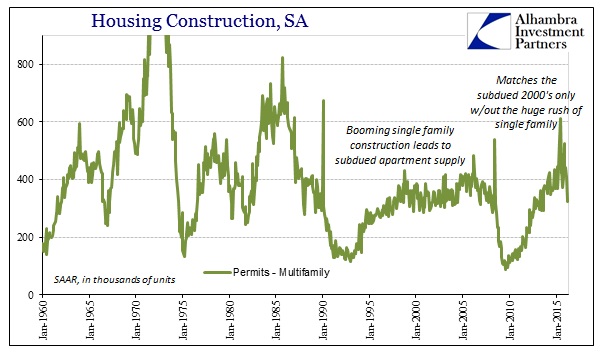

Home construction estimates continue to suggest the same kinds of economic imbalances unchanged from last year. While construction of single family homes had been rising, that increase was not nearly as widespread and voluminous to indicate that the real estate market had been restored by full economic restoration (jobs, jobs, jobs). Apartment construction, on the other hand, has been scaled back significantly of late. Multi-family permits had dropped to just 318k SAAR in March from above 500k as late as November. At barely more than 300k, it was the lowest indication of future apartment construction since the summer of 2013. There was only a minor rebound in April to just 348k.

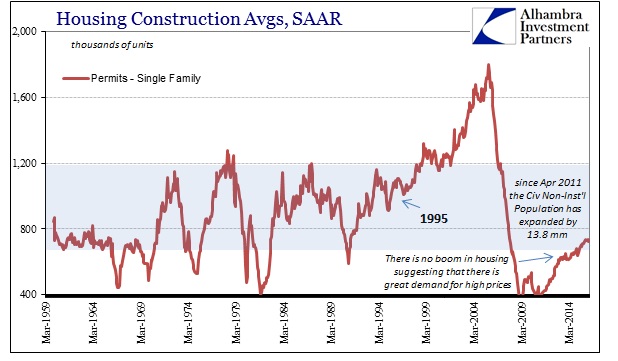

If we assume that the narrative about the single family market is true, meaning that upper level homes are selling but those in the lower tiers are not because of pricing (or mortgage availability) rather than economy, then we should expect either a burst of construction in the single family units or apartments (or both). If the economy is strong and getting more so by the month, then household formation would demand after six or seven years of depressed supply a rush of activity far beyond the lower levels of the historical range in each. The Civilian Non-institutional Population, the potential supply of new labor, expanded by almost 14 million since April 2011 when the housing market started to turn around. That alone argues for a significantly higher pace to construction.

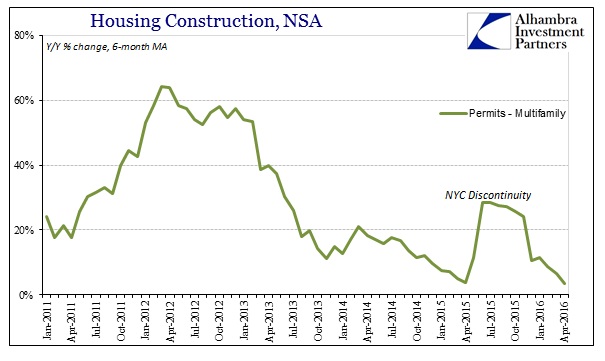

Instead, as you can see immediately above, the only big burst of activity off the bottom was in the early years under the auspices of the QE’s. The construction mini-bubble slowed in 2013 during the precursor episode to the “rising dollar” and never really regained that prior optimism. That, along with the subdued nature of the single family market, does not argue for a strong economy.

In more immediate terms, the reduction in activity since last autumn might only be a temporary pause in that restrained pace, but it might also signal a potentially dramatic shift in financial conditions. How many marginal apartment projects have been funded by leveraged loans? Or junk bonds? If there is a financial component to the current decline in construction indications, you would expect that diminished future “supply” to increase the prices of existing units.

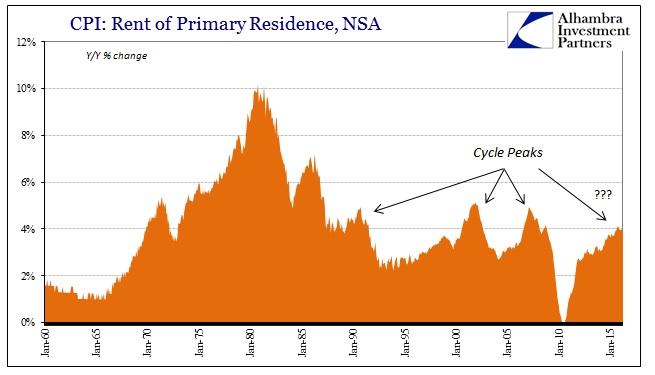

The current estimate for the rent component of the CPI (not including the housing price index for owner’s equivalent rent) accelerated to near 4% year-over-year, but that is still less than prior cycle peaks where apartment construction was also declining. In other words, it doesn’t really clear up any of this conjecture. If the economy and recovery was more “normal” and apartment supply was affected by financial disturbance, then we would expect to find a more rapid rate to rent increases. That still might happen this year if apartment construction continues to depress, but I seriously doubt it.

Instead, it seems more likely the indications for construction and price increases both suggest the weak economy while also not precluding the possibility of disruption in the flow of funding for new construction. Though below the rate of those prior peaks, rising rents under these conditions would not help move young Americans out of their parents’ basement or others out of their cohabitation arrangements. That might propose another explanation for diminished(ing) apartment construction, that weak income growth and quite limited actual job gains price out of the rental market what little supply there has been.

If that is the case, it would mean rents rising more so to “pay” off the financing of that past mini-bubble than anything else. It is certainly a debatable proposition, but the continued curious irregularity of housing suggests just that kind of distortion. It is perhaps yet another factor to add to consideration of the already considerable cost of the QE’s.

Stay In Touch