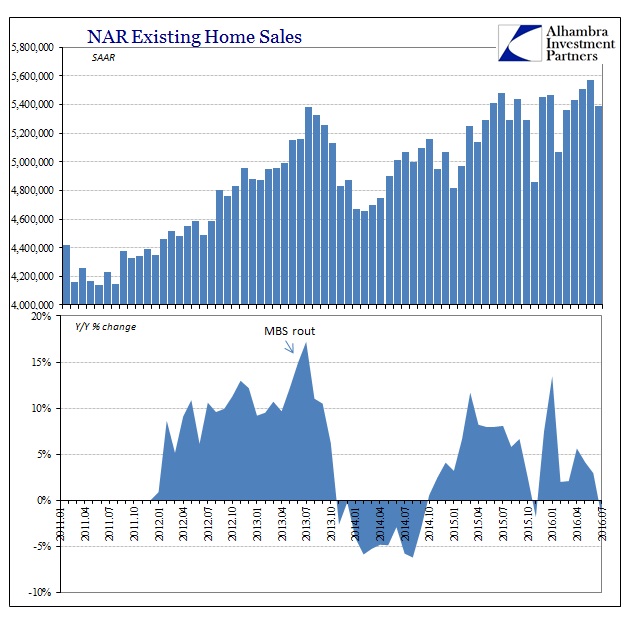

The contradictory nature of the real estate market continues to be exhibited in resales as well as new construction. Though sales of new homes jumped, resales fell. Since last June, the level of contracts for the sale of existing homes has been stuck around 5.4 million SAAR. That was about the same rate of activity as reached at the height of the mini-bubble back in 2013 (prior to the MBS rout and bust that followed).

The NAR reported that the rate of transactions in July was 5.39 million, down sharply from 5.57 million in June. It was also the first yearly contraction for sales activity since last November.

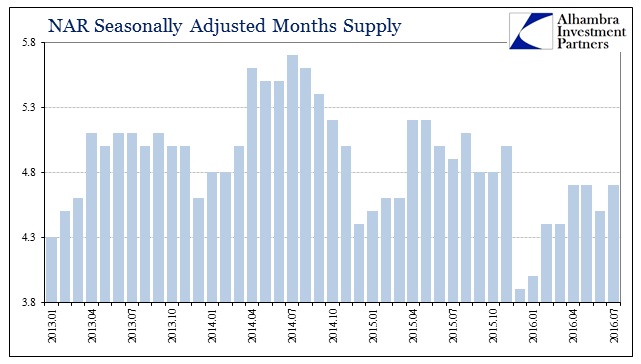

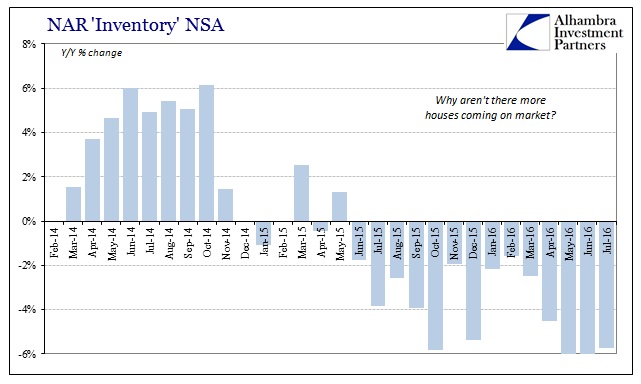

It isn’t necessarily the contraction or even the lack of sales momentum that is cause for concern. What we find in the monthly and even yearly comparisons might just be statistical variation. But inventory levels continue to decline, a contrary signal to what should occur in a healthy real estate environment attached to a healthy economy. As prices rise along with even gentle increases in the number of home resales transactions, the combination should produce sufficient confidence to warrant more and more Americans entering the market with their property.

Instead, going back to, unsurprisingly, last summer that just hasn’t been the case. As NAR’s chief economist Lawrence Yun reports:

Severely restrained inventory and the tightening grip it’s putting on affordability is the primary culprit for the considerable sales slump throughout much of the country last month. Realtors® are reporting diminished buyer traffic because of the scarce number of affordable homes on the market, and the lack of supply is stifling the efforts of many prospective buyers attempting to purchase while mortgage rates hover at historical lows.

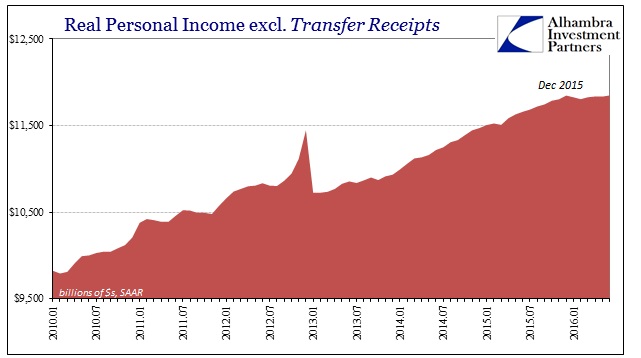

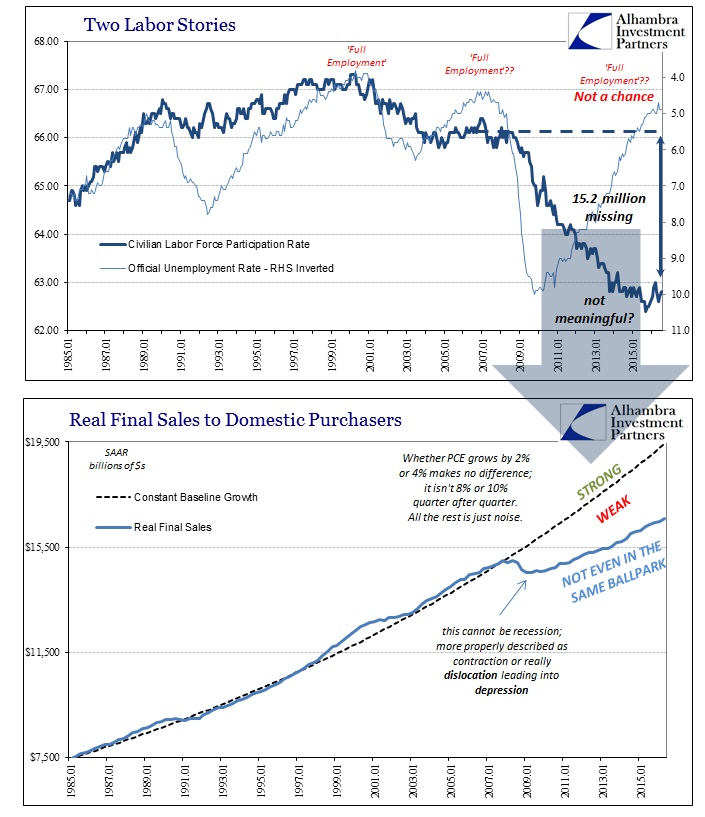

Low mortgage rates, rising prices, and an unemployment rate indicating full employment should mean nothing to “stifle the efforts of many prospective buyers.” We know without doubt the first two of those three to be true, therefore calling into question the third part of the economic equation – “full employment.”

There is more than just an income component to the idea, however, as confidence is as much a part of it as paychecks. The concept of full employment is meant to signal an extremely fluid and flexible labor market, where employers are at a disadvantage to employees who feel strongly enough to freely move on to plentiful other opportunities. Such poise spills over into consumer activities, including and especially the purchase (or sale) of big ticket items like cars and homes.

As with the possible “plateau” in auto sales, however, this lack of inventory despite low mortgage rates and clearly rising prices can only be confidence; and that means a reflection of labor and jobs quite apart from the unemployment rate.

Stay In Touch