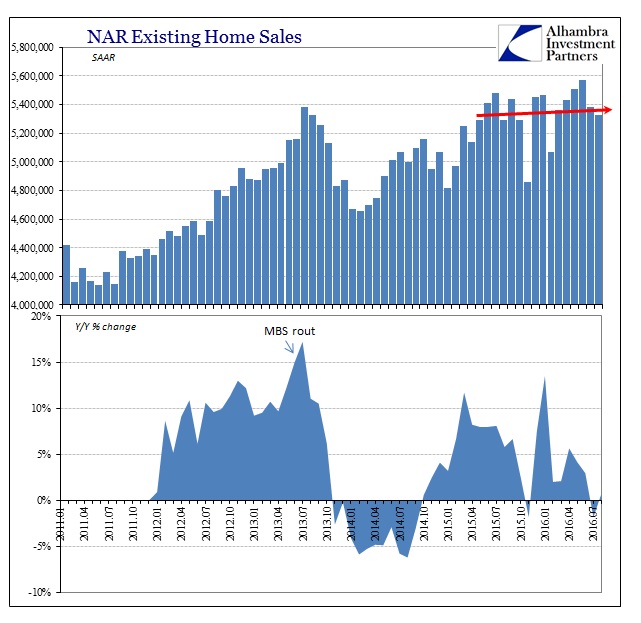

The pace of new home sales fell again in August according to the National Association of Realtors. On a seasonally-adjusted annual basis, the rate of resales registered 5.33 million compared to 5.38 million in July and 5.29 million in August 2015. The growth rate on sales has clearly slowed, and the NAR itself finds that curious in light of supposed and purported labor market strength.

Lawrence Yun, NAR chief economist, says recent job growth is not yielding higher home sales. “Healthy labor markets in most the country should be creating a sustained demand for home purchases,” he said. “However, there’s no question that after peaking in June, sales in a majority of the country have inched backwards because inventory isn’t picking up to tame price growth and replace what’s being quickly sold.”

Added Yun, “Hopes of a meaningful sales breakthrough as a result of this summer’s historically low mortgage rates failed to materialize because supply and affordability restrictions continue to keep too many would-be buyers on the sidelines.”

Using simple logic yet again, if “healthy labor markets” should create sustained demand for houses then the absence of sustained demand implies that labor markets might not be so healthy. There are, of course, other factors to consider but those continue to be highly favorable, too, and not on a phantom basis. Mortgage rates, primarily, are once again ultra-low, historically so as the NAR economist points out.

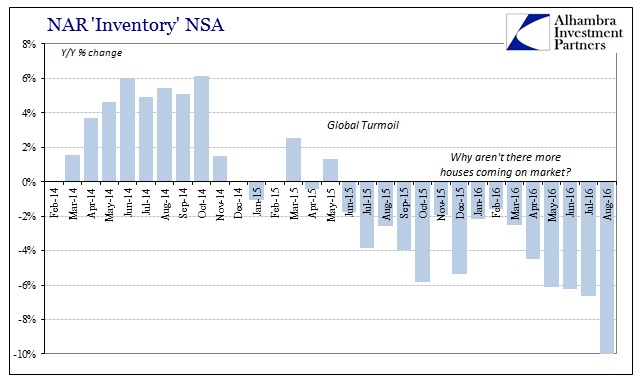

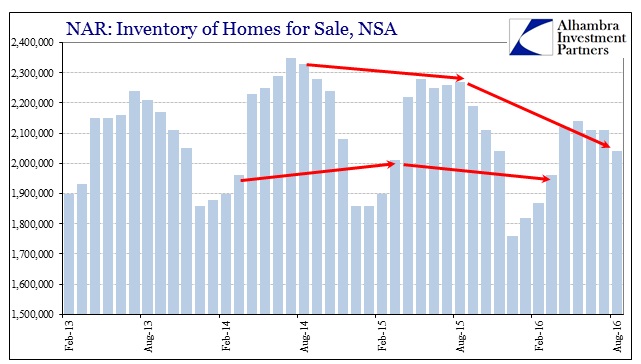

As has been the case for some time now, the evidence of this inconsistency at least as far as the mainstream rhetoric about the labor market goes is found in the lack of inventory of homes for sale. The estimate for properties currently on the market awaiting sale tumbled by 10% year-over-year in August. Despite rising prices, prospective sellers not only remain reluctant but are increasingly so. That suggests “something” beyond the labor market not being healthy, it might even be moving in the wrong direction, perhaps even to a concerning degree.

We don’t even need seasonal adjustments to pinpoint the start of the discrepancy; it began to show up as reluctance in late 2014/early 2015 but then turned to avoidance, unsurprisingly, right around last summer – the latest indication to suggest that “something” changed in the real economy where policymakers claim was just a minor, random blip of now past “global turmoil.”

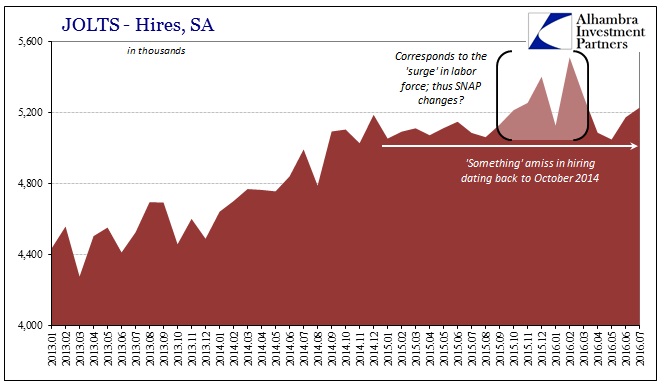

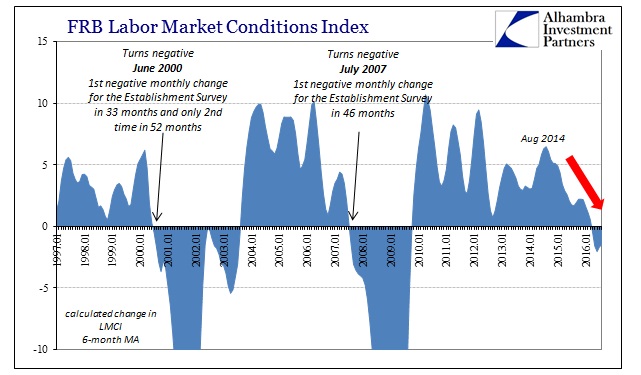

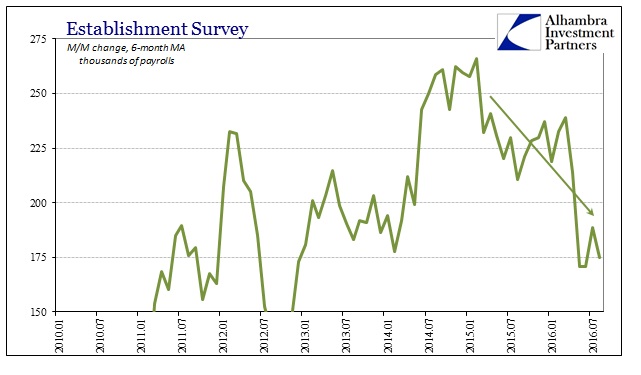

That is a problem all its own, of course, but more so given that whatever weakness was exhibited in 2015 was supposed to remain in 2015. This year was supposed to be different, and so far that is proving to be the case just, as resale inventory, in the wrong direction. Unlike the unemployment rate, the reluctance of possible home sellers to put up their homes is corroborated by any number of other statistics, including several labor market estimates. From JOLTS Hires to the Federal Reserve’s LMCI to even the Establishment Survey itself, there is every reason to suspect that the economy did slow and significantly such that even the labor market felt it and continues to.

There aren’t more homes for sale because income growth was never sufficient to keep up with rising prices but more so against that backdrop Americans have become less confident about taking on more expensive big ticket items, especially moving up in homes and acquiring not just pricier property but also the larger mortgage payment that goes with it – historically low interest rates or not. If you are not confident about economic prospects as they relate to your own situation, especially how you personally view the jobs market, the last thing you are going to do is radically alter your living arrangement no matter how much home prices seem to appreciate.

In many ways, this is a positive sign in structural terms as a rejection of the housing bubble ethos a decade ago, where the primary consideration for far too many was not income but how much they could profit on the flip. Thus, it seems as if ten years later a great many Americans are more keenly aware that no matter if they make some money selling what they have, they still have to pay for what they will buy and that seems to be the primary consideration. It would make sense in an unhealthy labor market where that factor would be the biggest impediment holding back potential sale supply against the trend of prices.

It isn’t a disaster and it isn’t a recession (at least not yet), but it is consistent with what is economically speaking the worst case. It reflects the growing notion that the already weak economy (depression) became that much more so as a result of the “rising dollar” period. Therefore, the continued mainstream debate that revolves around only recession or not, muddying the interpretations of all this data, is looking at it all wrong. Moving beyond the business cycle has the effect of delivering consistency where all these things suddenly make sense. The economy did not fall off a cliff in 2015 as it appeared it might, though it came close to what might pass for recession, instead it is just slowly suffocating on the same shallow negative trajectory that last year became noticeably less shallow.

This is why overall 2016 looks worse in the real economy than even 2015 despite no recession in between. It isn’t about to accelerate in a deferred liftoff confirming monetary policy expectations as Janet Yellen still talks about, rather the economy is, again, appreciably worse and in every way behaving like it. Even the Fed knows it, they just don’t want to say it out loud.

The economic math has been forced by actual conditions over the past two years to “see it.” Economists are themselves talking about it if only internally at the moment, but they, too, are finally recognizing at least the results of what all this means. They will resist calling it a depression to the last possible moment, but increasingly there is no room left especially by way of their own regressions for any other word. It’s why even now many central bankers are advocating a new approach using more aggressive and forceful promises (forward guidance) because this depression is finally speaking their language. What Janet Yellen says is entirely irrelevant; it’s all in the numbers.

Housing and labor numbers, reflecting each other, too.

Stay In Touch