximum level that Chinese authorities allow an individual stock to fall in one day.

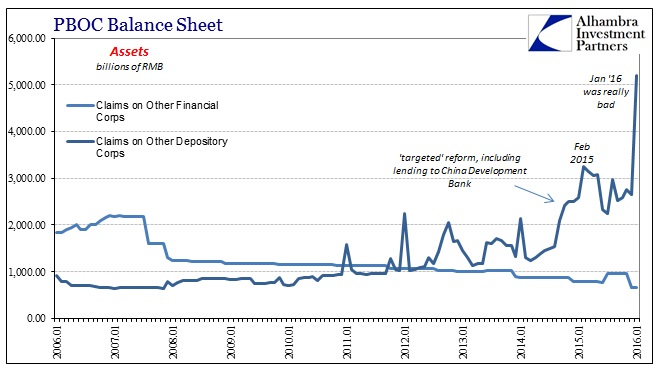

In my view, the PBOC’s efforts since mid-January have been at best superficial. That might reflect the state of affairs or it might be the case that they don’t have many (any) other options at this point. Whatever, the central bank made a big show of stuffing “liquidity” into what is really a non-systemic channel. It made for all the right appearances, and it was taken as an extreme and powerful injection, but the illusion can never last.

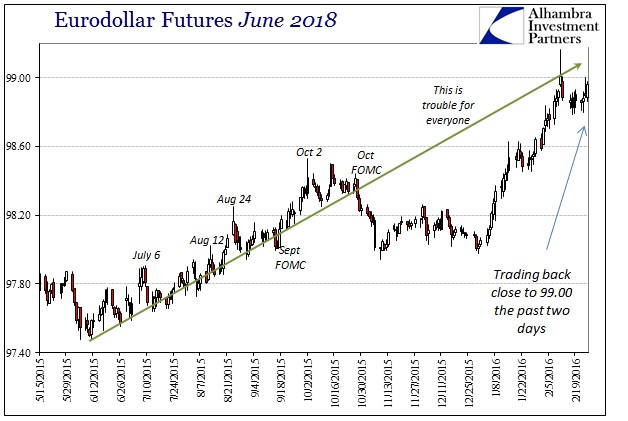

Stocks are up in the US and several other places, but credit and funding are not buying it. The UST curve is bid again, with the 10-year benchmark trading under 1.70%, and similarly the eurodollar curve, with June 2018 futures nearly back at 99.00.

Since the PBOC returned to pegging CNY on January 8, when it first dropped to 6.60, not much has really changed outside of cosmetic shifts on certain balance sheets (notably the PBOC’s). The global financial imbalance might seem like a liquidity issue, but that is only the manifestation of the larger, more fundamental problem. RMB 2.5 trillion through the SLF and MLF isn’t going to change that, as such liquidity isn’t even liquidity.

In other words, if TSF increases due to “money” still fleeing WMP’s (from outside to inside) and the asset bubbles what good is it if the PBOC redirects that overall true liquidity increasingly through the narrowest of channels (such as China Development Bank, the primary recipient of SLF funding)?

For Chinese banks, it might be that they realize what the huge surge in liquidity in January actually means – it must be withdrawn at some point in the future (“when” depends on its exact form). Perhaps, then, Chinese banks are especially active ahead of time in anticipation of funding being less than suggested (in the mainstream) in the near future?

So far that theory seems to be the case. It suggests more and more as if the nightmare scenario I laid out last September has come true; the further the PBOC goes in wholesale verse the more they sink for the effort. Like quicksand, the more the Chinese central bank struggles, the further down they go. In these financial terms, the PBOC attempts to “buy” calm but it is plainly obvious now that the cost of doing so has only increased (by a lot) while the space of (relative) tranquility only shrinks. Nothing else changes; the big wholesale problems remain. That leaves the Chinese system only more vulnerable the “next” time – with the eurodollar problem guaranteeing that there will be a “next” time, and the PBOC’s tightening noose assuring it will be only worse.

If nothing else, and the smallest of silver linings, all the talk of “devaluation” has largely ceased from what I can tell. The correlation of the CNY exchange may have finally sunk in; that when the currency rate gets pounded, so does the rest of the world. The PBOC was never trying to “devalue” and was always fighting against it on the wholesale level. The next big conceptual leap is to realize that they can’t possibly win; it’s far too late for that now.

Stay In Touch