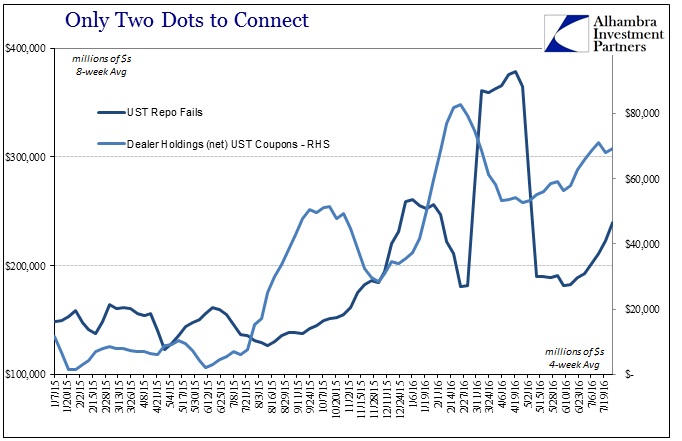

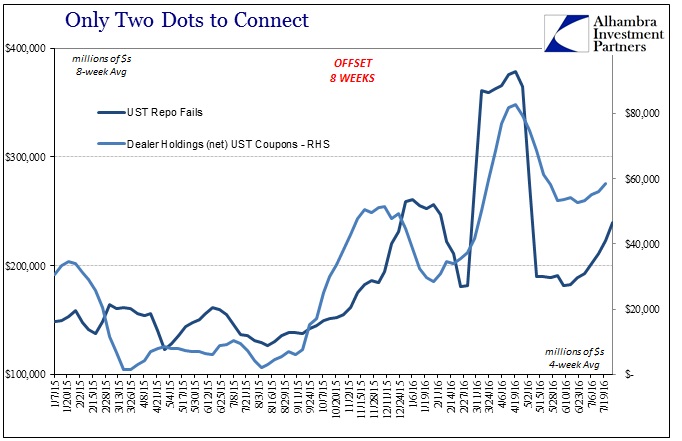

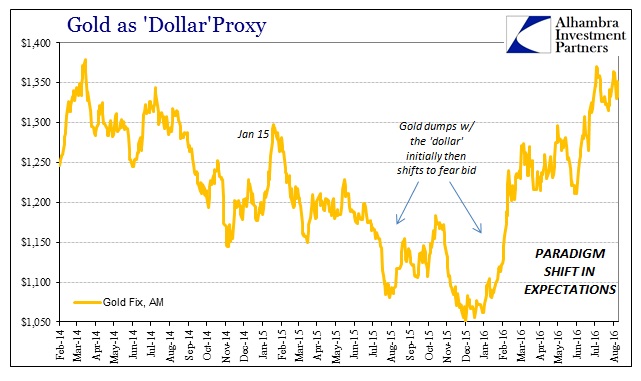

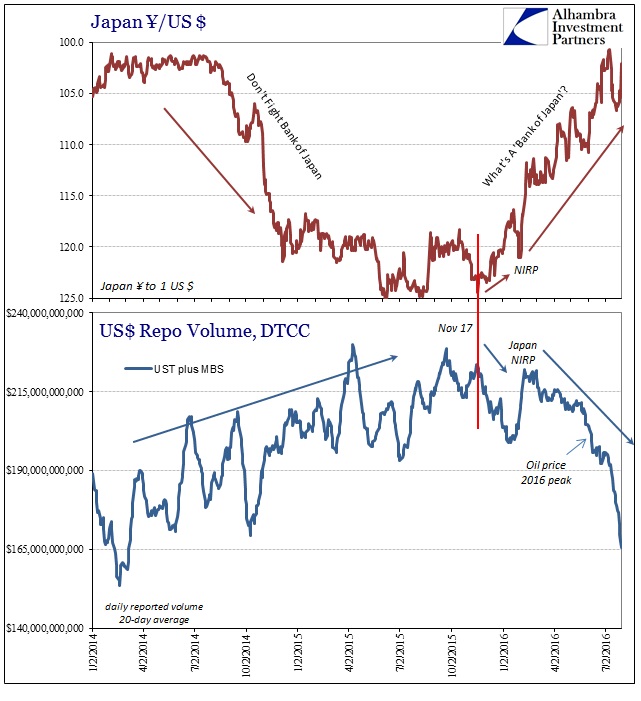

It’s not an exact fit or correlation, but that’s not the point. One follows the other, though the manner in which they relate is outside of any view. The point here is common sense, unclouded by the increasing absurdity with which this simple relationship is denied:

Repo fails are an indication of collateral “tightness.” Dealer net long inventory is an indication of collateral hoarding. How and when one becomes the other is a matter for the markets themselves. Why and what it means is what this is all about.

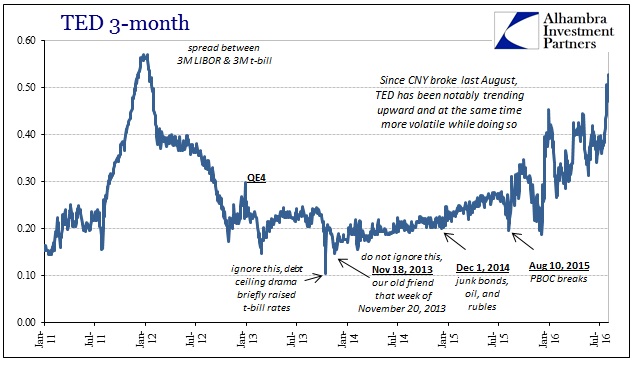

There is a lot more than LIBOR going on (subscription required).

You really don’t need to know much about the repo market or its technical operations and conditions to figure this out. There are only two dots to connect – high levels of dealer holdings of coupons and repo fails. The correlation is as obvious in the charts above as it is in plain common sense. Dealers, the bedrock of the global monetary system, are hoarding collateral and it shows. That, however, doesn’t fit within the recovery narrative, so the media resorts to the easy and absurd to obscure what “should” not be happening.

The Bank of England yesterday, on the second day of restarted QE, failed to find enough offers to complete its purchase allotment of UK government bonds. Mainstream observers are left scratching their heads because, we are told incessantly, there is nothing wrong anywhere in the economy or financial system.

Who might not want to sell UK gilts who also might have enough of them to fill BoE order tapes? Perhaps global banks and money dealers who in “dollars” are already proved unwilling to part with UST’s? We already know there is heavy foreign demand from unspecified counterparties for UST collateral access under the Federal Reserve’s foreign reverse repo accommodation…

Rising LIBOR couldn’t possibly mean anything other than money market “reform”, right?

Other dots already connected:

Stay In Touch