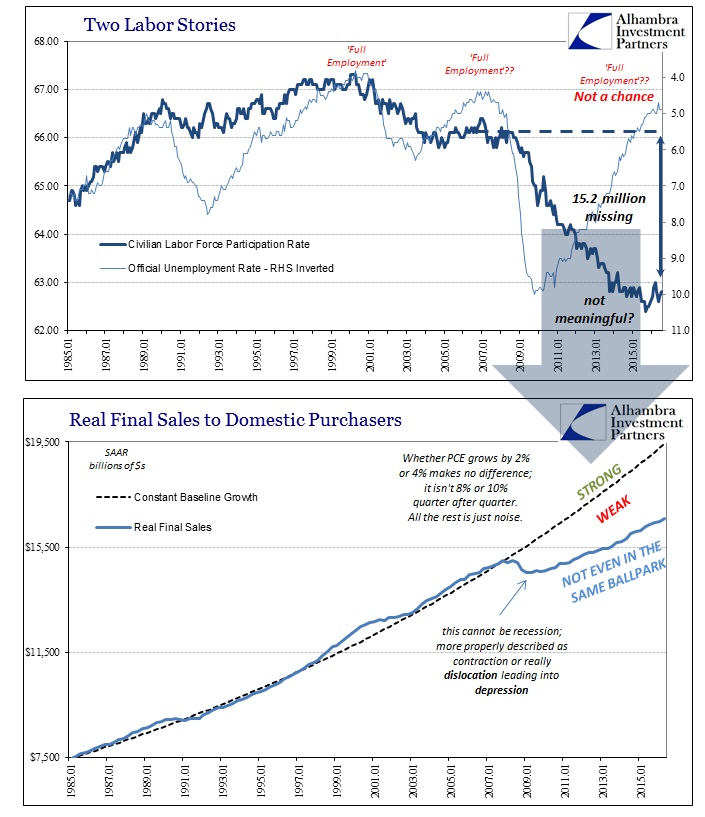

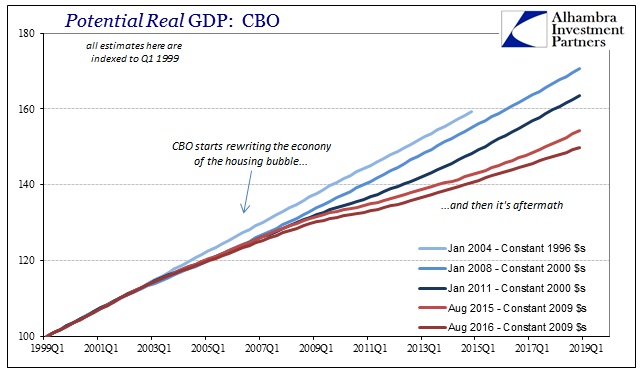

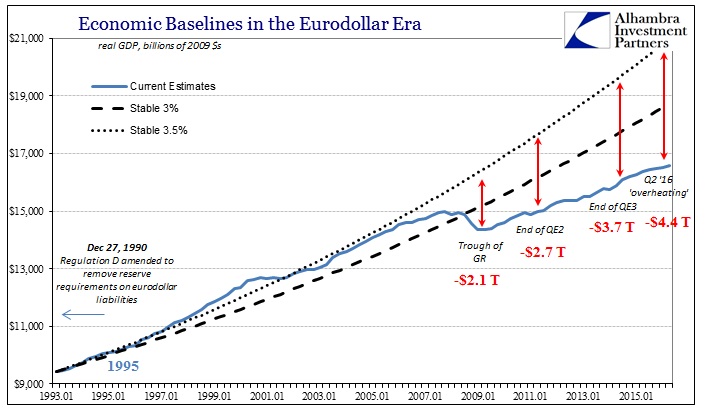

The primary symptom of the economic malaise or depression that has developed since the Great Recession (which wasn’t a recession) is an economy that works less and thus earns less. Such a condition would suggest a shrunken system or at least vastly diminished potential. That much is well-established even in the orthodox literature though it isn’t ever talked about publicly. What happens, however, when an economy that is already working and earning less starts to reduce even further?

I don’t know if anyone knows the answer to that question since in many ways it is unprecedented; though I suspect we are about to find out. The process of deceleration from such low growth after shrinking has taken so far about two years, an arduously shallow decent that has caused enormous difficulty in interpretation as much as economy. Because of that slope it was easily dismissed in the beginning as an “aberration” or “transitory.” Instead, however, the negative pressures have only increased if still very slowly. The next stage of this kind of spreading weakness was always going to be jobs and labor, it was really more a question of when.

Labor utilization is usually the final act in the recessionary cycle process, but again this is not (necessarily) recession; it is in every way much, much worse. Slow and persistent decay without a visible end is by far the worst case; with recession it is nasty and perhaps violent, but only for a short time and then the world goes back to growth again. Enlarging cutbacks to labor inputs is usually the confirmation that the recession process has begun; and very quickly it becomes self-reinforcing, as layoffs reduce spending which signals the need for more layoffs, etc.

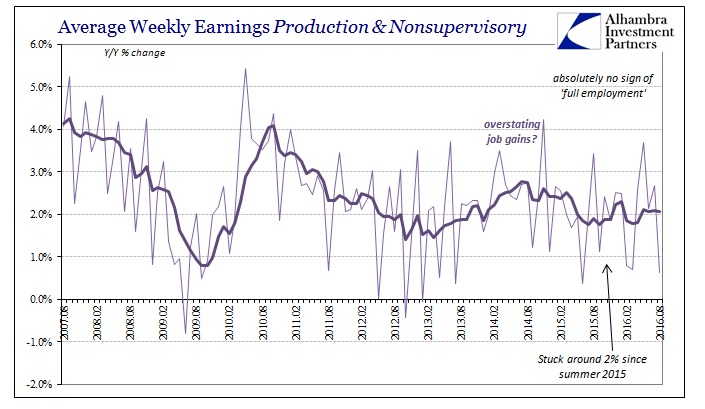

During this “rising dollar” we have only observed a general slowing but because of the statistical cloudiness of the headline numbers (due mostly, in my view, to the overstating of job gains in 2014) it isn’t immediately apparent what that actually means. As noted earlier today in cutting through the statistics of the monthly CES, if the job gains in 2014 were actual job gains then deceleration showing up in the Establishment Survey in 2016 might just be normalization to the weak baseline of this era after a temporary boost around 2014 and nothing more.

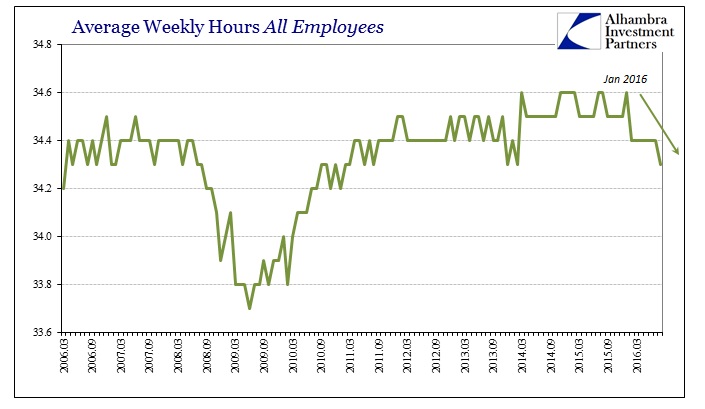

There is, however, growing evidence that slowing in labor is taking on much more than those potentially benign proportions. Other parts of the labor report estimate that labor utilization not only is reducing its rate but to levels not seen since the Great Recession. The BLS measure of average weekly hours for all employees, for example, fell to 34.3 in August, the lowest since the Polar Vortex of 2014 and more importantly down noticeably from January.

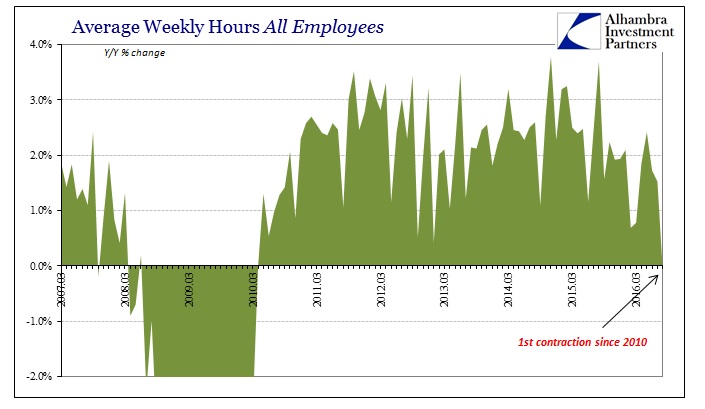

The size of the decline as well as its now seven months in length increasingly precludes normal statistical variation as an explanation. The index from which that average is derived, average weekly aggregate hours, estimating the overall total number of hours worked by all employed persons, actually contracted year-over-year in August for the first time since 2010! In other words, despite the purported increase in headcount shown in the Establishment Survey, there was slightly less work output in August 2016 than August 2015; thus, average weekly hours had to fall so far reconciling to less work per employee.

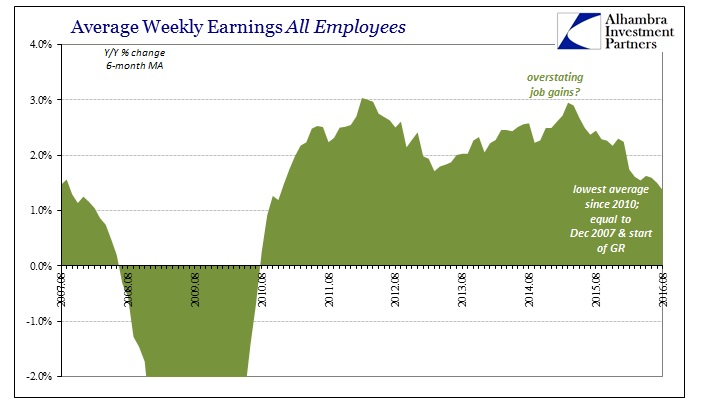

Not only does the pattern conform to the seasonal configuration observed in so many places (the increase in hours worked peaked in May, rebounding after a weak start to 2016; now turning lower into summer) it does so where overall the seasonality becomes clearer as the rate of labor utilization falls further. In average terms, the rate of growth in total hours is now the lowest since 2010 and equivalent to December 2007 and the outset of the Great Recession.

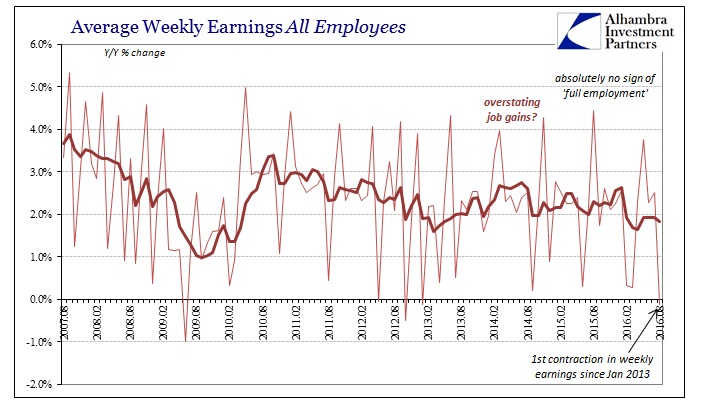

Even though there might be more employees on business payrolls, the effect of less hours or fewer hours gained is a slowing in paycheck growth perhaps to the point where weekly earnings actually decline. Average weekly earnings for all employees contracted in August for the first time since January 2013 because of the contraction in hours worked.

It certainly provides some evidence as to why consumers might be more unwilling to engage in big ticket purchases, like houses and autos, this summer as compared to even last year. Not only is there a curious absence of any indication for the mainstream idea about “full employment” you can be sure that if the figures reported in this part of the CES are at all close to accurate consumers are acting on that uncertainty – and not just automobile purchases.

The pace of all this deceleration is nothing like recession, but the general behavior and the order of these processes are familiar in that regard. In other words, what started out as commodity prices and financial negativity moved into manufacturing and then trade (goods and the trade of goods always get hit first in monetary events like the “rising dollar”), all of which was dismissed and ignored as either temporary or contained to just 12% of the economy. From that perspective it was believed this year would be nothing like last year, and so far that is proving to be the case just not in the direction economists and policymakers expected. In other words, a broad view of the labor market shows that what might have been limited (but forewarning) weakness in 2015 is spreading not abating such that even the labor market is showing signs of being broadly affected.

That is a problem all its own, of course, raising issues of cyclicality, but more so under these conditions of ongoing depression. The reduction in both hours and then earnings suggests that we are about to find out what happens when contraction starts to spread under conditions where recovery never happened. Does that lead to recession within recession? Or another round of shrinking and permanent reduction?

Whatever the outcome, the biggest cost is already lost time and opportunity (running inconceivably into the trillions already) so however it works out the worst case is the one where growth is pushed that much farther into the future. One lost decade is enough; unlike Japan, I doubt the world will stand for a second.

Stay In Touch