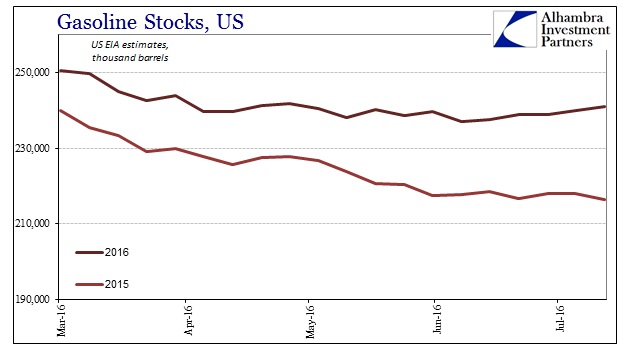

Oil prices fell again today and it seems that gasoline is now on everyone’s mind. As noted last week, I don’t think that is the reason for the price action except in that it tells a very different story than the one in the media about “stimulus” hope.

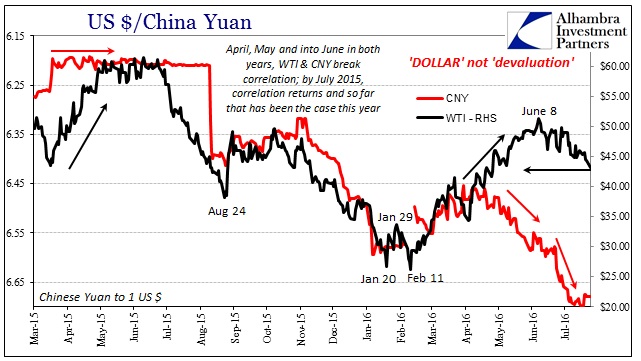

The significance of crude and gasoline is the difference in narratives and what is supporting them. Stock prices at record highs, or near them, is likely being driven by renewed hope for monetary policy wherever it may strike, all the while forgetting how patently ineffective past monetary policy has been. The energy sector and the renewed drop in the futures curve (the whole curve, though more so at the front) is remembering the consequences of monetary policy that doesn’t work while at the same time finding still little evidence that anything has changed (and some evidence that if something has changed it is only further in the “wrong” direction). Stocks once more trading, though much less enthusiastically, on what “should be”; energy trading on what actually is. All that is also a replay of last year, specifically last July.

As it turns out, there is a lot more to the gasoline “glut” than just the inventory numbers suggest. It has already become a major factor in actual activity, suggesting that there is a big problem here. In other words, unlike what is believed about monetary policy and especially the whispers of “helicopter money” more recently, the real world has way too much gas to the point of exposing in 2016 as 2015 narrative vs. reality.

In a summer of discontent with high inventories and an unseasonably weak demand, some refiners have started blending winter grade gasoline earlier than usual to sell later in the year, two trading sources told Reuters last week.

The switchover from summer blends, which are more environmentally friendly and costlier to produce, usually happens in August for sale starting on Sept. 15, the date allowed under U.S. government regulations. Winter blends are more likely to evaporate in the summer heat and cause smog.

Betraying these actual physical conditions are news accounts of very “strong” particularly US economic fundamentals as well as near-record stock indices. Some of this disconnecting hope set purposely against physical condition can be traced to what is surely seasonality that escapes the traditional perspective of either recession or not recession. But I don’t think that is the whole story.

There is another element to all this that is undoubtedly more difficult to find and unpack. I think more is occurring than we may be aware, and that includes central banks in places we might not suspect doing things we can’t really define. If all that is a bit too nonspecific, there is a reason – in 2016, specific is a problem.

In 2015, central banks were, largely, content to depend upon their narrative of 2014, meaning that weakness was truly believed as temporary and would soon dissipate. The events since the middle of last year showed that was nothing but fantastic folly. But monetary policy around the world still depends upon that narrative, meaning central banks have put themselves in such a bind they can’t really act without confirming they had 2015 all wrong. Discretion is advisable from their perspective; to get the world feeling better without appearing to do much to make that happen. Europe and Japan are the exceptions because there is no ambiguity.

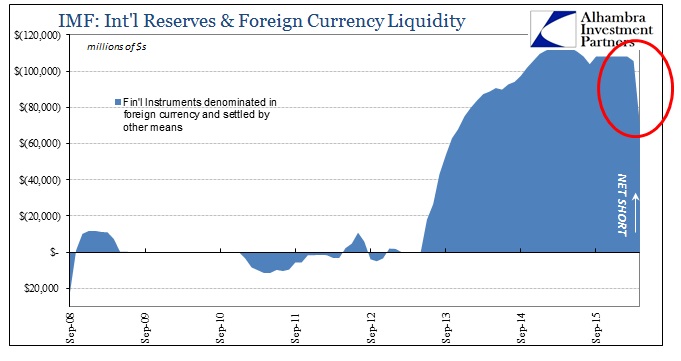

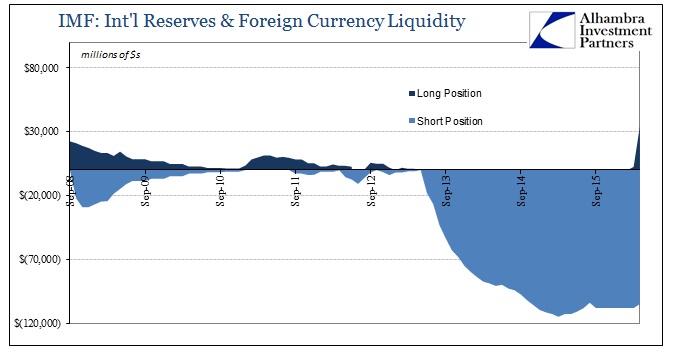

One example, I think, is in oil with the Chinese taking crude rather than “dollars.” Another one may have presented itself in Brazil. The last IMF update (through April) suggests something possibly extraordinary (subscription required).

In February, the net short position was $108.1 billion, practically unchanged going back to September 2015. In March, the net short fell to $105.6 billion; then just $70.7 billion in April. In the breakout for the line in the IMF data, the overall short position itself remained exactly the same, meaning that what changed was the sudden and so far unexplained introduction of long positions in “Financial instruments denominated in foreign currency and settled by other means.” April’s new “long” was more than $30 billion – a huge amount.

In that article, I walk through a potential explanation of what this new “long” position could mean, though I have little hard data so it remains a speculative theory (which is why it stays behind the paywall). The notion is, however, consistent with China taking oil; desperate times call for desperate measures.

That was always the danger to playing up the middle part of this year as some kind of rebirth. Not only did “they” do the same last year, these sorts of countermeasures, hidden, narrative, or explicit, are asymmetric risks. In other words, the payoff in particularly economic terms was always likely to be both small and improbable; the downside, by contrast, could be enormous in continuing the same line of “harmful” inquiry of markets further dismissing central banks as anything other than bluster.

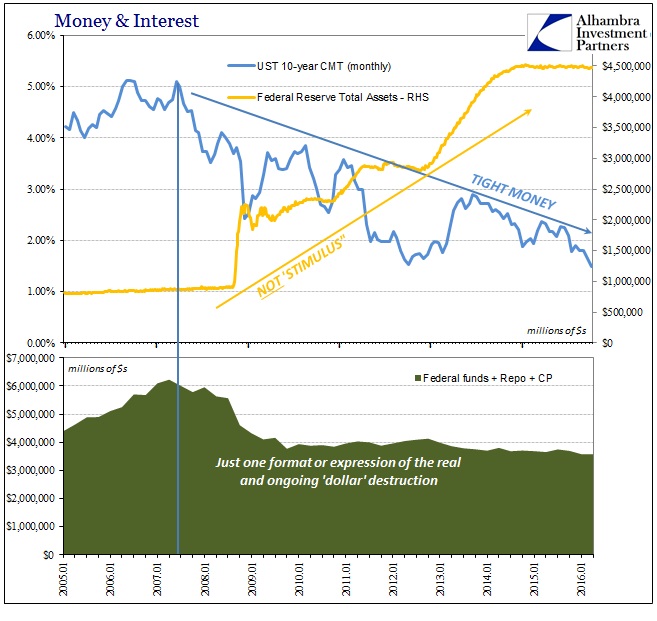

The financial and economic world in 2016 is, more than anything, a confidence game (dual meaning intended). The year started with confidence severely shaken, so gasoline (as one real economic variable) and hiding intervention (the further hint of desperation) are more likely to have lasting negative effects than effusive but unbacked mainstream praise for the nth year in a row. There are a lot of layers to untangle, but underneath all that it is really simple “dollar” conditions and the imperfect, ill-suited responses to them.

Stay In Touch