Ten days ago, it was reported that the Bank of Japan for the first time set aside reserves against expected losses should its massive portfolio of JGB’s finally move toward QQE success. The main part of all this “stimulus” has been the accumulation of primarily government bonds at massive premiums. If it were ever to actually work, then the Japanese central bank will have the very good problem of a winning economy causing financial losses as market-determined interest rates rise. To account for that scenario, BoJ last year updated its policy framework so that it could set aside some interest income to offset any such principal losses.

The first accumulation of this reserve was reported as ¥450 billion for the year ending March 2016. It is a tiny fraction of the ¥350 trillion in total JGB holdings, but much larger in proportion to the payments the central bank makes to the central government (but it’s not monetization?). In fiscal 2015, the BoJ is believed to have only remitted about ¥425 billion, much less than the ¥757 billion paid during the prior fiscal year. Part of that drop was in relation to this new reserve, while BoJ also had to take account the rest of its enormous asset holdings – including those denominated in foreign currencies (like UST’s).

As with any bank’s loss reserves, the intent is to minimize swings in income so that results are far more predictable, in this case payments to the federal government. The implication is that BoJ is more confident in the ultimate success of QQE and NIRP so that it would begin what is really an “exit” strategy.

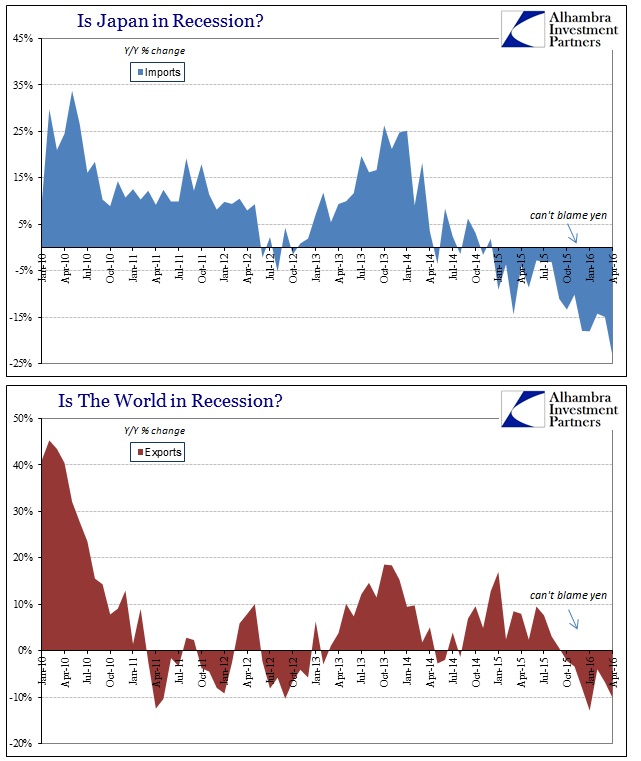

Around the same time as news of this “exit” found its way into the mainstream, Japanese government officials spent the better part of the latest G-7 meeting trying to get the group to declare a high risk of another Lehman-type crisis.

Japan had pressed G-7 leaders to note “the risk of the global economy exceeding the normal economic cycle and falling into a crisis if we did not take appropriate policy responses in a timely manner.” On Thursday, Abe presented documents to the G-7 indicating there was a danger of the world economy careering into a crisis on the scale of the 2008 Lehman shock.

It seems quite the official contradiction, with the Bank of Japan preparing for the best of times while its government through diplomacy wishes the rest of the developed world to declare the worst of times (or at least the highest risks for them). Of course, neither of these efforts was at all what they seemed, though officials in both are truly exposing their contempt for anyone else’s intelligence. These are absurd times made so by these absurd people and their enormous degrees of self-reverence.

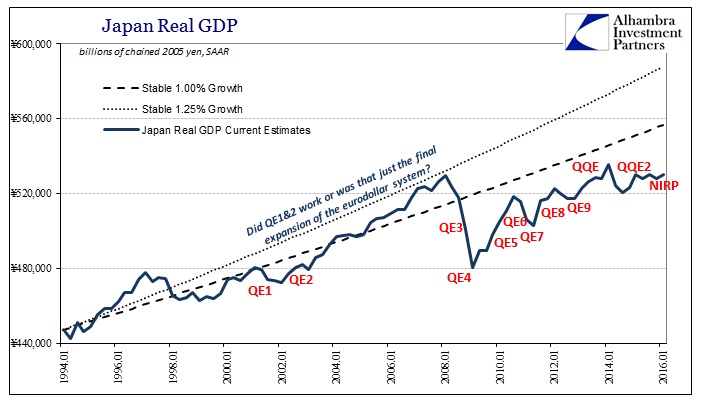

Abenomics is a complete failure; on every count. The government which had planned another tax hike is now cornered by its own past unearned confidence. In order to sell QQE and the other “arrows”, Prime Minister Abe had on numerous occasions declared that April 2017’s tax hike would proceed unless there was another earthquake or Lehman. Therefore, for his government to announce this week, as is widely expected, that the tax increase will be at best delayed is tantamount to admitting QQE, the main “stimulus” effort, didn’t work even after three years of it.

Rather than take the route of full attestation of the obvious, absurdity reigns in all official corners. The BoJ will act like QQE is fostering all the right sorts of economic conditions right up to the point of shifting income payments and loss reserves, even though hardly anyone outside orthodox economics believes it anymore (except the media that still, somehow, refers to it as “stimulus”). The federal government tried to get the rest of the world to declare high Lehman risks just so they could have an excuse that wasn’t a confession. They really do think we are just that stupid.

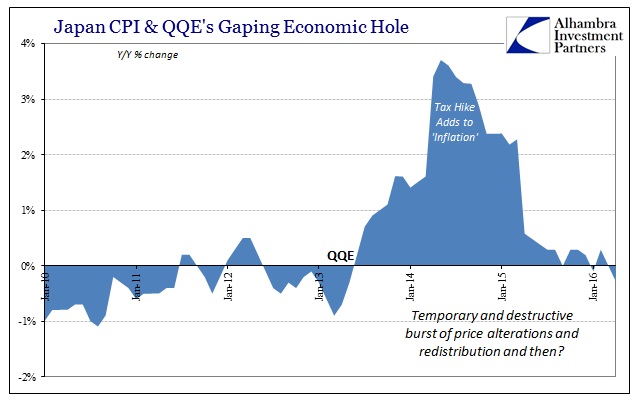

To start with, Japan has once more found itself without any “inflation.” To be clear, that is about the best part of the Japanese economy at present since inflation is nothing other than a burden, but in terms of QQE and “stimulus” that fully intends at least 2% sustained price increases it can only be viewed as if QQE never happened. When it first started in April 2013, BoJ declared that two years would be sufficient; now after three years they are still at zero. Apart from an initial burst of yen-driven price changes that ended up only further impoverishing the Japanese people, from which orthodox economics actually expected a full, sustainable recovery to result, there is no trace of “inflation” left. Now that the CPI is once again firmly planted at and below zero, Japan’s QE experiment can join the rest of the world’s in proving no long-term inflationary effects from “money printing” – which was supposed to be the economic foundation for “stimulus.”

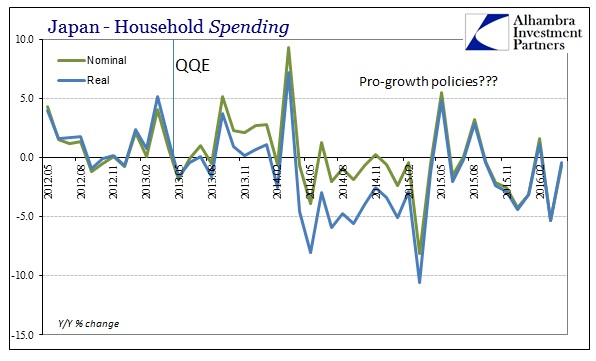

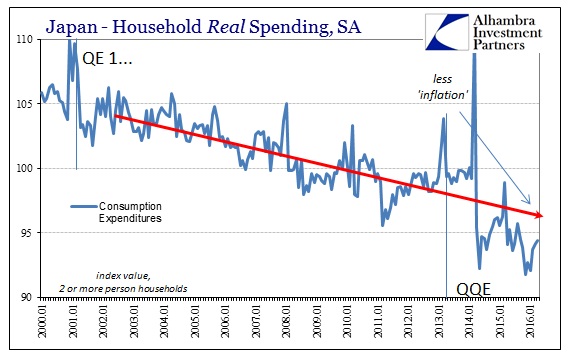

Household spending continues to decline in either “inflation” setting, even though once again a negative CPI is “adding” to the rate. In other words, nominal spending fell 0.7% year-over-year in April while the negative CPI “added” to obtain a real rate of just -0.4%. There are no indications that Japanese consumers and households are in any condition to begin a robust buying binge. Three years is more than enough time for any positive effects to appear.

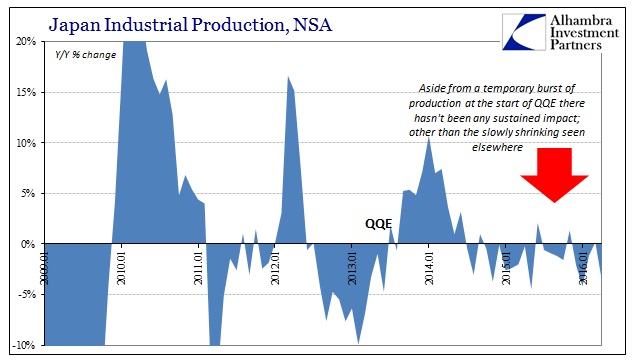

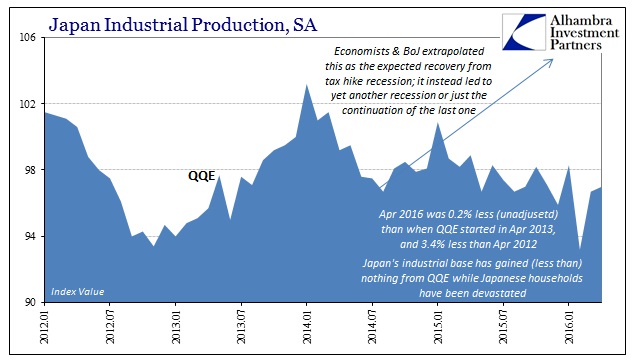

Japanese industry has not gained anything for the surrender of Japanese households, with industrial production falling 3.5% in April, the 18th time in the past the 22 months. IP in April 2016 was slightly less than the production level in April 2013 when QQE began. Worse, IP is still 3.4% below April 2012, which further suggests both continued economic decline and a distinct lack of any effect from all the “stimulus.”

Together with the atrocious state of Japanese trade, there isn’t anything at all to suggest QQE in particular and Abenomics overall has made any positive impact. At best, the Japanese economy shows little notice of it, though there is a great deal more evidence that these intrusions have made an already bad economic situation that much worse – especially for Japanese households who have had to bear the brunt of programs that obviously don’t work but are so politically attached that official sectors have to resort to increasingly bizarre means to justify them.

They really do think we are all so dumb and economically illiterate that we can’t easily recognize that they really don’t know what they are doing. It means, once again, that the recovery is only political; admitting that QQE doesn’t work undermines their claim to political authority. If “stimulus” isn’t stimulus, then what do we need central banks and central bankers for? They would rather continue the lie and remain politically relevant than admit what the rest of the world is already finding out; they choose to reign over economic wreckage rather than serve in our recovery.

Stay In Touch