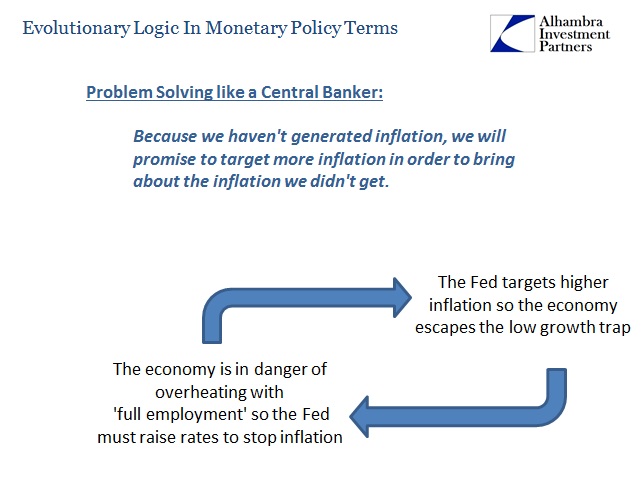

Finally, monetary policy frameworks should be critically reevaluated to identify potential improvements in the context of a low r-star. Although targeting a low inflation rate generally has been successful at taming inflation in the past, it is not as well-suited for a low r-star era. There is simply not enough room for central banks to cut interest rates in response to an economic downturn when both natural rates and inflation are very low.

“We are close to our targets,” Fischer said in a speech at the Aspen Institute in Aspen, Colorado on Sunday. “Looking ahead, I expect GDP growth to pick up in coming quarters, as investment recovers from a surprisingly weak patch and the drag from past dollar appreciation diminishes,” he added, without giving explicit views on his rate outlook.

What?

On Sunday, Fischer said the behavior of employment has been “remarkably resilient” even as the economy has passed through several shocks, while GDP growth has been “mediocre at best.”

While the economy has done “less well” in moving toward the Fed’s 2 percent inflation target, Fischer said the central bank’s preferred price benchmark, minus food and energy costs, at 1.6 percent was “within hailing distance of 2 percent.”

Stay In Touch