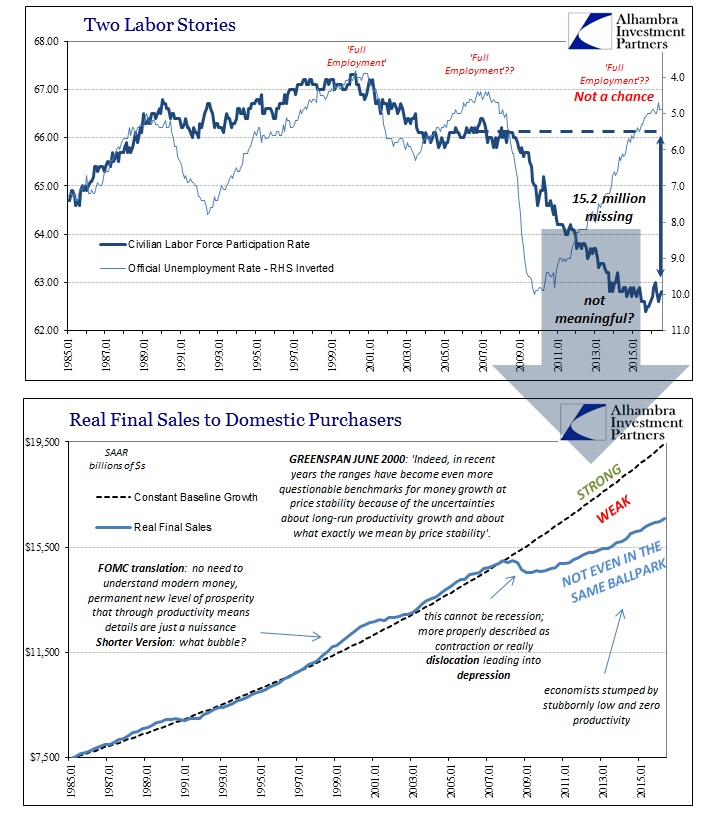

In yet another data point that identifies depression rather than a Great Recession, the Wall Street Journal reported last week what most people outside the economics profession had realized a long time ago. Janet Yellen likes to say that the housing market is recovering, highlighting the economic sector as one of the few bright spots left. The FOMC regularly and officially makes mention of it, largely for the same reason.

As with everything else in this economy, however, that something is not getting worse does not immediately indicate that it is getting better. The housing market has been out of its crash for five years, but that is not at all the same as a housing recovery. Monetary policy interference is still interference, even if it is done with the best of intentions.

The housing recovery that began in 2012 has lifted the overall market but left behind a broad swath of the middle class, threatening to create a generation of permanent renters and sowing economic anxiety and frustration for millions of Americans…

But most of the price gains, economists said, stem from a lack of fresh supply rather than a surge of buyers. The pace of new home construction remains at levels typically associated with recessions, while the homeownership rate in the second quarter was at its lowest point since the Census Bureau began tracking quarterly data in 1965 and the share of first-time home purchases remains mired near three-decade lows.

The Journal leaves undisclosed this critical incongruity, the “lack of fresh supply” that is creating a bottleneck into which prices zoom ahead in the upper tiers while those in the lower tiers, including this new “permanent” class of renters, are forced to watch anxiously from afar. The most the article offers for an answer to this enormous disparity is, “damaged credit, swelling student loans, tough credit standards and a dearth of affordable homes.” Why is there a “dearth of affordable homes”?

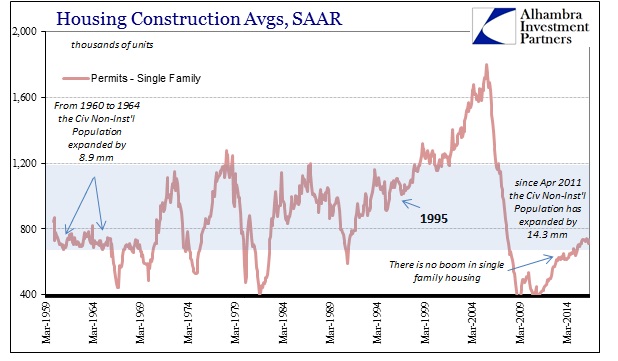

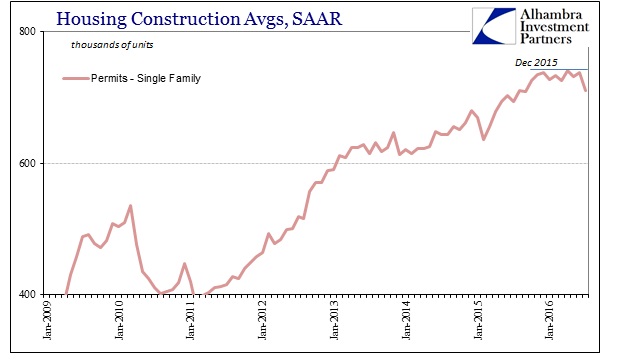

Basic economics demands that rising prices coupled with a supply problem equals suppliers rushing to cash in. In other words, home construction in the lower end starter homes should be booming to fill up this obvious vacuum; it isn’t. The latest construction estimates confirm that new supply remains at depressed levels that we usually find during recessions.

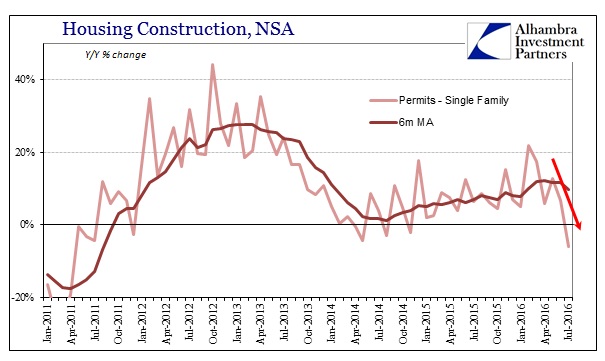

Not only that, there are growing indications that what little forward momentum there was in new home construction, including single family, has hit a wall. Permits for new single family dwellings were just 61k in July, down 6% from July 2015. That isn’t just one month of variation, as dating back to, surprise, December 2015 growth in construction intentions has flat-lined and now declined.

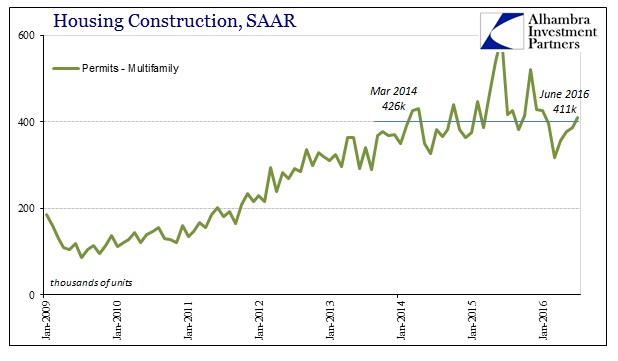

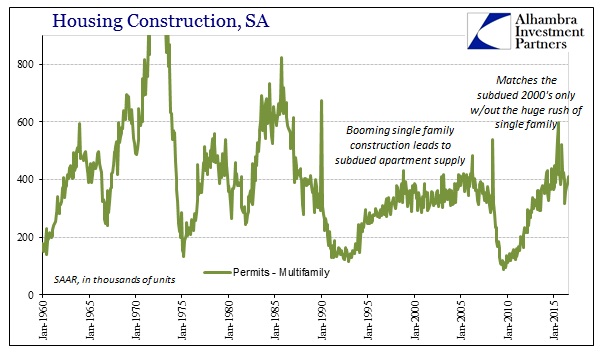

Though that might leave so many Americans to rent, there isn’t any huge burst of activity to take up that potential supply shortfall, either. New permits for multi-family construction were also down in July, -6.4%. That was the sixth straight month of contraction, suggesting that there is much more negative than the base effect of last year’s NYC discontinuity (which occurred in June). That would mean that developers are cutting back in apartment construction to some as-yet unknown degree.

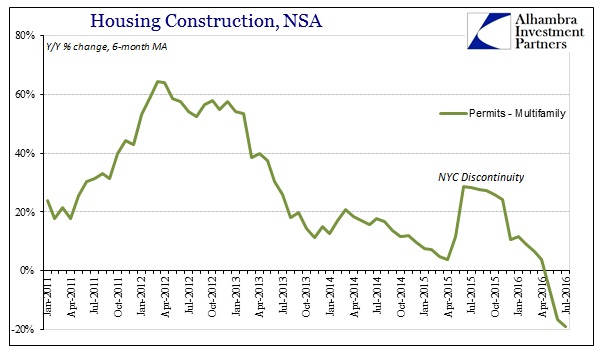

That leaves only one possible comprehensive explanation, the one that neither the Wall Street Journal nor economists (redundant) would ever consider given the “full employment” suggested by the unemployment rate. In other words, for all the bluster about labor strength these past few years, housing construction and the unusual supply imbalance points out that wages and overall national income are likely nothing like full employment. Plentiful good jobs and income growth would override many of those factors holding back prospective home buyers – and developers know it making their living from exactly this landscape.

As bad as that is, the potential verdict of home builders is worse in terms of second derivatives. The reluctance to increase the pace of home construction has been irregular, meaning that more recently developers have been even more unwilling to build than they were (especially multi-family). Thus, they have indicated that conditions are and have been worsening as the unemployment rate falls and misleads economists toward the opposite conclusion, explaining once more why policymakers seem so surprised time and again. Positive numbers alone do not equate to economic recovery.

The slowing in single-family construction especially in 2016 is also alarming in that it corroborates what we have found in autos. That would mean, if it is indeed a durable change this year, that consumers are at the margins increasingly avoiding (by choice or by ability) the two largest items in the catalog of major economic forces; “full employment” might be getting much less full by the month in 2016. If 2015 was a year full of “unexpected” weakness with positive home construction and auto sales, what might the balance of 2016 be without both autos and housing?

Rather than lash out at the wind and try to explain what seems like a perpetual mystery, it is much easier and more consistent to set aside the labor statistics and see that there is none. The economy has never recovered and what little growth there was has increasingly disappeared over the past two years. The narrow view of the headline labor statistics just doesn’t match any part of the real world.

Stay In Touch