Goldman Sachs is cutting back more in its staff than previously announced. Though not yet confirmed, Bloomberg writes that the reductions in the fixed income business are being increased. After posting absolutely horrible results for Q1, the job cuts were expected. The continuation of them, however, seems to be more drastic than first thought even though “market” conditions improved into Q2.

Goldman Sachs Group Inc. is cutting more jobs in its securities units, extending reductions in fixed-income operations this year to roughly 10 percent of workers there, according to people with knowledge of the situation.

The dismissals in New York and London this week build on cuts that already had targeted about 8 percent of fixed-income personnel through last month, people with knowledge of the matter said, asking not to be identified because the plans aren’t public. The push also affects the equities division, one person said.

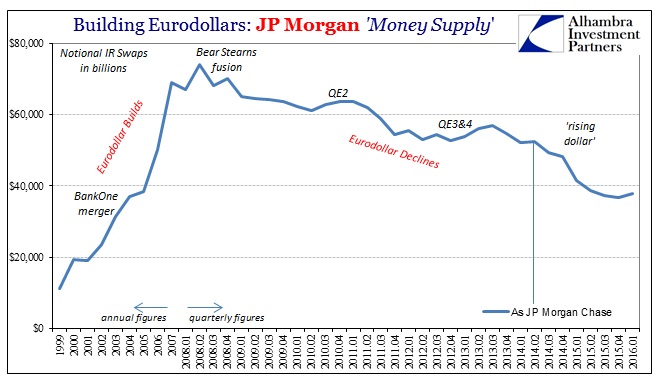

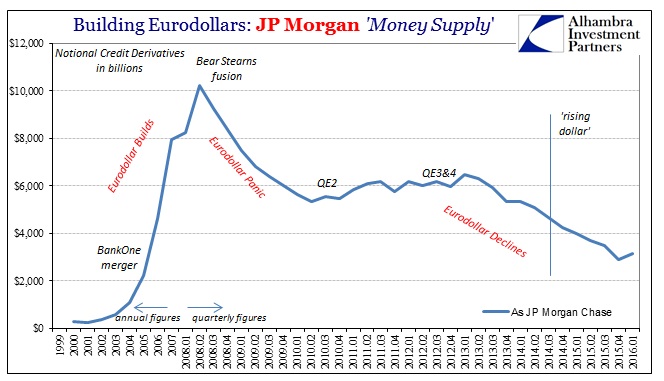

The article notes that Goldman’s CEO while mindful of the sting of the “bank’s” results is still hungry for opportunity, “looking to grab market share as rivals including Morgan Stanley scale back amid the industrywide slump.” With the firm’s SEC 10-Q now available, it is interesting to see that Goldman reported significantly higher derivatives notionals in Q1 perhaps in opposition to what one might expect given the nature of the funding/trading environment.

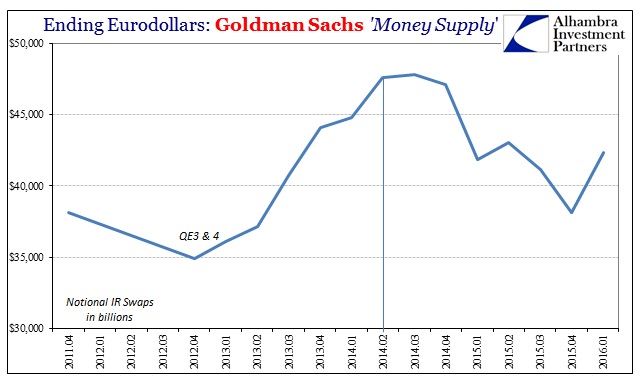

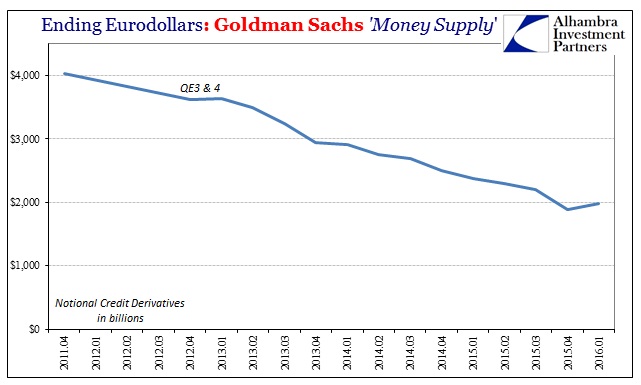

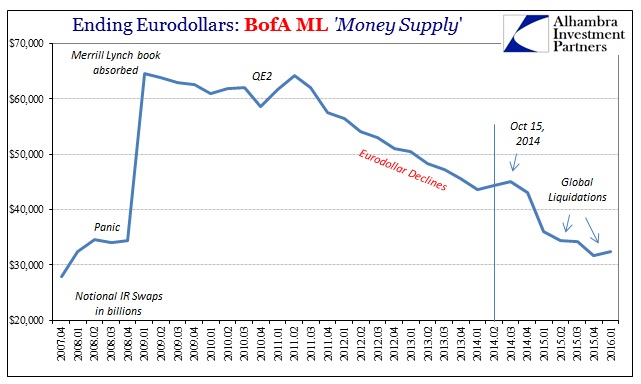

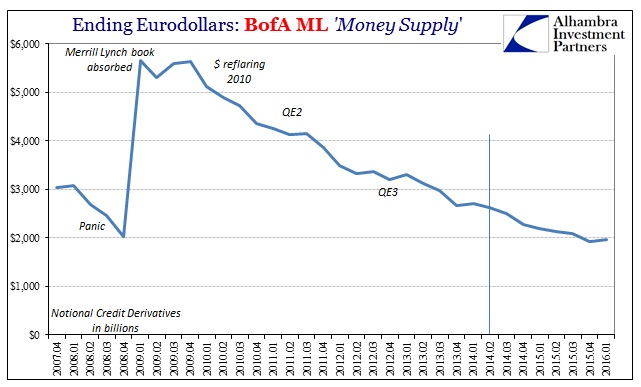

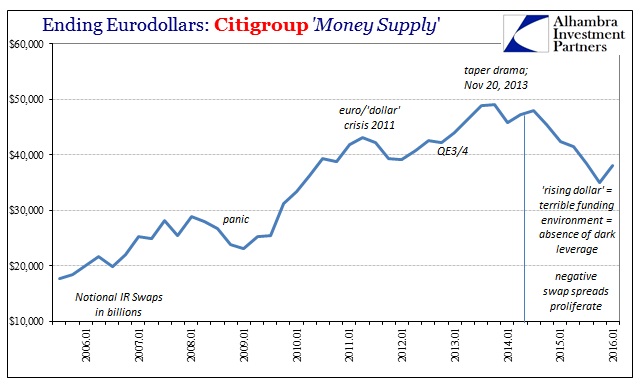

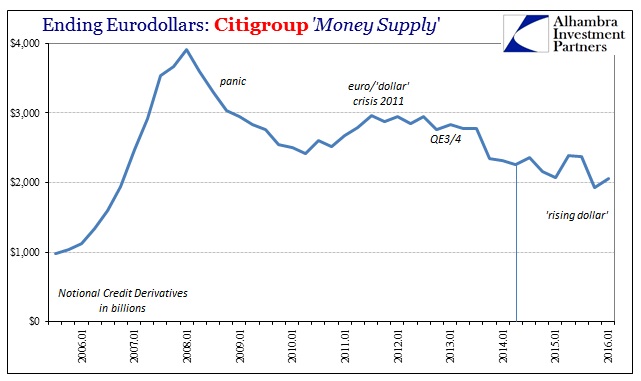

The increase in interest rate swaps was especially notable, rising $4 trillion to the highest level since Q2 last year. It wasn’t just interest rate swaps, however, as the reported balance in credit derivatives also rose. While it wasn’t a huge amount, it was the first increase since the start of 2013 and the initial phase of QE4.

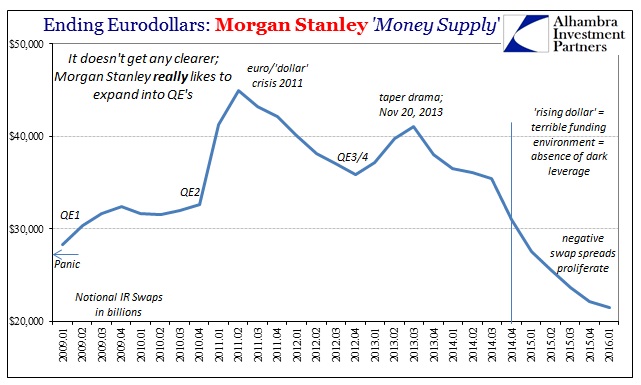

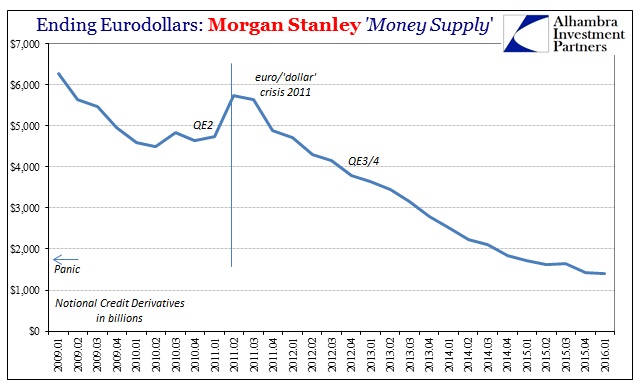

Over at Morgan Stanley, sure enough, that bank’s reported notional balances continued instead their declines. In both interest rate swaps and credit derivatives, MS indicates only that it is steadfastly committed to moving out of the derivatives business. On just this comparison alone, it does seem like despite the job cuts in FICC Goldman might appear to be trying once more for opportunity.

If we look around the dealer universe, however, we find evidence to support a much different interpretation. Goldman was not the only bank to increase its notional exposures in either interest rates swaps or credit derivatives. In fact, again contrary to what you might expect given the “market” circumstances of Q1, there was a curious uniformity in behavior. JP Morgan, Citigroup, Merrill Lynch (BofA) and some other foreign dealers all added to their derivatives books at the very time it seemed like they should have done the opposite.

There is a major difference between Goldman Sachs and Morgan Stanley in the area of derivatives and this segment of eurodollar systemic dealing. Of the domestic banks, there are four that account for 91% of all gross notionals outstanding (as tabulated by the OCC from bank call reports) and these Big 4 have dominated this space for practically the entire history of standardized traded derivatives. Goldman is one of them; Morgan Stanley is not. The other three banks I mentioned above, all of whom increased their derivative books in Q1, were the remaining three members of the domestic backbone in derivatives dealing.

The larger dealers are those firms that are counted on to offer balance sheet risk absorption and pliability in the worst of circumstances; i.e., true systemic liquidity. Sometimes that obligation is simple profit (the textbook case of widening bid/ask) and sometimes it may be contractual. In reality, as noted in prior examinations, derivatives books are often used for other purposes not directly related to the exact money dealing function. As a kind of shock absorber, an increase in derivatives usage might indicate an attempt (systemic or idiosyncratic) at more desperate risk management.

One of the most extreme examples was the London whale for JP Morgan in 2012. As the market turned against the intended trading positions in the CIO (prop trading) book, the bank was “forced” to write protection (it was more complicated than that, but on net) for itself to try to gain control over an entirely illiquid position that was going further and further sideways. There are other examples from the 2007 and 2008 period, where bank positions were by market condition pushed way outside of tolerances that required enormous “hedging” to try to get them back before serious marks would have to be introduced.

In other words, by the almost uniform behavior of the larger dealers in Q1 it seems quite likely (to me) that they were forced (perhaps too strong a term) by raging systemic illiquidity into creating more positions than they might have otherwise attempted. If that is correct, it would certainly add more color as to the intensity of the liquidation wave in January and February, as well as the losses or revenue reductions taken during it. It was, after all, Goldman that reported the worst of the quarterly results in these relevant segments while also showing the largest increase in derivatives.

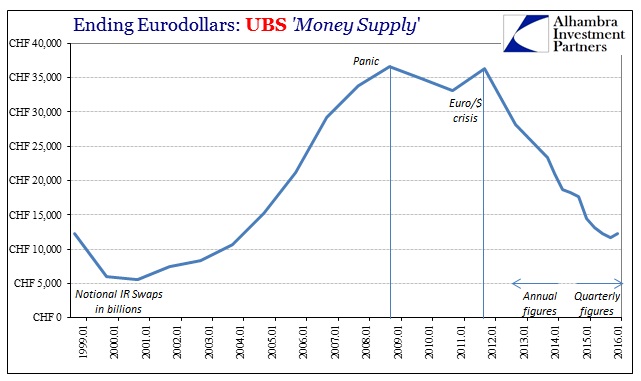

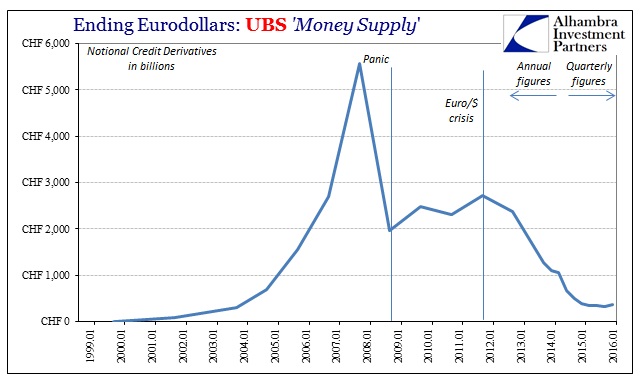

I would also add one more bank (of those that have reported updated figures) to the class of dealers, though now we are left with only overseas purely eurodollar banks. UBS, the Swiss bank that has been far more aggressive and consistent in reducing its derivatives books and overall FICC position, also reported an increase in interest rate swaps for the first time in its quarterly results (going back to 2013). It was by no means a huge amount, but it is noteworthy in how it breaks the clearly established trend. Notional balances in credit derivatives also rose, though very slightly.

If this is indeed the case across the dealer spectrum, you can appreciate why these banks want to get out of the business. Being on the hook for liquidity at the worst times is a very bad proposition, Goldman Sachs standing out most on that account in this most recent episode. It is particularly troublesome when even in the more benign quarters you don’t make much if any revenue anyway.

If Goldman really was looking at tremendous opportunity they would be adding to staff in that area. The fact that the firm continues to shed resources (beyond just job cuts) in FICC strongly indicates they don’t see opportunity in either the near or longer term, only risk.

Stay In Touch