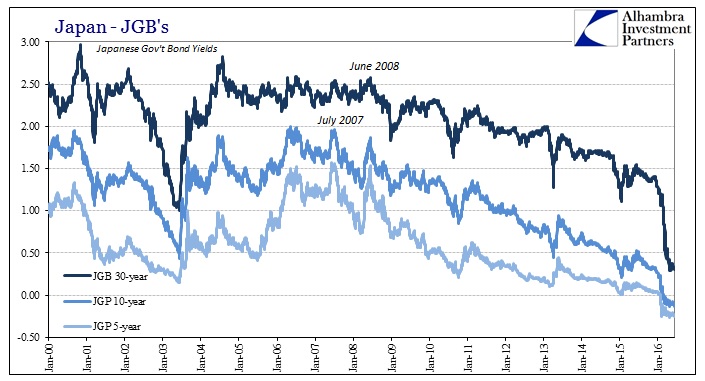

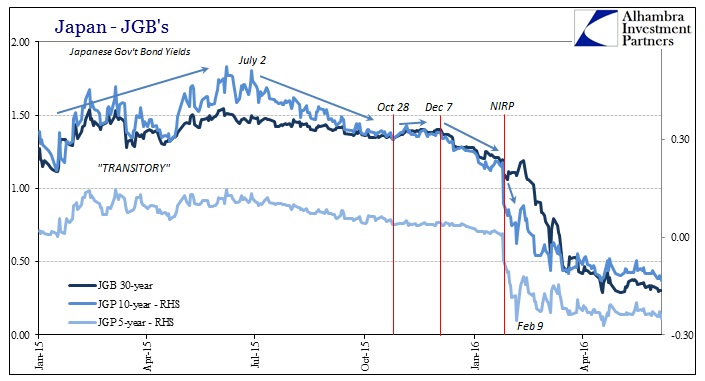

On July 2, 2015, the 10-year Japanese Government Bond (JGB) traded to a stout closing yield of 0.511%. That was up significantly, in Japanese financial terms, from the start to the year where the benchmark bond yield had tumbled to as low as 0.206% supposedly in the aftermath of QQE expansion. The Bank of Japan had added to its already-disgusting pace of JGB purchasing at the end of October 2014, where the 10-year yield had been 0.466%. As of yesterday’s close, the JGB 10s yield -0.133%.

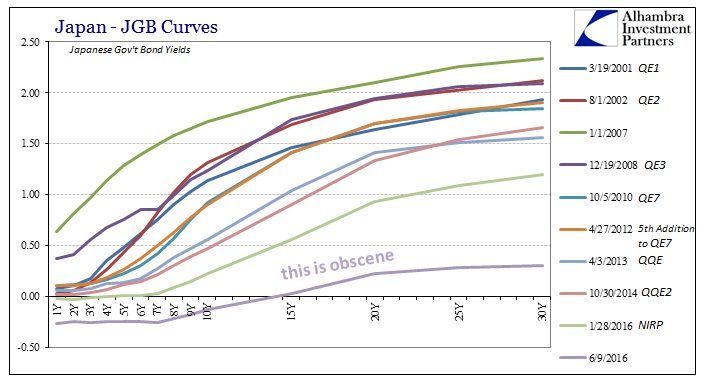

Conventionally, it has been assumed that monetary “stimulus” explains these movements – even to the extremes of late. If almost the whole of the JBG curve is under zero now, it is typical to think that the introduction of NIRP was the cause.

From a broader historical perspective, it is also very easy to believe that the rather steady if uneven decline in JGB rates was also due to all the BoJ buying. After all, its holdings of Japanese government bonds recently surpassed the cumulative holdings of all Japanese banks. Very often under QQE the BoJ is the only buyer in a trading session because it has to be to keep up its mandated pace to the point of crowding out even its dealers. This has become such a problem, along with negative yields, that Bank of Tokyo-Mitsubishi has applied for resignation from its primary dealer status. BoTM is Japan’s largest bank.

Bank of Tokyo-Mitsubishi UFJ is preparing to relinquish its role as a primary dealer of Japanese government bonds as negative interest rates turn the instruments into larger risks, a fallout from massive monetary easing measures by the Bank of Japan.

Banks, once the biggest buyers of JGBs, see little appeal in sovereign debt today. The bonds have very low yields, and a rise in interest rates could leave banks with vast unrealized losses. Private-sector banks held just over 229 trillion yen ($2.13 trillion) in JGBs at the end of 2015, nearly 30% less than at the end of March 2013, before the BOJ launched massive quantitative and qualitative easing measures.

But the BoJ does not set the price for its purchases, even where it ends up as the only one undertaking transactions. The 22 (for now) primary dealers are required to bid in any JGB auction and the private market dictates the price for secondary activity (the BoJ has to have a seller to buy from). The problem with every central bank intervention is that all activity is done from a non-economic perspective; volume is the key component in “quantitative” “easing”, not price.

At the margins, then, the BoJ is only transacting at the price which mostly secondary market participants would be willing to give up their JGB’s. It is quite reasonable to assume that if the world were looking much better, as it did between January 2015 and that July, JGB sellers would take a relatively lower price at each transaction iteration. Conversely, if the world were looking much worse, JGB sellers would “need” greater premiums in order to part with the perceived safety of these sovereigns. The focus on quantity of Japanese bank holdings is misplaced or at least inappropriately over-emphasized in the context of price.

While the acceleration to QQE starting in November 2014 likely had an effect on the JGB market, the price for those bonds was far more attuned to the global economic context of the time – which was, amidst the “unexpected” oil crash and sudden proliferation of negative signs in so many economic accounts in so of a wide geographic distribution, not good. From January forward, and really after March 2015 (CNY pegging), the world appeared to be a much better place. Weakness increasingly looked in the mainstream as if Janet Yellen was right about “transitory.” Not surprisingly, the Japanese government bond market followed that general outline.

It all changed again in early July, as the JGB 10s clearly demonstrate on the chart above. Trading volatility in terms of price fell dramatically and the yield dropped steadily throughout the global liquidation in August and its aftermath through September and October. With only a slight pause in November, Japanese bond yields at the long end began declining almost two months before NIRP. These moves were not without context, however, as at that time there was no shortage of indications (coincident to the change in yen to appreciation) that “transitory” was not just wrong but very wrong; especially in Japan’s very close economic and financial relationship with the central focus of the “dollar” run, China.

From this context, NIRP takes on an entirely different character. It wasn’t added “stimulus” so much as confirmation that BoJ had panicked into doing something, anything, thus confirming the worst interpretations (for intermediate terms) of what was already a serious global liquidation. From that view, the continued low yields thereafter were and are not due to NIRP, either, but rather the combined outlook of the continued “dollar shortage” and what that means on a fundamental level for both Japan and the global economy – it hasn’t gotten any better.

This is a fundamentally different proposition than “stimulus”, a seismic change that is now finally penetrating the mainstream:

Investors are seeking the relative safety of bonds as central banks struggle to spur economic growth and inflation. Policy makers in Europe and Japan are pursuing record stimulus programs, and traders are scaling back forecasts for when the Federal Reserve will raise interest rates.

It isn’t quite that far, but it is close to the observable conditions that propose “stimulus” isn’t actually stimulus, only confirmation that the economy is weak enough to warrant some kind of action. This is the natural reaction that should have been the defining setting dating back to early 2010; if the US, or really global financial system and economy, needed a second QE then what kind of trouble must it have been in that the first didn’t fix? The mainstream characterization of QE2 was entirely focused on what it “would” do rather than how bad economic and financial conditions must have been to precipitate another large Federal Reserve response. This was all repeated in 2012 with QE3, and in any and every other central bank jurisdiction where “stimulus” was continual.

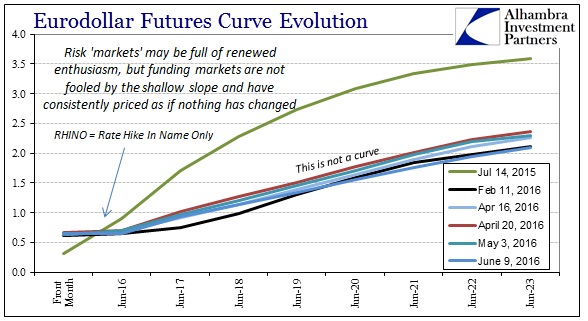

When you are no longer so enthralled about what QE or “stimulus” “will” do, you start to focus correctly on why that should even be a possibility. The record low rates all across the world are not because of “stimulus”, then, rather it is the combined effect of monetary policy amplifying worries that monetary policy doesn’t work – and that it won’t ever work. The more extreme and really obscene it becomes, the more the mainstream cannot escape what was the case all along.

Low interest rates are not the mark of further “stimulus”, they are the bright shining light of complete, continuing failure; financial, meaning “dollar” and wholesale, as well as the related global slowdown undeterred by any central bank’s overestimation of itself.

As noted yesterday, this is endemic and not just a Japanese problem. I highlight the Japanese bond market here because it is most commonly associated with BoJ policy. If even JGB’s, despite the heaviest of heavy central banking, can follow along very closely with the global “dollar” outline, then it is the best evidence that “stimulus” is nothing like how it has been described and faithfully recited. All this “money printing” is supposed to lead to inflationary recovery and success, but the world’s credit markets show only increasing concern of further and worsening monetary restriction and the economic consequences of it.

There is a silver lining, albeit very small at this juncture. The more the world starts to re-evaluate “stimulus” along these lines, the more there will be demands for answers – real answers, not more orthodox buzzwords and nonsense. Unfortunately, that is still a long journey to get the mainstream to where global credit and funding already are.

Stay In Touch