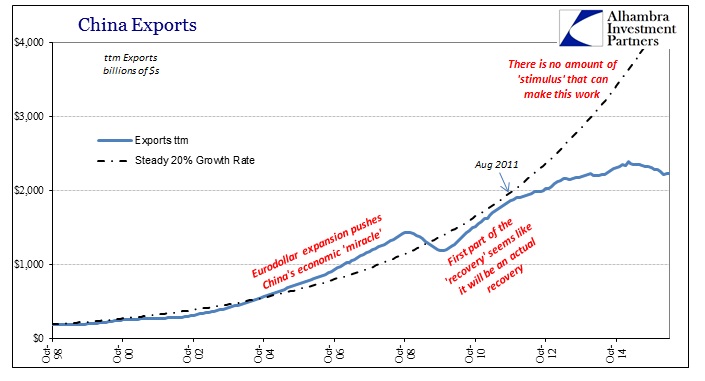

We often think of liquidation events exclusively in terms of price, but in the real economy there is volume to consider. When financing dries up as financial agents run for cover lest they receive only further margin or collateral calls, it enacts a short run disruption in economic flow. At the margins, some firms are forced to delay activity while others are can only give up altogether. It is difficult to figure how much in any liquidation is temporary and how much ends up as a permanent reduction.

The dramatic events of January and February all across the globe undoubtedly created just this kind of mix. As it ended around February 11, there was going to be some bounce back in economic terms as funding began to flow again, allowing delayed projects and activity to restart. Because of that, it wasn’t surprising to see certain economic accounts and factors seemingly improve especially in March. That did not mean anything other than the end of the liquidation crunch, as the baseline decay remains in place and, as we are finding out again, was only amplified by further reduced capacity during the liquidations – those projects and activity that will never be restarted.

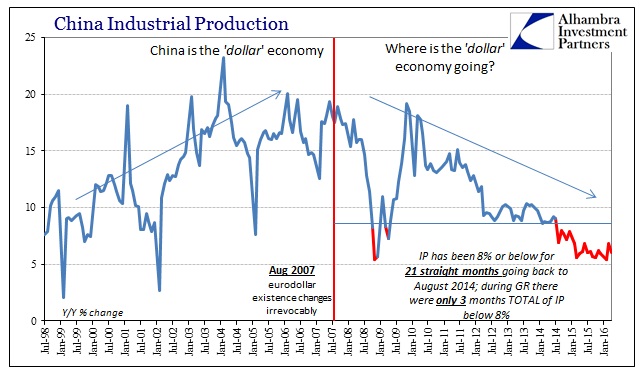

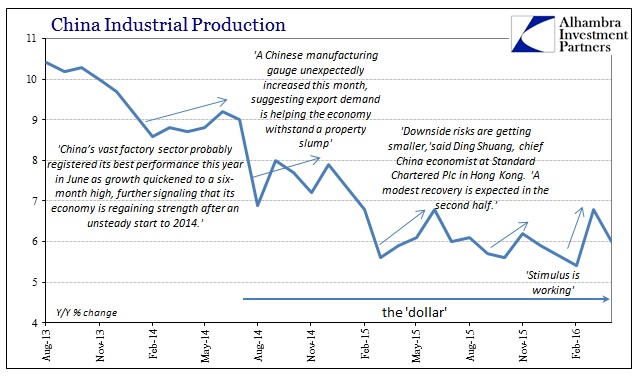

As usual, this global process is most evident in China. Despite a burst of optimism especially in March statistics, the temporary part of the liquidation rebound is increasingly within view. Industrial production had jumped to 6.8% from a multi-year low of 5.4% in the January-February holiday combination and brought with it the usual “it’s all over” commentary. Instead, IP dropped back to just 6.0% in April which, like exports, suggests only what I propose above; a (very) brief respite only because the “dollar” hasn’t been as obviously stifling as it was to start 2016.

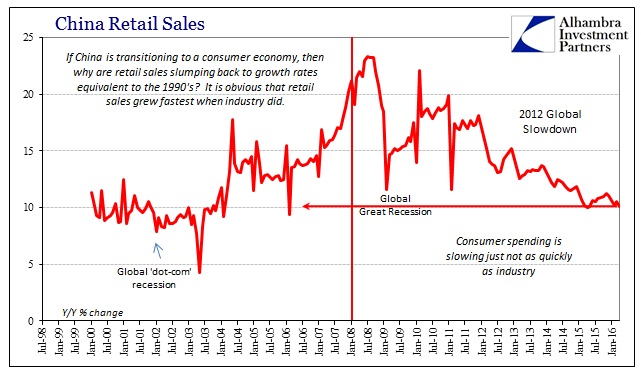

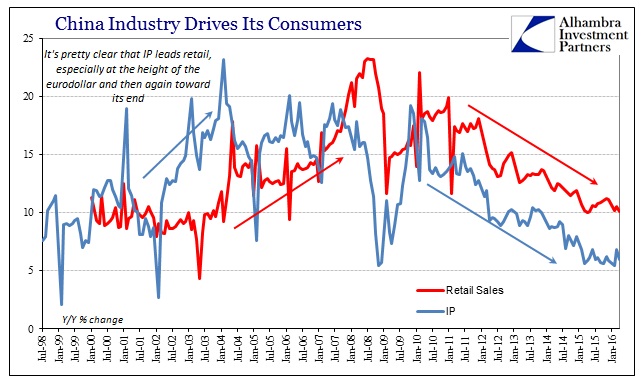

The same trend was recorded in Chinese retail sales, as well, which is perhaps a bigger blow to March’s hopeful sentiment. Even economists have started to admit China’s industrial “miracle” may never be resumed so they have turned in near desperation to the idea of a “consumer driven” economy as if there is some plan being carried out to replace the manufacturing/export orientation of the rising eurodollar period. This wishful thinking gained traction only because retail sales have decelerated at a lag to industrial production.

It is clear, however, through a wider perspective that China’s consumers are slowing just as China’s industry where “stimulus” can at best explain the delayed reaction. Even in 2016, the same pattern emerges as in manufacturing and export; retail sales were atrocious to start the year (Jan/Feb) at just 10.2%, nearly as bad as the worst of 2015, rebounding to 10.5% in March. The latest update for April is even worse than the Jan/Feb period, as Chinese retail sales slowed again to just 10.1%.

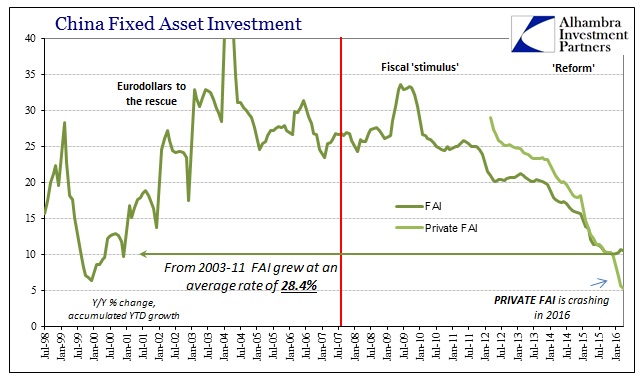

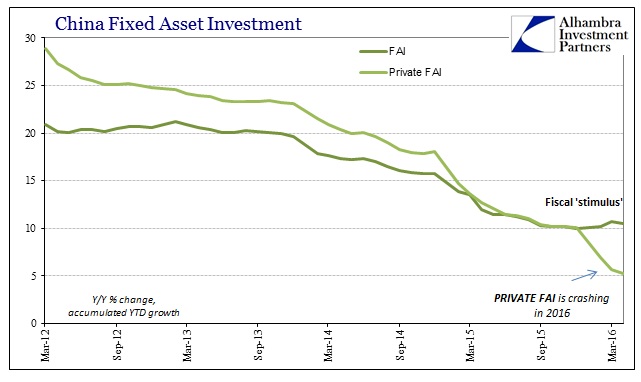

As bad as those end results are for the direction of the Chinese economy, the real bad news is buried in productive capacity. Where industrial production and retail sales may have picked up the temporary portion of the economy disrupted by liquidation, fixed asset investment (FAI) suggests the reduction in baseline economic reality might be even worse than feared. Private FAI is crashing in China.

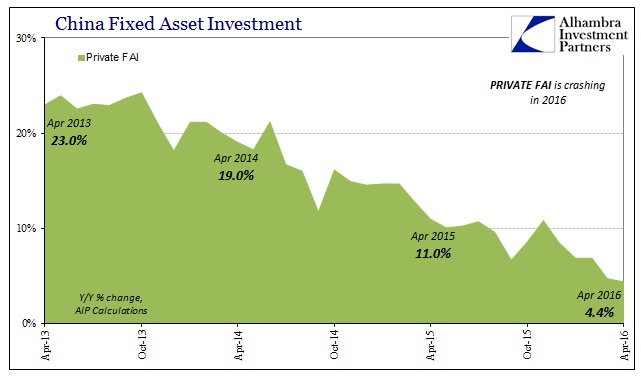

Overall, total fixed asset grew 10.5% in April, down from 10.7% in March. Private FAI was just 5.2%, however, as it is clear the Chinese government is back to fiscal “stimulus” once again. The National Bureau of Statistics reports FAI in “accumulated” annual growth, which means the stated estimates for April include all months of the year through April. Since Private FAI was 6.9% to start the year but only 5.2% in April, actual growth in capex was less than that still. In other words, rather than rebound Private FAI has only slowed further into this year.

By simple calculation we find that Private FAI for April alone was just 4.4% more than April 2015. That compares to 11.0% growth in April 2015 over April 2014. Before the “rising dollar”, private-driven capex in China was expanding at and above 20%, and had been nearly 30% when the NBS first broke out the private component in 2012. That would be a level more consistent with what China was expecting of the “recovery”, which can only suggest 4.4% (and the obvious trajectory to get to that level) really is crashing industrial investment.

Unlike the remaining components in FAI, private sources of capital investment are the primary expressions of job growth and Chinese economic advance. Any “stimulus” that flows through the State-Owned Enterprises is largely inefficient and ineffective, the usual waste of spending for the sake of spending. Because China is still oriented toward manufacturing, private spending to increase that capacity accounts for about a third of all Chinese labor! Further, state-owned media has reported that Private FAI is responsible for 90% of new urban employment. China is in big trouble at 4.4% (with the arrow still pointing further down).

This helps explain the lagged deceleration in retail sales and the Chinese economy overall, more so the persistent and stubborn slowing than the lag. Unlike temporary bursts of production levels, capex investment growth is determined by longer run projections and harder reality than the overflowing optimism that arrives with every minor, short-term uptick in monthly variation. In many ways, this descent in the Chinese baseline is incredibly simple and intuitive unlike the orthodox commentary that tries to deny it month after month:

The fact that Private FAI is now crashing in 2016 is related to the effects of the liquidation(s). The lack of financial flow in “dollars” convinces more and more firms that despite all the promises the global economy will never rebound while at the same time mothballing projects that will never be restarted and canceling many before they ever get that far. It is the brutal reality of this ongoing paradigm shift – the slowdown that will not stop slowing down. From this perspective, as noted on the chart above, it is easy to understand that there is no amount of “stimulus” (read: waste) that can make it work; without a eurodollar resurrection there is no path back to 2005. The manner of this decline is often uneven and lumpy, but it is uniform across China and the global economy. It will be undisturbed by anything except further liquidations to carry out the business end of the capacity reduction.

That is the most important piece of the economic update for China in April. Industrial production and retail sales demonstrate that despite some optimism that March wasn’t January/February the direction of the Chinese economy has not actually changed. The dramatic slowing in Private FAI suggests an even sharper incline in the already downward tilted baseline.

Stay In Touch