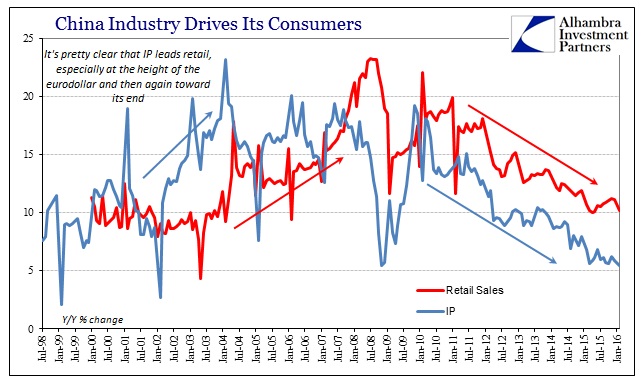

The idea that China was transitioning to a “consumer led” economy was always a precarious wish. Doubts start with the timing, as it wasn’t until 2009 that it was even proposed, but the idea really didn’t gain any traction until after 2012. In other words, the only time Chinese consumers were ever given much thought was when industry was facing either deep or intractable problems (now in 2016, both deep and intractable).

The relationship between Chinese retail and Chinese industry is so absolutely clear that suggesting retail sales, for instance, would decouple from the export or manufacturing sectors really was nothing more than wishful thinking. Some of that was undoubtedly related to continued belief in “stimulus”, what was already offered and what was surely going to be offered once China returned to the orthodox playbook. But, again, industry prevails as the global economy, including US “demand”, prevails upon Chinese industry.

Anecdotal evidence suggests that Chinese consumers may actually be in much worse shape than what is shown in the official statistics. What is increasingly clear, however, is that any possible window for China to escape its industrial baseline may be drawing to a close:

Retailers in China are shedding staff, slowing expansion plans and seeing stocks pile up in warehouses as shoppers tighten their belts – a major headache for a country that has pinned its hopes on consumers to drive economic growth.

With that growth running at its slowest in a quarter of a century, China’s consumption patterns are changing, with wealthy middle-class households trading down from up-market to more affordable brands, and poorer families paring back on even basic purchases.

China’s top 50 retailers saw sales fall 6 percent at the start of the year, and sales of basic goods from noodles to detergent grew just 1.8 percent at the end of last year, down from over 9 percent just three years ago, according to Kantar Worldpanel data.

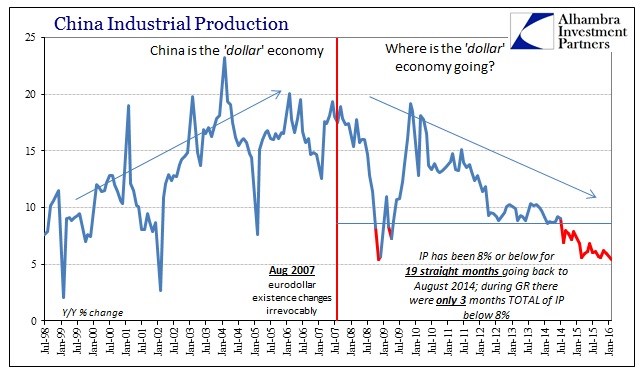

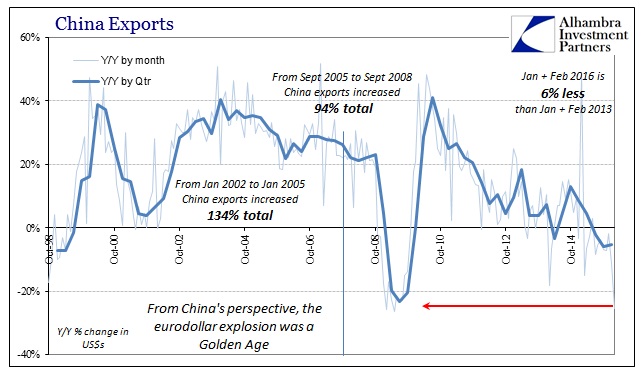

It’s not recession; it is a paradigm shift, becoming a slowdown that won’t stop slowing. The pre-2008 world is long gone and there is no going back. Despite the fact that this transition has been ongoing for years already, we may only be witnessing now the next phase of it. This should not be surprising since that seemingly ancient “miracle” period was the eurodollar period and without eurodollar expansion there was never any other economic destiny.

Stay In Touch