In early 2005, the US Senate began debating a bill seeking to impose a broad 27.5% tariff on Chinese exports to the United States. Congress was emotionally moved by the supposed problem of pegging the yuan to the dollar, then at about 8.28 CNY for every USD. In reality, the problem wasn’t so much dollars as “dollars”, meaning that because of the flow of finance across borders the flow of goods could be, though for only a short while longer, a one-way trade. In other words, even the government started to notice that so much of the stuff Americans were buying during the housing bubble was stamped “Made in China.”

The Chinese, for all the bluster on both sides, did listen. Symbolically, the PBOC in late July 2005 finally let CNY appreciate by a whole 2.1%. The official central bank statement declared that it was done “with a view to establish and improve the socialist market economic system.” The Chinese could afford it because they had already dominated the American market and were by then starting to do the same in Europe and elsewhere.

In 2004, the Chinese had managed a merchandise trade surplus of about $33 billion. This was a dramatic change from fifteen years or so prior where an agrarian China imported almost every industrial product, from cars to microwaves and anything in between. “Something” came along in the late 1990’s that completely changed the global trade paradigm.

If we take out the US trade surplus from China’s 2004 figures, however, the trade terms flip to a $47 billion deficit. It wasn’t until early 2005 that the rest of the world began to buy what America already had been for many years. American “demand” was the primary basis and core of that which built China, all financed by eurodollar explosion in both directions.

The Chinese might be forgiven, then, for wondering what it is economists in America are talking about in 2016, or since 2012 for that matter. It is days like today that more completely demonstrate the utter meaninglessness of the payroll report as anything other than an emotional exercise of confirmation bias. The ubiquitous use of the word “strong” is meant to emphasize the Establishment Survey as the primary basis for economic commentary, yet also today the Commerce Department supplies trade figures that contradict everything about the word’s application in this context.

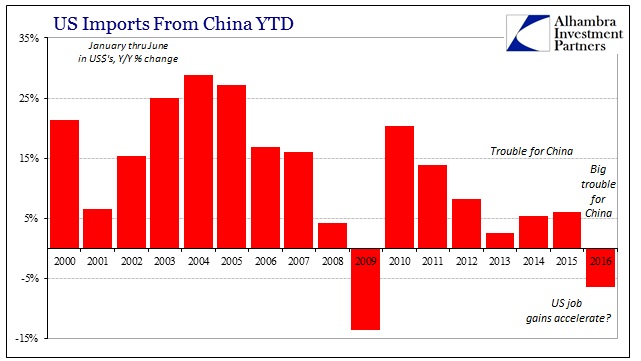

That is particularly true of US demand for Chinese production. In the first six months of 2005, the US imported 27.2% more in Chinese goods than the first six months of 2004, and that was 28.8% more than the first six months of 2003. In the first six months of 2016, the US imported 6.5% less than the first six months of 2015, itself only 6.1% more than the first six months of 2014. The US actually imported slightly less from China so far this year than two years ago.

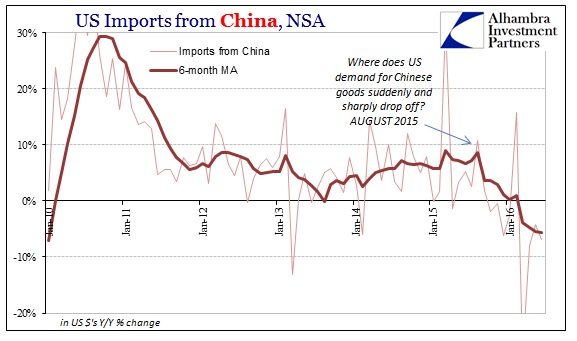

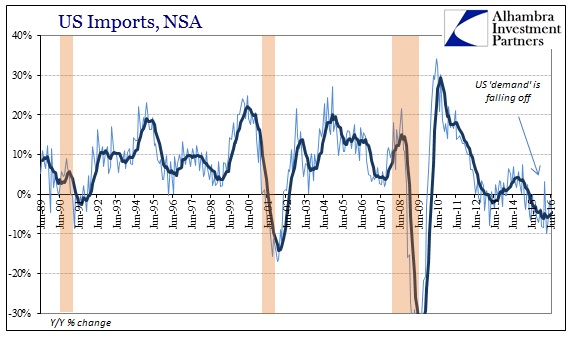

As we know very well from US production levels it’s not as if some native “buy American” grassroots opposition has successfully convinced American buyers to ditch the cheaper Chinese alternatives, redistributing “strong” consumer spending toward American products. There is much less goods being produced and traded with and within the United States – alarmingly so. Further, as you can see above and below, the timing of this most recent change from plain weakness to dangerous weakness is significant.

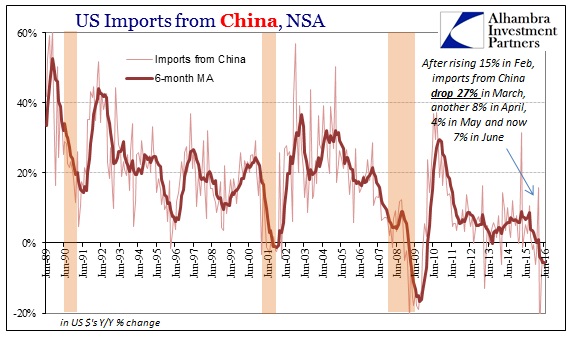

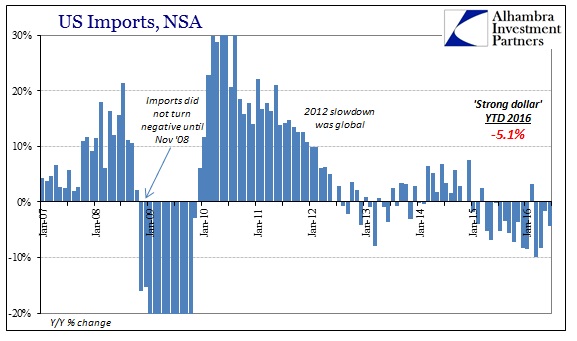

Starting September 2015, meaning dating back to August, US imports from China have dropped off a cliff. While year-over-year growth was slightly positive in September, it has been negative in every month since except February 2016 and that was due to calendar effects here and holiday weeks there (and was easily wiped out by the massive contraction in March). The mainstream reading of the payroll reports up to that point indicated that US demand would and should be nothing but strong. Instead, it has been much worse than it already was.

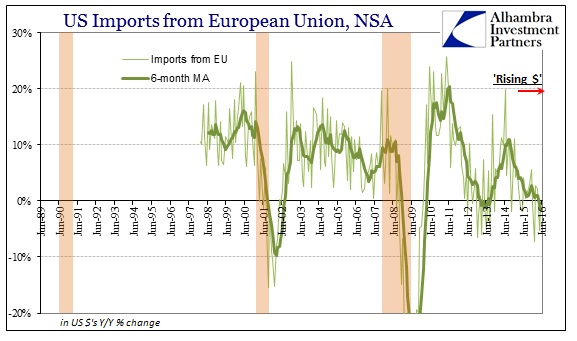

It isn’t just China that is feeling the increasing absenteeism of the US consumer. US imports from Europe contracted for the third straight month, where the -1.8% 6-month average is the lowest since 2010 and the initial recovery from the Great Recession. Imports from Japan were up for the first time in three months, but overall for the first half of 2016 are down nearly 5% in total.

Total US imports were down 4.3% year-over-year in June 2016, the fourteenth decline during the past fifteen months (with the only positive being February and its extra day). For the first half of this year, imports are down more than 5% from 2015 and nearly 8% from the first half of 2014. In fact, total imports so far this year are less than in the first half of 2011. These are, unlike the headline payroll figures, not just isolated numbers. The rest of the world has noticed the terrible absence of US demand that completely contradicts the “strong” payroll report this month and every month before.

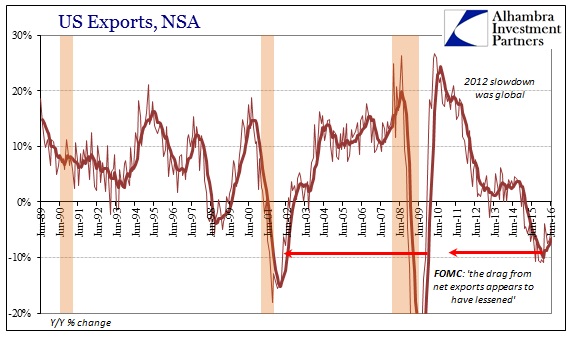

To think that “overseas turmoil” is actually a problem of overseas conditions alone is naïve nonsense. The total reversal in global trade now moving closer to a third year is being reflected back to the US as a weak export environment that economists try to pin on the “strong” dollar. Instead it is the monetary “tightness” of the rising “dollar” that is the primary problem, including its effects on the US economy directly that since last August have further decreased already weak levels.

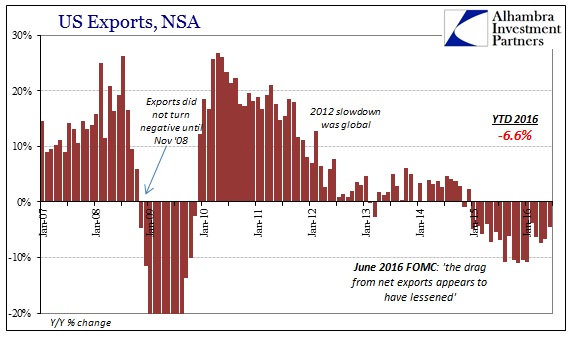

Exports were down 4.6% in June, the eighteenth consecutive contraction. In H1 2016, exports were 6.6% less than the H1 2015 and 11.5% less than H1 2014.

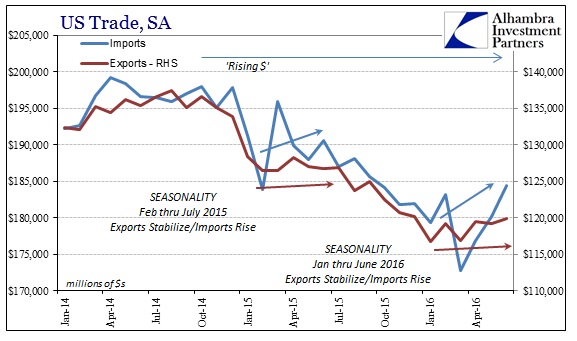

Seasonally-adjusted, imports have risen since a low in March. Exports are up only somewhat from their low in January. In general terms, we have seen this before, just last year at the same point in the calendar – the spring rebound.

There isn’t anything to indicate that trade conditions have changed. That is an enormous problem since exports by count of the seasonally-adjusted series peaked in August 2014 while imports did in April that year. Embarking upon a third year now of even more contraction even if relatively gentle is harmful beyond typical recession conditions. Economists are deathly afraid of anchoring deflationary expectations for a reason, though modern orthodox economists have purposefully remained ignorant about money and therefore how and why especially in this setting.

The “dollar” on this side of the panic has accomplished what no tariffs or threats of tariffs ever could, including devastating the Chinese export sector even with a weaker yuan.

With automakers now reporting the outlines of a “plateau” in autos, the lone bright spot in what little US demand, and US trade terms continuing to signify a sustained and increasing lack of further US demand all over the world, it is a much heartier and more robust counterpoint to the meaninglessness and absurdity of yet another payroll Friday.

Stay In Touch