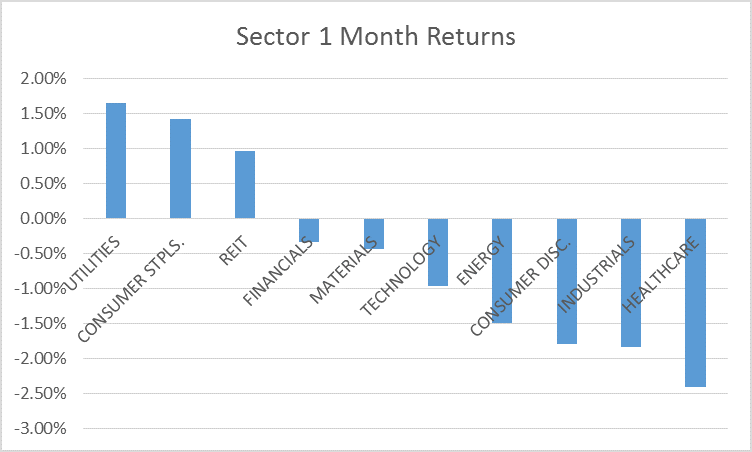

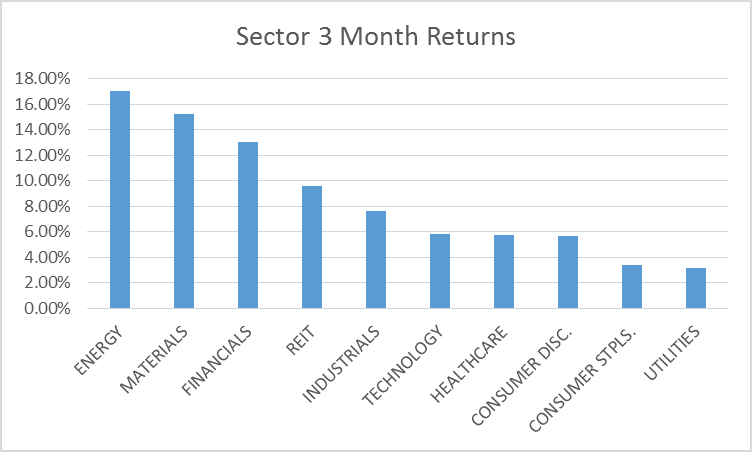

The short term leadership is shifting as the dollar comes off its lows. Energy and materials had been leading the market during the recent period of dollar weakness. As the dollar found its footing over the last month, defensive sectors took the lead.

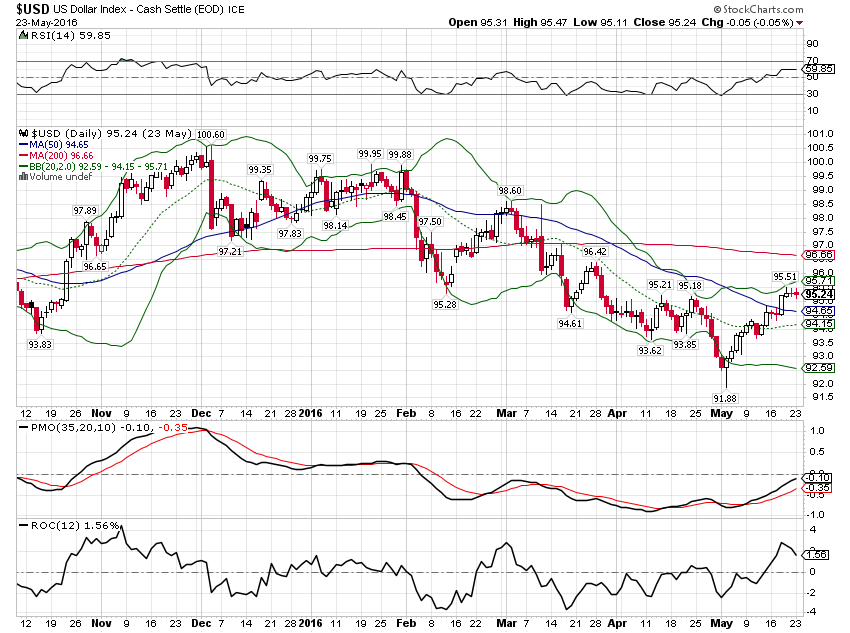

Whether this short term shift continues will likely depend on whether the Fed is right about the economy and how the market reacts to higher interest rates. What produced this pullback in materials and energy and the rally in defensive stocks was the dollar’s reaction to the recent more hawkish Fed statements. A higher dollar is now associated in the market’s mind with weaker global growth and potential troubles outside the US. Higher dollar = risk off at least for now. History says though that if the Fed is right and growth does re-accelerate in Q2 and beyond, then stocks will shrug off the short term weakness and move higher with better growth and earnings. So, is the Fed right about growth? Their track record surely doesn’t inspire much confidence but hey, blind squirrels and all that.

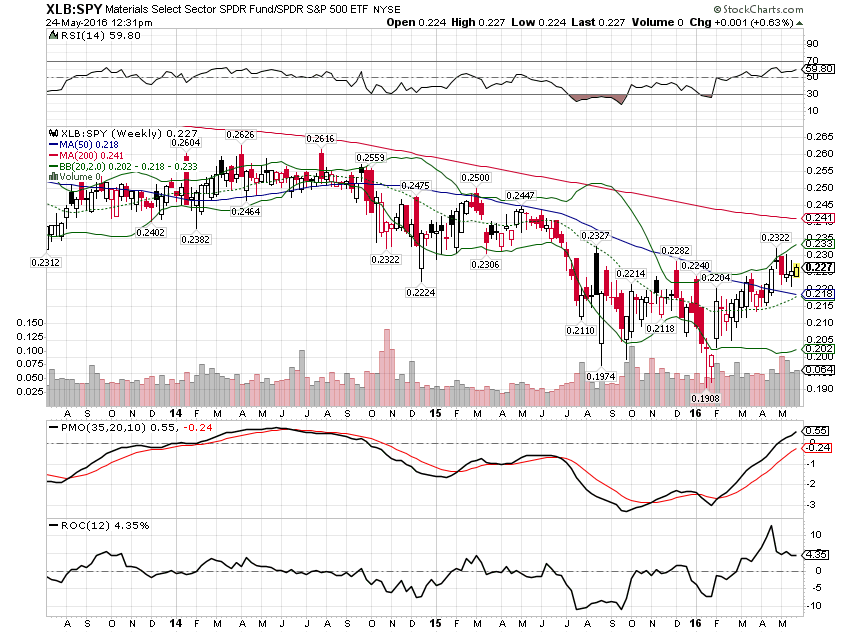

For now, the longer term momentum remains with the weak dollar investments, an indication that for now, the market isn’t really buying the Fed’s accelerating growth scenario. Bond markets seems to back that up with real rates still negative.

Energy and materials are obvious beneficiaries of the weaker dollar. Financial benefitted from a yield curve that had briefly stopped flattening. The contrast between the 3 month and 1 month returns can essentially be summed up by the phrase risk on/risk off. Or if you don’t like that one, how about cyclical versus non-cyclical. The obvious conclusion the market has drawn is that a weak dollar is positive for US growth because it is positive for global growth. In the short run that may be true but longer term we do not want a weak dollar. Or a strong one for that matter; stability should be the goal. In a sense it is the volatile dollar that has gotten us in this mess.

As for the dollar itself, at this point the bounce looks more like the dead cat variety than a change in trend:

Materials are outperforming the S&P 500 since the beginning of the year. For that to continue we will likely need to see a resumption of the dollar weakness.

The dollar’s recent rally does not appear to be anything more than a rally in a downtrend. As long as real interest rates are negative I see no reason to expect a sustainable rally. Negative real rates do not point to an acceleration in real growth regardless of what the Fed is predicting, expecting or hoping. I would still advise caution on the weak dollar trades until we see a definitive break down in the dollar though. This recent rally could carry a bit higher before reality sets in.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch