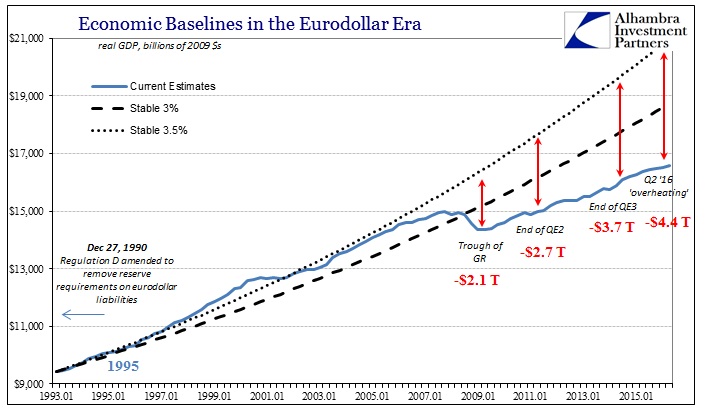

In advance of today’s GDP release, it was expected that the Q2 estimate would be around 2.6% (it was only 1.2%). The major reason for the anticipated rebound was “strong” consumers, a theme that has been a part of the dominant economic narrative since 2014 introduced the phantom “best jobs market in decades.” No matter what happens in the economy, however, GDP or otherwise, consumer spending is always brought up as the basis for what will just around the corner erase all memory of persistent failure.

Before the GDP release, Fox Business had this to say under the headline Consumers Seen Powering 2Q GDP:

The U.S. economy likely regained speed in the second quarter as robust consumer spending offset a sharp moderation in inventory investment and weak exports, pointing to underlying growth momentum that could be maintained for the rest of the year…

“The economy clearly bounced back in the second quarter because consumers put the economy on their backs. Things are falling in place, the economy will continue to move forward,” said Ryan Sweet, a senior economist at Moody’s Analytics in West Chester, Pennsylvania.

It doesn’t help that the Moody’s economist quoted above made much the same declaration last year at this same time about Q2 2015, but the media doesn’t care about anything other than perpetuating “strong” on behalf of economists who seem to be unable to calibrate their views to anything other than what “should be.” Even though the actual published GDP figure for the latest quarter was less than half of what it was thought to be under the “strong” consumer, these expectations haven’t in any way changed with the new number.

The U.S. economy grew far less than expected in the second quarter as inventory investment fell for the first time in nearly five years, but a surge in consumer spending pointed to underlying strength.

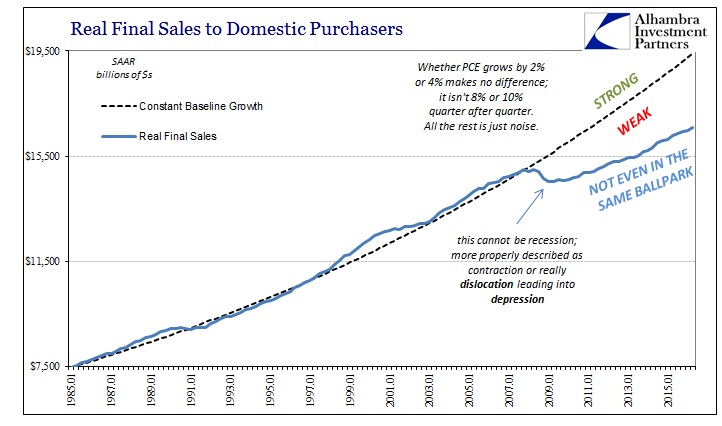

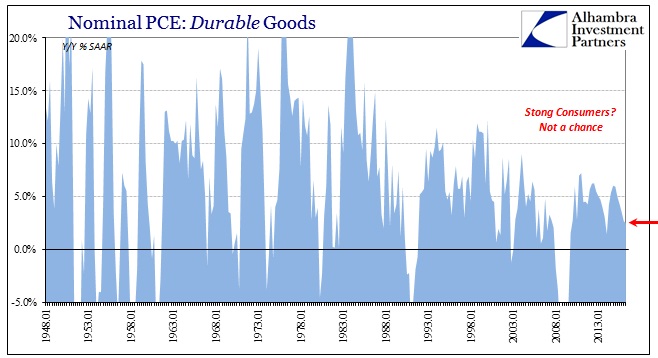

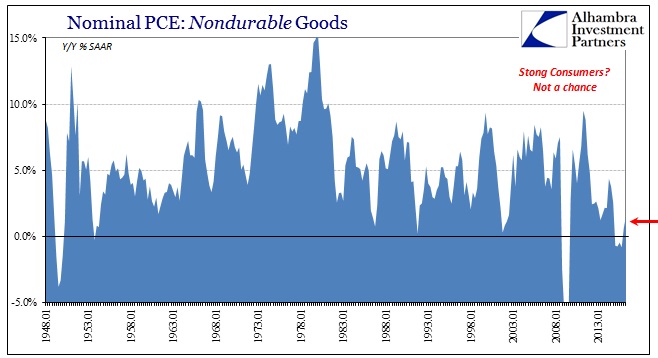

They can get away with making the claim because of the peculiarities of GDP accounting, and the fact that they simply ignore any comparisons outside of it. From Q1 to Q2, Personal Consumption Expenditures (PCE) grew by 4.2% in real terms, seemingly a “strong” figure. Spending on goods jumped by 6.8%. But those numbers are, in isolation, meaningless without context particularly since Q1 was atrocious. Thus, less atrocious even at 6.8% more is still quite bad.

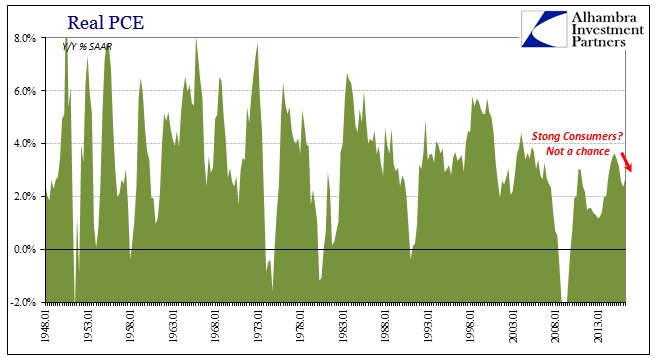

Year-over-year, Real PCE was only 2.7% more than Q2 2015, just slightly better than the 2.37% Y/Y growth rate in Q1 and significantly less than the 3.4% in Q2 last year. It should be pointed out that though Real PCE was substantially higher in the middle of 2015 it did not in any way “point to underlying strength.” Quite the contrary:

The reason is simply that economists and their media refuse to see consumers and the economy as anything other than relative to really bad. If it is “less bad” it is immediately labeled as good and published that way. In the real economy, however, “less bad” means only more of the same disaster now with the financially-downward tilt added by the “rising dollar.”

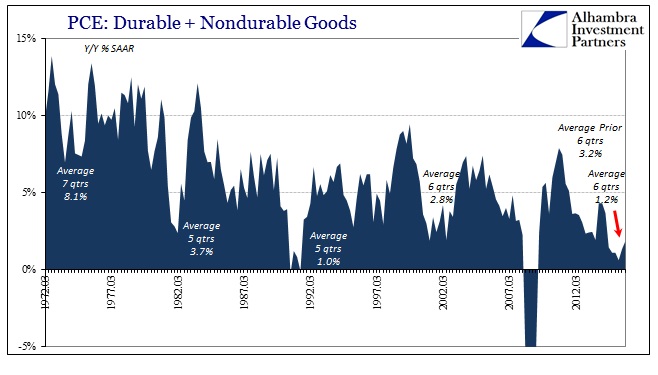

So no matter from what view you choose for consumer spending in the United States aside from the seasonal winter/spring change, it is the furthest from “strong” you can get, including suggesting recessionary conditions.

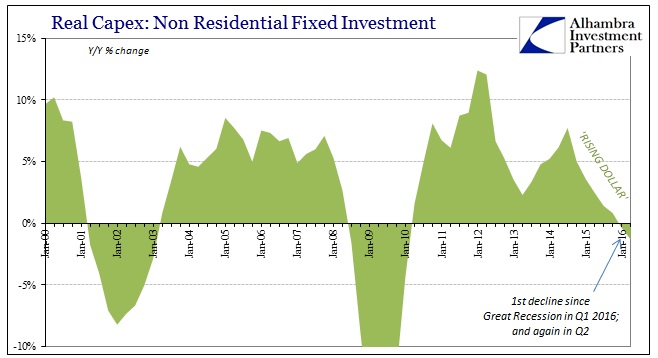

Instead, the global economy has much more pressing problems related to the persistently weak consumers that the data actually exposes, the same as has visited China of late. Capex is contracting in the US, which signals business uncertainty and growing timidity in the face of unrelenting weakness.

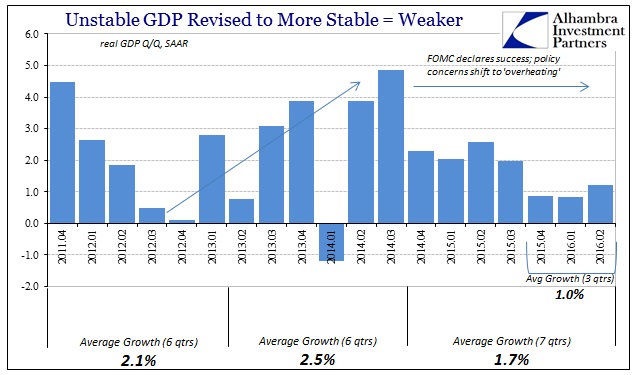

When the Establishment Survey surged ahead in late 2014, economists said it only meant good things ahead, even to the point of “overheating.” Almost immediately, the economy instead fell off to start 2015 even in GDP (smoothed or not). Last summer, we were told “strong” consumers would fortify or firewall the economy from “overseas” weakness. The economy grew weaker again. The mainstream is looking at each of those periods as if the differences between them were actually different; they are not. The consumer of 2016 is the same as the consumer of 2015 or even 2014 (or 2012), which accounts for why even GDP has slowed rather than surged as would be the case with actually strong consumer spending.

Economists are splitting hairs in order to classify less bad as really good. If there truly was a positive and fruitful economic basis we wouldn’t need the mainstream’s constant stamp of “strong” quarter after quarter, it would be obvious in every sector. What is obvious, to the contrary, is just how much (increasing) economic trouble we are all (the world) in.

Stay In Touch