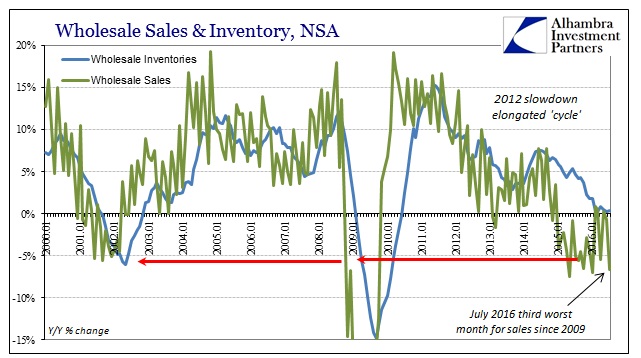

The worst month for the wholesale level of the supply chain during the Great Recession was May 2009, just at the tail end of the heaviest part. The amount of sales as well as the calculated decline has moved around somewhat over the years as revisions have rewritten the amplitudes and the ultimate depth of that event, but May 2009 remains as the darkest moment for wholesale sales. The latest benchmark series shows a truly unthinkable 23.3% decline that month; it is difficult even now with the perspective of years later to contemplate nearly a quarter of sales disappearing.

I doubt we will see anything to that kind of scale again anytime soon. No matter how bad this depression may get, there just hasn’t been any kind of growth that would precipitate such an enormous decline. There was a lot of marginal swing built up from the excesses of the housing bubble that account for the scale of the disaster, so that once money became the primary “shock” the true baseline for the economy was so far below as to offer little “support” during the most revulsive phase. There is certainly a fair bit of artificiality to this current economy, but not like that.

A perhaps fairer comparison for the standards of depth might be the dot-com recession. That was historically mild despite the massive bursting of the dot-com bubble; the eurodollar’s cushion providing all the monetary artificiality such that what some economists feared might turn into something similar to 1929 barely registered in the public consciousness (the eurodollar would simply push the depression six years into the future, which was itself a terrible cost, not benefit). In terms of wholesale sales, the worst month was, unsurprisingly, September 2001 and suggesting again why those people that realize there was a recession then associate it more often than not with the effects of 9/11.

Year-over-year, wholesale sales fell (again, as of the current benchmarks) 5.5% that month. Overall, sales would only decline for at worst eight months in succession and across 17 months intermittently in total.

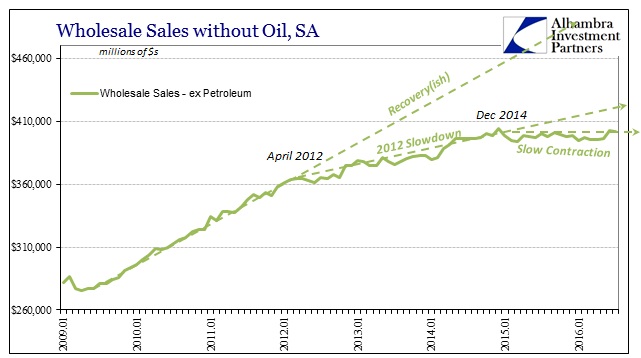

Because of the rebound in oil prices since February 11, wholesales sales had clawed back to positive this year. Just to remind anyone how this depression economy works, those very slight increases year-over-year in February, March, and May (all less than 1%) were punctuated with a sharp 5.4% decline for April 2016; nothing moves in a straight line. In other words, amidst what some economists thought was going to be different about 2016 intruded a contraction that was nearly as bad as the worst month of the dot-com recession.

The current update for July is even worse. Wholesale sales fell 6.6% in July 2016, the third worst month for sales since 2009 and appreciable lower than anything in 2000, 2001, or 2002. It is hard to argue that the economy in 2016 is even slightly better than 2015 (a very low standard) when there is enough evidence that it is at best the same (springtime) and as much evidence that it could yet be weaker still.

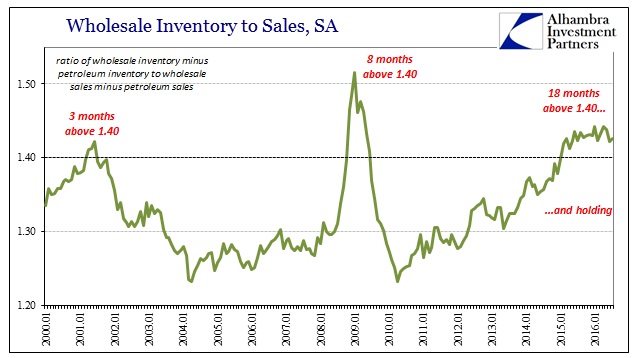

The cause for pessimism is, as always, inventory. For whatever reason, from Janet Yellen’s “charisma” in declaring what is not true true to the indisputable fact that we live under unique economic circumstances where we can have, in at least wholesale sales, something like a dot-com recession that lasts eighteen months continuously, inventory is still not being drawn down. Thus, as sales decline it makes the comparison to inventory remain as if nothing has changed – petroleum or not. In GDP terms, that delivers decelerating growth but not continuous contraction (since recessions in GDP are as much inventory as anything else; GR the exception).

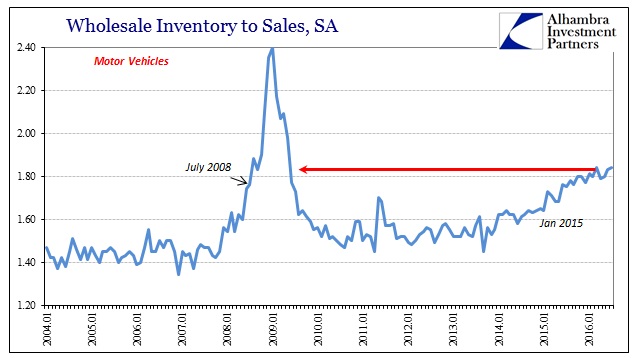

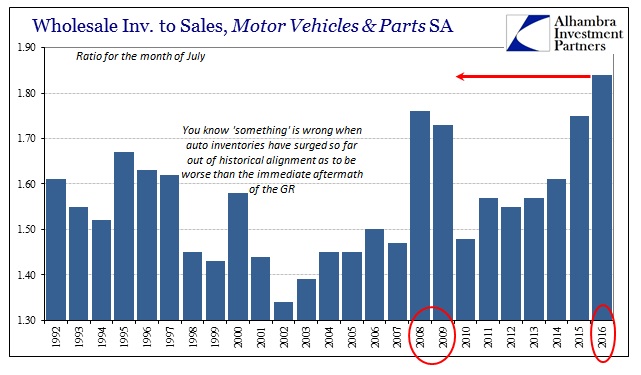

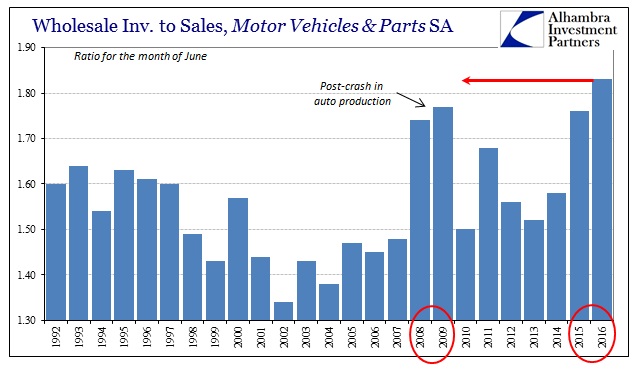

Where 2016 is likely to become appreciably worse than 2015 is certainly autos. With this so-called sales plateau having become established lingo in the mainstream, that actually represents a best case for topline sales while underneath the imbalance only gets that much more dangerous. According to the latest calculations for July, the inventory to sales ratio for the wholesale sector for autos is back up to 1.84 again, matching the highest point set in March 2016.

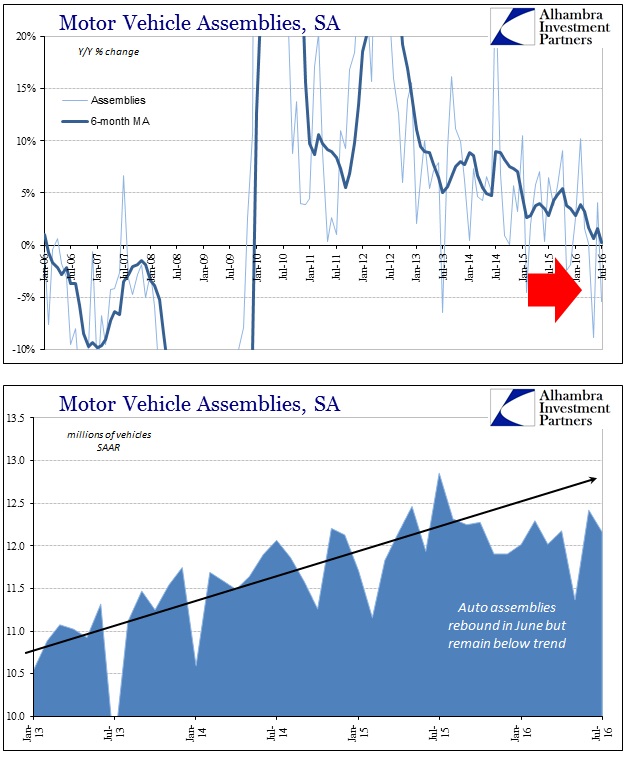

That amount of inventory compared to sales is appreciably more than the immediate aftermath of the Great Recession. Automakers have already indicated to their shareholders that incentives are going to be unusually large in the coming months to try to trim the imbalance not just in wholesale but what is already building now in retail. Thus, even if auto sales at the retail level stagnate from here, auto production must adjust because the current level of production even trimmed is still introducing far too much supply into the system.

With auto production practically the only support to manufacturing during this no-growth period overall, a more determined cut in motor vehicle assemblies and fabrications will have an outsized impact (and multiplier effects).

There is very likely some of that taking place in overseas trade, as noted earlier today with regard to German manufacturing struggling in July due to exports especially to the US. Even removing the effects of oil prices and petroleum considerations, inventory in the United States has been unusually high for a year and a half. That can only mean further depressed conditions for the global manufacturing economy already two years into contraction. By inventory alone, weakness should never have been, and should not be, “unexpected” here or anywhere else.

Again, it’s not recession; it is much worse than that, even when compared to the depths of the GR. Though wholesale sales had utterly collapsed in May 2009, by May 2010 they were up appreciably so that total sales were only 11.4% below May 2008. Wholesale sales for July 2016 are an almost identical 11.34% less than July 2014. In other words, for an equivalent two-year period the current contraction, again, at least in terms of wholesale sales, is already of a similar scale as that spanning the worst part of the Great Recession except that by May 2010 everything was pointing up where in July 2016 everything still points down and perhaps at a rate more than what we have seen to this point. By further comparison, wholesale sales in September 2002 were 0.3% more than September 2000, with at least sluggish recovery afoot then, too.

Time is the greatest cost and it is set to only increase. Economists have been stuck on “stimulus” for years allowing this contraction to build instead of undertaking necessary monetary reform to end it.

Stay In Touch