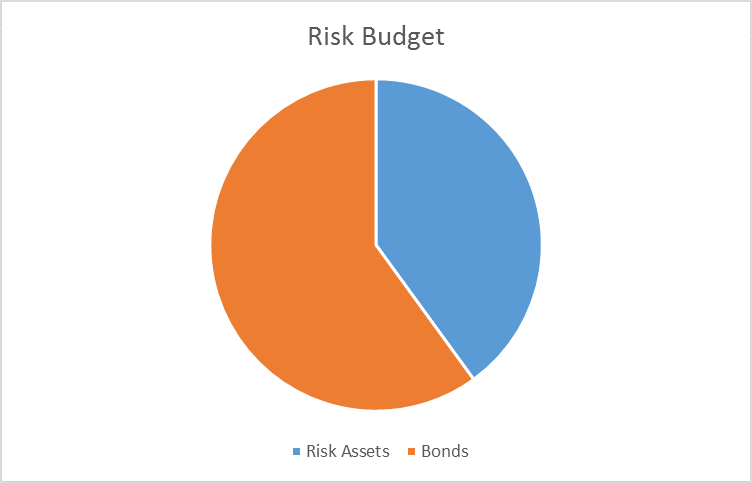

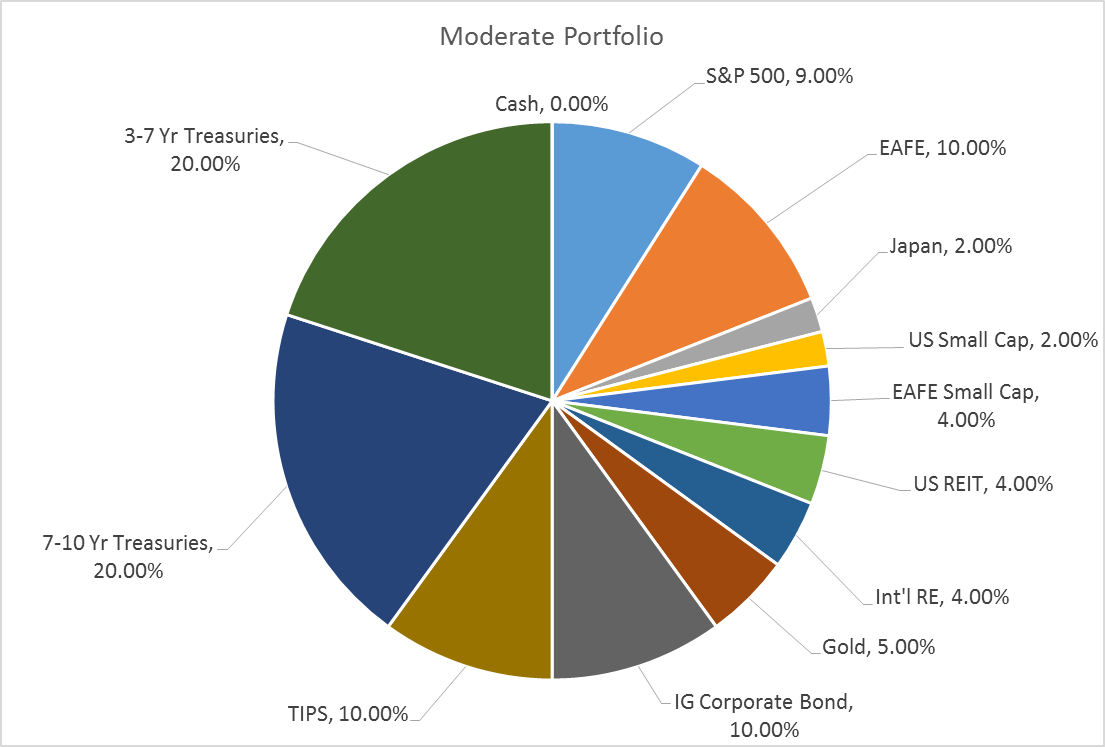

The risk budgets are unchanged again this month. For the moderate risk investor, the allocation between risk assets and bonds remains at 40/60. I struggled more with this decision than any in recent memory but in the end there just isn’t sufficient evidence to make a change. Raising or lowering the allocation to risk assets right now would require making too many assumptions about the future and I’m not in the business of foretelling the future. Credit spreads did narrow again over the last month but not enough, as last month, to change the overall trend toward wider spreads. All other indicators continue to support the bearish case. Sentiment does seem to support the case for risk assets but isn’t a primary consideration in our allocation process and not as clear cut as it seems in any case.

As I related in the Bi-Weekly Economic Review, the economic news recently has not been encouraging. The negative turn in the economic data has been reflected most directly in the bond and currency markets. The yield curve continues to flatten while the 10 year Treasury yield pushes toward record lows. The US dollar index is again testing its recent lows, threatening to break the uptrend of the last few years. Stock and junk bond traders have taken lower rates and a cheaper dollar as a positive, a dubious assumption in my opinion and contrary to the survey based sentiment readings. Investors may tell pollsters they are not bullish but their portfolio say something entirely different.

Indicator Quick Review

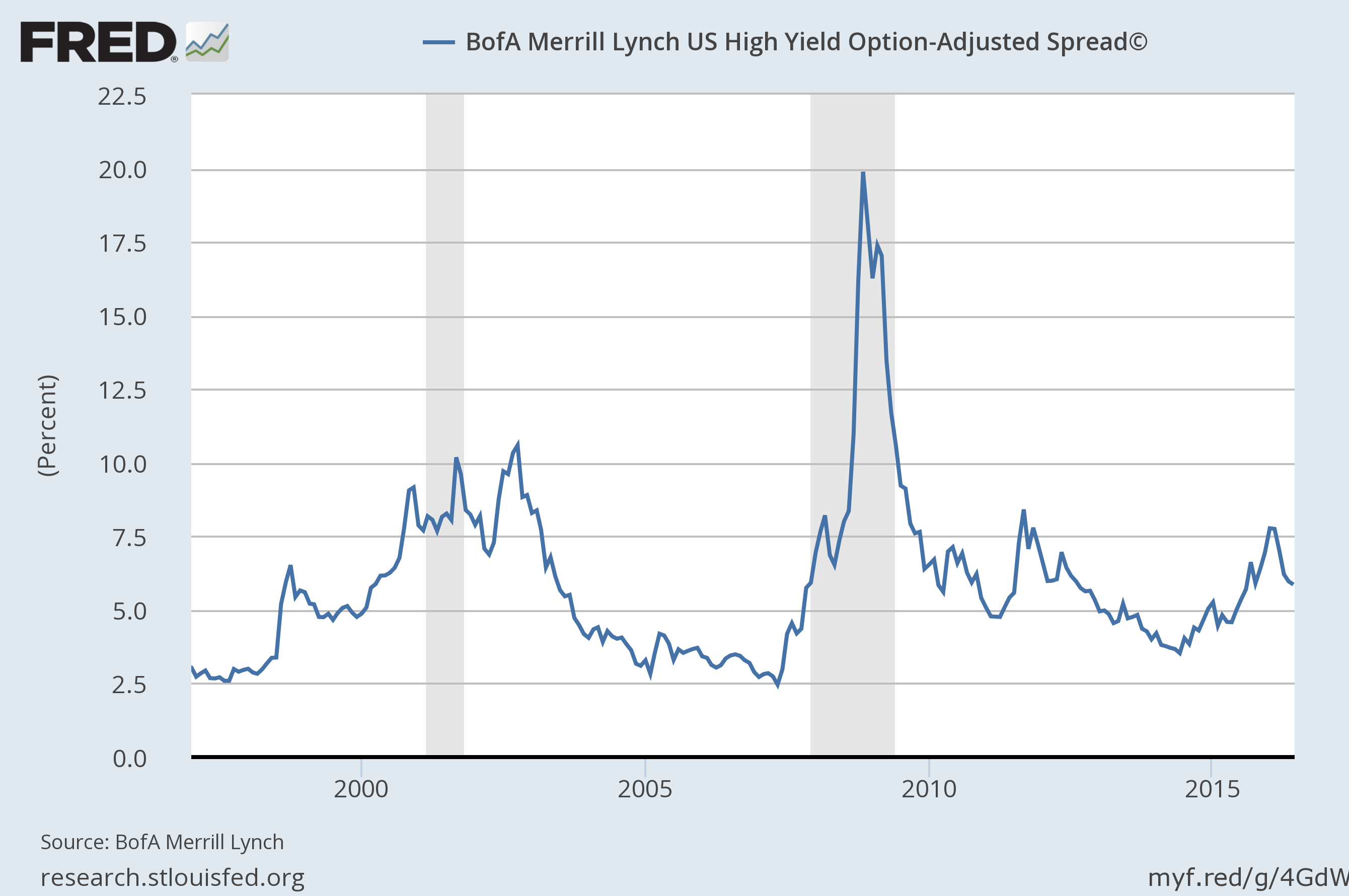

- Credit spreads: Spreads continued to narrow falling from 6.46% at the last update to 5.86%. That still does not break the widening trend that first started in the summer of 2014. Spreads globally have generally narrowed since early February during this risk on phase but it seems more a reflection of risk appetites than any real improvement in the fundamentals.

- Valuations: Nothing has changed with regard to valuations. US stocks are expensive and the rest of the world is generally cheaper.

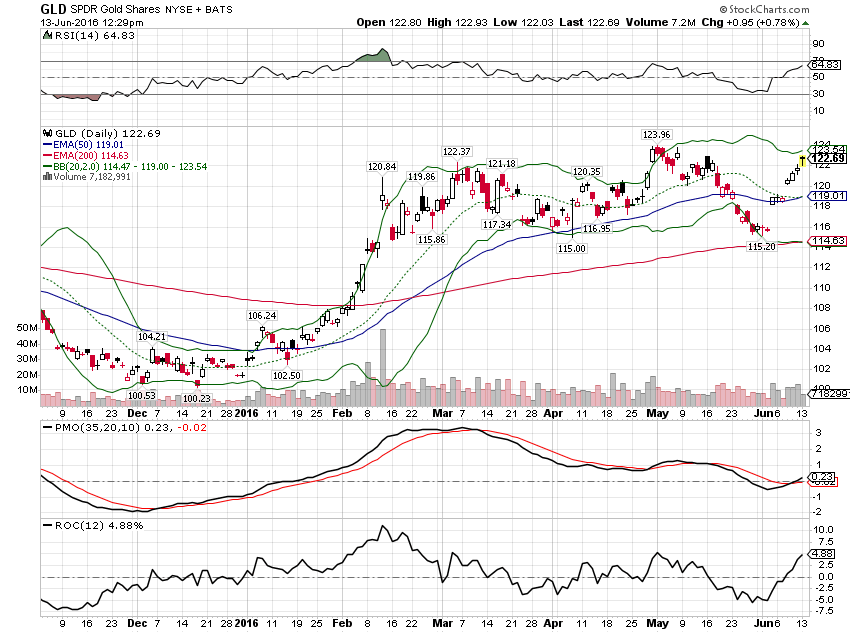

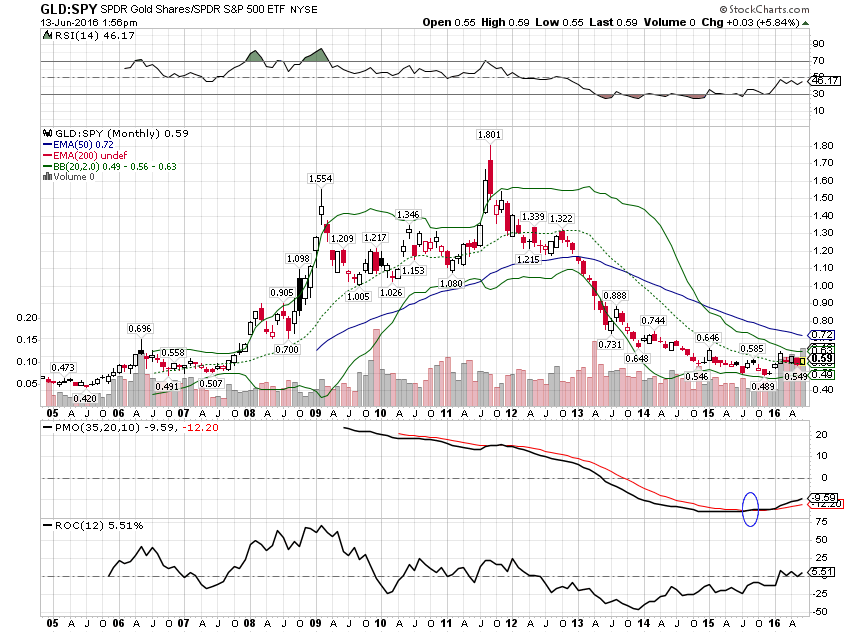

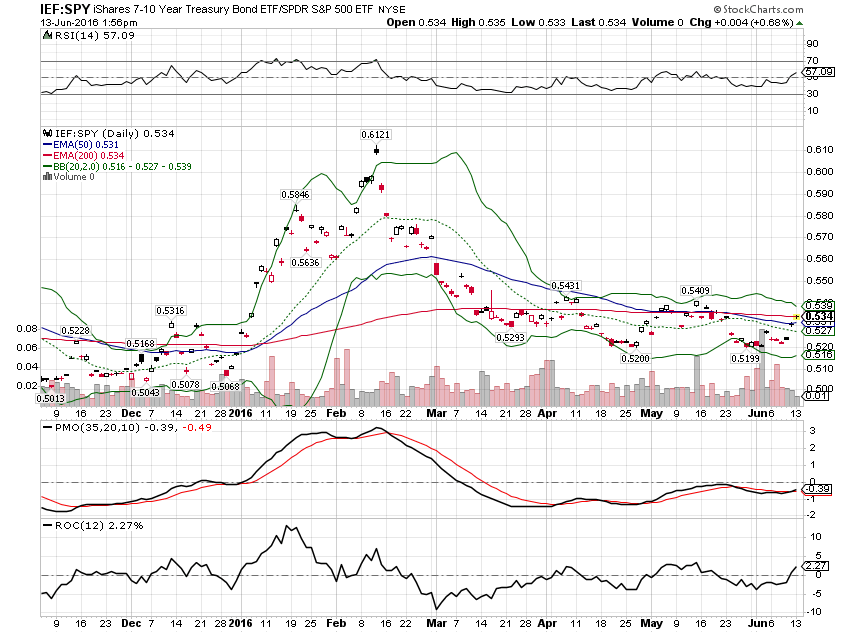

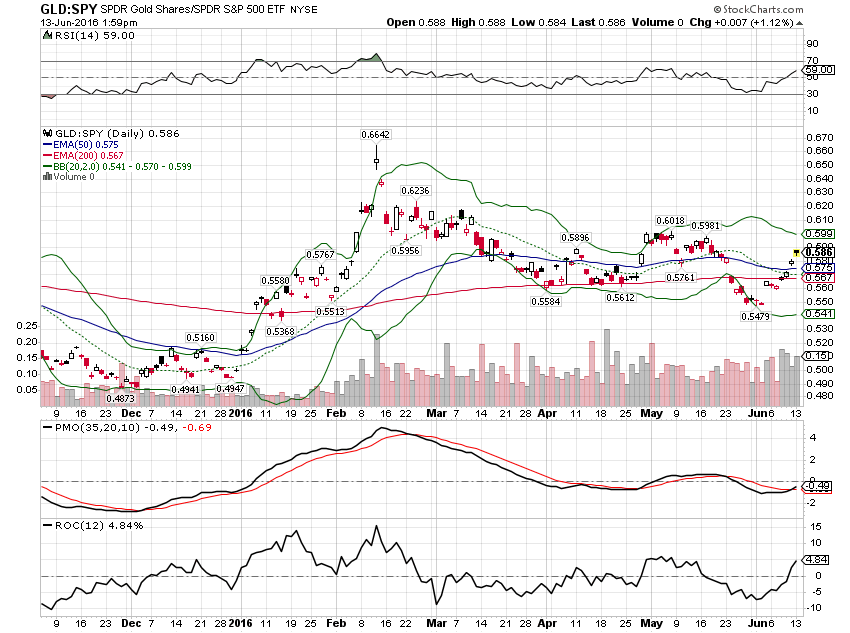

- Momentum: Long term momentum for US stocks has not changed, still negative. Momentum continues to favor gold and bonds over stocks.

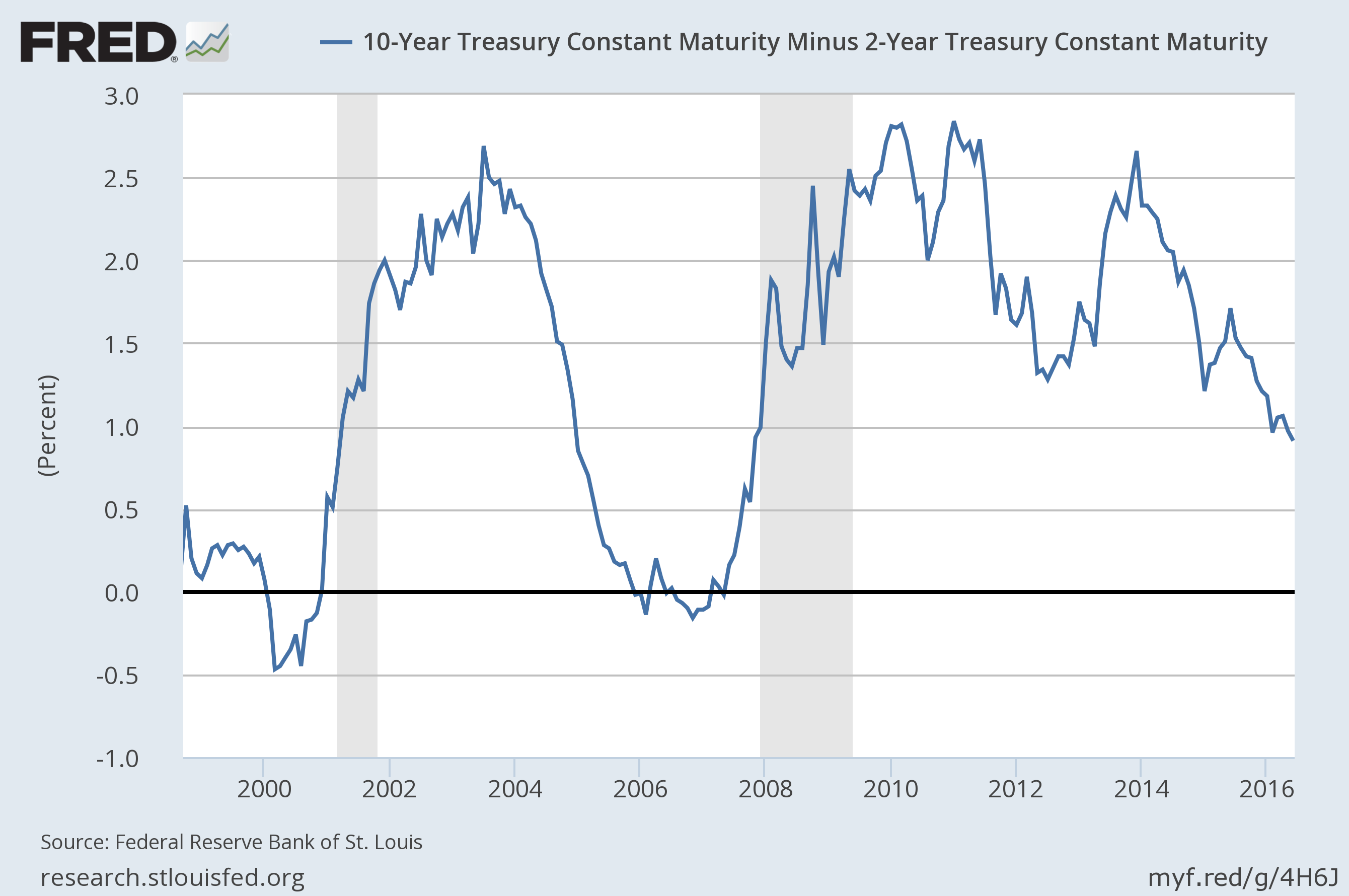

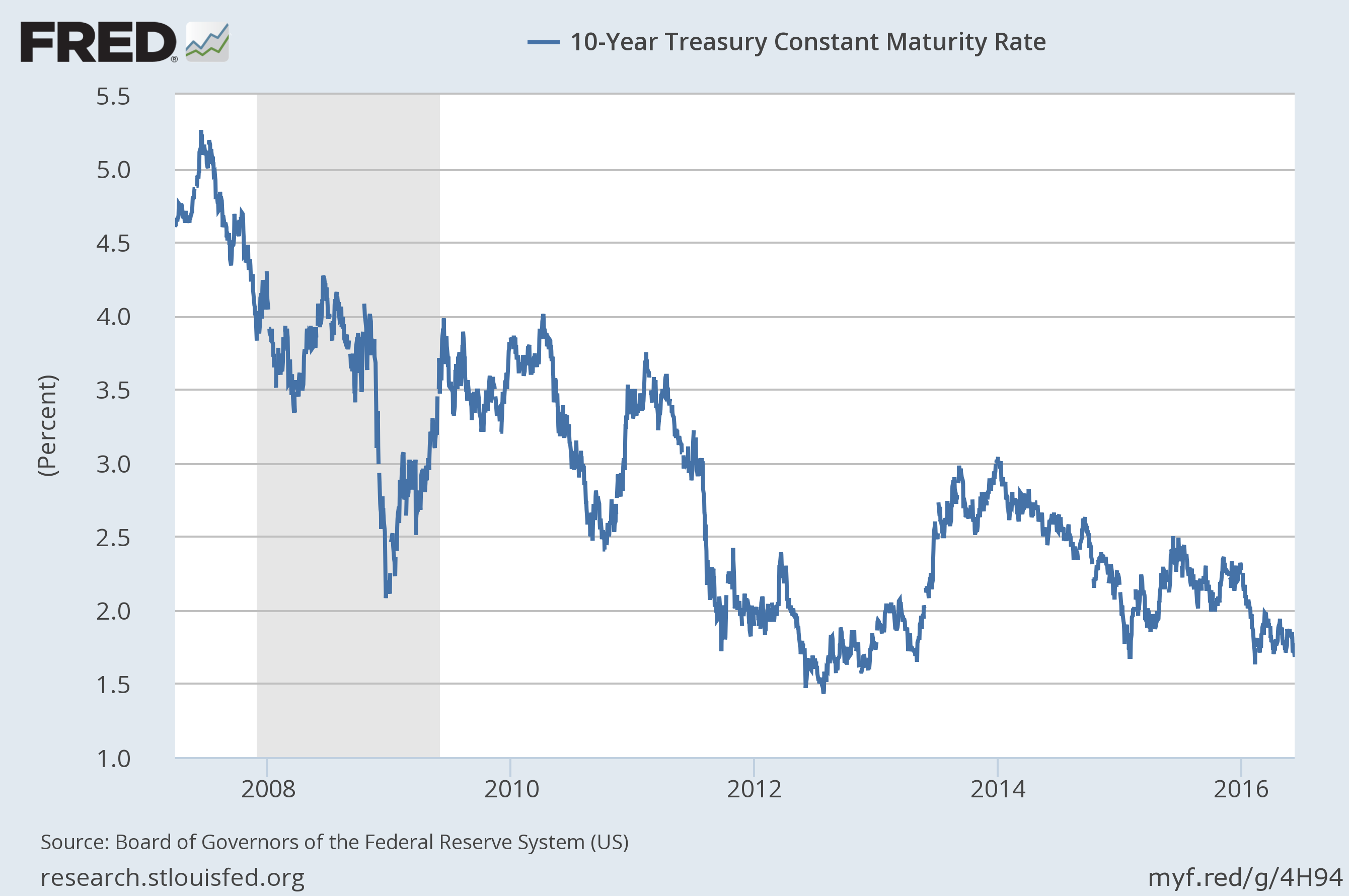

- Yield Curve: The curve resumed its flattening trend, the 10/2 spread dropping 14 basis points since the last update.

Credit Spreads

Credit spreads continued their short term narrowing but the longer term widening trend is intact. The weaker dollar has driven this rally as it has pushed oil prices higher and reduced concerns about the shale industry. I think that could prove a mistake as $50 oil is not going to save the shale industry from its previous excesses. Oil companies may be ready to drill at $50 but I suspect their bankers have a different view. I also question how much higher prices can push based on just a weak dollar. To move higher from here would seem to require a step up in global growth expectations. That would also seem to apply to other commodities, gold being the one exception to that rule. In any case, with spreads still 70% wider than where they were two years ago, there is little reason to make a long term change to our portfolios.

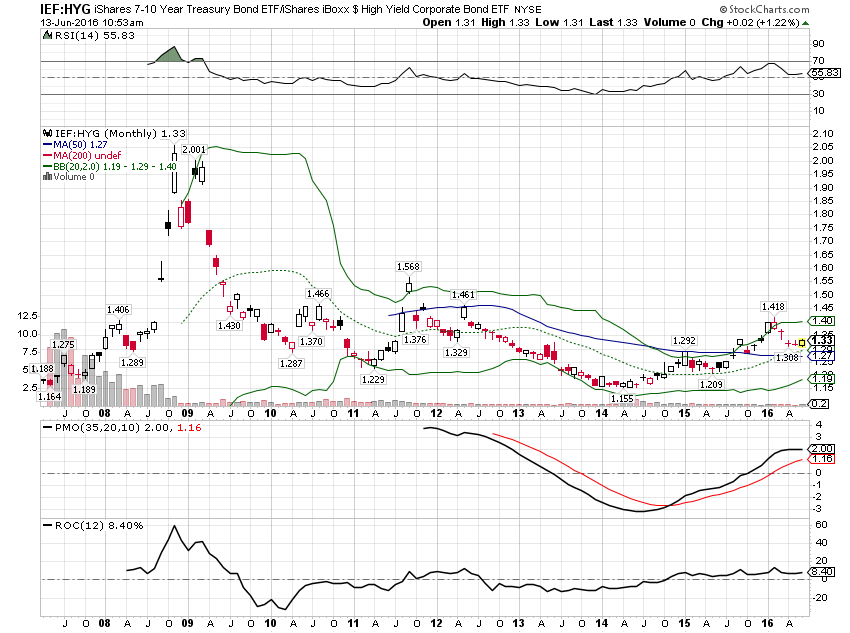

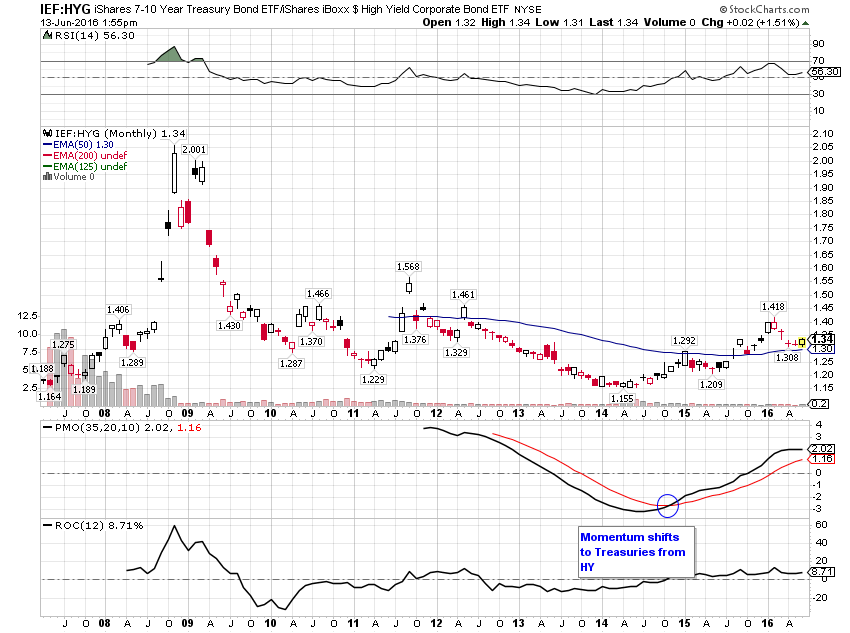

Long term momentum continues to favor IEF over HYG:

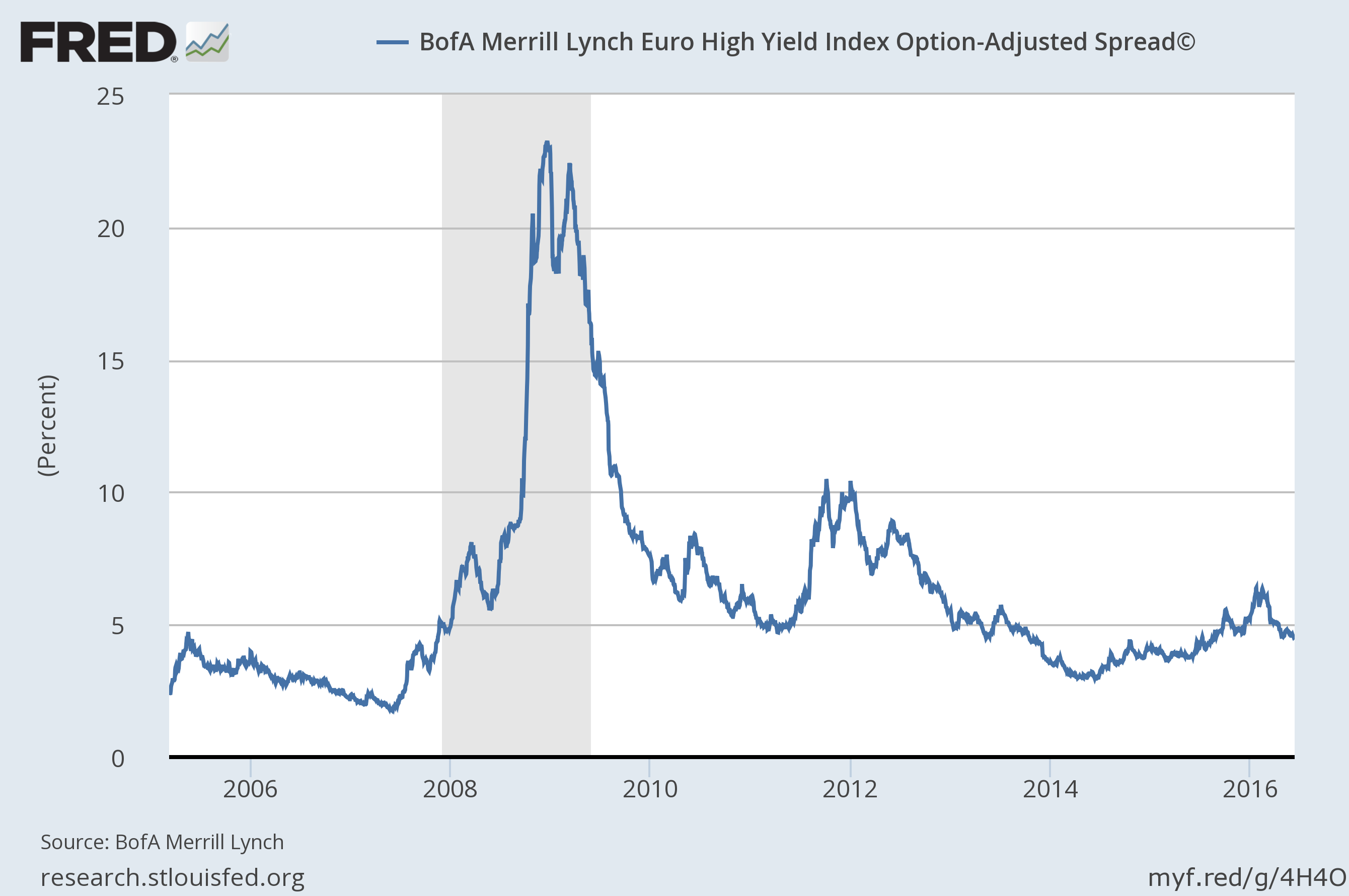

It is interesting to me that it is European and US high yield spreads that remain elevated. EM spreads, in Latin America and Asia, have narrowed much more than the US. That would seem to imply that the widening of US spreads was much more about shale concerns than EM concerns. As for Europe, even ECB direct buying of corporate bonds hasn’t been able to close the spreads in the HY market. The ECB may be the only entity in Europe willing to take risk right now.

A lot of the rally in emerging markets is based on commodity prices coming back from the dead so that makes some sense. On the other hand, as I said earlier, global growth prospects do not seem to be improving, something that would seem necessary to sustain the commodity rally. Is it possible that a weaker dollar has healed the global economy’s wounds? Seems unlikely but thinking about it from a different perspective may yield a different conclusion. If a weakening dollar means capital inflows to EM, that is certainly a positive for those economies. Will it be enough if the US economy continues to weaken? I have my doubts but…

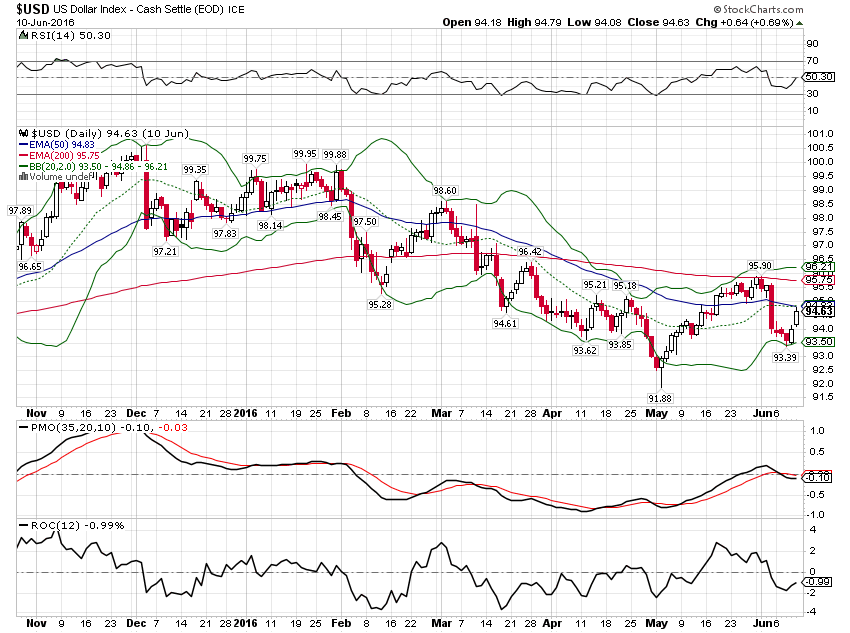

The dollar does seem to be trying to stabilize at these lower levels. One must consider the possibility that dollar stability at these levels is exactly what the doctor ordered and a major positive for the global economy. In all the talk about a strong dollar and a weak dollar we often lose sight of the fact that the best outcome, by far, would be a stable dollar. Is the Fed paying more attention to foreign exchange and the impact of dollar movements on the global economy (not just the US)? If so, it should not be unexpected; I predicted as much when Stanley Fischer was nominated as Vice Chair. He emphasized the value of the Shekel while at the Bank of Israel and his role at the Fed is to monitor the impact of Fed policy on international markets. But dollar stability is at this point a short term phenomenon and not something on which to base long term investment decisions.

Yield Curve/Bonds

While credit spreads have been arguing for a hike in our risk allocation, the rest of the bond market is screaming the opposite. It is the movement of the yield curve and long term Treasuries that kept me from adding to our risk positions. The yield curve resumed its flattening trend over the last month and is now the flattest it has been since November of 2007 when it was going in the opposite direction, anticipating Fed rate cuts. That the yield curve continues to flatten even as the Fed is forced to back off rate hikes is probably not a positive sign. Getting the yield curve to steepen would probably require the market to start anticipating more easing from the Fed rather than just a lack of tightening.

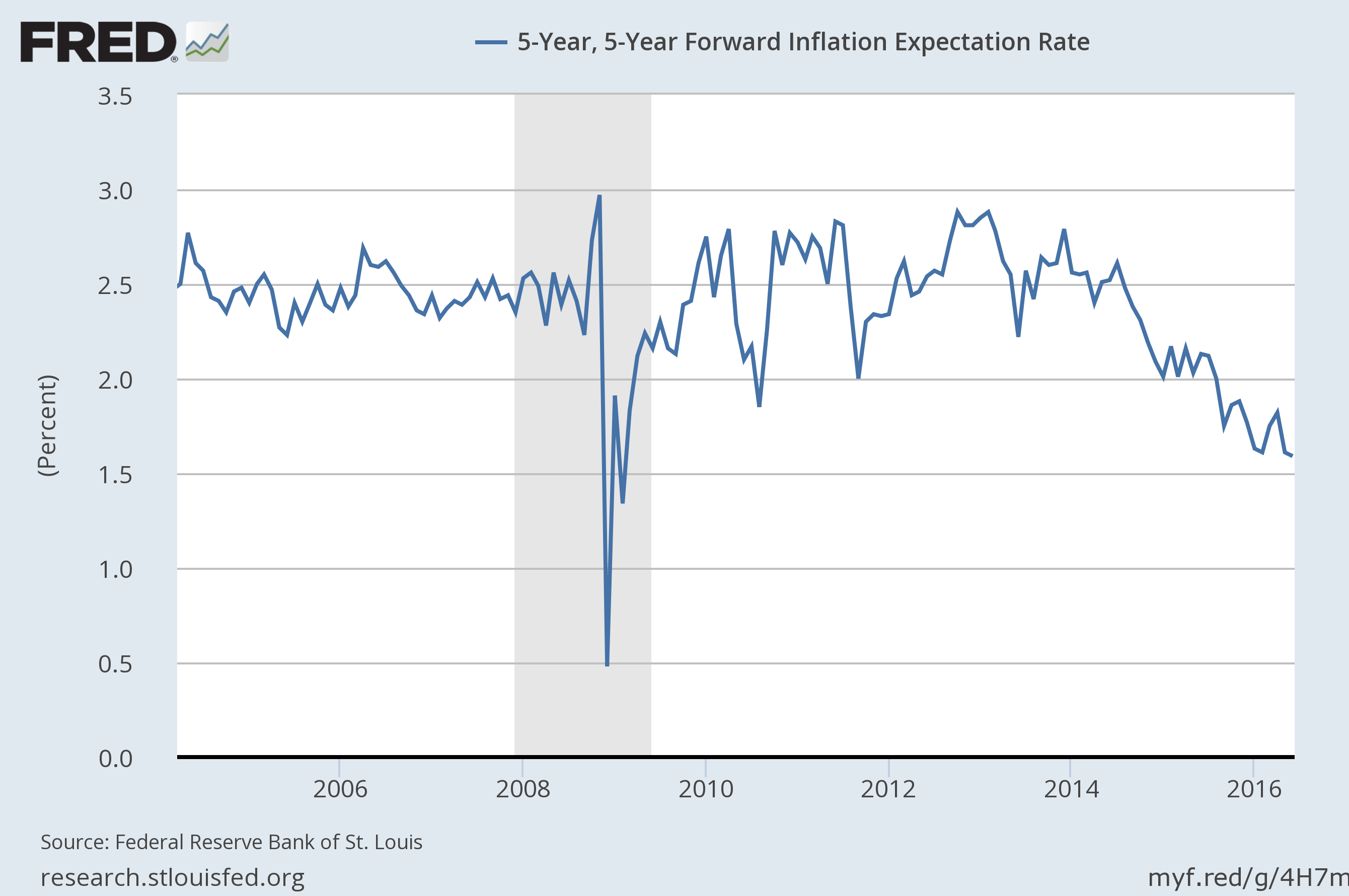

Inflation expectations also resumed their fall as the dollar rallied for most of the last month. Falling inflation expectations are not by themselves a negative. Deflation is the natural consequence of capitalism and should not be feared as much as it is by the mainstream. But a rising dollar that pushes down prices is not the same thing and that appears to be what’s driving inflation expectations.

The dollar rallied up to nearly 96 before getting sidetracked by the employment report. Interesting that the dollar weakness from the labor market report does not appear to have been lasting with two big up days to end last week.

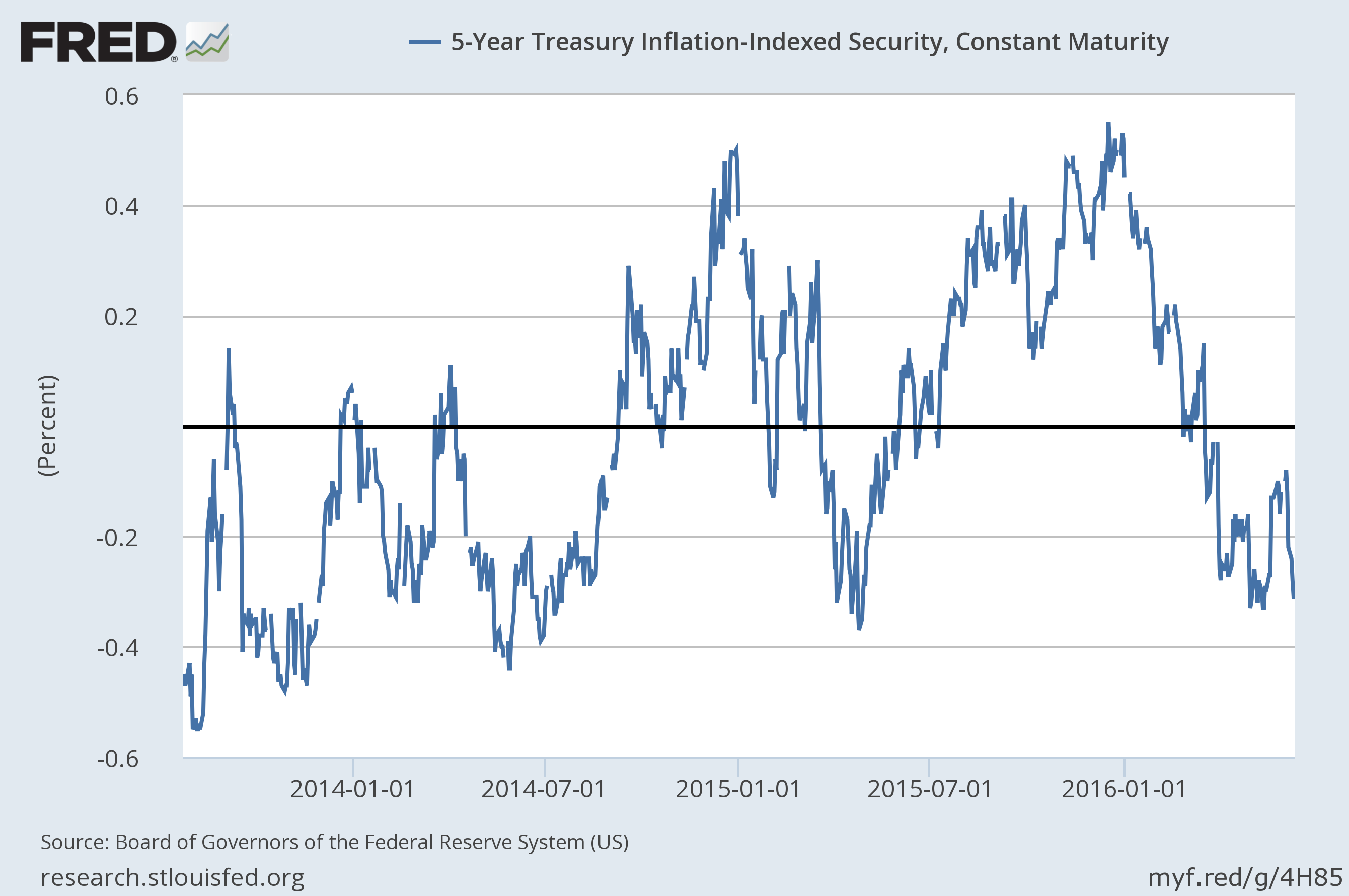

Meanwhile, real interest rates also resumed their fall, an indication of falling real growth expectations. Not exactly shocking considering the economic data over the last month.

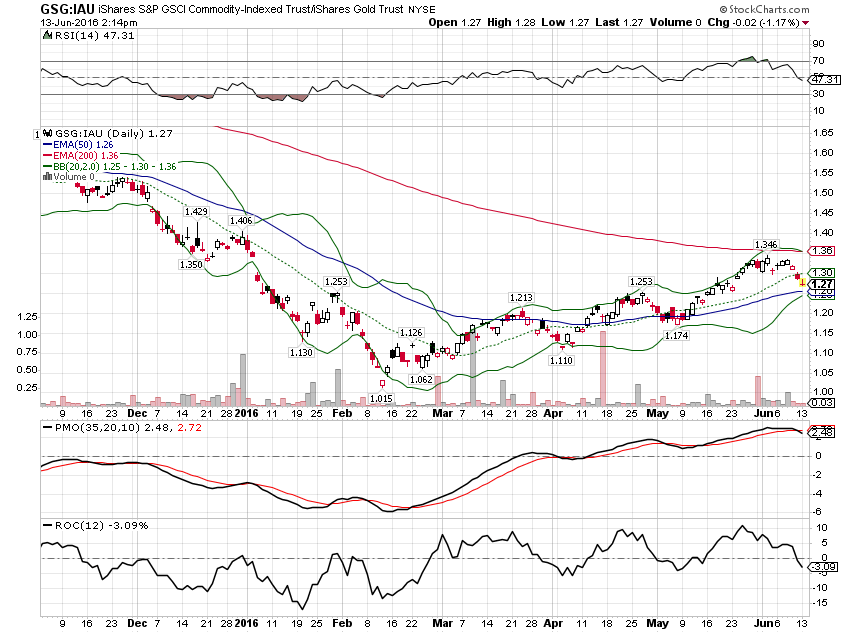

Those negative real interest rates should be a positive for gold but the metal has stalled after the big rally to start the year.

Nominal bond yields fell as well with the 10 year Treasury now near the lows for this cycle. I find it hard to square the stock and commodity rallies with the action in the bond market. Bonds paint a picture of very weak growth while stocks and commodities show the opposite. Someone is going to be spectacularly wrong.

Valuations

Valuations have not changed in any significant way over the last month. Analysts continue to look for a surge in US earnings later this year, probably more laziness and inertia than a reflection of actual expectations. International valuations are still much cheaper than the US but value isn’t the driving force in these markets now and hasn’t been for some time.

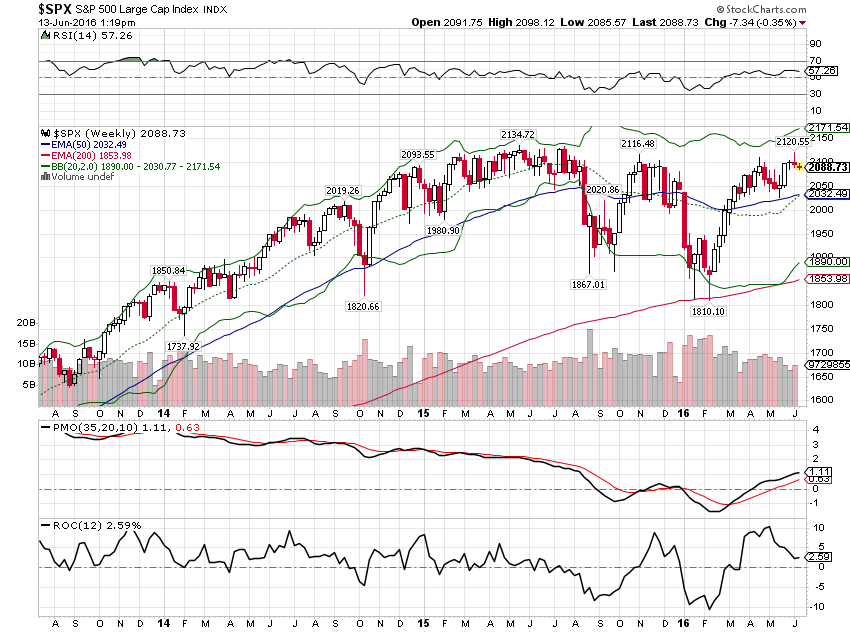

Momentum

Short term momentum in stocks is rolling over again, intermediate momentum is positive while long term is still on a confirmed sell signal. I continue to believe, and will until I see something technical or otherwise that changes my mind, that we are putting in a long term top for stocks. I admit it is possible that stocks could just continue to tread water, trading in the range that has been in place for two years now – the S&P 500 is only about 5% higher today than it was in June of 2014 – but that is an outcome without historical precedent.

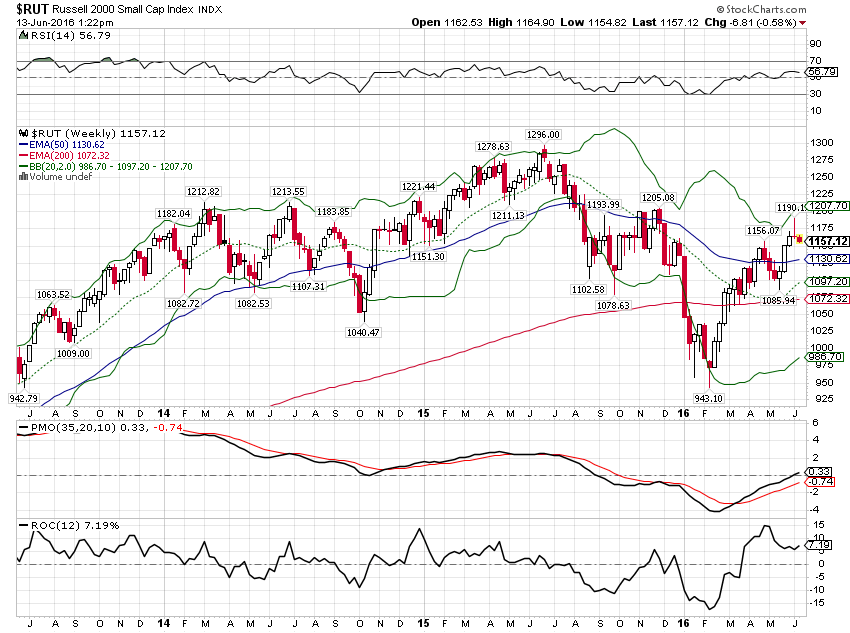

Small cap stocks have not done as well with the Russell 2000 now trading at roughly the same level as December 2013.

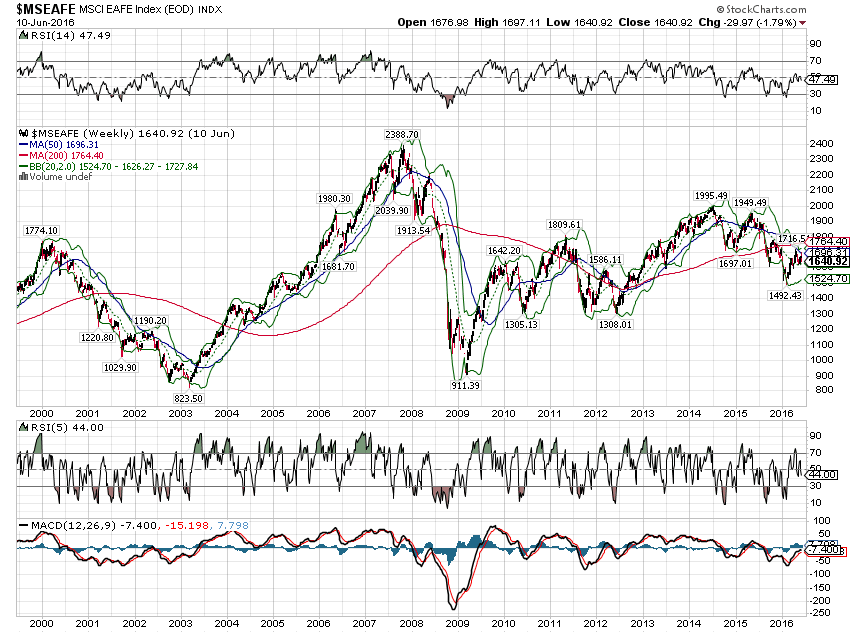

Foreign markets have fared even worse. The EAFE is now trading at levels last seen in early 2013 over three years ago. More importantly maybe, these levels were first seen in late 1999 over 16 years ago.

Emerging markets haven’t even done that badly. The emerging market index is only trading at levels from 10 years ago.

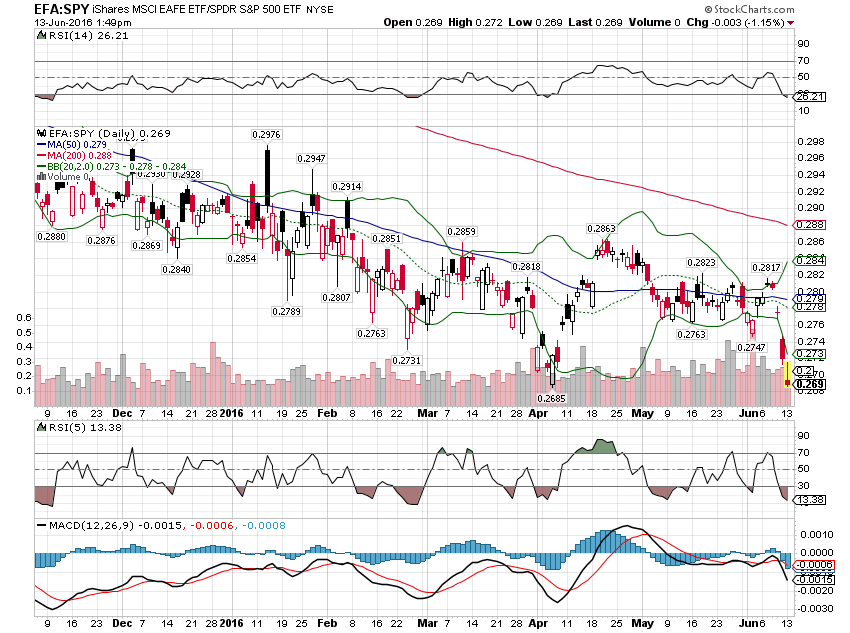

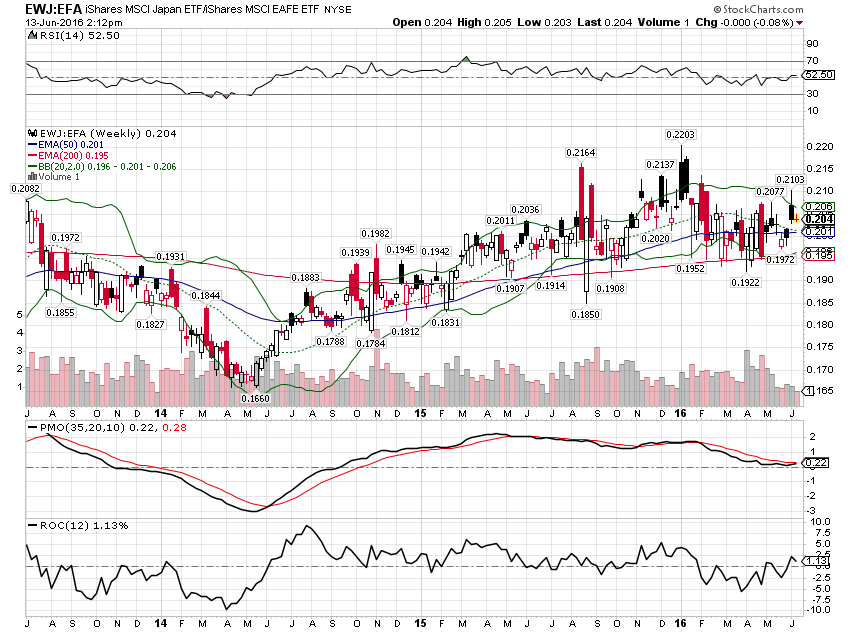

But then we probably don’t want to make investment decisions based on these really long trends. Obviously, there have been bull and bear markets – cyclical – within the secular bear market in foreign stocks. Focusing in on more recent history, despite the obviously lower valuations of foreign markets, the outperformance of the US is persistent. In the last allocation update I highlighted a short term uptrend in the relative performance of EAFE vs S&P500. That short term trend appears to be over as of last week:

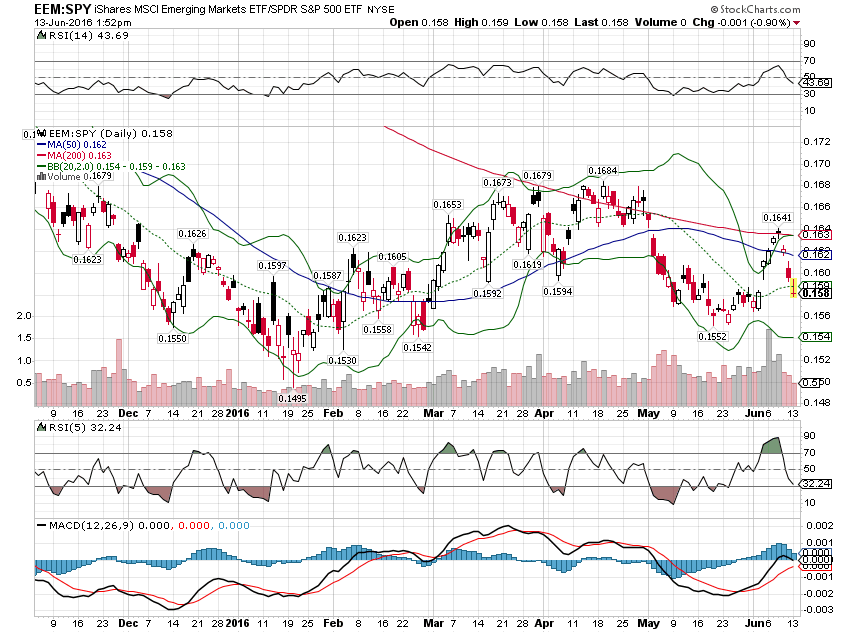

Emerging markets look a little better but as I’ve said before, I have a hard time buying EM unless the dollar breaks down decisively.

From a longer term perspective, momentum continues to favor Treasuries and gold over stocks.

The shorter term picture is what has us on hold this month. Essentially there is no trend and until it breaks out one way or the other, I think it prudent to make no changes.

Japan is performing only slightly better than EAFE at this point but I will hold for another month to see if the Yen strength can be overcome. I have my doubts but valuations are still some of the cheapest in the world and value will at some point be a consideration for investors.

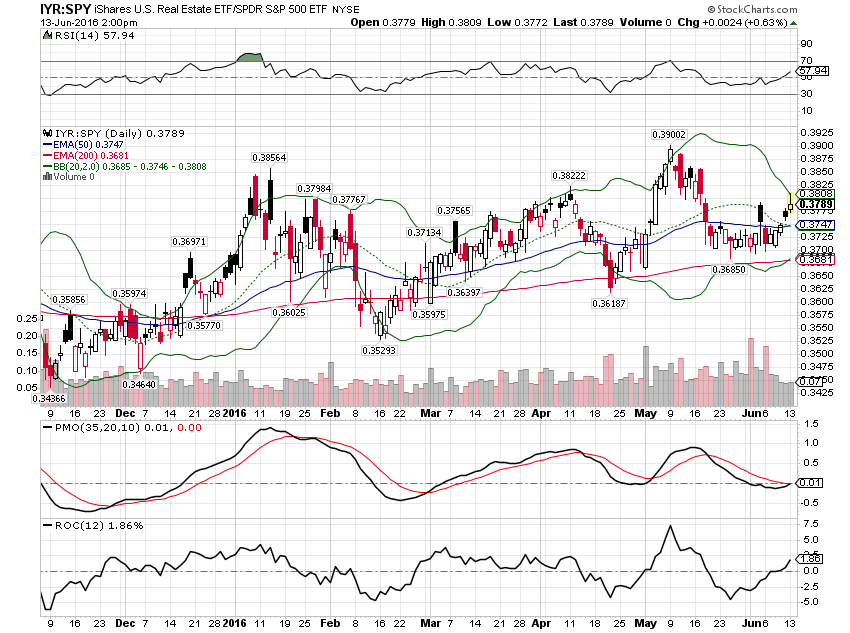

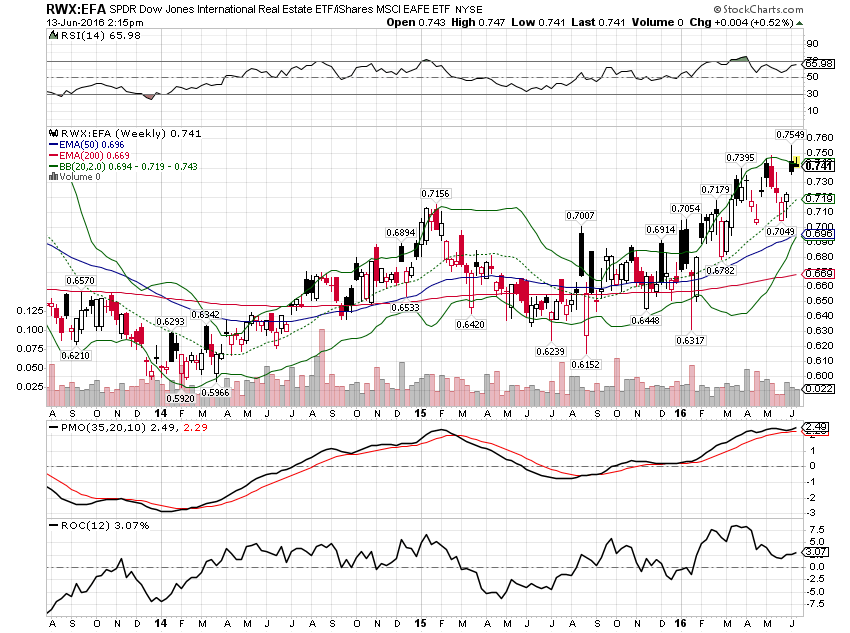

REITs continue to outperform both domestically and internationally:

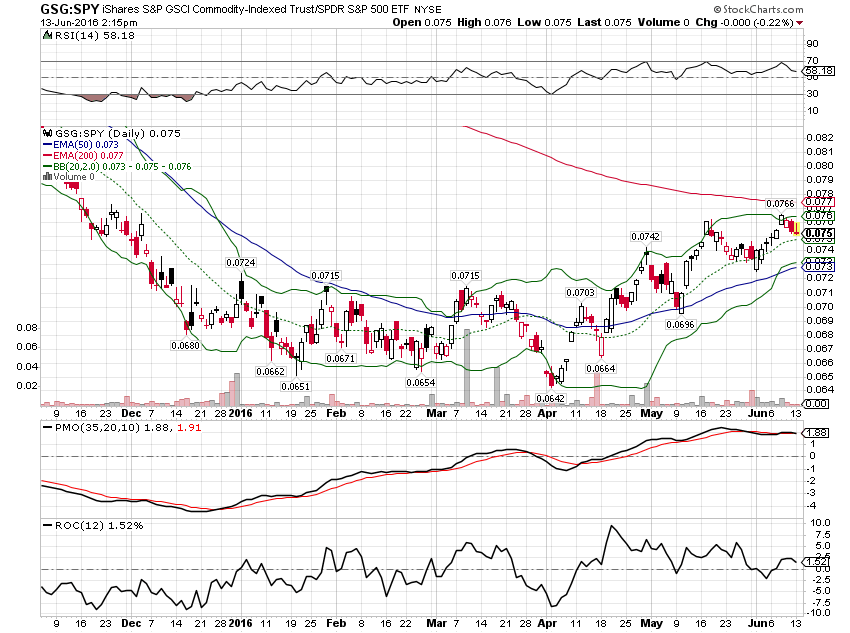

Finally, the general commodity index continues to outperform gold and stocks on a short term basis. I don’t think this will last if the economic data continues to be weak.

Longer term momentum indicators, however, still favor stocks over general commodities. That may change but I won’t make a portfolio change until it does.

And so, after a great deal of agonizing I have decided to do….nothing. I just don’t see sufficient evidence to make a move in any direction right now. We are positioned conservatively with 65% of the portfolio in bonds and gold. Another 8% is in REITs leaving less than 30% of the portfolio directly exposed to stocks. Only if I feel strongly that recession is in our immediate future would I take that risk allocation down any more and despite the trends, I just can’t say that right now. Only if I feel strongly that global growth is picking up would I raise the risk allocation and while stronger currencies (the flip side of a weaker dollar) are a positive it hasn’t been long enough yet to make a significant difference. Be patient. Don’t try to force a trade or try to predict the future. The market will tell us what we need to know when we need to know it. In the meantime, maybe our best move is vacation.

FOR INFORMATION ABOUT OTHER RISK BASED ASSET ALLOCATIONS OR ANY OF OUR OTHER TACTICAL MODELS, PLEASE CONTACT JOE CALHOUN AT JYC3@ALHAMBRAPARTNERS.COM OR 786-249-3773. YOU CAN ALSO BOOK AN APPOINTMENT USING OUR CONTACT FORM.

CLICK HERE TO SIGN UP FOR OUR FREE WEEKLY E-NEWSLETTER.

“Wealth preservation and accumulation through thoughtful investing.”

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch