Some people have impeccable timing. Even if by accident, there are occasions when what they say or write comes out in almost perfect sequence. At the end of August 2014, UC Berkeley economist J. Bradford DeLong wrote an article for Project Syndicate that argued in favor of proper categorization. The lack of recovery was so drastic that the economist community and indeed the world at large needed to come to terms with what was actually taking place; and that was not anything like what was being described especially at that time.

To have such a Keynesian of prominence make such an indictment like that may seem somewhat surprising, as it has been they who have most objected to classifying this economy as anything but robust. Some of it is surely political, or at least loyalty to the good standing monetarist/Keynesians (neo-Keynesian, saltwater-ists, or whatever they call themselves these days) at the Federal Reserve, where no economist shall direct any disparaging comments toward the palace. But to DeLong, the issue had never been about recession at all:

Cumulative output losses relative to the 1995-2007 trends now stand at 78% of annual GDP for the US, and at 60% for the eurozone. That is an extraordinarily large amount of foregone prosperity – and a far worse outcome than was expected. In 2007, nobody foresaw the decline in growth rates and potential output that statistical and policymaking agencies are now baking into their estimates.

By 2011, it was clear – at least to me – that the Great Recession was no longer an accurate moniker. It was time to begin calling this episode “the Lesser Depression.”

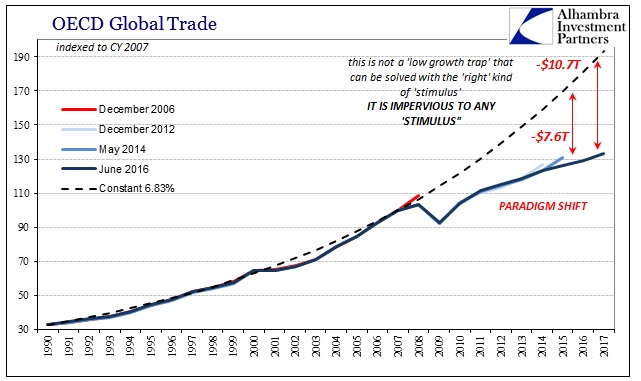

As I wrote above, the timing was perfect at the front edge of the “rising dollar.” The economy of greater eurodollar shortage and inflexibility has served, in this context, to demonstrate the claim. Rather than sail off into the Hollywood sunset as Bernanke and then Yellen assured us, the economy instead went the other way, and not just here. Further, subsequent data revisions have shown that it was folly all along to believe that 2014 was anything other than the anomaly; and a fictional one beside.

The idea of calling it the “Lesser Depression” makes good sense because the similarities with the Great Recession are in some ways unbelievably close. What made the Great Depression was not just its collapse but how it lingered interminably for more than a decade. What makes this the Lesser Depression is that same time problem, only following a much smaller contraction at its start. When comparing them, the real difference is the scale of collapse at the front, leaving what followed each as remarkably, undeniably similar.

This is where Ben Bernanke’s forced reputation intrudes; he will claim, has claimed, that it was his efforts that made all the difference. Indeed, that is one reason, as DeLong wrote in August 2014,

it was dubbed the “Great Recession.” And, with the business cycle’s shift onto an upward trajectory in late 2009, the world breathed a collective a sigh of relief. We would not, it was believed, have to move on to the next label, which would inevitably contain the dreaded D-word.

All the world’s central banks did exactly that. Congratulating themselves on a job well-done, they moved on to the cyclical recovery and the universal accolades that would surely follow. By 2011, however, as DeLong also notes, it had become clear something was very wrong. Policymakers have spent the last five years trying to deny to themselves as much as anyone in the public that wasn’t true. Deep down, however, they must have known or at least allowed themselves in their whatever brief moments of clarity outside their dense bubble to worry that they really could have it all wrong.

That was the whole point of QE3, Draghi’s promise, QQE, etc. They would go so far, so big, and so long that they would leave nothing to chance, all doubts erased by sheer size and determination. If the economy didn’t want to follow the script then they would call down the monetary thunder and make it. That was the narrative setting for 2014, and the small improvement from 2013 was their mountain of a molehill “proving” it.

While I personally believe the actions of central bankers from 2011 to 2014 was unforgivable (there really is no excuse, they should have known better; it was their job and self-appointed sacred duty to know better) you can make a case that it was all understandable and perhaps legitimate. After 2014, however, that ship sailed. What has happened in 2015 and 2016 has been to wholly repudiate cyclicality down to the simplest terms. Janet Yellen really cannot claim to be expecting recovery when it was on such shaky ground to begin with and then that ground falling out from underneath her in the trembling earthquake of the “rising dollar” she tries to pretend the FOMC can’t see or hear (“global turmoil”).

As noted yesterday, the bond market is making this act of willful blindness that much more impossible especially in light of the comparison to the 1930’s; yet central bankers carry on because they can. They can play themselves into fools in public and in private, but it doesn’t matter because they are still politically insulated. They have called a depression a recovery for years on end, but there are no repercussions for having done so; indeed, their dutiful media still reports everything they say as fact and everything they do as “stimulus.”

At her regular press conferences nobody in the press bothers to ask Chairman Yellen the simplest yet most poignant question of all; why is she still looking for a recovery through constant “accommodation” seven years after the recession officially ended? The answer is equally simple and straight forward – Brad DeLong was right; it was never a recession.

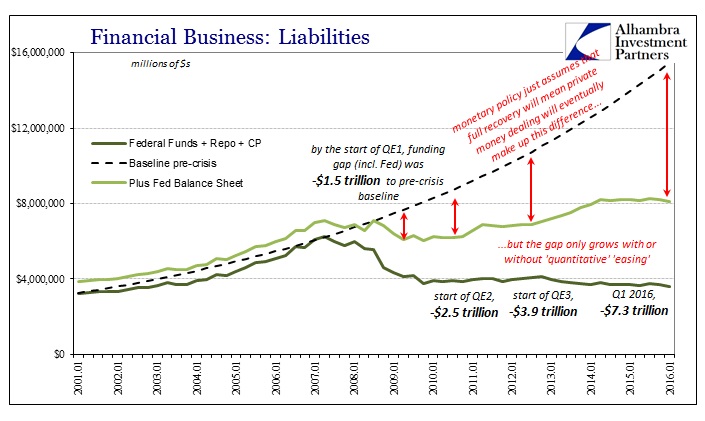

The monetary tools of QE and ZIRP are meant as temporary measures. The turn to QE2, as then the third and the fourth, was supposedly a reflection of the severity of the recession, but that also was a false assumption. Monetary policy is meant to cushion the blow as the economy is pushed to heal, in what none other than Brad DeLong (with Larry Summers) wrote in 1988 was an intentional, determined attempt to, “fill in troughs without shaving off the peaks.” The idea is to use monetary (and fiscal) policy to buy time so that no matter how bad it never gets too bad – like 1929.

Rather than buy time, however, monetary policy has instead squandered it by thinking that “shaving off the peaks” was something that had been avoided not just as a circumstance but even as a possibility. If this all is a “Lesser Depression”, mimicking the lack of recovery in the 1930’s so well, then that, too, must be made accountable. How could the global economy fall into depression when such an outcome was held out for decades as totally impossible? For that to have happened could have only meant the rules of the game changed on them without their notice. That is an entirely new class of negligence, gross misconduct that is costing the world lost economy beyond all comprehension.

A comprehensive survey of our predicament isn’t universally bad, however. There are small fissures of hope taking the form of political revolt and populism, as I wrote earlier today. There was Brexit and now:

The light at the end of this tunnel is in the growing body of evidence that we are not yet Japan. The lost decades of the Japanese economy are both parts monetary criminality (“stimulus” after “stimulus” after “stimulus” with nothing ever being stimulated) but also political status quo to further entrench bad economics. Just this week, the Republican National Committee unveiled its commitment to restoring some type of Glass-Steagall. I have no idea how committed they really are, or exactly through what mechanism it might work, and I don’t really care. More important to me is the symbolism of even saying that they will do it and that banking (really money) is no longer a sacred political cow; recognizing just how far that is from TBTF.

In some ways it astounding it has taken this long; in other ways, in terms of glacial political shifts, it is amazing in only two presidential cycles just how far it has come. The last Republican President was committed to Too Big To Fail. That idea was birthed under cyclicality, where the Great Recession would be kept to a recession if Ben Bernanke and Hank Paulson got what they wanted and the awful ramifications of depression avoided by bailouts, monetarism, and the status quo. But we got the ramifications of depression anyway, showing yet again it was all a lie.

As much progress as this dramatic change may be, we aren’t nearly there yet. Central bankers are not anywhere close to having been brought to heel, and they have proved time and again they will not themselves stop. That actually creates something of a vacuum, a window actually for the most unpleasant opportunity:

The real danger of 2016 and immediately beyond, then, is this race; those that are catching up to the real problem and trying to find a real solution not of inflation or deflation but of stable money will need time to find and then implement it (this is where the lost opportunity of 2008 is so tragic). Against them are those who would impede intellectual growth (as what did happen in 2008). But as confidence in the old order falls and the strong populist desire to look elsewhere begins to take its place, into that messy void is still the potentially disruptive force of bad economics. Where do all these curves meet? In other words, what is the point at which shrinking faith, desperate central banks, and growing economic despair all conspire to push us into the darker reaches?

That is the real difference in 2016 – desperate central banks. They were (mostly) content to sit back in 2015 under expectations they formed from 2014. It was a big mistake in so many ways, not the least of which was growing suspicion from markets, even the stock markets (bank stocks as prime examples). They have rallied somewhat this year, with the ECB and now Bank of Japan leading – but all still in hope, not actual results. If this is a depression, and that is where all the evidence points, from GDP to labor to consumers, then this burst of desperation will have the same effect; nothing. Then what?

The narrative basis of my column was the German hyperinflationary episode of 1922 and 1923. I am not claiming that is the next step awaiting central bank bungling inside of the current depression, merely pointing out the commonalities of the situations that can lead to bigger, more intense problems of all kinds of bad possibilities.

In other words, German monetary officials, particularly Reichsbank head Rudolf von Havenstein and Minister of Finance Karl Helfferich, denied that Germany had an inflation problem at all – right up until the end. Minister Helfferich declared that Germany had better gold coverage after the war than before it, despite that more than quadrupling of currency volume. One economics professor, Julius Wolf, wrote in 1922 that, “in proportion to the need, less money circulates in Germany now than before the war.” As much as the easy-to-see Versailles excuse played a part, there can be no doubt that beyond 1921 the German people themselves began to recognize that authorities had no idea what they were doing; worse, they came to see that even though policymakers were inept and incompetent, officials themselves would never admit as much and thus nothing would prevent Germany from its fate. That awakening meant an increase in danger that French occupation could never have unleashed on its own. [emphasis added]

Confidence is truly a big part of economics (small “e”); that is why orthodox Economists (capital “E”) spend so much time with asset prices, infatuating themselves with bubbles while also convincing themselves they aren’t that. It isn’t something that can be conjured out of nothing, manipulated like a regression variable (raise stocks X, confidence increases Y, economy grows Z). But it can work in the other direction, such as when policymakers claim the “wealth effect” and then watch the economy instead sink. The real danger in terms of money and economy might be when the world wakes up to what I wrote above; policymakers have been calling a depression a recovery for nearly a decade. The implications of that might be where this possible event horizon sits; that central banks have exhausted themselves and we still got depression anyway.

I’d like to think that logic and reality will prevail; that distaste for being told how great the world is has become sufficiently revolting and obviously false to stir the world’s populace to end the imbalances. But that, again, will take time, perhaps a good deal of time; until then, whenever it hopefully is, central banks continue to operate with impunity even though the risks of their intemperance rise exponentially as time further accumulates and their claims fall further from reality. It’s not a good set of circumstances, especially since all QE did everywhere it was tried was show that confidence in it was sorely, disastrously misplaced.

Stay In Touch