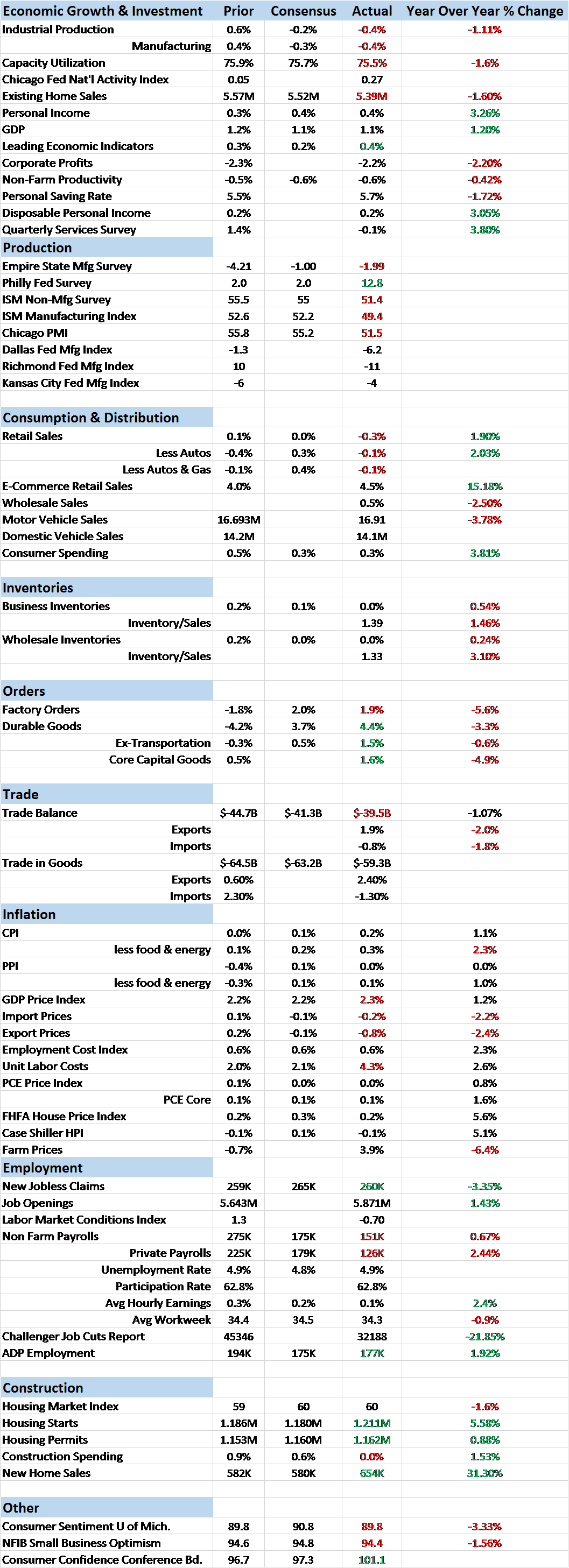

Economic Reports Scorecard

That improving economy the Fed has been touting? Well, as Emily Litella once said on Saturday Night Live, never mind. The surging economy of the Fed’s feverish imagination melted away over the last two weeks amid a deluge of weak and weaker than expected data. The data was never that strong to begin with but as I said in the last report, there had been a very slight improvement in July and early August. The last two weeks would seem to lay that short lived trend to rest. As always, we had some positive data points mixed in but the overall tone has definitely taken a turn for the worse.

Let’s take the positives first since it is a shorter – much shorter – list. The JOLTS report showed another rise in job openings to the highest of this cycle to 5.871 million jobs. That seems like good news but frankly we’ve had our doubts about this report for some time. In the report, the hiring rate, the quits rate, separations rate and the layoffs rate all were unchanged. I suppose it could be that companies just can’t find anyone to fill all those open jobs but even if that is the real truth it doesn’t say anything good about our economy. College degree = high employment rate does not mean Any College degree = high employment rate. And it certainly doesn’t mean college degree earned by attending only the classes that didn’t offend me or challenge the strongly held beliefs I acquired by smoking dope and reading The Nation = high employment rate. But I digress. Suffice it to say that we are suspicious of that job openings figure.

The other positive report – because there were only two during the last two weeks – was weekly jobless claims which continue to come in less than 300k. It should be noted though that claims have stopped falling and based on history probably have nowhere to go but up. But for now, it’s a positive and that’s how I’ll classify it. Employment – a coincident indicator at best – continues to be one of the few positives for the US economy.

The list of negative reports is quite a bit longer but to be fair some of them are not very predictive. The ISM manufacturing report, for instance, fell back below 50 in August and that is certainly negative. But that report is actually not very helpful in pinpointing recessions; it is much more useful when coming out of recession. Not only that but 50 is the dividing line between growth and contraction for manufacturing but it takes a reading well south of that to indicate recession (a reading over 43.2 is consistent with an expanding economy according to ISM). The ISM non-manufacturing index, which fell to a less than expected 51.4, hasn’t been around long enough to know if it is useful or not.

The ISM non-manufacturing report was confirmed by other reports though, not least the Quarterly Services Survey which showed a drop of 0.1% in information revenue in the second quarter. The year over year rate is falling, down from 5.7% in Q1 to 3.8% in Q2. Markit’s version also came in less than expected at 51.0. On the manufacturing side, both the Empire State and Philly Fed reports seemed to confirm the ISM. The Philly report did have a positive headline reading of 12.8 that was better than expected but I’ve included it in the negative column because the details of the report were so bad. New orders were up but barely positive while unfilled orders and employment remained solidly in the negative camp. The Empire State report was just plain ugly from top to bottom.

And while the optimists were pointing to the JOLTS report, Yellen was probably more interested in her own indicator, the Labor Market Conditions index which returned to negative territory last month. The retail sales report was negative across the board which is probably a better indicator of conditions anyway. The year over year rate of increase continues to fall (now down to just 2%) and this report showed special weakness in building materials and garden equipment which will feed right into the GDP report. Also of note was the drop in non-store retailers’ sales of 0.3% which doesn’t sound like much but we’re talking internet sales here which until this report, have been gangbusters. Amazon shareholders might want to take note.

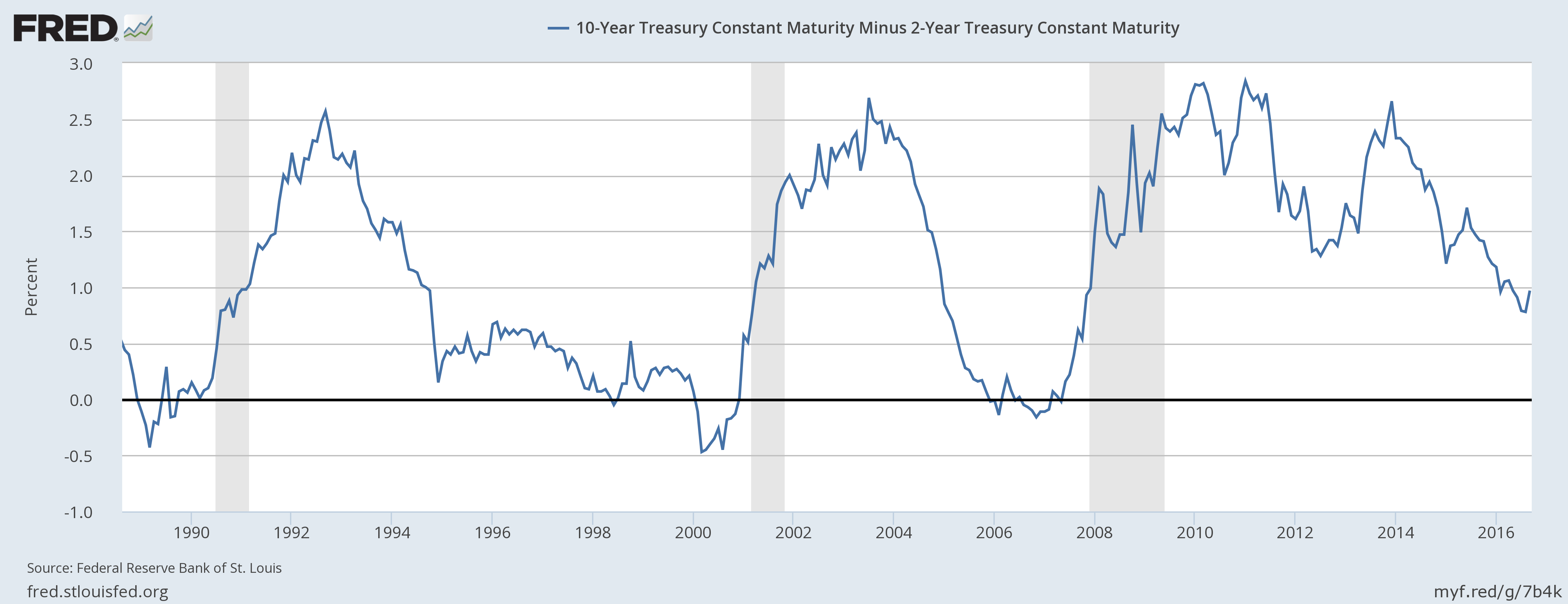

Based on the recent data it is hard to see any move by the Fed at next week’s meeting but that assumes the Fed is really data dependent as they continue to tell us. The inflation part of that data shows core CPI inflation above their target of 2%. I don’t know of anyone who believes the Fed, which prefers PCE deflator as its guide, cares. The market knows that of course and the yield curve adjusts accordingly, pricing in higher inflation expectations on the long end and the near certainty of no rate hike on the short end. It is a slight steepening that doesn’t mean much…yet.

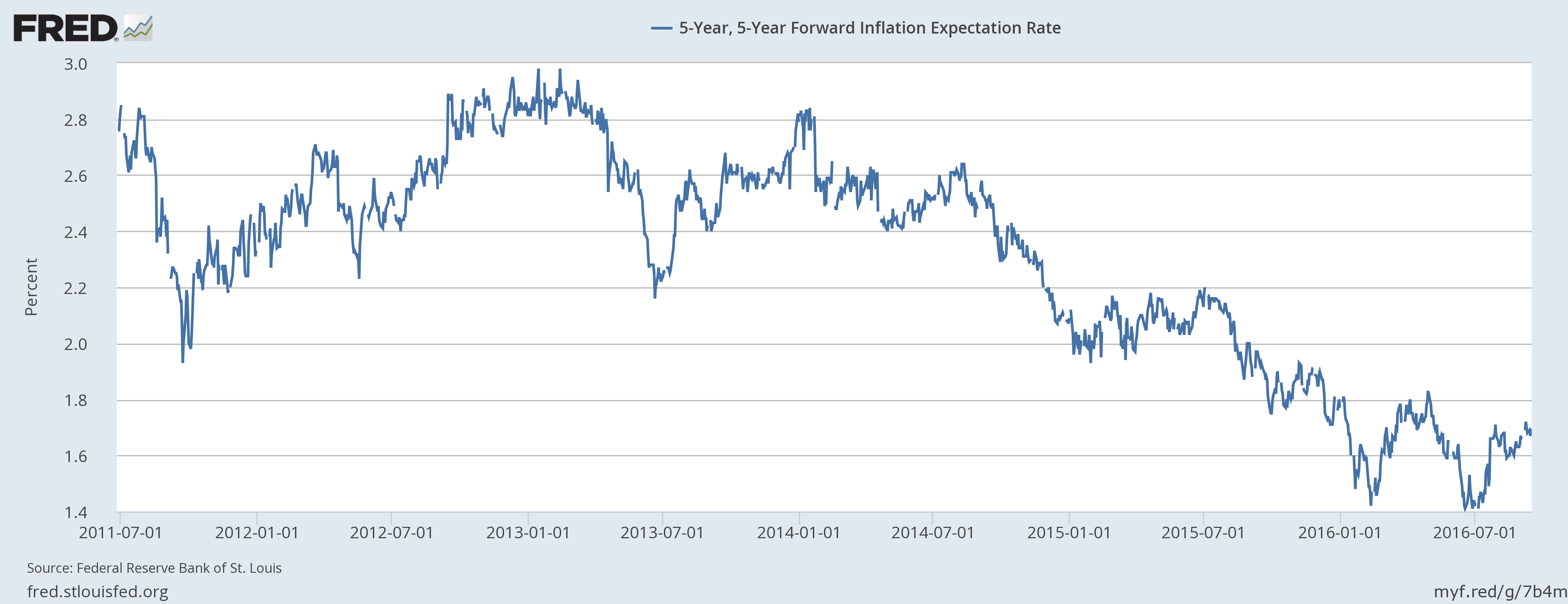

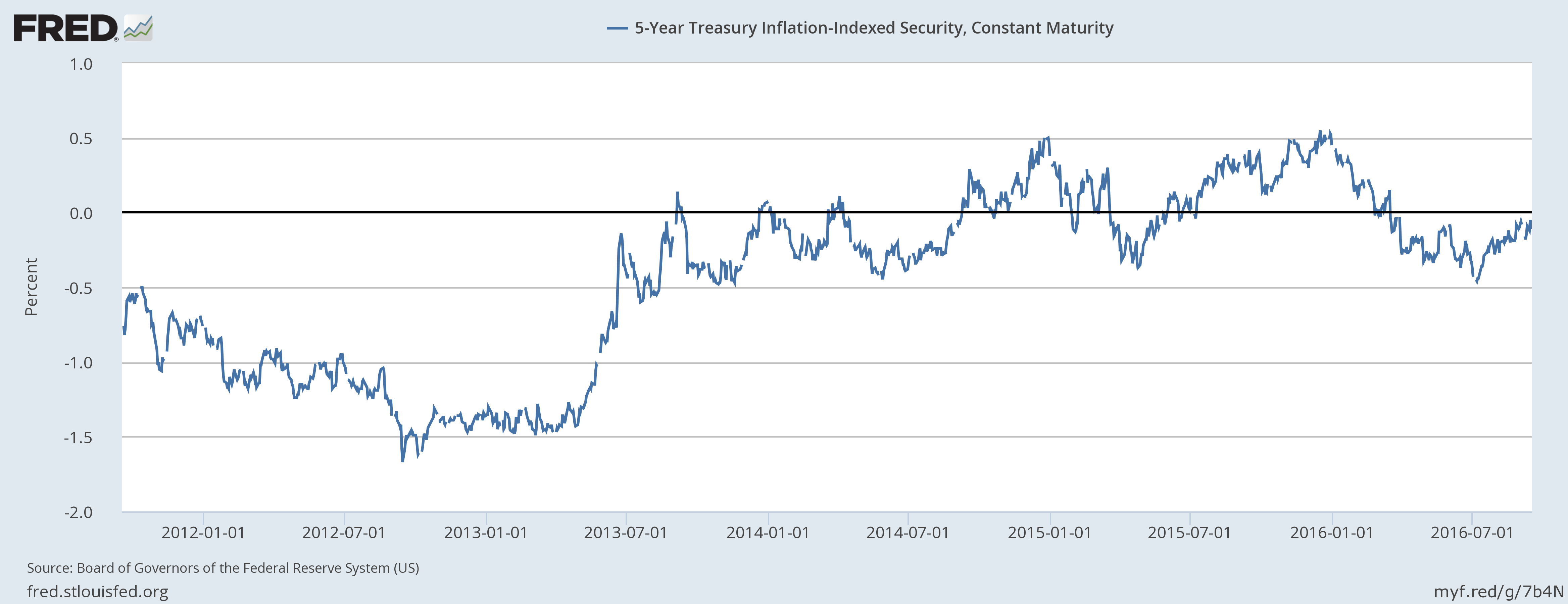

Inflation expectations barely budged the last two weeks but have been creeping higher over the last couple of months:

The longer end of the curve sold off, the farther out the bigger the move. 30 year yields were up 16 basis points since the last update while the 10 year moved up 11 basis points.

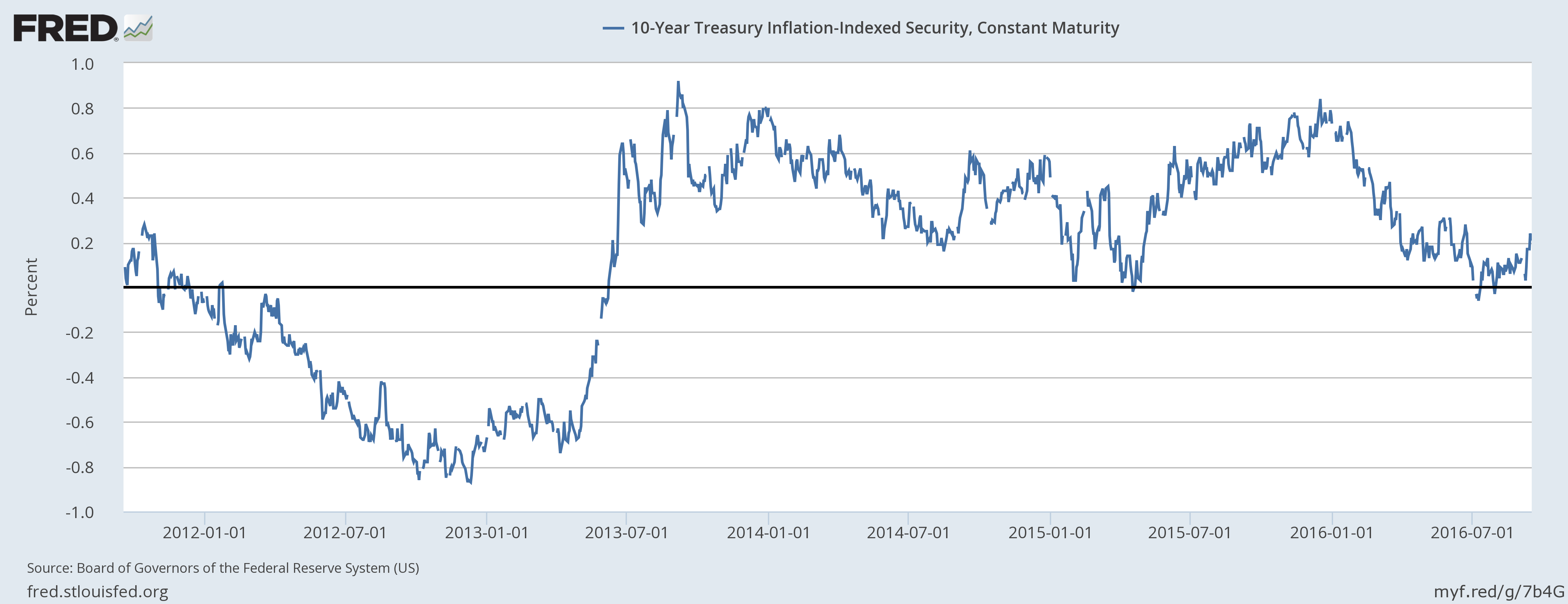

The steepening of the curve in this manner is an indication that the market believes the Fed may be falling behind the curve a little when it comes to inflation. Real rates, meanwhile, were essentially unchanged. The concern in the bond market is not about growth but inflation.

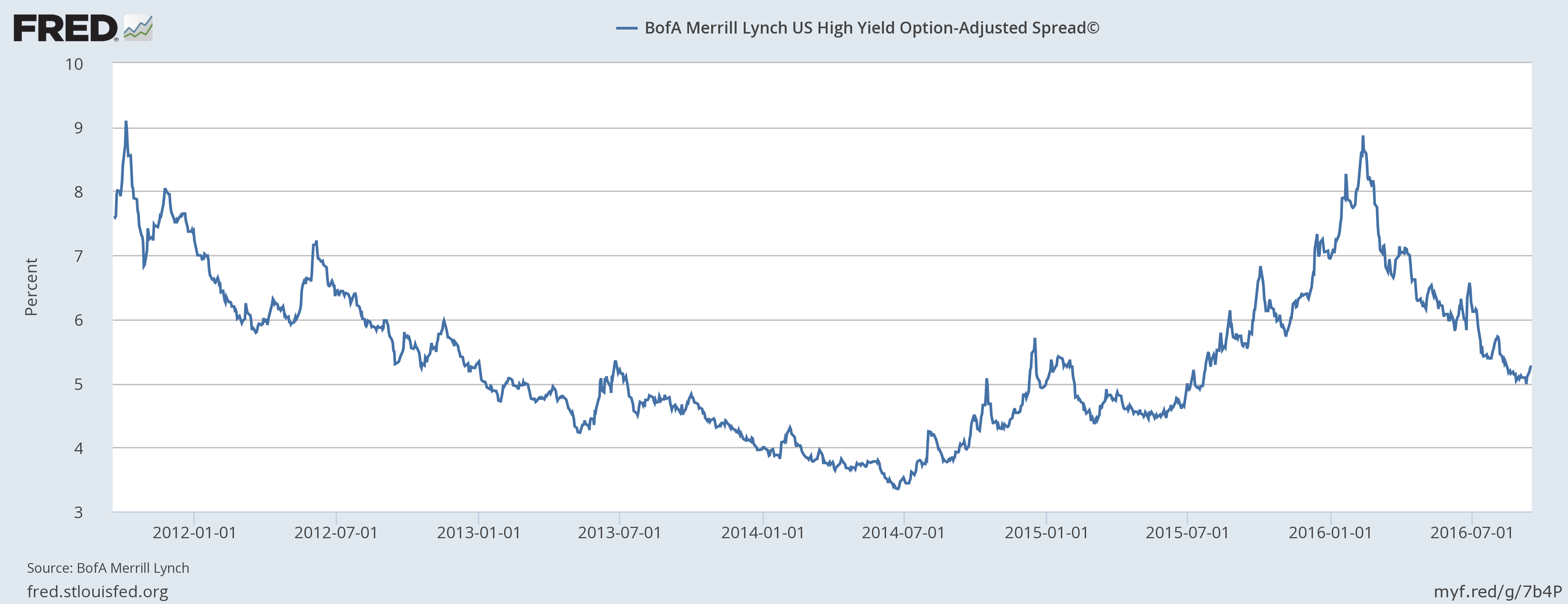

Of more concern from a growth standpoint is the widening of credit spreads over the last two weeks. It isn’t much and it may just be a blip but if it continues it spells trouble:

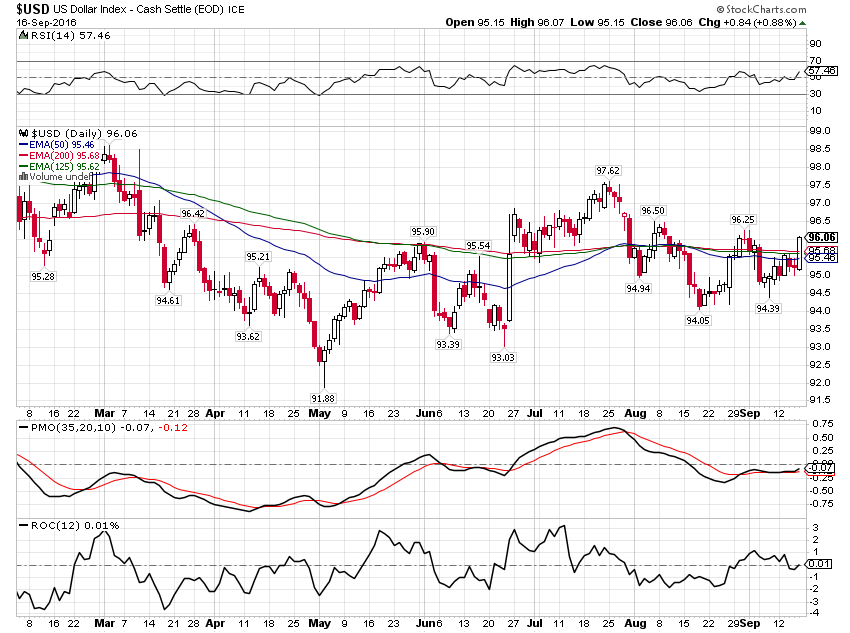

The dollar was essentially unchanged since the last update but it has been firmer than I’d expected.

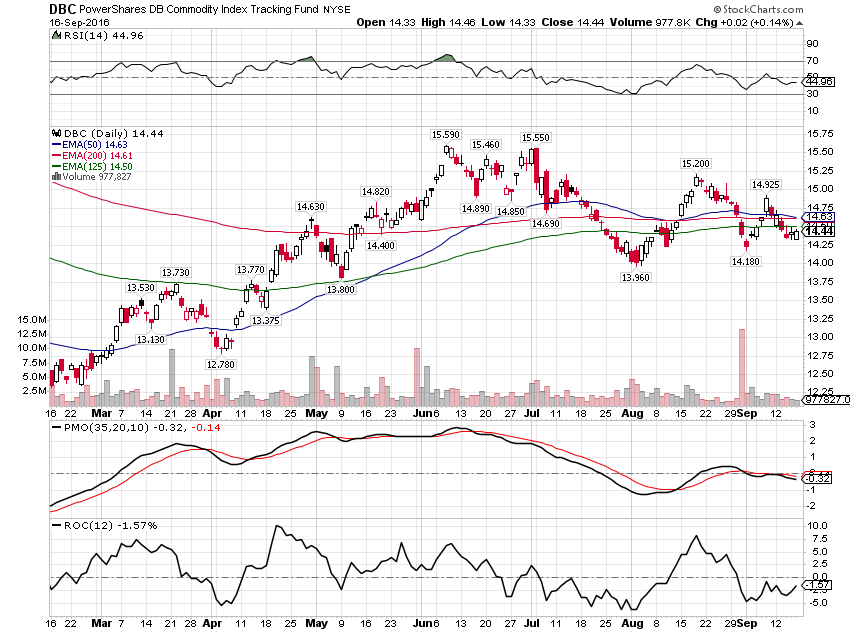

Commodities reflected the move in the dollar, first rallying then falling back:

The economic data is once again weakening, a double edged sword that is cutting the anxiety over a potential rate hike and honing concerns about growth. Nominal growth expectations have risen but negligibly so far and at this point mostly about inflation rather than real growth. I do not expect the Fed to hike rates next week although they probably should. They’ve spent the last 7 years rewarding the reckless, borrowers and speculators with low rates. I’d say it’s time for the pendulum to swing back in favor of the prudent, the savers. The Census Bureau reported last week that household income rose 5.2% last year, a percentage that probably has most Americans scratching their heads. Especially if they are trying to make something – anything – on their savings. Get on with it Ms. Yellen.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch