Basic economics has proven that when the supply of something dwindles, absent an offsetting drop in demand the price should rise. When translating these fundamental terms to the labor market especially of the past few years, the supply means “slack” or the available pool of workers not yet working; demand has been, we are told repeatedly, very robust; therefore the price of labor, the hourly wage rate, should be rising and rapidly so if only to match the rhetoric (“best jobs market in decades”).

Monetary policy is already at a great disadvantage because its core philosophy seeks to discourage rapid growth in wages. Figuring that wage inflation leads to actual inflation, central banks believe they must act to control it even though, as noted above, it’s basic economics that shows and truly delivers the best basic economy. This policy handicap isn’t one-sided, however, as this “recovery” has proven beyond any doubt. In other words, central banks have also philosophical problems about getting wages to rise in the first place.

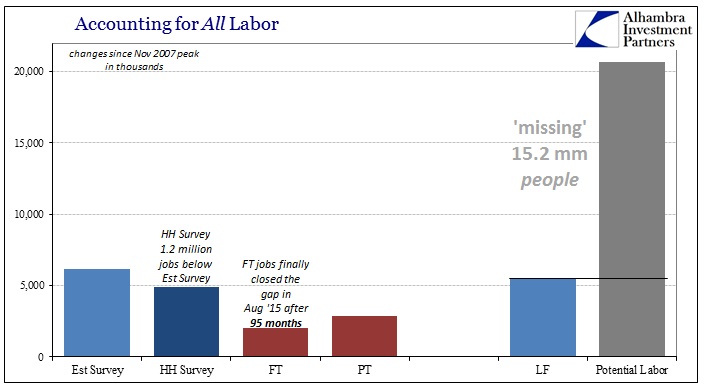

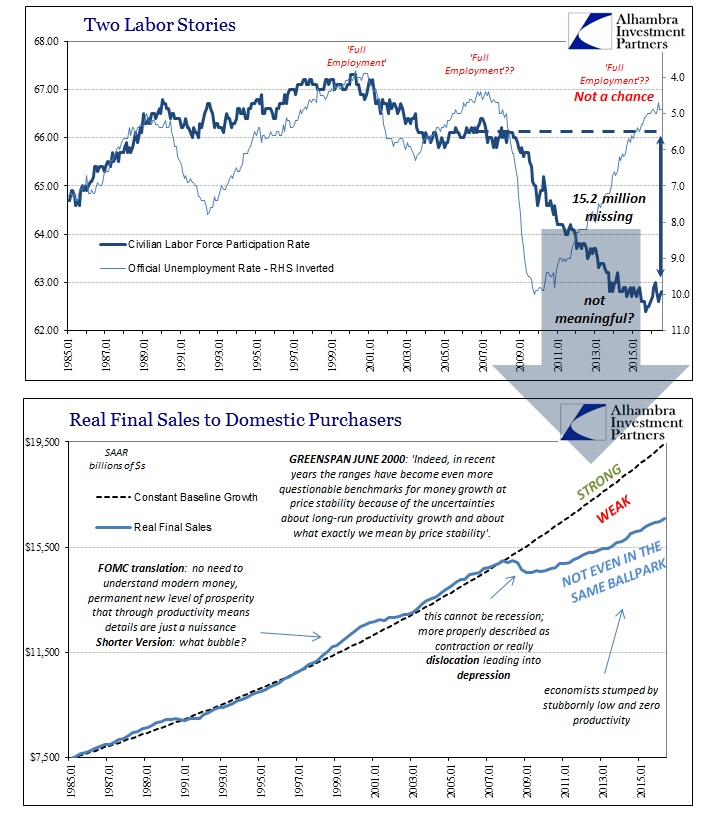

In the past nearly decade, it all works around and toward “slack.” Economists claim that the unemployment rate is the best indicator of it largely because of what we find of the past. Despite positive growth since the Great Recession, it was never at any point enough to erase the deep hole with which this post-crisis period started. But because the BLS surveys the labor force and that survey is taken as scientific verification of it, this initial deficit is just ignored as if covered by demographics or other non-economic factors. The unemployment rate says those who want to work are doing so and rapidly enough since the middle of 2014 that the recovery is full and the economy will only getter better from here (so that monetary policy must shift before it gets “too” good).

This is all, of course, rationalization starting from the premise that monetary policy is actually “stimulus” and that the Great Recession was a recession. The only way those assumptions can remain valid is to ignore the 15 to 16 million “missing” workers.

Economists have convinced themselves these people have self-selected out of the labor force for whatever reasons, and thus just don’t matter for either “slack” or the economy in general. It is a bold assertion, which is why the emphasis on wages. If it is a correct one, then wages would rise and do so rapidly under the terms of inarguable basic economics.

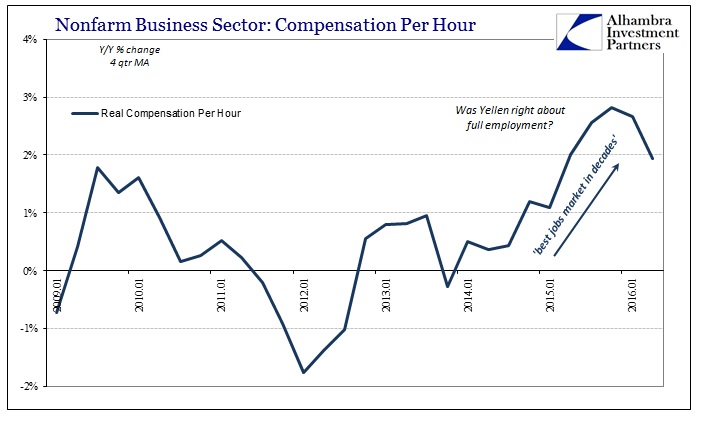

For the last year or so, that did appear to be the case, at least in a narrow view of compensation rates. Included within the BLS productivity data, productivity being another factor to consider with wages and economy, are various measures of pay and overall employment pay factors. The agency surveys and constructs statistics on hourly compensation both nominal and real. According to the BLS, real wages (hourly compensation) have been rising since the middle of 2014, which seems to agree with the Establishment Survey view of payroll growth.

Real compensation per hour sank in 2012 coincident to the slowdown and remained curiously subdued until the “best jobs market in decades.” Even throughout the “global turmoil” of 2015, real wages were rising, almost hitting 3% year-over-year growth.

Real compensation per hour sank in 2012 coincident to the slowdown and remained curiously subdued until the “best jobs market in decades.” Even throughout the “global turmoil” of 2015, real wages were rising, almost hitting 3% year-over-year growth.

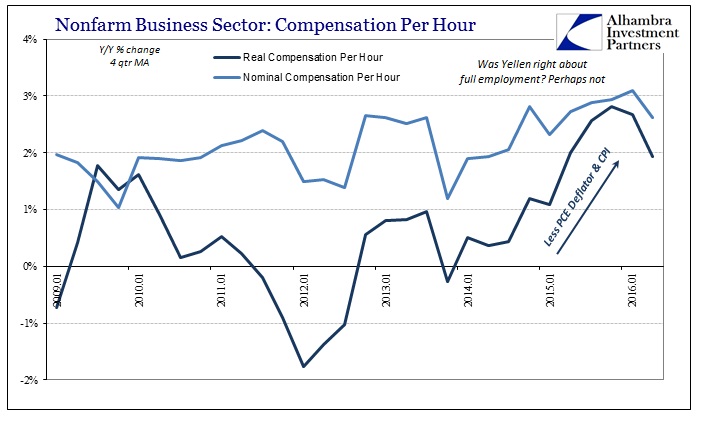

Almost all of that acceleration, however, was due to nothing more than monetary policy failure as viewed from inflation measurements. In other words, as the “rising dollar” indicated global monetary “tightness”, and often dramatically so, commodity prices including oil crashed, greatly and negatively affecting the PCE Deflator and the CPI. In nominal terms, growth in hourly compensation was much, much less convincing.

There is a slight upward trend in per hour compensation before inflation, but hardly anything that would suggest monumental changes completing “full employment.” While economists spent much of 2015 claiming that real wages would matter, that consumers would spend their “tax cut” windfall of lower gasoline prices, the truth is that the vast majority of workers views the labor market far differently and responds more so to nominal wage growth – particularly when it isn’t any different than before and their perception of inflation doesn’t match the officially calculated CPI.

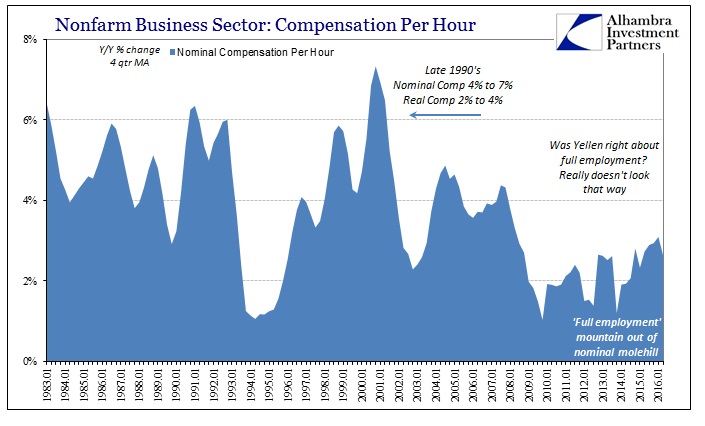

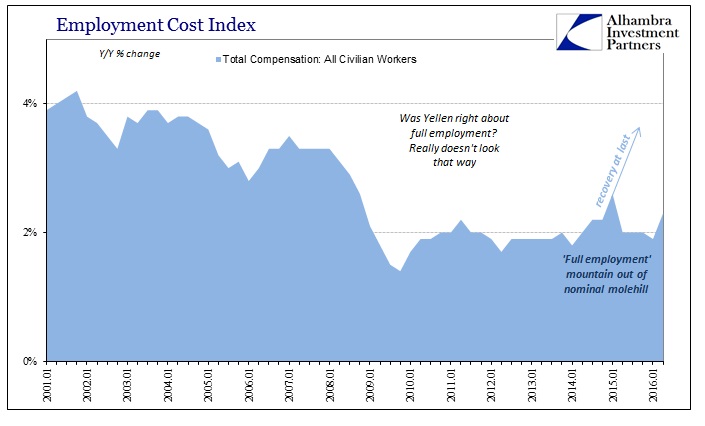

While Janet Yellen may focus on the past few years in order to try to make a lot out of it, in historical terms what we find is just how continually diminished pay increases have been; and workers know it. Even at 3% nominal growth, that is far below any prior comparison, especially during a period that is supposed to be experiencing near “full employment” driven by rapacious demand for labor.

In the late 1990’s, the last time job growth was comparable at least as far as the Establishment Survey statistics suggest, nominal compensation was rising between 4% and 7%, not 1% and 3% as now. The entire FOMC and Janet Yellen in particular are keenly aware of this discrepancy, which is why they rarely allude to it directly (preferring instead the passive voice of “wages remain weak”) and prefer instead to focus on its second derivative. Wages may have been weak for a long time, but with the unemployment rate so low rapid growth has to start somewhere.

Because of this view of the economy as it “should be”, economists take every little jump in wages or compensation (or anything) as the start of something big that will finally, finally confirm the orthodox interpretation of not just monetary policy but its take on basic economics. The seeming rise in 2015 was the latest in that line of false positives.

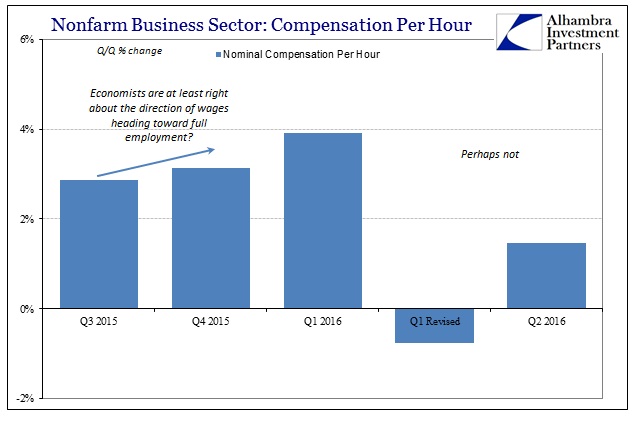

Measured quarter-over-quarter, as they prefer, compensation per hour did seem to be at least moving solidly in the right direction. Nominal growth was near 3% in the last half of last year, with Q4 2015 revised higher to 3.1%. The initial estimate for Q1 2016, despite again negative productivity in that quarter as the one before it (and now after), was another 3.0%, revised shortly afterward upward to almost 4%. But in the latest productivity release, that Q1 growth has just disappeared, now figure to be drastically different at -0.8%; Q2 is initially estimated to be just +1.5%.

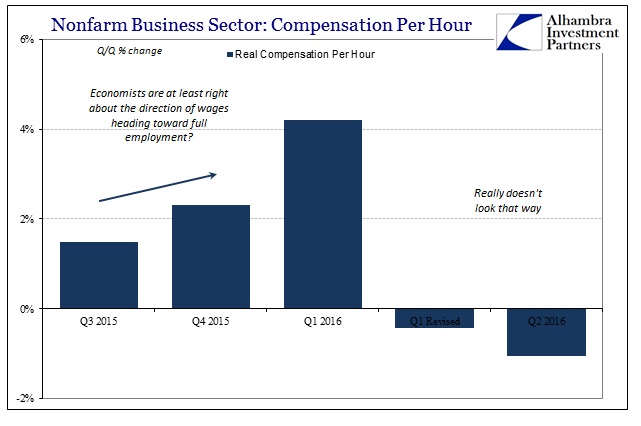

In real terms, Q/Q “growth” in hourly compensation rates is even more discouraging. As nominal, revisions to real compensation per hour drastically altered Q1, which was as high as 4.1%, to the same negative number only now followed in Q2 with a deeper negative (as the calculated “boost” from lower oil prices fades).

There is only disheartening news in these estimates, as wages remain historically restrained and there isn’t any indication that is about to change no matter what the unemployment rate suggests to orthodox economists. When the full Employment Cost Index jumped by 2.6% in Q1 2015, economists themselves followed and seized that rise as that which they had been seeking since it all started. It didn’t matter that 2.6% itself was paltry since it was, again, the right direction at the right time and that was enough.

“These growth rates are still quite modest by historical standards, but the upward trend is now very obvious,” Capital Economics’ Paul Ashworth said.

“While the market was expecting a firm print in q/q terms, the rate of acceleration in y/y terms is likely to be taken as a sign that the economy is beyond full employment,” BNP Paribas economist Bricklin Dwyer said.

It fell back to just 2% the very next quarter and stayed that way until this latest quarter’s 2.3% initial estimate. The labor statistics away from the headline payroll figures and the unemployment rate are a mainstream exercise in bias, starting from that premise that the 15 million should not be considered; to do so can only lead to the conclusions that monetary policy is impotent and the Great Recession was not a recession.

Common sense, as basic economics, dictates that those millions of unfortunate “leftovers” actually matter and matter a great deal (just ask the Chinese). They declare the jobs market quite insufficient both in historical terms and for the past few years. Wages aren’t rising because “slack” remains immense, and it does so because this is was never a business cycle matter.

Stay In Touch