The words of the day are apparently “sluggish” and “challenging.” Overnight both Target and Cisco, bellwethers in retail and tech, respectively, were both the subject of intense scrutiny. Target released earnings that “beat” while revenues and really same store comps were particularly weak. Year-over-year, sales declined 7.2% total (revenues from Q2 2015 include Target’s pharmacy business which was sold to CVS late last year), while same store sales were down 1.1%. Even the company’s digital channel struggled, where +16% sounds terrific but was significantly slower than +23% in Q1 and +30% in Q2 2015.

How does the company explain these results?

While we recognize there are opportunities in the business, and are addressing the challenges we are facing in a difficult retail environment, we are pleased that our team delivered second quarter profitability above our expectations.

That was the bland, boilerplate response of Target’s CEO and Chairman, Brian Cornell. Thus, the word “challenging” was repeated over and over today throughout the media, especially in relation to its troubling forecast:

Citing a challenging environment, Target issued weak third-quarter guidance and lowered its forecast for the year. The company now expects to earn $4.80 to $5.20 a share, compared with prior guidance of $5.20 to $5.40. It expects comparable sales in the third and fourth quarters to come in flat to down 2 percent. It had previously said it expected full-year comparable sales to grow 1.5 to 2.5 percent.

The news from Cisco was perhaps even grimmer, though the company won’t release earnings until later today. A tech news site, CRN News, reported that sources close to the company shared plans to layoff 20% of Cisco’s global workforce. It should be noted that this is still an unconfirmed rumor, and will remain that way until the earnings report when the “quiet” period expires.

Searching again for reasons why such a major firm would be delivering such bad news, Reuters, the mainstream news outlet that first distributed the CRN report, could only manage “sluggish.”

San Jose-based Cisco is facing sluggish spending by telecom carriers and enterprises on network switches and routers, its main business. In response, the company has been beefing up its wireless security and datacenter businesses.

To the mainstream, the world has gone crazy. How can there be so much political discontent in 2016 when the FOMC and the unemployment rate combined show an economy that is if not already booming must be on the verge of doing so? Laying off 12,000 at Cisco just doesn’t jive; Target falling back into negative comps cannot possibly reflect the “best jobs market in decades.” Serious corporate discontent is just as unthinkable.

As noted yesterday, the housing market is acknowledged as being in a curiously unbalanced state, as if that was equally some mystery of perhaps the subprime legacy. In reality, all these things are much simpler and related.

That leaves only one possible comprehensive explanation, the one that neither the Wall Street Journal nor economists (redundant) would ever consider given the “full employment” suggested by the unemployment rate. In other words, for all the bluster about labor strength these past few years, housing construction and the unusual supply imbalance point out that wages and overall national income are likely nothing like full employment. Plentiful good jobs and income growth would override many of those factors holding back prospective home buyers – and developers know it making their living from exactly this landscape.

From the perspective of Janet Yellen’s “full employment” the world plain makes no sense, leaving economists to lash out at the unwashed masses who are too unsophisticated to realize how good they have it. Everything now is an anomaly, whether of weather or just blanket “global turmoil.” In reality, stepping outside the unemployment ratio, it is the idea of “full employment” that is the aberration.

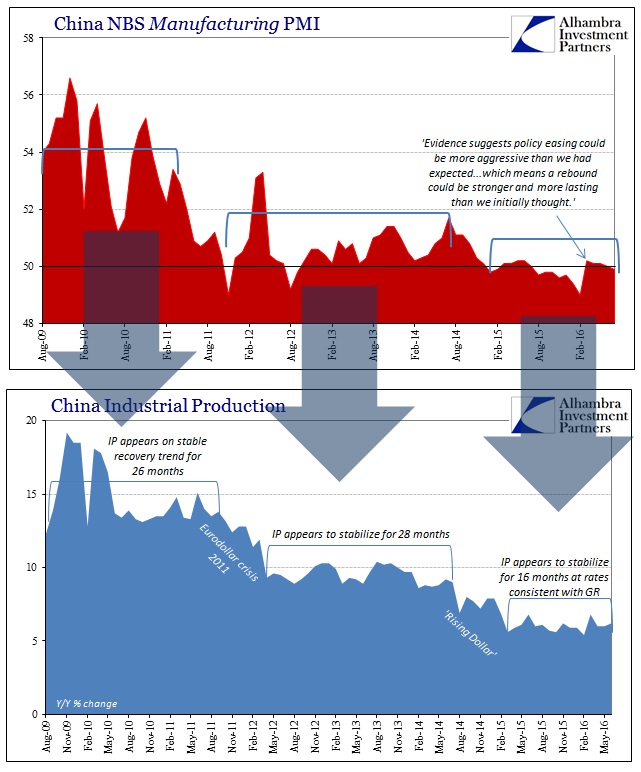

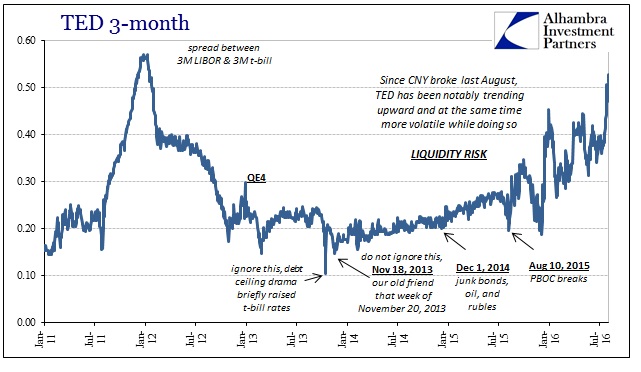

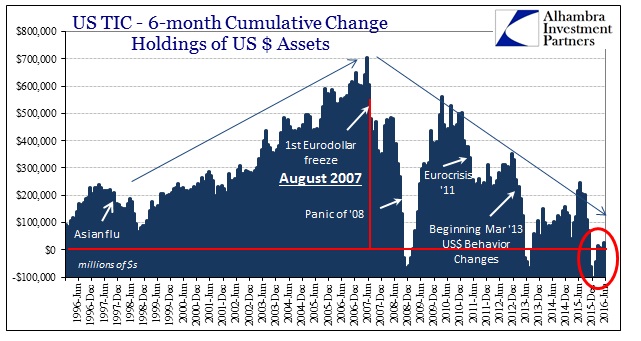

What has occurred since 2012 is remarkably straight forward removed from that colored lens. The sudden burst of retrograde eurodollar problems in 2011, really global wholesale finance across all currencies, of which the “dollar” remains primary, cut off the primary avenue of intended and necessary (in the financialized economy) channels of economic growth in the US, Europe, China, EM’s, Japan, etc. We saw this monetary-driven deceleration in the US as a near-recession, while in Europe it was full-blown. Rather than indicating the start of another business cycle so close to the prior one, that period only confirmed that the Great Recession itself wasn’t actually over; it wasn’t even a cycle.

The validation of the eurodollar view was both the panicked response of central banks (major “stimulus” from China to Europe to QE3 and QE4 in the US) as well as commodity prices. Under increasing money “tightness”, the global economy only became weaker, though it was still growing overall, stripped of its pecuniary vitality even as it appeared to be stabilizing at a “new normal” of “sluggishness.”

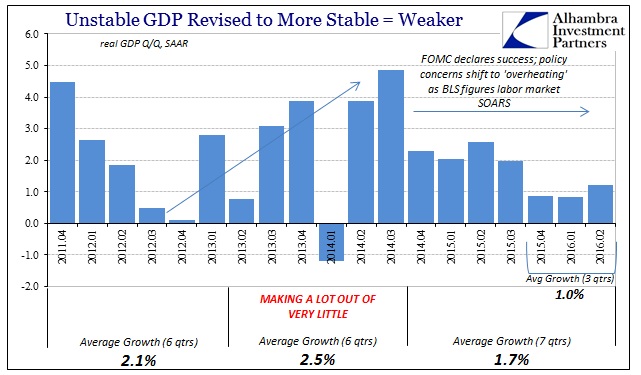

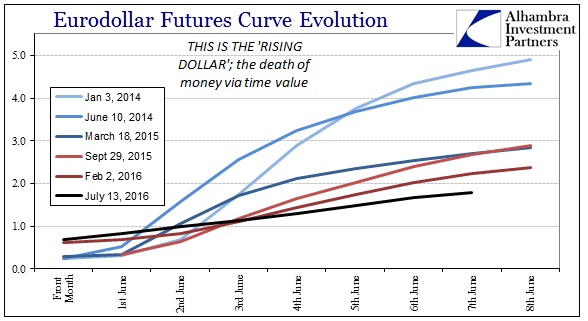

It was highly unstable, however, weakened by serious monetary decay, lurching from growth to not-growth awaiting only the next “push” to be moved into yet another slower state. The “rising dollar” of June/July 2014 obliged. It is the timing of this latest shift that is so confounding to the mainstream. At that very moment, the idea of “full employment” as the crowning achievement of QE-driven recovery became more plausible than at any point; all driven by a narrowed view of the labor market.

At first, even GDP appeared to confirm the theory, as it looked to be on course for acceleration. But that interpretation, too, was derived from an unsuitably limited perspective. In order to see meaningful acceleration, one had to entirely dismiss the “Polar Vortex” economy as if it were an aberration of snow and winter. Accepting Q1 2014 for what it was on its face, however, greatly restricted the possibility of economic acceleration for the rest of that year and really beyond.

Orthodox economics abhors unevenness; all the major statistics, most especially the Establishment Survey, are designed and constructed to remove as much variation as possible – leaving only what economists have defined as “meaningful” economic context. Irregular economic growth does not fit their definition. Thus, by the end of 2014 economists and policymakers (redundant) were using an improperly calibrated interpretation to declare the world ready to resume its prior cyclical place.

No great effort was expended in trying to explain why it took six years and nearly $4 trillion (in the US) just to seemingly put the US economy into position where “full employment” might only be a possibility, particularly as a negative reflection on so much “money printing.” It was just accepted as if that was how these things go (“these things” being financial aftermaths). Nor was there much attention paid as to why that massive balance sheet expansion had even by late 2014 been already two years removed from the Fed’s now-official 2% inflation target. In other words, there were already grave warning signs in addition to commodity prices.

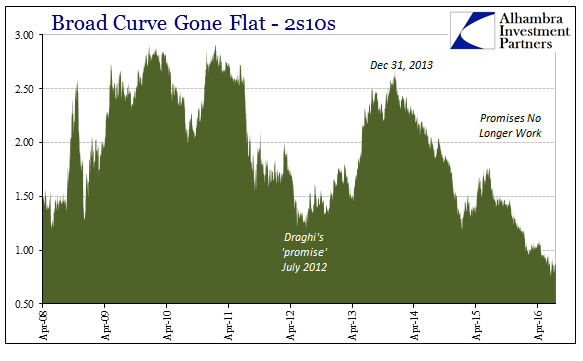

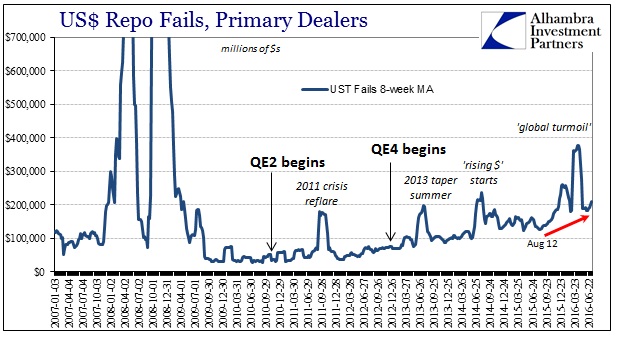

The UST curve began an almost-constant flattening and nominal shrinking; eurodollar futures matched that move, setting up in late 2014 a rerun of 2007. Prior to August 9, 2007, the Federal Reserve and the FOMC had convinced themselves that eurodollar futures were in “disequilibrium”, favoring instead stock prices and primary dealer surveys of primary dealer economists (they are very much a xenophobic cohort, very much afraid of any data that isn’t derived from within). The FOMC even discussed how it was trading desks at these very same primary dealers that were betting against not just their own economists, but the FOMC policymakers themselves.

And so it was again in 2014; money dealers were actively betting against the FOMC while it was increasingly sure, as 2007, there was no rational reason to do so. Rationality has been self-assigned by the Fed as purely a matter for their discretion alone. Policymakers once again dismissed these primary, deep, and crucial markets in favor of themselves and their math. The mystery of 2016 is thus not mystery at all, traders were right yet again; economists know nothing of economy while monetary economists know nothing of money or economy.

The real problem, however, is still to come. Eurodollar futures and credit markets have moved even more bearish just in the past year. Policymakers and stock prices have, unsurprisingly, once more decided it is money markets that are in “disequilibrium” as if they cannot appreciate the unemployment rate in the US. But the world continues to move in the direction of money markets, not “full employment.” The amount of corroboration dwindles by the month, having lost this year, potentially, now housing and autos; two of the very few pillars that were left suggesting the slightest hint the economy was improving.

Monetary strangulation does not happen all at once; it is slow and uneven but no less determined. Target’s “unexpected” guidance and Cisco’s (maybe) layoffs are a mystery to economists’ models, but to eurodollar futures they represent the next and predictable steps of slow burn escalation. A slow motion crash is still a crash.

Stay In Touch