It seems as if some “markets” are having a difficult time coping with the different speed at which the economy is changing. Maybe that should be expected given the dramatic transformation of them into often computer-driven frenzies of headline scans. But this is something else, made so by the nature of this current economic condition as divorced from our experience. As my colleague Joe Calhoun observed, it makes investing an entirely different animal trying to figure the fundamentals into an overall tendency to ignore them at the first sign that it might be convenient to do so.

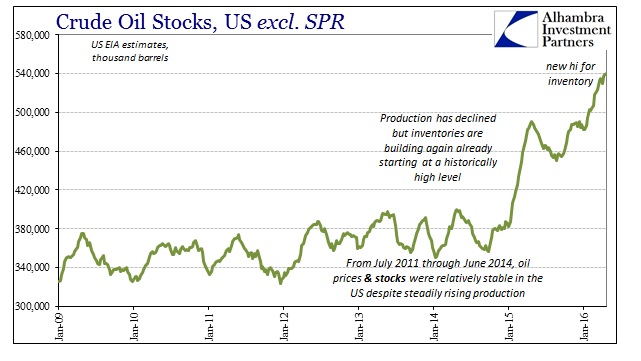

The most obvious example of this dichotomy is oil. This is true in terms of oil as one expression of risk, but also as oil prices are themselves split up and pushing two very different narratives. As I examined last week, the WTI futures curve appears to be pricing something else at the front since February 11 where the backend is looking still at a world that has too much crude and “somehow” no one in a rush to use it.

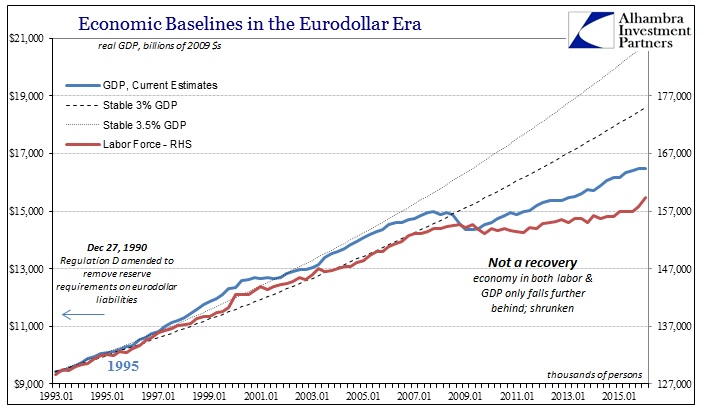

Because this slowdown or elongated cycle isn’t a classical recession, it seems as if that is the major point of contention. A recession is clear – everything drops in unison and to a high degree. What we have seen to this point isn’t that (yet) so economists aren’t quite sure what to make of it. Their first instincts being always to defer to “stimulus”, lack of historical recession is thus taken as if recession or weakness is impossible. This latest phase of the slowdown, however, is nearing its second anniversary and we are no closer to resolution than when it started. Despite the fact that the US and global economy has essentially ground to a halt, the economic risks are still as large now as back then when the halting began. It is a startling realization that leads in an entirely different direction than what is being made of March and April.

Since recession is a singular wave or impulse where uniformity is the defining characteristic, the fact that this slowdown is not that instead entirely uneven and even heterogeneous at times removes any historical basis for analysis (and since we live in a world of statistics that is defined almost exclusively by the historical basis, economists are left in the dark leaving the media utterly confused). Without that confirmation, markets and commentary are left groping at times in nothing but imagination; the mainstream views everything as if the baseline for the economy were still highly positive and only temporarily disrupted. Because of that perspective, most commentary is caught up in the narrowest of focus, trying so hard to turn any positive uptick of the slowdown’s unevenness into the final growth resolve.

It seems clear now that that was the verdict of March and April.. There is no doubt that economic data and markets were better than at the start of the year, but that is not at all the same as marking an inflection. By focusing on only the monthly variations, the mainstream has missed the trend – one step forward, always greeted with assured enthusiasm, followed quickly by two steps back described as “unexpected” and “transitory” weakness. Or, as at the start of this year, three (maybe four?) steps back.

Thus, the step forward over the past few months was given special deliberations it did not deserve. Especially in the past few weeks, those three (or four) steps back at the start of the year are again being asserted; it has started to dawn, in more data points, that not getting worse was, in fact, not at all the same as getting better. Too many “investors” and economists have taken it that way, just as they had all the way down to this point.

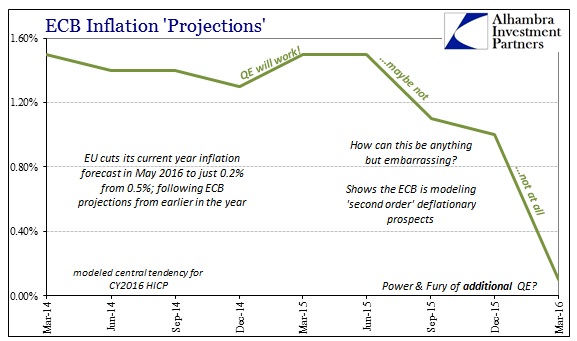

Just today, China’s PMI’s disappointed while (relatedly) Australia’s monetary authorities “unexpectedly” reduced interest rates to a record low. In Europe, GDP and inflation estimates were reduced yet again in yet another blow to QE fanaticism. The EU “government” seems finally to recognize the dangers already expressed by the ECB, as if this second round and expansion of QE weren’t enough of an admission already. In pointing out that weakness is now the defining feature, European authorities made clear once again that this unusual speed of the economy is fully global:

Still, the commission cautioned that several factors could further curb growth in the coming years. On the external side, a slowdown in emerging markets—especially in China-—could trigger significant spillovers in Europe and the world, the commission said, adding that weaker growth in a number of advanced economies, such as the U.S. and Japan, is further clouding the global outlook.

A year ago, it was “overseas” meaning primarily Asia, that was “clouding the global outlook.” The US was believed on an unmovable course toward “overheating”; now the US has become a global risk like any other “stimulus”-ridden economic corpse. And as much as the past few months seemed to have erased a good deal of doubt, there is power behind the EU’s warning.

With the season past its halfway mark, corporate results have so far failed to suggest a speedy recovery from what’s on track to be a fourth straight quarterly decline. Apple Inc., Microsoft Corp. and Alphabet Inc. all forecast sales in coming periods below analyst estimates, sinking large-cap technology shares even as Facebook Inc. and Amazon surpassed forecasts. Banks, however, used cost cuts to top predictions, helping financial shares post the second-strongest performance behind energy producers since the reporting period began.

Analysts still project an 8.2 percent decline in first-quarter earnings for S&P 500 companies. Predictions call for a 4.8 percent drop in the current quarter, compared to forecasts for 3.7 percent growth when the year started.

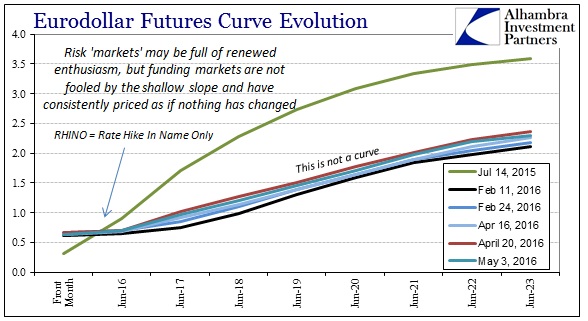

While sentiment and momentum appear unable to grasp this fundamental difference in speed and really slope, funding and more basic markets have never really wavered.

It is, so far, a slow, painful, drawn-out death by any number of small imbalances that only continue and fester. The US manufacturing recession, for instance, has gone on for more than a year and a half already and still it’s as if it were only the start of recessionary imbalance (inventory); Goldman’s earnings portend only worse “dollar” conditions ahead and therefore still more “headwinds” for the global and domestic economy that has been worn down by them for almost two years already (and really for longer under the surface).

The world seems totally confused by the slope, and in some ways that isn’t surprising. Again, a slow motion crash is still a crash – though “crash” may not be the best suited description, as that is just one possible outcome of what is really more like a systemic reset that could manifest any number of ways.

The eurodollar curve, for instance, has barely budged since February 11 while risk markets have been bid back as if the last two years never happened. Systemic liquidity, as I noted here (subscription required), is just as bad and perhaps even worse now (as hard as that might be for some to imagine) than at China’s Golden Week that marked this turn in sentiment. Some parts of the financial system don’t seem to have gained enough space or margin to be able to so fool themselves.

After all, one step forward after several steps back is still further behind in a world that really, really can’t afford to be still going backward.

Stay In Touch