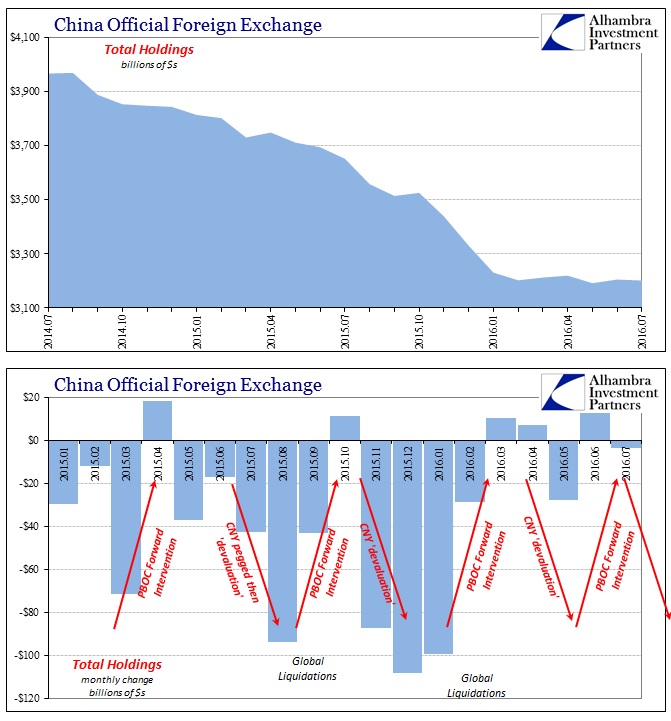

China’s State Administration of Foreign Exchange (SAFE) reported a slight decline, -$3.6 billion, in foreign “reserve” assets in July. That followed a $13 billion “inflow” in June, which was the largest since early last year, maintaining the same pattern that we have observed for some time. A positive month isn’t so much an “inflow” as very likely forward operations from the PBOC that skew these traditional accounting methods; conversely, an “outflow” is the further “dollar” disruption that we find consistent with CNY “devaluation.” Given that CNY leveled off right at the start of June, this data provides consistent evidence that it was indeed the PBOC that intervened as “devaluation” began to gather too much dangerous acceleration.

The level and pace of these changes is evidently different from the massive and violent shifts that the PBOC tried (in vain) to contain last year. It already suggests a more proactive approach, a marked difference between this year and last, a possibility raised earlier today.

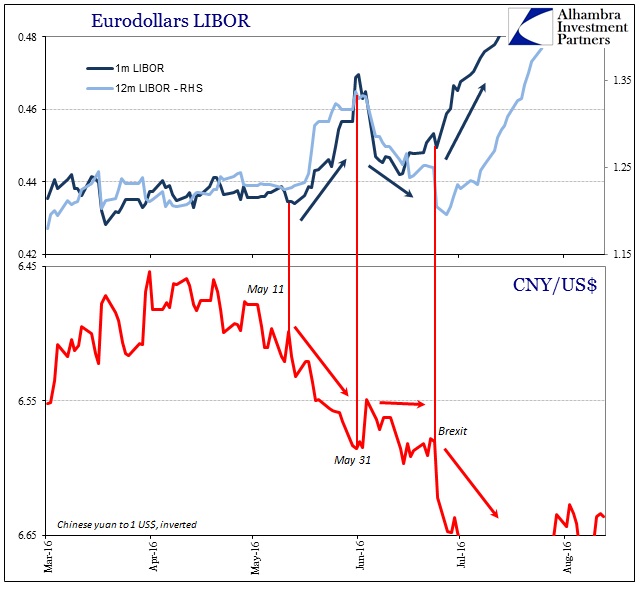

The amplified drop in CNY is marked by the larger decline in reported forex holdings in May; turning around in June as CNY stabilized; only to begin falling again at least into early July, the reversing on July 11 (the split month likely accounting for the small decline). Not only does the SAFE data match CNY, interestingly it follows LIBOR during those months.

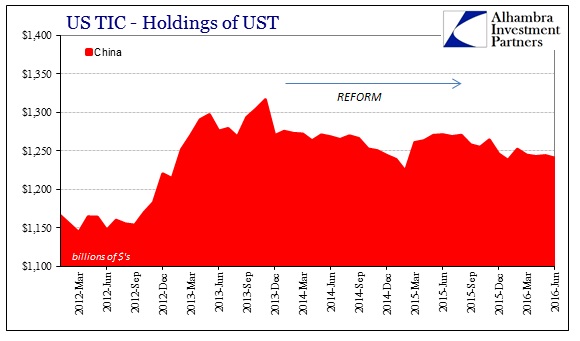

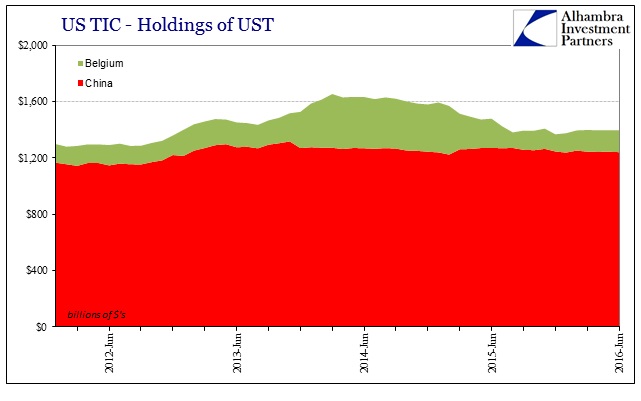

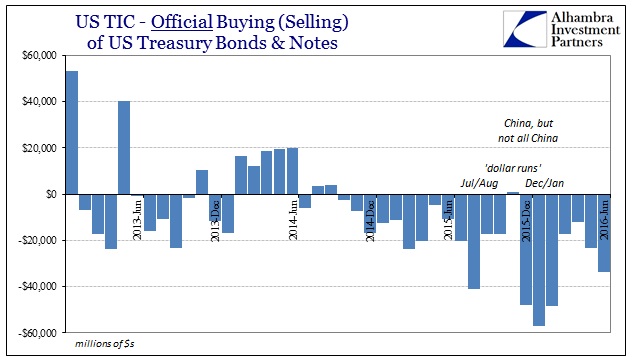

But that leaves a bit of a mystery, as the trajectory of Chinese holdings presented by SAFE largely agrees with the reported holdings of UST’s as tabulated by the US Treasury Dept.’s TIC series. Whether we include Belgium with mainland China’s UST portfolio or not, the result is the same. Chinese “selling of UST’s” has largely ceased particularly in comparison to 2015. This year is remarkably more placid, or so it seems.

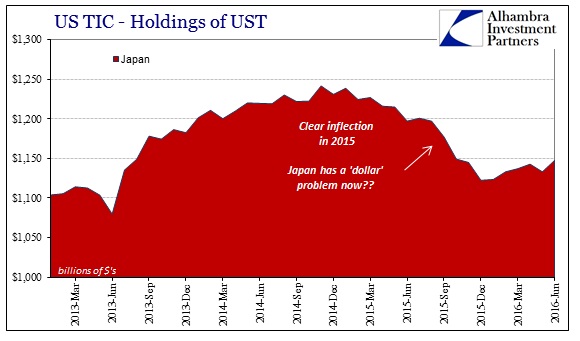

If China isn’t doing it, then someone else is. The TIC data continues to show heavy official “selling” right through June. It could be related to China’s activities, or it could be smaller EM central banks attempting, on their own, to stay afloat rather than sink with this clear “dollar shortage.” Even Japan has added to their UST holdings in 2016 in contrast to 2015 (though there is much more going on with Japan than these simple numbers).

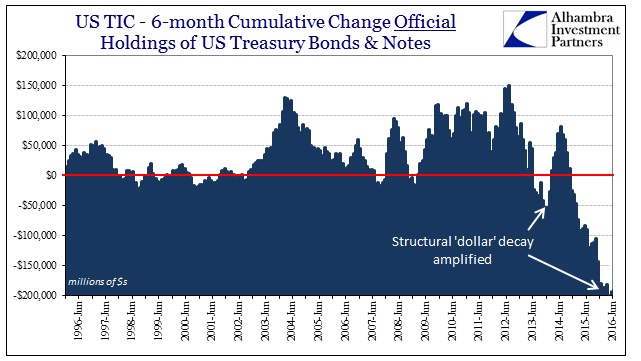

Whereas China’s reported holdings of UST’s (TIC) or just forex assets (SAFE) have leveled off in 2016, what we find everywhere else is the opposite. June was the heaviest month of “selling” in the official sector since February, and would have been greater than every month in 2015 except August.

Since central banks and other foreign finance ministries mainly “sell” in an attempt to fill in any private “dollar” funding gap, the level of official sector declines is a direct reflection upon global “dollar” conditions.

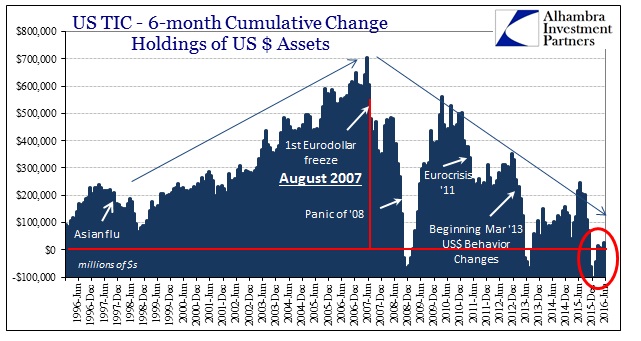

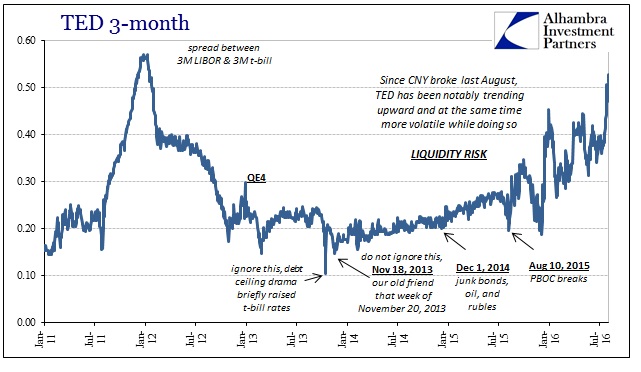

While we don’t know exactly who is doing what and to what quantity, it does suggest what I proposed earlier today; that the level of overall interjection into “dollar” markets is and continues to be greater this year than last. That further suggests efforts that may scale beyond what can be presented and exposed from within the traditional framework and accounting of forex operations. And it may point to greater liquidity risks than are readily apparent, as the immediate effect of such activity is to hide or reduce the visible elements of funding disruption and insufficiency; though interestingly not LIBOR (and its liquidity risk relation, TED).

From SAFE and TIC estimates for China, it would appear as if the Chinese are intervening much less than they were. We know that is likely false from CNY behavior alone, therefore we are pushed to conclude that they are either doing something else, or that someone else is doing these things too (or some of both). In other words, the stability in Chinese forex holdings is misleading, as it counterintuitively submits greater involvement, not less. The global picture of TIC adds the possibility of others being included either in concert or on their own perhaps adding up to the same short-term, unappreciated effect either way.

Stay In Touch