The US is awash in economic data that shows its economy isn’t close to matching the rhetoric of policymakers. FOMC minutes for the September policy meeting show largely what I have been writing for almost two years. Rate hikes aren’t about the economy as it is, they are about the economy that “should be”, the one that “full employment” denotes where it is about to take off into overheating. That is why central banks move toward tightening as a matter of policy; they look at today and figure what that means about tomorrow.

The problem that has been revealed these past two years is that economists and policymakers are terrible at such a task. Despite the label, economists have proven time and again how little they understand economy. To review what was said at the end of 2014 and the start of 2015 with the benefit of hindsight is to see how laughably wrong they all were. While that may appear understandable given the 20-20 nature of looking backward, in this case it was both specifically their job as well as relatively easy to see even at the time why they would be so bad at it.

There really was no shortage of indications that heading into 2015 the dangers of deceleration were real while the expectations for acceleration were not; the latter were “grounded” in simple phantoms of confirmation bias. And that in 2016 is what “rate hikes” have been reduced to, just as they were in 2000’s Japan. I reviewed this morning the constant excuses from the retail sector that served as a poignant rebuttal in real time and the real life of hard numbers to the idea that the economy was finally moving into position for “liftoff.” Related to US retailers were the struggles of those who made the products that weren’t selling as robustly as they “should” have been.

It was mildly amusing in a small way later last year when Chinese exports began to register just how serious this concern was, only to find that officials here were looking there to cast off all seriousness for US struggles. In other words, China was blaming “overseas” for its problems at the same time especially Fed officials also blamed “overseas” for our problems, leaving us to wonder how “overseas” may not have involved either of the two largest economies in the world.

US manufacturing declines on “overseas” weakness while Chinese manufacturing declines on “overseas” weakness as if the two economic systems never deal with each other, only the same, non-specific “global economy” that doesn’t somehow count either of them within its growing malaise? It seems far more likely, beyond a doubt, actually, that with the amount of trade between them (especially from China to the US) if Chinese manufacturing is declining then US “demand” is a problem.

Chinese manufacturing isn’t the only powerful foreign anecdote in favor of the view of the US in unanswered depression. Recognizing the risks (but stressing this is not my intent) of bringing up illegal migration, the Department of Homeland Security provided Congress (courtesy of the Arizona Republic) with more anecdotes on the subject. I take no stand here one way or the other (my own views remain only that), and the purpose of including it is purely as possible data in furtherance of my hypothesis.

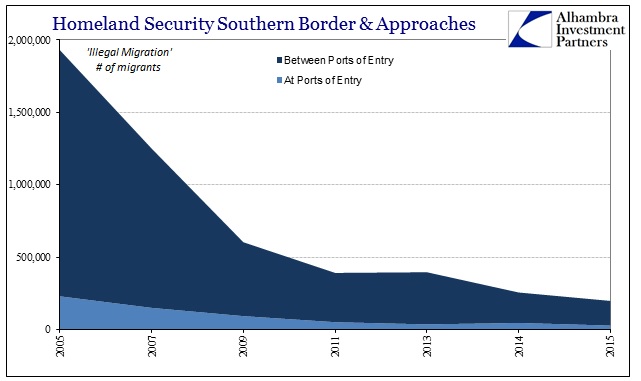

The executive summary shows that the estimated number of “successful illegal entries” has plummeted over the past decade. Writing that sentence, however, belies what likely happened, as it wasn’t anything like a straight line. In fact, plotting the figures shows a strikingly familiar pattern.

These estimates show that between 2005 and 2007, “illegal migration” began to rapidly decrease. Where there were about 1.9 million “successful illegal entries” in 2005, by 2009 there were likely less than a third of that level. That would be perfectly consistent with first the housing bubble bursting and then the Great “Recession.” It is the last six years (latest data through 2015) that provide evidence for the quotation marks around “recession.” According to Homeland Security estimates, “illegal migration” never came back, especially after 2013. By these numbers, “successful illegal entries” for the Southern Border & Approaches in 2015 were 90% reduced.

The reason given is law enforcement:

Although illegal entry levels are affected by a variety of factors such as economic conditions, DHS law enforcement activity directed towards border security is undertaken to prevent successful illegal entry. [emphasis added]

It bears emphasizing that these numbers are not official results, rather they are statistical estimates put together by a government agency clearly intending to present its own efforts in the most positive light to its Congressional oversight. There are, obviously, political considerations given the topic and the related stances of “both” sides. Take these figures for however you want to consider them.

Even if they are only somewhat close to realistic, then working from the opposite end shows they make sense given economic rather than political contentiousness. What I mean is that Homeland Security is in my view committing another Polar Vortex fallacy, a post hoc ergo propter hoc mistake just like when the media blamed sharply cold weather in early 2014 for clear economic struggles. Seeing causation where there was only correlation, the economy was instead weak when it just so happened to be unusually cold, not the economy was weak because it was cold.

Homeland Security cannot make an economic determination of its own, and even if it were permitted there is the smallest chance it would deviate from the accepted version of recovery and “full employment.” By bureaucratic rules the economy in the US is more than sufficient, therefore dramatically lower illegal migration must be due to in most part law enforcement. Being free of any such governmental strictures, another far more plausible option remains open to consideration – illegal migration never came back because the US economy didn’t.

As I wrote at the outset, there is any number of statistics that indicate the FOMC has no idea what it is talking about, let alone in debate of monetary policy. Further, there are a greater number of just these sorts of anecdotes supporting that fact, against which we are supposed to balance these justifiable doubts with the unemployment rate and the further pleading of officials to just “trust us?” That is what this latest rate hike debacle is distilling into, a game not of actual economic fulfillment but rather an internal struggle as to whether the FOMC really has the guts to believe in its own fantasies (and fallacies).

Stay In Touch