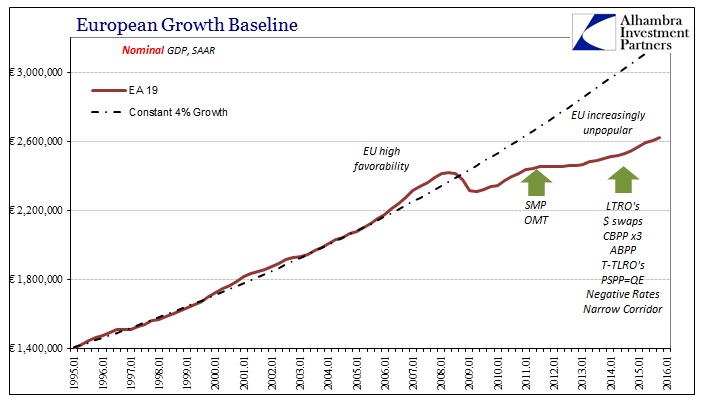

By experience of different kinds and settings of balance sheet expansion in the United States, Europe, and Japan, we can only conclude that monetary policy with these intentions has no effect, direct or otherwise, on inflation in each of these jurisdictions. The varied forms and exact nature of central bank execution allows us a broad and nearly comprehensive examination of these effects. No matter what monetary policy setting with regard to balance sheet size, inflation is at best random and at certain times indicative of other independent factors beyond monetary policy (that should, by predominate theory, be attributable to secondary effects of controlled inflation) .

Because money printing should be easily observed through at least inflation if not economy, we can only conclude that either money printing no longer leads to the same expected outcomes, or that what central banks offer is not it. Given human nature and economics (small “E”), the latter is far more likely.

With no evidence to support it, statistical or just plain observation and unbiased common sense, we are left with what this vast amount of data might indicate instead. That starts with the most obvious change at the most obvious time; before 2008, central banks (BoJ excluded and indeed ignored) operated by mere threat and myth with regard to their balance sheets and direct effects upon bank reserves. Everyone assumed they could, if they wished, start printing money so all that appeared necessary was moral suasion.

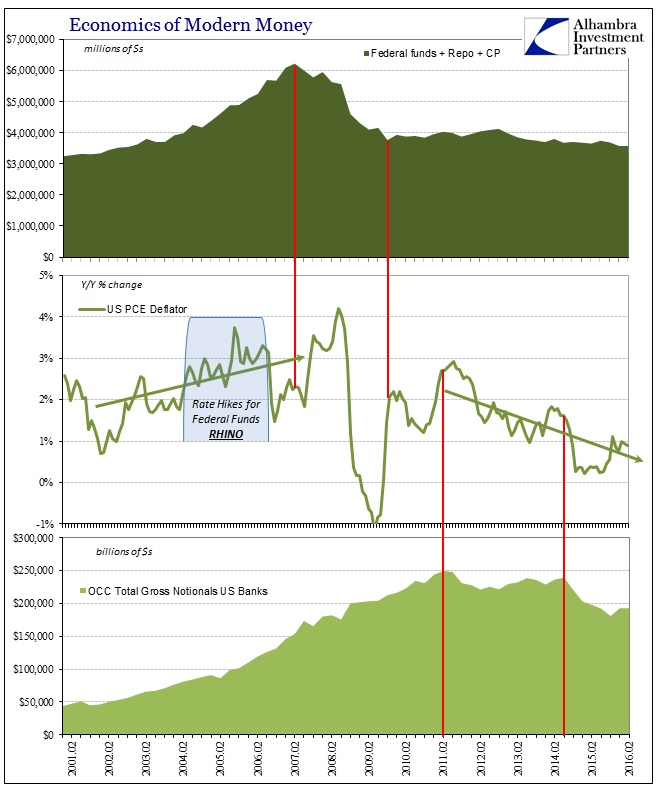

However, as noted of the explicit divide to the US PCE Deflator, while it may be less certain and evident there were already indications that monetary conditions were being set by factors apart from even the implicit regime of that time. This was revealed as the true case by the crisis and panic.

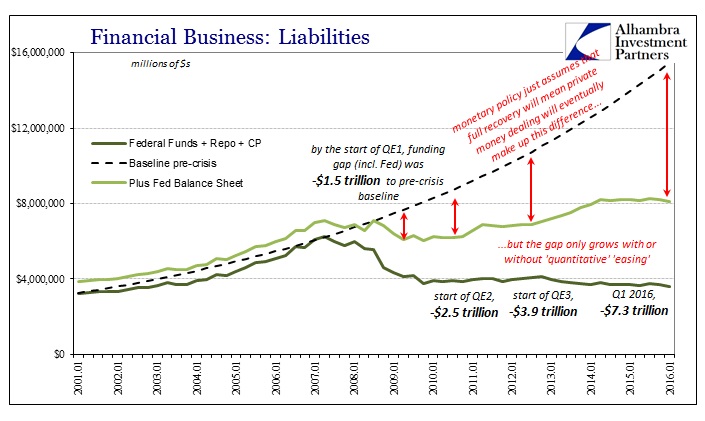

Thus, QE and balance sheet expansion was to make explicit effort, to do what the private banking system no longer supplied by threat. The troubling, consistent lack of evidence of success especially in inflation, let alone economy, shows that central banks cannot do what private banks used to, and by extension they may not ever have been able (under the wholesale, eurodollar format). Again, that was already indicated especially during the rate hike “tightening” regime in 2004-06, where private money clearly and openly deviated from established policy intentions across several dimensions.

In other words, there was more than one breakdown of basic monetary assumption staggered into the crisis and panic itself; several very prominent opportunities arose which central bankers should have received as evidence they were all wrong. It was true that the Federal Reserve need only target a rate for federal funds and that private banks would carry out that specific target in not just federal funds but also LIBOR (geographical, onshore/offshore divide). But as more than PCE Deflator shows, a specific target in federal funds did not itself translate into expected economic factors, notably downward pressure for inflation at that time.

Starting August 9, 2007, LIBOR no longer followed federal funds, further restricting the Fed’s monetary policy assumptions and reach. By the end of the crisis and the worst of the Great Recession, everything was completely detached even though balance sheet expansion had already been started as if that weren’t the case. In other words, all the monetary assumptions particularly about myth and implicit functions had been thoroughly repudiated.

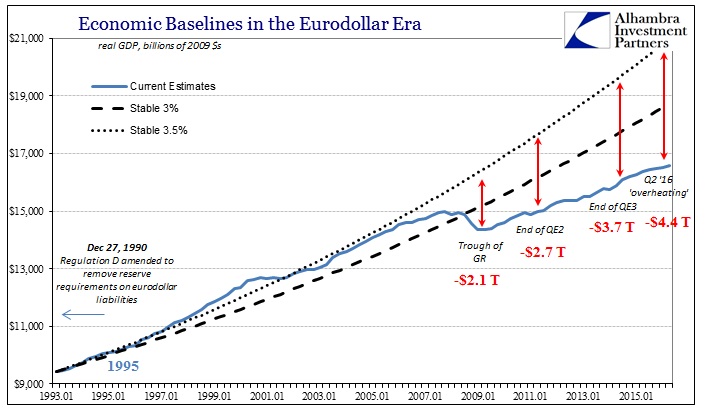

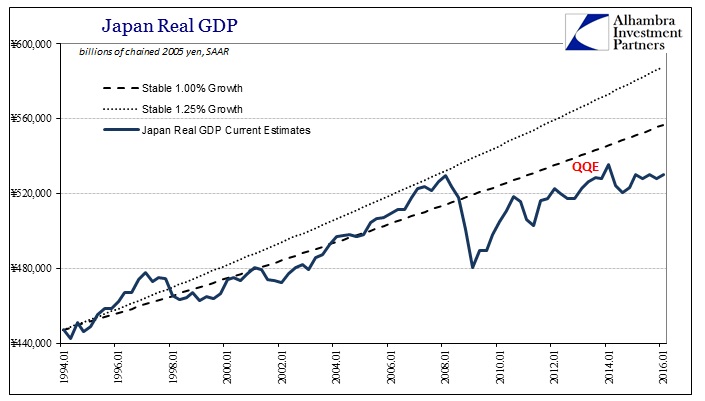

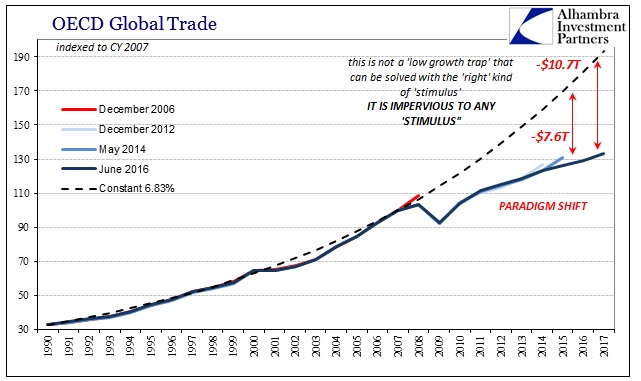

Sensing that the Great Recession was a recession, monetary authorities around the world responded as if that was just a temporary setback for their theories and philosophies. Instead, it has been a permanent paradigm shift. Because this has occurred all over the world in largely synchronized fashion, it leaves just one suspect.

The textbook definition of an economic response to monetary contraction is deflation, or at least disinflation and severe declines in commodity prices, and increasingly depressive economic conditions. That describes very well the global economy especially since 2012. In case after case, we find the same pattern of monetary behavior being mimicked in the real economy. That has led to enormous confusion in orthodox economics because it sees the Fed’s balance sheet expansion in a vacuum – as monetary expansion. Instead, as only partially demonstrated here, the Fed’s balance sheet was only a small offset factor to an otherwise enormous, wide-ranging, and ongoing contraction.

Central bank monetary policy has failed because in reality it is only a subset of systemic monetary policy set by global bank balance sheet factors. We find no evidence of public balance sheet effects because private balance sheet effects are far more central to the economy, and overall much larger and more important (in terms of qualitative reach, not just quantitative volume). Again, this was hinted by the contrary behavior of inflation established long before the systemic break in 2007.

Thus, the eurodollar system more closely explains the behavior of inflation not just in the US but all over the world (including those jurisdictions so far spared from QE or balance sheet expansion) on both sides of the Great Recession divide. In these purer monetary terms, it corroborates what we find in economic conditions, meaning that the Great Recession was never a recession to begin with and the paradigm shift in operative monetary factors explains the ineffectiveness of central bank policy as well as the more-than-temporary deviation of the economy globally from its prior trend.

At the very least, the Federal Reserve and other central banks should have known that when their money market targets no longer applied to LIBOR (and in Europe, as Eonia sank below the MRO midpoint and remains that way to this day) prior monetary assumptions about central bank policies and their ability to carry them out had been at least altered if not ruptured. In short, “money printing” should have been recognized nearly a decade ago at minimum as far more complex than what it is still assumed about it. The lack of inflation and recovery are much easier to comprehend from that informed perspective.

Central banks have been reduced to at best random noise and at worst coincident victims of their own unscientific biases. While perhaps a harsh statement, it is at least supplied by a great deal of evidence; “stimulus” has none.

Introduction, US statistics are here.

European statistics are here.

Japanese statistics are here.

Stay In Touch