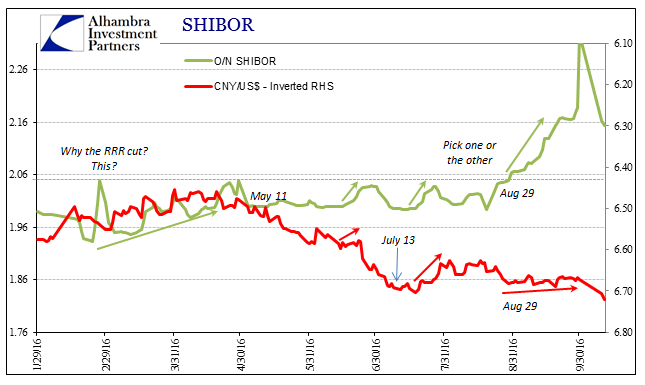

You can only pick one. Going back to around July 11, the People’s Bank of China decided for whatever their reasons CNY had gone far enough and that the central bank would intervene to all over again to obtain a stable currency importantly against the dollar. This was nothing new, however, as the PBOC had interceded on several other notable occasions before, only to be defeated each time by time; short-term mediations always assume that the disruption is temporary rather than structural. When it is the latter as in the case of the “rising dollar”, these kinds of provisional actions have a way of becoming regular features.

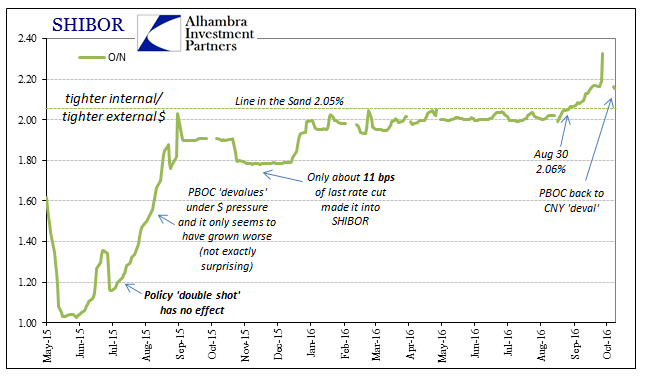

What was different about the latest CNY manipulation (“selling UST’s” or more closely “supplying dollars”) was how far the Chinese central bank allowed its choice to affect the other side. In the case of choosing currency stabilization, the “other” side is liquidity within the internal RMB system. On August 30, this new resolve in “dollars” was highlighted as the overnight SHIBOR rate rose above 2.05% for the first time in nearly a year. Prior to that day, the PBOC had used 2.05% or thereabout as a rule by which they would prioritize RMB over “dollars” (meaning stable CNY). To me, that suggested “something” different and more troubling about “dollars” that the PBOC would violate what appeared to be a hardened SHIBOR rule (which is clearly more ad hoc and in some ways incidental).

By the final day of September, just before the Golden Week holiday, the overnight SHIBOR rate shot up to 2.327%; as China reopened this weekend, the PBOC finally let CNY go to be “devalued” by “dollar” problems all over again. In trading today, CNY has been steadily lower for the second straight day (in sharp contrast to a great many days over the latter half of September where the exchange rate would barely move even for a minute during the trading sessions), falling to a new low below 6.72.

We can’t know exactly why the PBOC shifted back to RMB, but 2.327% O/N SHIBOR is a pretty solid indication. There are other considerations, of course, such as rumors of heavy PBOC interest in heavy China corporate offshore funding (in dollars) in September, but in my view it really is just that simple. As I wrote at the end of last month:

If I have to venture a guess as to one reason that there is “something” so different about global “dollar” liquidity especially in September 2016, it is that sudden attention to Asian currency. Maybe monetary authorities in both Japan and China realize that letting their currencies adjust on their own as they should leads to nowhere good, just as last year falling CNY was a surefire indication of further global financial problems and this year rising JPY doing the same. But establishing a hardline in currencies by whim, if that is the case for one or both, doesn’t solve anyone’s problems; it just moves them somewhere else with greater fury and intensity.

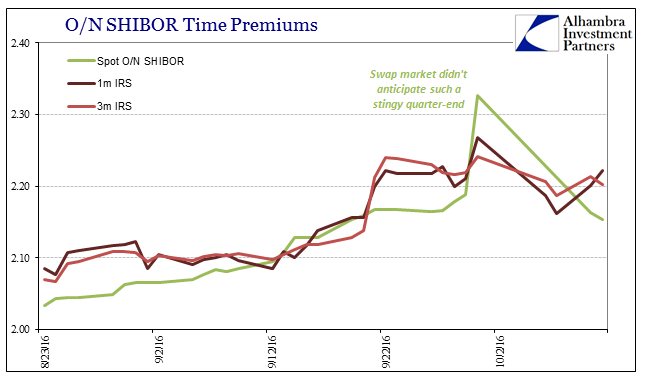

The “greater fury” was obvious in RMB at that moment (but not just RMB), a factor that the PBOC was almost sure to address, as I believe it did. The greater problem now is that despite two days of sharply lower CNY, SHIBOR isn’t settling back down. There was the initial drop to 2.193% in weekend Chinese trading, but the behavior since then has been more muted. The rate was 2.162% yesterday and 2.153% today.

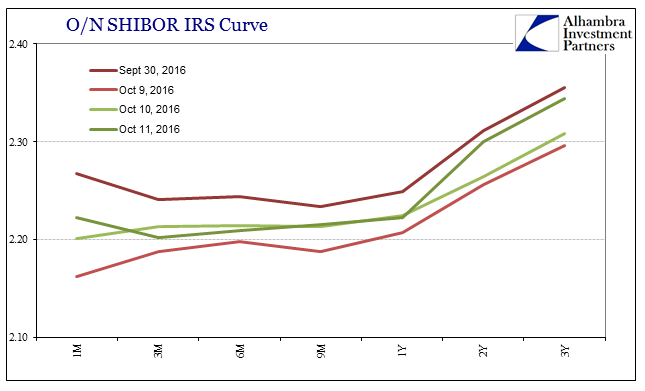

There are growing contrary indications, however, that Chinese money markets may not be expecting more “normal” SHIBOR rates anytime soon. Interest rate swap trading finds the O/N SHIBOR curve rising again especially in the shortest maturity (indication of RMB illiquidity; heavy demand to term funding just to 3 months) even though it appears CNY is heading lower.

That might be because the Chinese have left themselves with yet another instance of amplified “dollar” pressure – the “ticking clock”. I wrote yesterday (subscription required):

That might also have been indicated by Friday’s flash crash in the British pound, whereby a confluence of factors might be pushing Chinese financial conditions in unwanted directions. We also have to keep in mind that starting mid-July was another “ticking clock” where the first round of possible renewed forward (or other) interventions to arrest the then-CNY slide was first started up again.

If July 11 was indeed one of these “clock” points, then we would expect to see the start of forward expiration around October 11 – today. It would fit with the first couple days of China’s reopen; huge RMB pressure into the holiday combined with amplified “dollar” conditions that would make further CNY interventions that much more inefficient and costly (across several dimensions including RMB). From that perspective, being forced off a soft CNY peg is entirely understandable even if the antithesis of a “rules-based” approach the PBOC has tried to cultivate.

It’s not a pretty picture, one that we have come to expect. You can only pick one, but only for so long before the trend makes the choice for you.

Stay In Touch