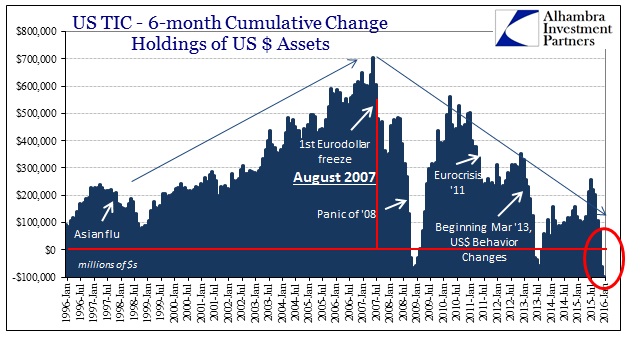

The basis for the ongoing economic paradigm shift that seems to be manifesting in a slow, lingering slowdown (that is now more than year into contraction) in the US and global economies can be nothing but the withdrawal of banks from the necessities of the credit-based reserve currency. So far, the updated bank reports for Q4 last year continue the trend, as do aggregated figures such as that provided by the Office of Comptroller of the Currency’s (OCC) derivative report. Taken from bank call sheets, it is the most comprehensive view of banking activities at least as related to window dressed reporting periods.

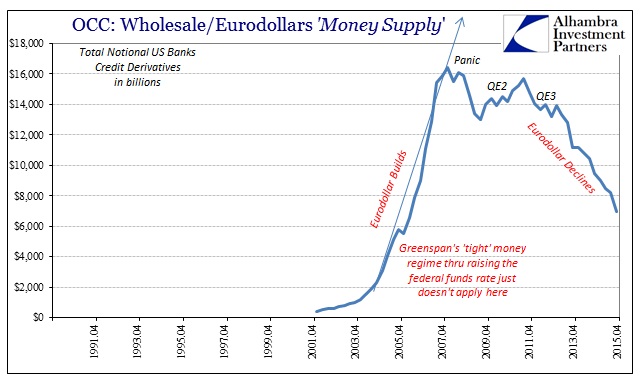

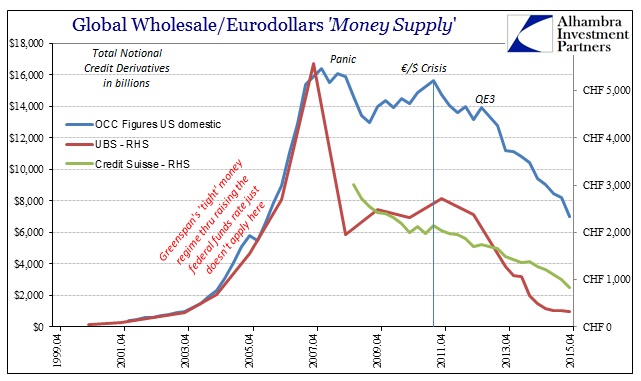

Given the circumstances of that time, following the events of August and prefiguring the events of January/February, the OCC finds in Q4 significant bank withdrawal by the proxy of reported gross notional derivative exposures. Total credit default swaps, once undoubtedly the marginal “currency” of interbank function at the eurodollar system’s artificial height, have withered to just $6.99 trillion, almost $10 trillion less than Q1 2008 just before Bear Stearns kicked off the full adjustment. That is the lowest offered balance sheet capacity for credit derivatives since the middle of 2006 nearly a decade ago; and that figure likely consists almost entirely of stale, prior books that are just being runoff.

It is still significant, however, that the trajectory shifted again lower after the events in the middle of 2013 (taper tantrum and the end of QE as possibly “open ended”). That extraction has only continued during the “rising dollar” period, seeing significant additional emphasis on getting out of the space.

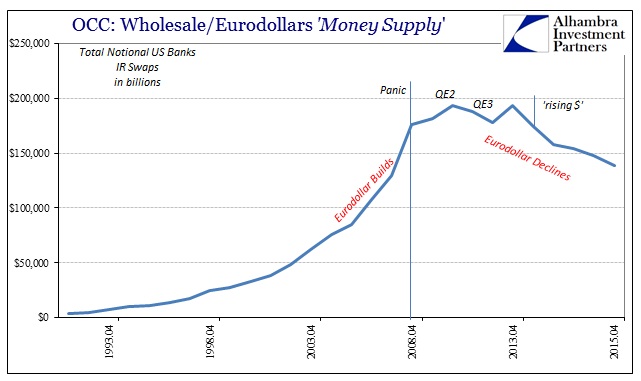

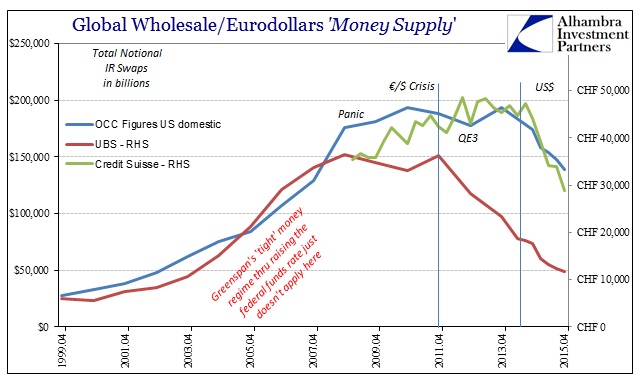

Similarly, total interest rate swap notionals declined 20% in Q4 2015 from Q4 2014, to just $138 trillion. That is down almost a third since 2013, with the majority of the reduction being experienced also during the so-called rising dollar.

Total notional derivatives have fallen in line with interest rate swaps, which is expected since IR swaps make up the vast majority by dollar notional. The decay of the eurodollar system as exhibited by balance sheet reporting of notional exposures matches up with the 2011-12 shift in global economic fortunes since that time/inflection. The rebound trajectory after the 2008 panic had been subdued to begin with, and it seems as if the circumstances of 2011 convinced many participants that a full paradigm alteration was at hand.

This view is consistent not just with OCC-reported figures, which are limited to domestic firms, as we see these trajectories replicated over and over around the world. That includes non-domestic bank balance sheets (below) and financial indications outside of the world of derivatives (above). Both the scale and the timing of implied balance sheet withdrawal suggest it is global banking and its eurodollar system prospects that are in the process of that paradigm shift, and that it is creating, as you would expect given the gravity of the subject, increasingly dragging and dire global economic consequences.

What is left open to debate is causation, and only because these official channels have undertaken the official position wholeheartedly. The mainstream view is that banks have never been healthier, especially as the US economy has undergone sufficient restoration as to now have come supposedly close to “overheating.” To find instead this kind of shrinking, shirking and withdrawal is hard against that narrative and it leads to any number of absurd attempts (not just in derivatives) at bridging the obvious disparity.

The OCC’s quarterly derivatives report features the same, as it mentions now both compression trading and volatility as if efficiency were suddenly the driving factor where it had been only growth and expansion before. It is the disingenuousness of the offered “explanation” that gives it away:

The general decline in notionals since 2011 has resulted from trade compression efforts, as well as the lower volatility environment, which has led to less need for risk management products.

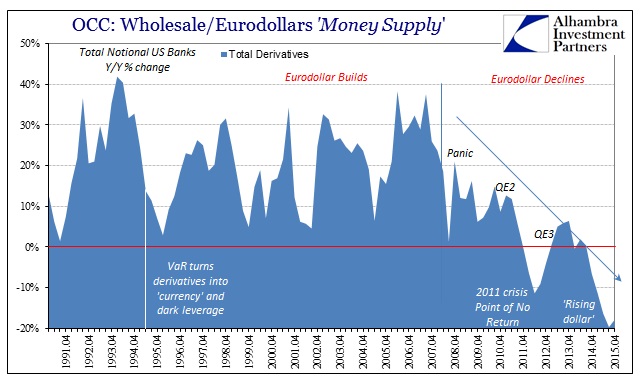

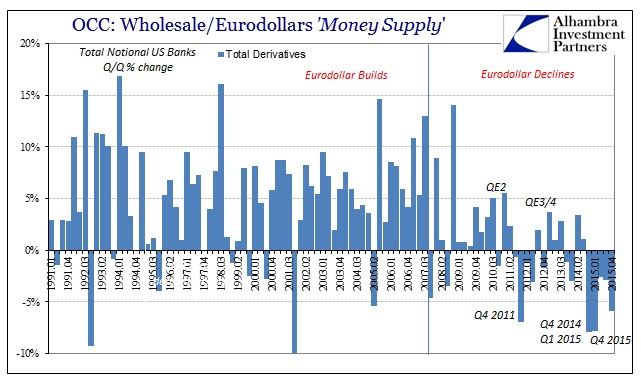

Not even close; the general decline in notionals since 2011 is because of what happened in 2011 and how that related to systemic capability and stability as revealed by what began in August 2007. Compression trading is not a process unto itself as if banks are taking to it as revenue source (it is not actually trading but eliminations). It is instead just one method (perhaps the largest) to achieve some other goal. The OCC, as the media, suggests that revenue problems instead relate to the “lower volatility environment” consistent with the narrative of recovery that is leading banks to figure efficiency and regulations above all other factors. It is a completely preposterous offering, especially when the OCC’s own figures show that the largest reductions in the cumulative derivative books occur during quarters with the highest outward volatility.

The largest quarterly declines in gross notionals match up exactly with the worst “market” conditions of recent years. OCC reports an enormous 6.9% decline in Q4 2011, a quarter that needs no explanation as it was the exact opposite of “lower volatility environment.” If banks ever exhibited a greater “need for risk management products” we would not find it in many quarters other than Q4 2011.

Of those where we do, we find it again in the last quarter of 2014 and the one following to start 2015; both of which showed bigger reductions in reported gross notionals than the end of 2011 and thus likely greater appeals to compression methods of exposure reductions. Again, those quarters were not the placid, boring circumstances where dutiful money dealers were standing by to provide their services only to find little demand as the OCC suggests in its absurdity. Quite the contrary, as October 15, 2014, and the conditions before and after kicked off the notions of trouble that we still find a year and a half later. There was the UST “buying panic”, the initial wave of the junk bond reversal leading into currency problems (Russian and others) and then the immense matter of oil and commodities crashing. In January 2015, European problems resurfaced in sovereign bonds and then the Swiss National Bank interjecting the very reverse of “less need for risk management products.”

Into that maelstrom of high volatility and constant high risk and turmoil, domestic banks withdrew 7.9% of their derivatives exposure in Q4 2014, and then another 7.8% to start out 2015. The only other quarter close to scale of those withdrawals was, unsurprisingly, the final quarter of last year which replayed all those simultaneous concerns only amplified in total global synchronization. In short, banks rushed out of the money business, at least in eurodollar terms, during the very same quarters the OCC suggests should have been booming. Instead, it seems as if the world’s eurodollar banks have been on the wrong end of the “need for risk management products” and are actively seeking to get out of the way.

From there we can infer the immediate problem of the banking position in the aggregate; by timing and by action, banks are acting in general terms as if they (a good many, to varying degrees) were “long” the recovery and all its manifestations (including rate normalization and a further elongated credit cycle). Their (uneven) withdrawal from the eurodollar is a belated (and painful) attempt to address that taken position. Since that is entirely at odds with the official and mainstream narrative, we are left to blindly accept the outrageous and the absurd to explain why the plain obvious must not be.

Stay In Touch