The PBOC surprised some by lowering the reserve requirement for the Chinese banking system this morning. That marks the sixth reduction since February 4 last year, totaling 350 bps (the reduction on April 19 was 100 bps). By orthodox calculations, that should have added about RMB 2.45 trillion in new “liquidity” as banks freed from holding reserves would have forwarded the newer margins into at least interbank.

China’s central bank said it will lower the amount of deposits banks hold in reserve by 0.5 percentage point, as a burgeoning liquidity shortage outweighs its concerns over the impact of more credit-easing on the Chinese currency.

The action, which the People’s Bank of China announced late Monday and which will take effect Tuesday, will free up about 700 billion yuan, or about $108 billion, in funds for banks to make loans, analysts estimate.

Both of those paragraphs contain inconsistencies; to the first quoted paragraph, the burst of “credit-easing” in January may not have been so much enthusiasm as dramatic concern, as I wrote here. In other words, banks rushed to achieve whatever volume while they could, knowing full well that it might get ugly very quickly. In that view, the “more credit-easing” is actually a reflection of the “burgeoning liquidity shortage.”

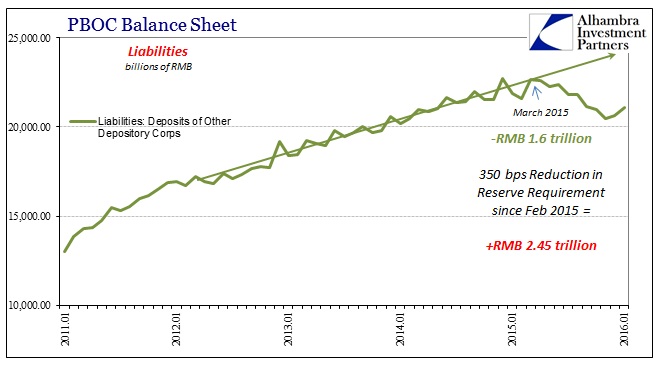

The second paragraph assumes a vacuum that doesn’t exist. The real world contains no clinical type conditions for ceteris paribus, of course, but at least in China prior to March 2015 expansion in bank reserves suggested a uniform backdrop for these kinds of policy measures. Since March, however, bank reserves have been declining as the PBOC’s balance sheet sinks. It has not been a straight line and there are indeterminate multiplier effects to consider, which means the exact calculation and nature is more of a guess than hard math, suggesting why the reserve reductions appear just as irregular.

With bank reserves rising over the past two months, the decline compared to March 2015 has been cut to about RMB 1.6 trillion. Thus, even factoring the shift in reserves, it appears that RMB 2.45 trillion in new liquidity tied to the six reserve adjustments should have been sufficient.

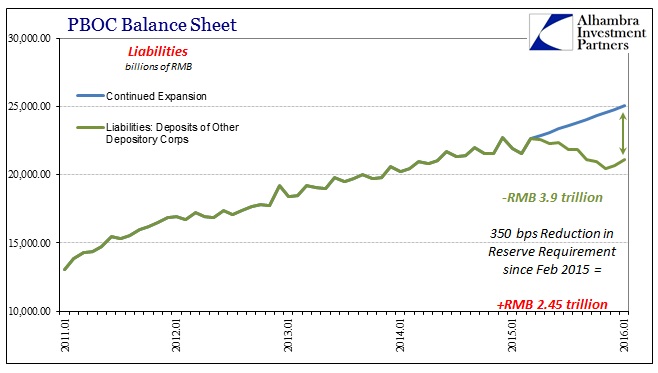

The correct comparison is not to the peak level of reserves last March but rather what reserves would have been had they not been interrupted. At that peak there were RMB 22.67 trillion (compared to RMB 21.1 trillion January 2016), but had average growth remained, total reserves by January would have grown to somewhere around RMB 25 trillion. Therefore, the “liquidity” deficit internally is something closer to RMB 4 trillion, and again likely more given multipliers and a great many unknown feedbacks and irregularities (complex systems).

I make no claim as to accuracy here, only that the estimates above are far closer to what has been observed over the past year than the continued suggestion that reserve requirements (and rate cuts) are “adding” to liquidity ceteris paribus. Not only that, the last time the PBOC felt pressured into a reserve requirement adjustment was late October – just before it all went into a tailspin yet again.

That leaves “adding liquidity” as far more fighting desperately against a global tide. The US CLO market, for instance, dropped nearly to nothing in January, and estimates have been reduced to just $45 billion gross (for CY 2016) from $70 billion in December, all down from a peak of $124 billion in CY2014; 65% reduced volume and that is the best case. For that reduction, the analysts making it still suggest issuers are in “ok shape.” US junk moving in this direction this far does not suggest anything like “ok” just as the PBOC’s repeating what already did not work does not indicate a winning strategy, only despondency. Yet, commentary and mainstream expectations are still conditioned into thinking US junk like China’s financial existence is all some “transitory” deviation from an otherwise healthy baseline. It isn’t and it can’t be (subscription required).

Stay In Touch