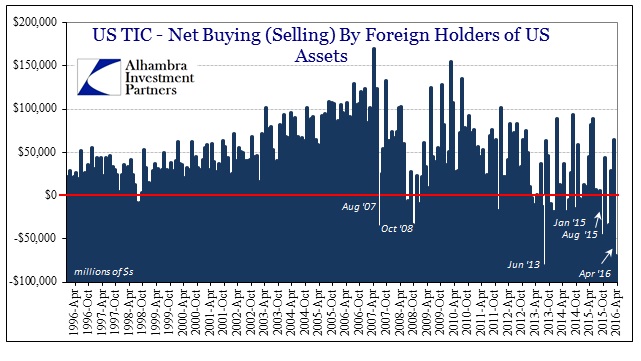

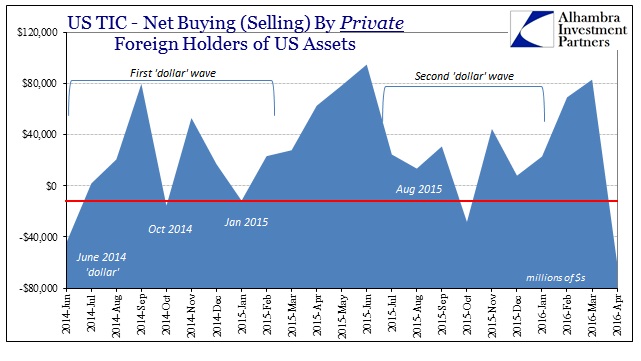

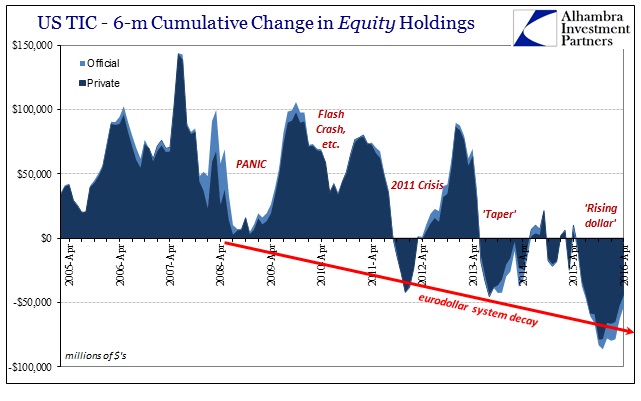

The Treasury International Capital (TIC) update for April showed a very large net decline in foreign (registered) holdings of US securities. The total net drop was $68.7 billion, the largest in one month since the severe “dollar warning” in June 2013. Though we have become accustomed to these kinds of results, the biggest factor in April 2016 was on the private side rather than the official selling of central banks. Official holdings declined as usual, but “selling” on the private side was sudden.

As usual, the mainstream tries very hard to shove this “dollar” decline into an orthodox narrative where the Fed still holds great relevance:

Foreign investors sold a record amount of U.S. Treasury bonds and notes for the month of April, according to U.S. Treasury Department data on Wednesday, as investors priced in a few more rate increases by the Federal Reserve this year.

There has also been references made to hedge funds shorting UST’s via Cayman Islands custody, and there might be some truth to that. Holdings of treasuries in the UK also fell, with London being another hedge fund hotspot. But this is wishful thinking at its most pressing; hedge funds are well aware of RHINO even if they did expect the Fed to get to its next rate hike. No matter what the FOMC does, rates decline especially in longer end funding and credit.

Treasury rates did rise in April from a low around 1.70% to as high as 1.94% (10-year CMT), but that was even less than the rate move from the February 11 end of the liquidations which saw the 10s yield go from 1.63% to 1.98% in a month – a jump in rates unaccompanied by hedge fund or foreign selling. In fact, while rates were rising throughout February the TIC data shows an impressive $58 billion in private foreign “buying.”

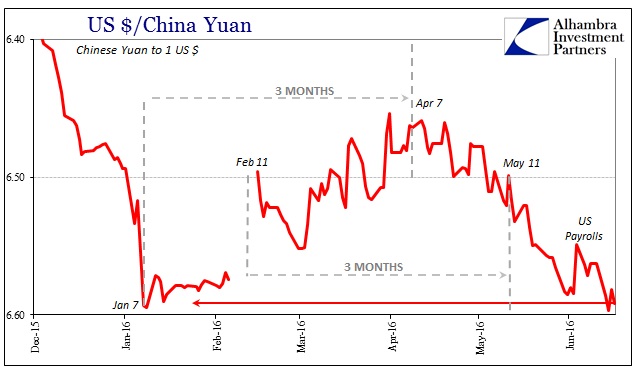

Rather than relating to a traditional, orthodox re-posturing in favor of the preferred recovery narrative it is far more likely that April’s decline was Asian in influence – especially China as PBOC forward cover started to unwind right when predicted on and around April 7.

That shift would have affected not just Chinese banks but any other next level counterparties engaged in the “dollar” supplying transactions. It adds another layer to the evidence that US monetary policy is written in Chinese after being developed in Tokyo and Hong Kong (and maybe still London). As I wrote in October:

The real tragedy here, if there is one to be found, is that this is all obvious to anyone with a minimal level of curiosity – you don’t need the fancy dressings of a central banker, decked out with impenetrably elegant orthodox regressions of correlations that have no bearing on real world function (instead being useful only in trivializing long ago machinations), just click on over to EDGAR and tear open any dealer bank’s balance sheet, or even just observe the continual tempest of negative FICC “revenue.” If there is still money left in this financialized world, it is there.

From that you are forced to conclude the global banks that made the financialized economy are in full retreat everywhere. Not even the stalwarts, those that listened too closely to Yellen’s siren song, are aching much for the eurodollar anymore; they are getting out faster than those that preceded them. The numbers are staggering in absolute terms, but far more depressive in relative terms for what the financialized global recovery should rightly need to fulfill central bank fakery.

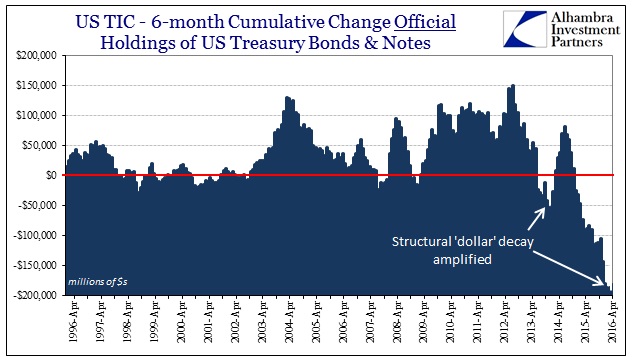

What that means is foreign central banks are forced to deal with this global “dollar” short or deficit as best they might, which can only be badly, poorly, and far too bluntly. There is no central bank substitute for retreating “dollar” capacity, no matter how high any one country piles its supposed forex “reserves.” That might be the biggest benefit of the TIC data, incomplete as it may be, since any “selling” of dollar assets by the foreign official sector is a rather reliable measure on how far the eurodollar system has dropped in capacity.

The FOMC should have taken the short, predictable window of calm provided by the PBOC’s efforts of early January and early February to at least salvage some pride and credibility; the rate hikes don’t and won’t amount to anything other than that.

Stay In Touch