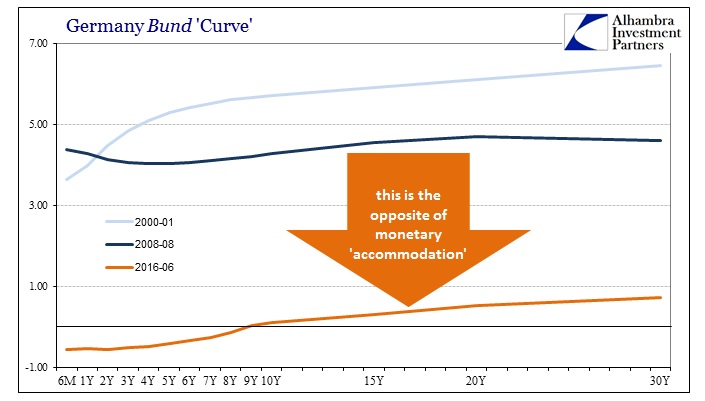

On June 14, the 10-year German bund yield traded briefly below zero for the first time. It was an inauspicious record but one that defines the contradictions at the center of all this economic and monetary controversy. On the one hand, that is what central banks tell us they are after especially with QE, to reduce interest rates even at the long end. By buying government bonds all throughout Europe, the reduction in benchmark rates (as sovereigns are judged to be the risk-free equivalent component of the Fisherian hierarchy) is supposed to spread through the rest of the financial system to be “accommodative” to the wider economy. This is “stimulus.”

Yet, on the other hand government bond yields are taken as a safety bid, meaning a natural tension between “accommodation” and concern. As the Wall Street Journal on June put it:

Bond yields in Europe have been sliding for a year, weighed down by aggressive central-bank bond buying, negative short-term rates and skepticism about an economic recovery that seems persistently to falter.

If QE and NIRP actually worked then the rest of that quote would never have been written, as yields have been sliding for far, far more than a year. The mainstream can’t figure out the inequity at the center of all this because orthodox economics has confused everyone with its models of dubious assumptions. Among them is that credit and money are interchangeable substitutes. They are not.

In April 1998, Milton Friedman wrote an article for the Hoover Institute (titled Reviving Japan) admonishing the Bank of Japan for these same kinds of mistakes. Primarily, he felt the central bank was repeating errors that the Federal Reserve in the United States during the Great Depression committed. The details of his criticism aren’t relevant here except for his charge that monetarists of that time had somehow gone upside down about interest rates – what should be a central belief in all economics of every persuasion.

It is rote mainstream recitation that low interest rates equal stimulus while high interest rates demonstrate the opposite to some degree of “tightness.” As Friedman pointed out, this is entirely backward as demonstrated conclusively by economic history:

Initially, higher monetary growth would reduce short-term interest rates even further. As the economy revives, however, interest rates would start to rise. That is the standard pattern and explains why it is so misleading to judge monetary policy by interest rates. Low interest rates are generally a sign that money has been tight, as in Japan; high interest rates, that money has been easy.

In the US during the Great Collapse of the early 1930’s, money supply fell by one-third but the Fed believed monetary conditions were accommodative, “point[ing] to low interest rates as evidence that it was following an easy money policy and never mentioned the quantity of money.” At the opposite end, during the Great Inflation interest rates only shifted higher and higher.

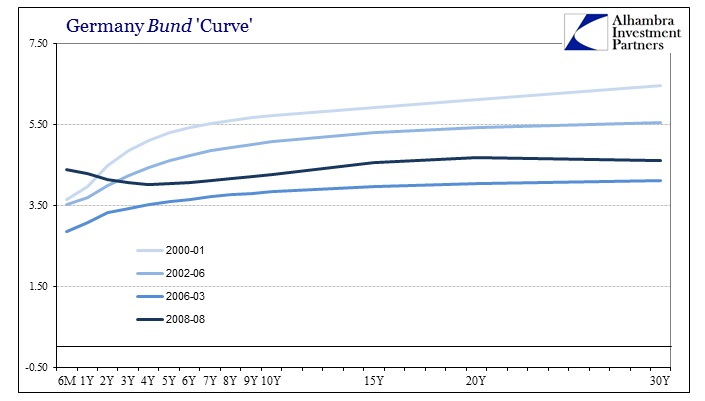

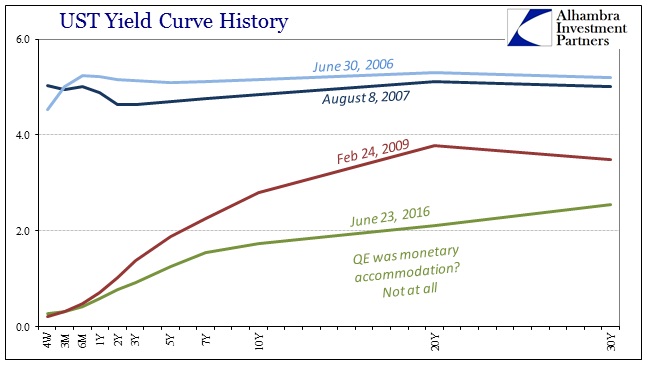

Reviewing the German bund curve follows these outlines. Prior to the financial crisis, the yield curve was generally normal and gave no clear indication of distress or monetary “tightness.” It moved around in a relatively narrow range, though at the time given monetary policy (myth) surrounding the global 2001 recession there seemed a fair bit of flexibility. By and large, the curve was well-behaved.

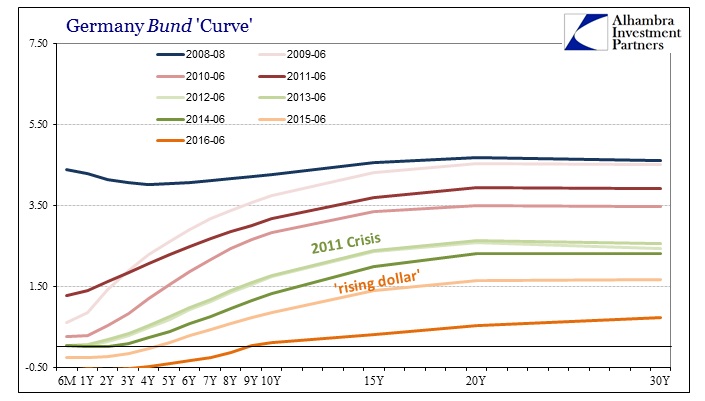

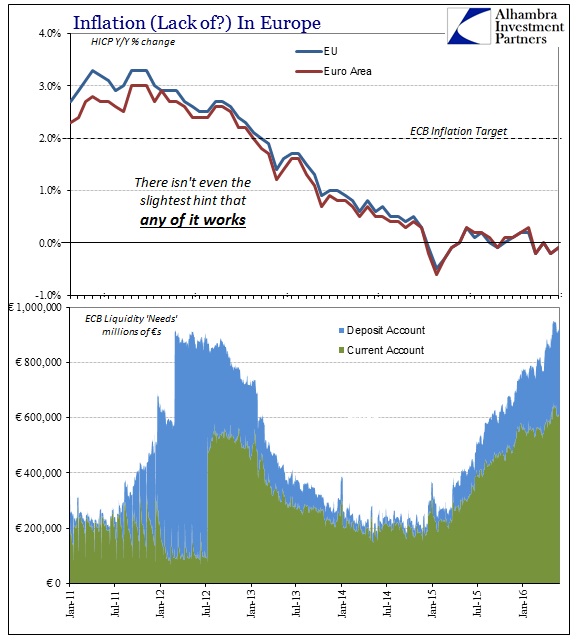

There were initial signs of money distortion and disturbance by August 2008, with inversion occurring at the front end. Thereafter, however, despite continuous “stimulus” the curve has moved in one direction. It has responded time and again not to what the ECB was doing but rather to why it was doing it.

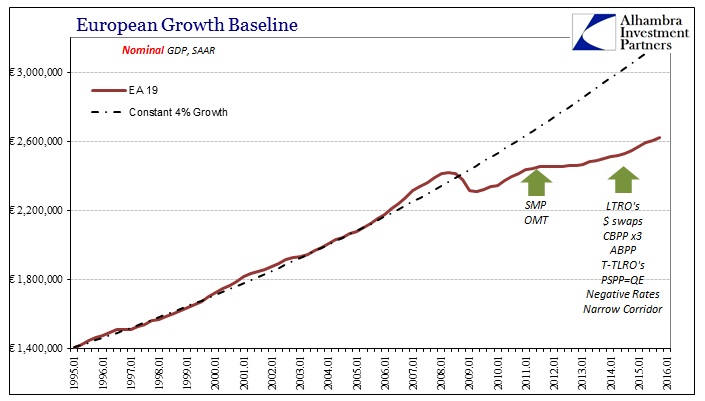

The evolution of the bund curve breaks down along these global financial events. The initial period after the panic and Great Recession saw it drop into 2010 before rebounding only slightly by June of 2011 – and the start of the next financial event. The ECB acted with LTRO “stimulus” that flooded the financial system with what appeared to be ample money and liquidity, yet the bund curve lurched downward again and kept shriveling. It is now almost unrecognizable as an actual curve suggesting legitimate time value and credit risk to money.

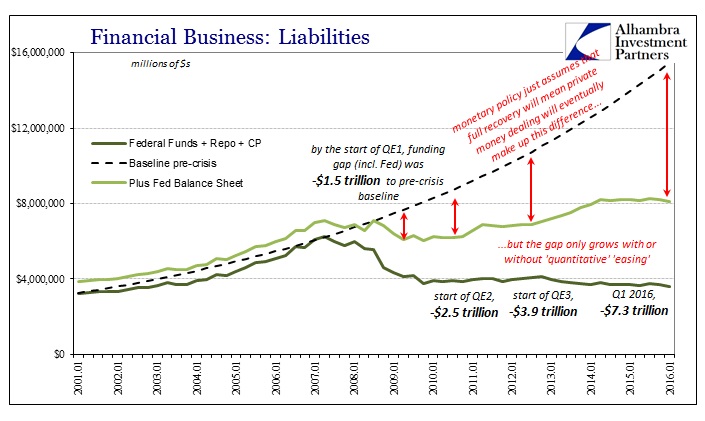

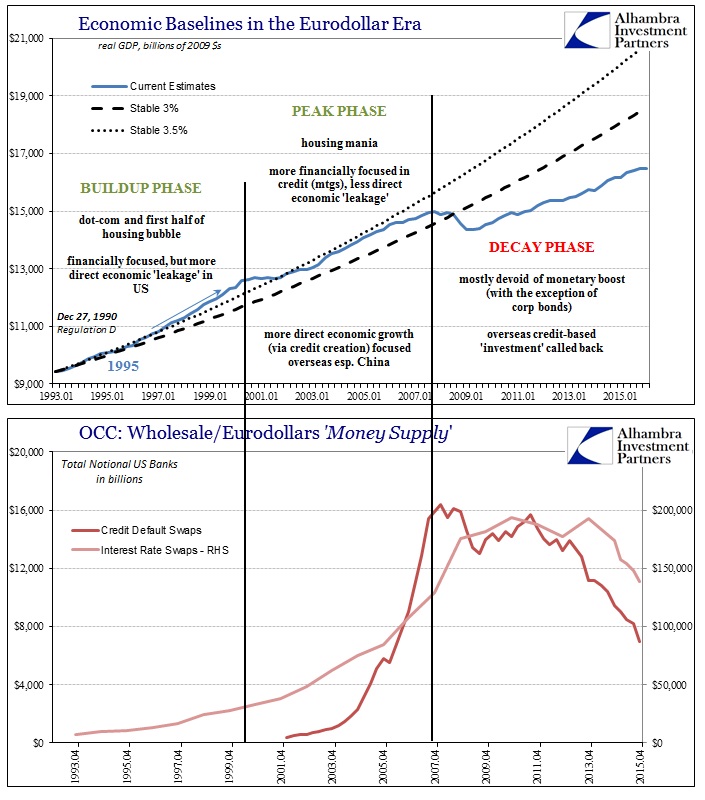

This singular progression is as Friedman suggested above. What we are seeing in falling rates all over the world is not the beneficial introduction of “stimulus”, it is instead quite the opposite. This is pure and worsening monetary tightness, and it is endemic far beyond Europe, euros or even dollars. This shrunken bond curve for German federal securities is perfectly consistent with any number of charts I have produced showing the decay in the eurodollar system; eurodollars apply not just in dollars but to wholesale money in general, including that of and in Europe. In other words, the two charts below are not just compatible they are really the same supply problem viewed from different angles.

But that is only part of the missing economic equation. Not only are there dire misconceptions about interest rates as they relate to monetary conditions, there is an even bigger misread of money itself. In his 1998 article, Friedman chastised the Bank of Japan for not expanding the monetary base, relying too much instead on interest rate policy alone (just as the Fed would repeat throughout the first phase of the financial crisis).

The answer is straightforward: The Bank of Japan can buy government bonds on the open market, paying for them with either currency or deposits at the Bank of Japan, what economists call high-powered money. Most of the proceeds will end up in commercial banks, adding to their reserves and enabling them to expand their liabilities by loans and open market purchases. But whether they do so or not, the money supply will increase.

There is no limit to the extent to which the Bank of Japan can increase the money supply if it wishes to do so. Higher monetary growth will have the same effect as always.

This is, of course, quantitative easing. Friedman argued that intentionally expanding the level of bank reserves, or high-powered money, would offset the “tightness” exhibited via low interest rates in Japan. The Bank of Japan followed that advice only three years later, as has the United States and Europe less than a decade after that. None of it has worked, as instead interest rates and bond yields continue to decline sharply all over the world.

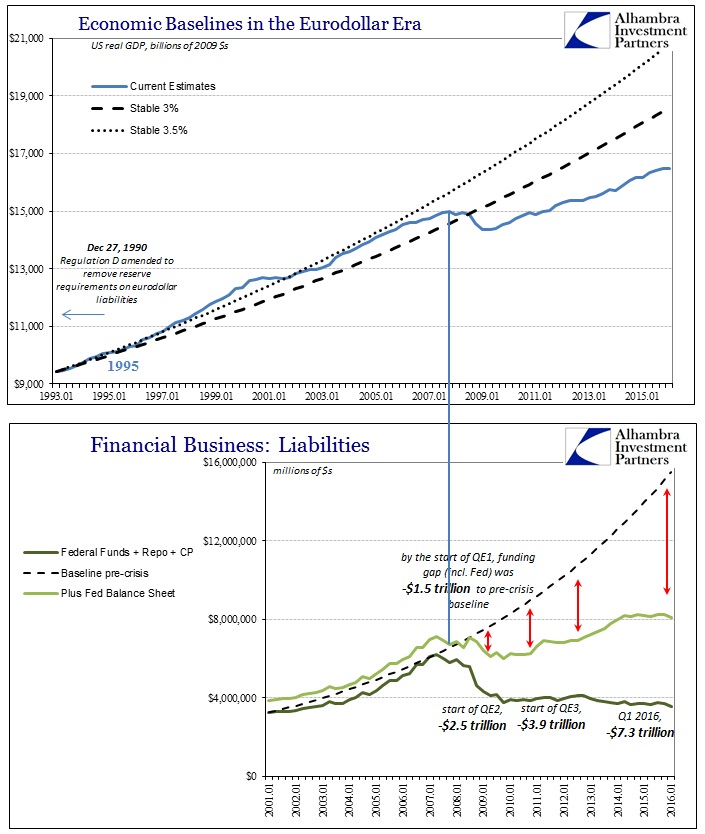

So if we view Friedman as correct about the interest rate fallacy, as surely he was, then he must have been mistaken about what constitutes “high-powered money.” In the global, wholesale banking system of a credit-based reserve currency it is not difficult to figure the flaw. Bank reserves are not money nor can they ever be; they require a subsequent step to be useful in any economic fashion. That step is bank activity, whether in interbank liquidity or raw lending, it was always inaccurate to simply assume that banks respond favorably and without question to the level of bank reserves. Orthodox theory posits banking as something like a rubber stamp, just passing along whatever the central bank does without question or comment, when it actually functions of its own accords and factors – making those protocols the actual, functional money supply.

That is the nature of the eurodollar standard, as it provides(d) and delivers(ed) primarily mathematical factors that are far more basic and conducive to bank behavior than the one form of potential liability. There is no shortage of bank reserves anywhere in the world, yet yield curves continue to plunge; therefore our only conclusion can be that bank reserves are not money, high-powered or otherwise. What is missing is all the rest that banks use in creating actual money and credit to be forwarded on into the real economy: balance sheet capacity, traded or internal. Central banks simply expanded the wrong monetary base; the eurodollar base, by contrast, continues to fall further behind or just outright decay.

From this view, it is no surprise to find increasing “tightness” and “deflationary” pressures after each financial episode – from the panic to 2011 to the “rising dollar.” Falling yields tell us everything we need to know about monetary conditions that we can’t directly observe of the internal eurodollar/wholesale mechanics. It is entirely unsurprising that in a world of increasing money restriction the global economy would only increasingly suffer. The German bund curve and the proliferation of negative rates don’t indicate a single thing about ECB success, they instead loudly proclaim all the ways in which it, and its global central bank comrades, has failed.

Central banks don’t know what money is and they have interest rates all wrong. That about sums up the post-crisis global economy.

Stay In Touch