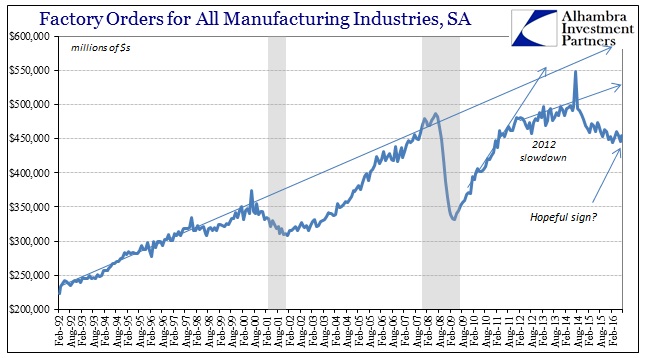

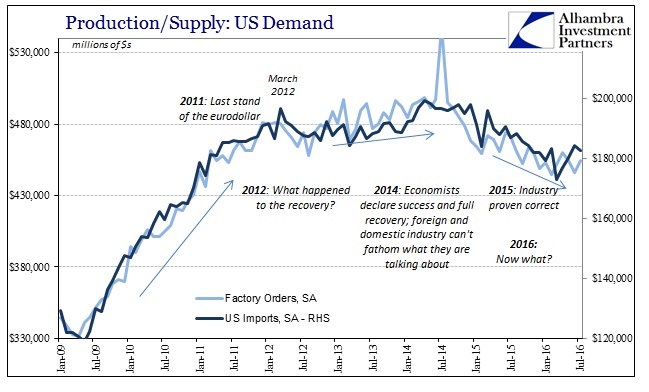

Factory orders rose in July in seasonally-adjusted terms from a downward revised June level. As has been the case with a number of economic data points this summer, that was a drastically different result than the unadjusted comparison. Since only the narrowest monthly interpretation makes it into most commentary about the economy, let alone manufacturing, the headlines leave a lot to be desired; sowing only further confusion as to how the economy could be getting worse when every uptick in factory orders or whatever else is trumpeted as the latest in an unending string of optimistic outcomes that never seem to get anywhere.

New orders for U.S. factory goods recorded their largest increase in nine months in July as demand increased broadly, in a hopeful sign for the embattled manufacturing sector.

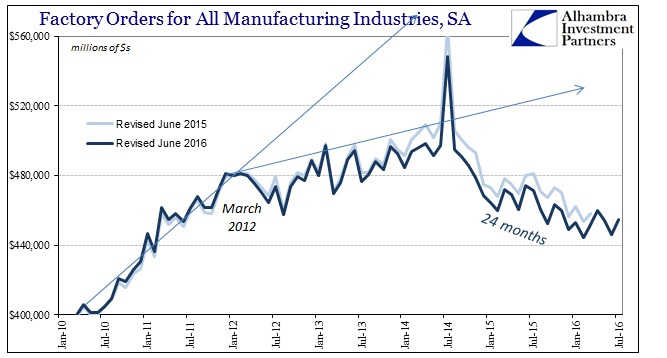

Even in adjusted terms, that is entirely misleading. Since June’s estimate was revised lower to just $446.3 billion, only $2 billion more than February’s “cyclical” low, the increase in July just left factory orders equivalent to May (or January, for that matter). In other words, at best factories remain at a standstill since orders advanced 1.89% month-over-month in July after falling 1.80% in June.

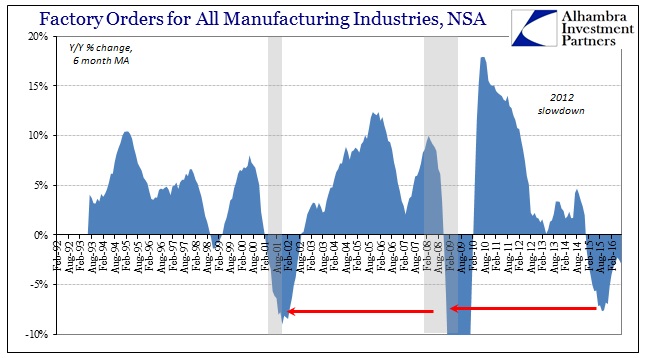

By any reasonable standard, it is clear that “something” is very wrong in the manufacturing sector. It would be unusual for factory orders to fall for more than two years in a declared recession, let alone in an economy that officially remains in a growth trend. During the dot-com recession, factory orders fell for only 17 months (seasonally adjusted) total.

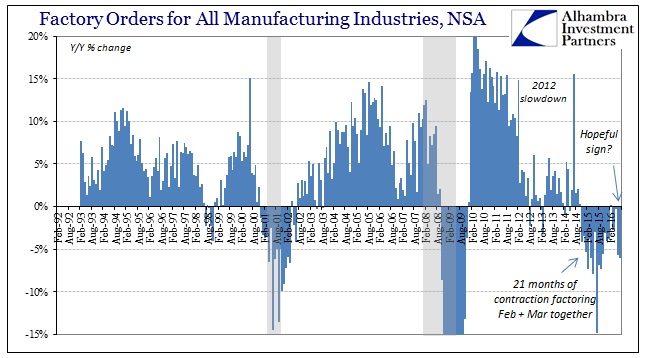

Unadjusted, factory orders are contracting at a faster rate again (summer). After falling by a revised 5.7% year-over-year in June, orders shrank by 6.0% in July, the worst monthly rate since last September. That leads to a vastly different interpretation than the “hopeful sign” derived from only seasonal adjustments.

Orders have fallen year-over-year unadjusted for 21 months (counting February and March together to account for February’s 29th day), compared to just 16 consecutive months (and 18 of 19 at the worst) from 2001 to early 2003. There is nothing hopeful about such a persisting contraction, especially since inventory remains unadjusted by it.

Instead, the stubborn weakness in manufacturing points to a lingering and serious economic problem that should not be so easily dismissed as it is in every single positive monthly estimate. On a day when the ISM Non-manufacturing Index falls to the lowest level since 2010 and the start of this “recovery” (or at least the official end of the crash portion of this depression), the mainstream message seems to have remained strictly encouraging that either manufacturing is “hopeful” or it just doesn’t matter:

Manufacturing, which accounts for about 12 percent of the economy, remains constrained by the lingering effects of a strong dollar and weak global demand, which have crimped exports of factory goods.

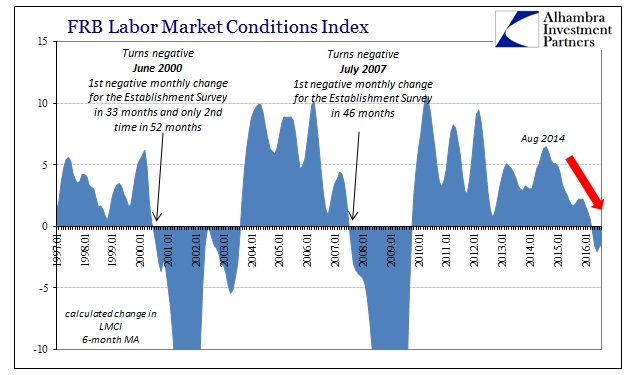

There is simply no way to reconcile two years of contraction for US factories (not to mention overseas production and goods that were supposed to be bought in increasing quantities due to that so-called “strong dollar”) and that steady problem not meaning anything as if some still unexplained anomaly. It is an obvious distress signal warning about especially US consumers, something increasingly corroborated by even services indications as well as those in and about the labor market. Weakness isn’t isolated, it is spreading because that is how the economy (and money) in the real world actually works.

To economists, and thus the media, however, econometrics dominates; therefore it is believed that correlations normally associated with a very low unemployment rate should instead be expected no matter how much conflicting infiltration. Among them would be rising consumer spending, so contracting factory orders (industrial production, capital goods orders, trade, etc.) are set aside in the unshakable belief in the mathematics of “full employment.” It is unbelievably contradictory how factor orders (as other accounts) have been declining the entire time the “full employment” narrative has been employed. These results cannot be resolved as some temporary distinction; only one can be correct.

As I wrote earlier with regard to clear slowing in the labor market (and that warning about the broader economy), what you see above is perfectly consistent with monetary “strangulation” starting in 2012 amplified in the middle of 2014 by this “rising dollar” that isn’t always rising.

Stay In Touch