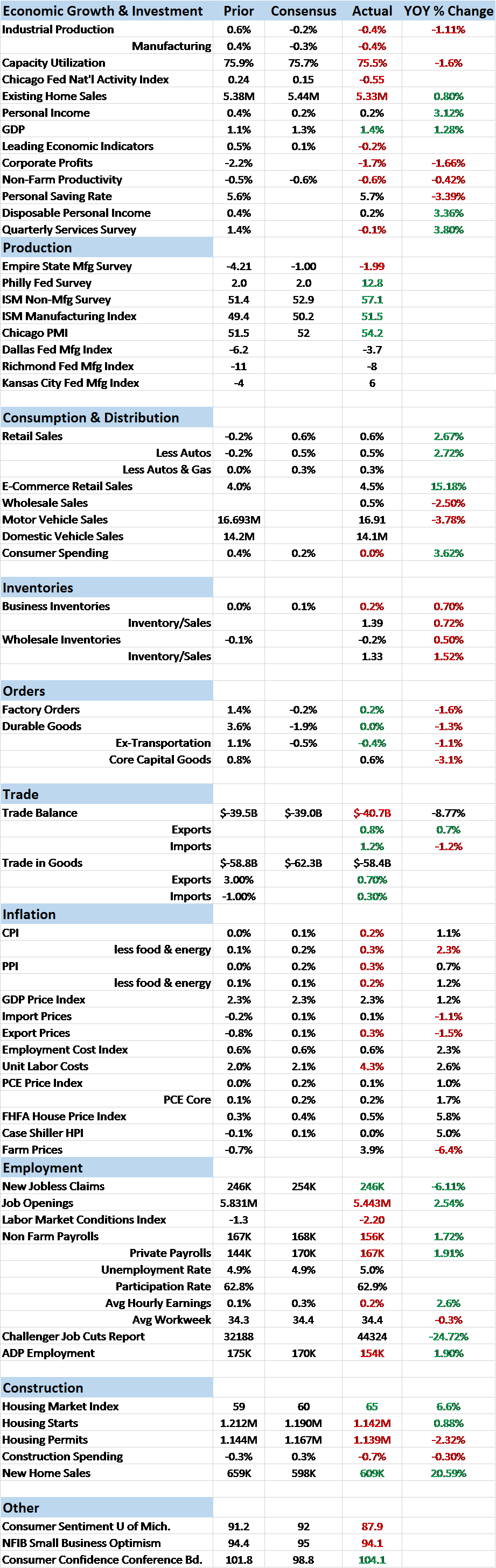

Economic Reports Scorecard

The economic data of the last fortnight was typical for this cycle with some reports showing improvement and others the opposite; “mixed” has been the most often used adjective of this expansion. Of course, some reports are more important than others and the bad news was concentrated in an area that has consistently supported the economic bull case – employment. Multiple reports showed evidence that the jobs market may have already peaked. And yet, even as the economic data continued to disappoint, our market based indicators showed an improvement in growth expectations. Whether those rising expectations are justified is doubtful in my opinion but markets do anticipate so it can’t be merely dismissed.

As I said the economic data does continue to disappoint with Citigroup’s economic surprise index now in negative territory for the US (interestingly it is the opposite in Europe of all places). The list of better than expected reports was fairly short. The ISM reports, manufacturing and non, were both better than expected. The non-manufacturing version was a huge upside surprise moving all the way back to a 57 handle versus expectations of just 52.9. The manufacturing version, while better than expected, was still a fairly disappointing 51.5; the employment component remains under 50. It was an improvement but not an especially robust one. Factory orders were also an upside surprise with core capital goods orders up 0.9%, the third straight monthly gain. That could be significant since investment has been conspicuous mostly by its absence.

The list of disappointing reports is somewhat longer starting with construction spending, down 0.7% on the month and now negative year over year. Single family was down for the 3rd straight month and non residential was especially weak. Multi-family seems to be the last sector standing. The construction numbers confirm the starts and permits reports from September but conflict with the home builder’s sentiment report and new home sales which are at the high for the cycle. I’d place a bit more emphasis on starts and permits since those are more hard evidence based and forward looking. Another somewhat positive report as retail sales where the year over year rate may have stopped falling. Autos remain a big positive for retail.

The employment related reports were mostly disappointing with just enough positive markers to keep the bulls hopes alive. The ADP report was down from the 175K pace in August and at 154K less than expectations as well. The trend here has shifted to slower. Layoffs reported in the Challenger report were up sharply, mostly due to the ITT bankruptcy but retail layoffs were surprisingly large as well. The official employment report also came in less than a higher revised August and expectations at +156K. Private payrolls was one of those minor bright spots at +167K, still slightly less than expected though. Glimmers of hope too in the participation rate, up 0.1% and average hourly earnings, up 0.2%. Not a lot to hang your hat on but positive nonetheless. The workweek continues to disappoint at 34.4 hours, unchanged.

The weakness in the Non-Farm Payrolls report was confirmed by the Fed’s Labor Market Conditions Index with August revised lower and September lower still at -2.2. The JOLTS report – another favorite of the bulls – also disappointed and job openings may have peaked; there has been little progress since last spring. The only employment related report that continues to show strength is new claims which are at levels last seen in the early 1970s when population was quite a bit smaller. The weaker jobs market – and probably the horror of the coming election – may be pushing down consumer sentiment. The preliminary reading from University of Michigan came in light at 87.9 down from 91.2 last month. Weakness was centered, not surprisingly, in expectations.

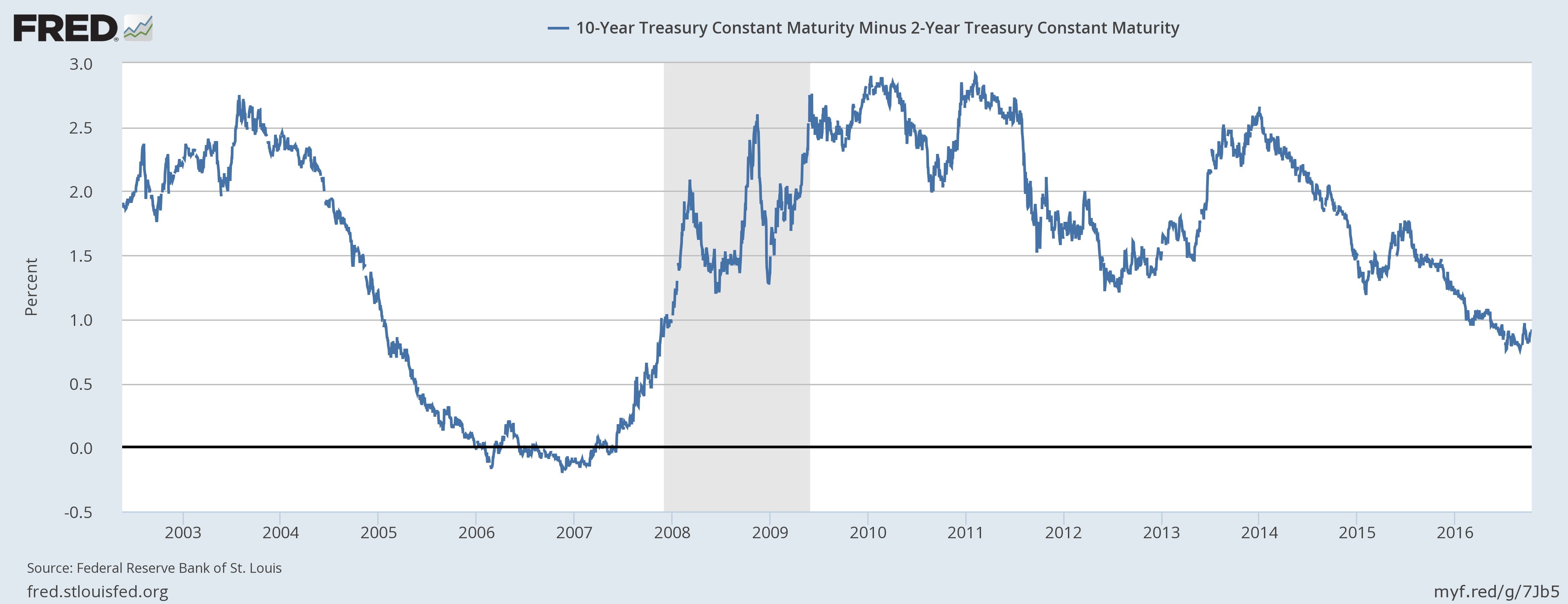

Despite the generally downbeat economic reports our market based indicators did show some improvement – minor – in growth expectations. The yield curve steepened slightly and is now essentially unchanged since late June. The steepening is due to a larger rise in long term rates than short term indicating a rise in nominal growth expectations rather than any change in monetary policy expectations.

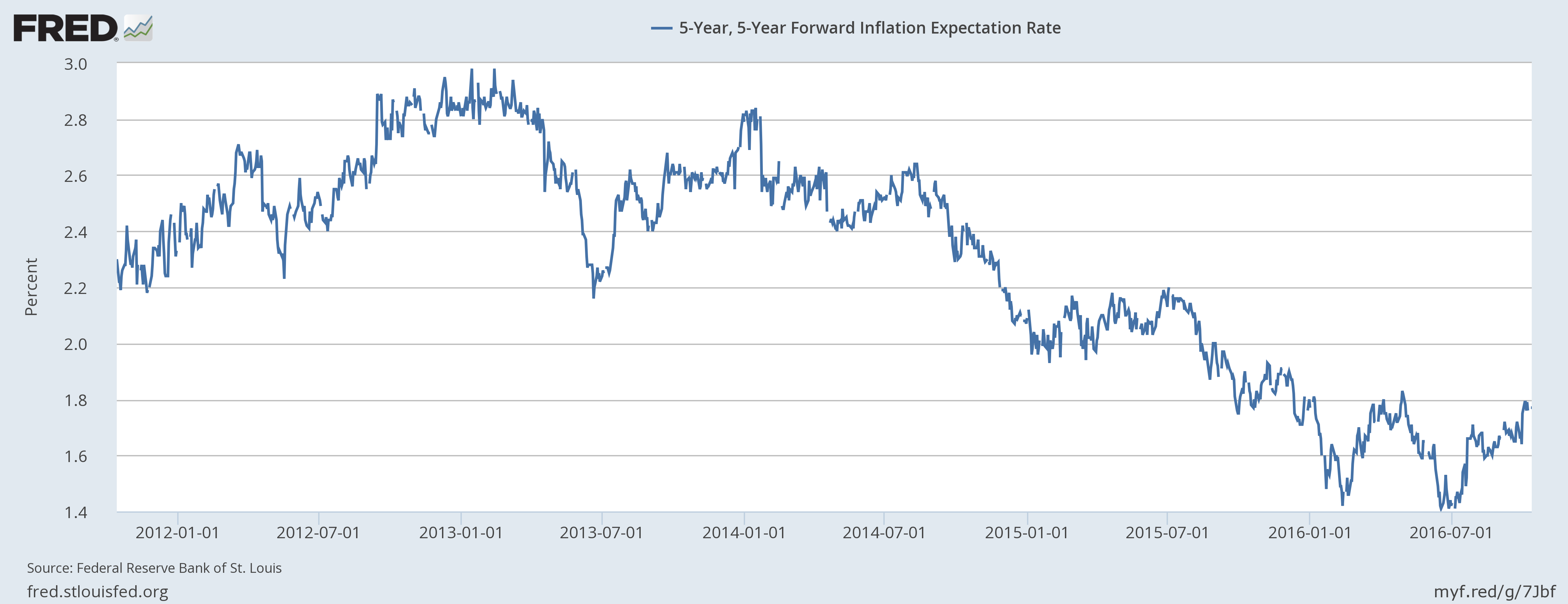

Inflation expectations were essentially unchanged:

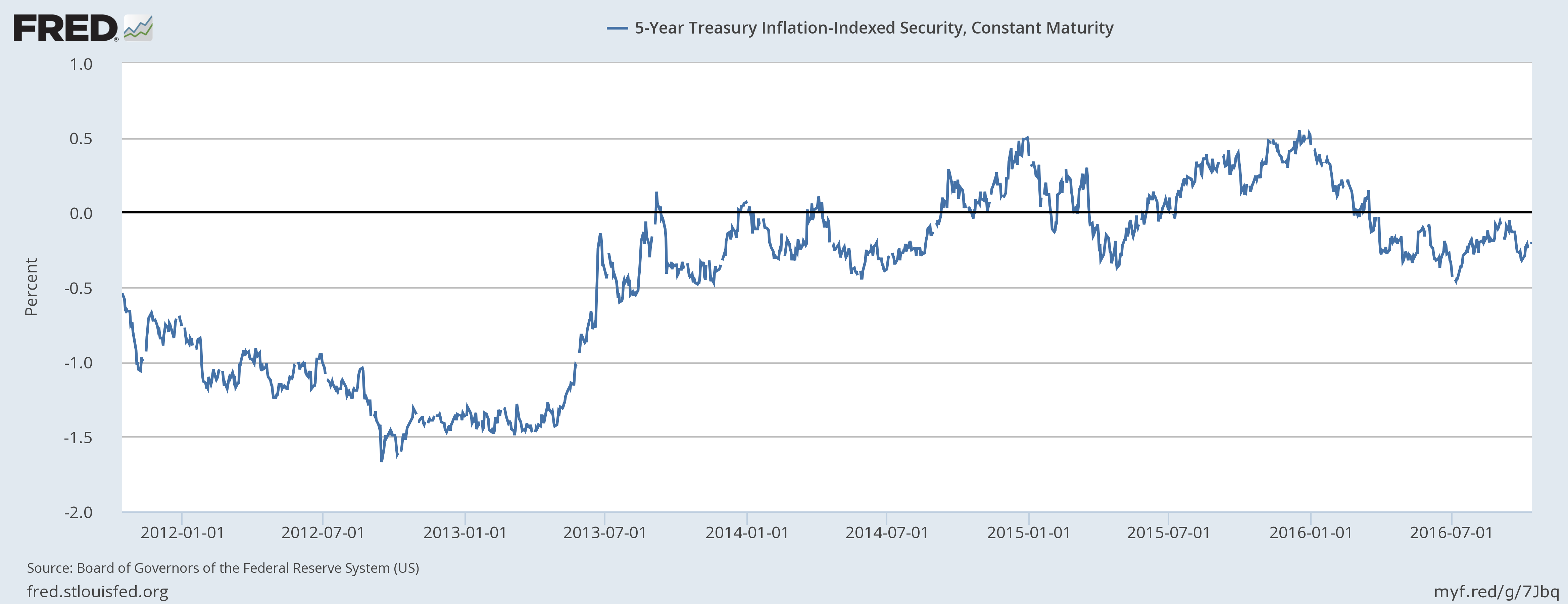

Real rates rose 11 basis points since the last update, more confirmation that the rise in yields and the steepening of the curve are related to real growth expectations. But real rates are still negative at the five year interval, so while growth expectations may have improved, it was from awful to merely bad. There is certainly no boom on the horizon.

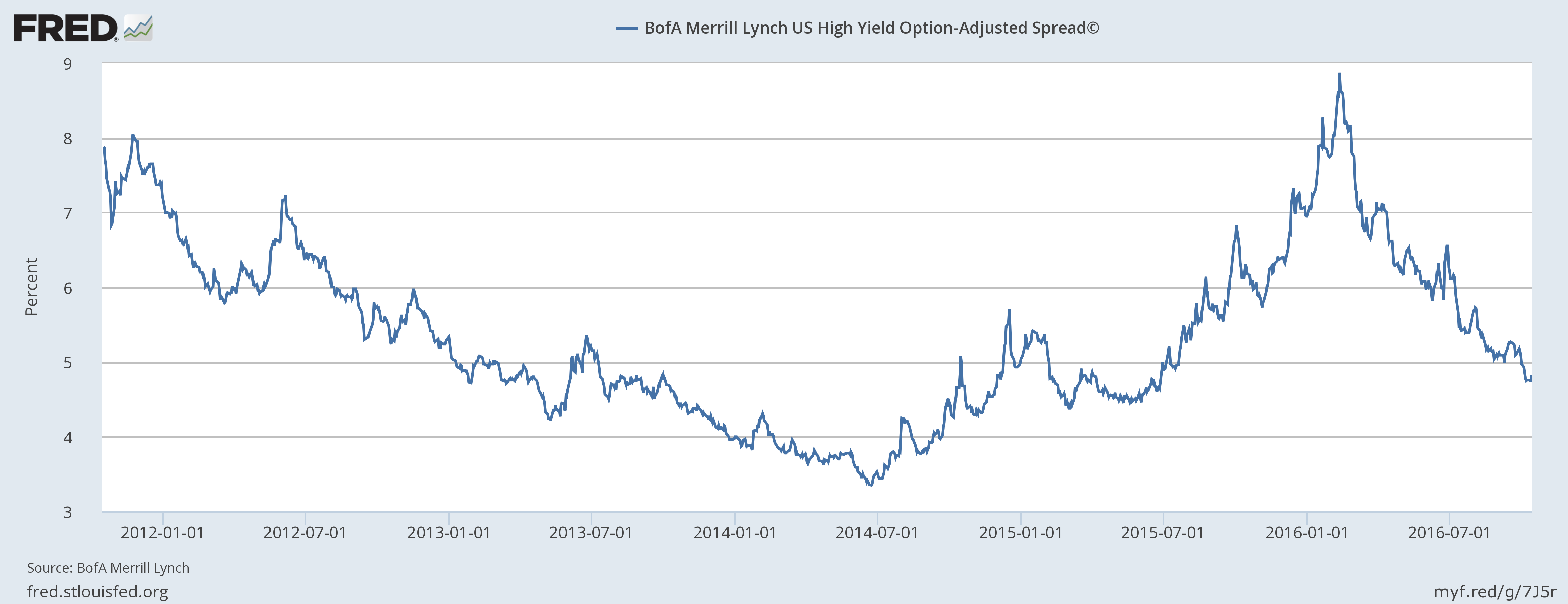

Credit spreads also improved since the last update, a function of higher oil prices and continued yield chasing by retail investors. The credit cycle may be turning for the worse but appetite for risk has not been sated.

The TED spread also improved, an indication that maybe the recent widening was due to money market reform. The trend is still worrisome though so I’ll keep an eye on it.

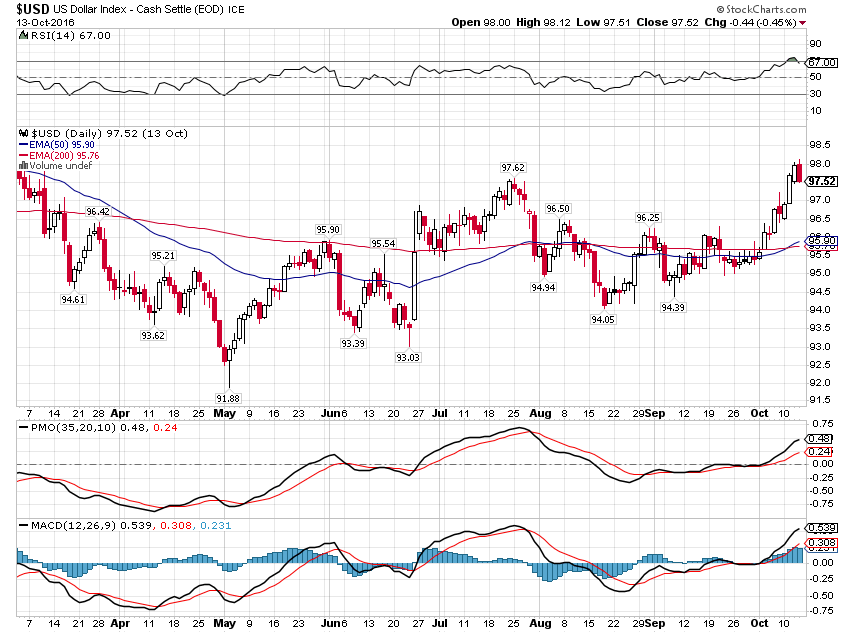

The dollar confirmed the improved outlook with a stout move higher.

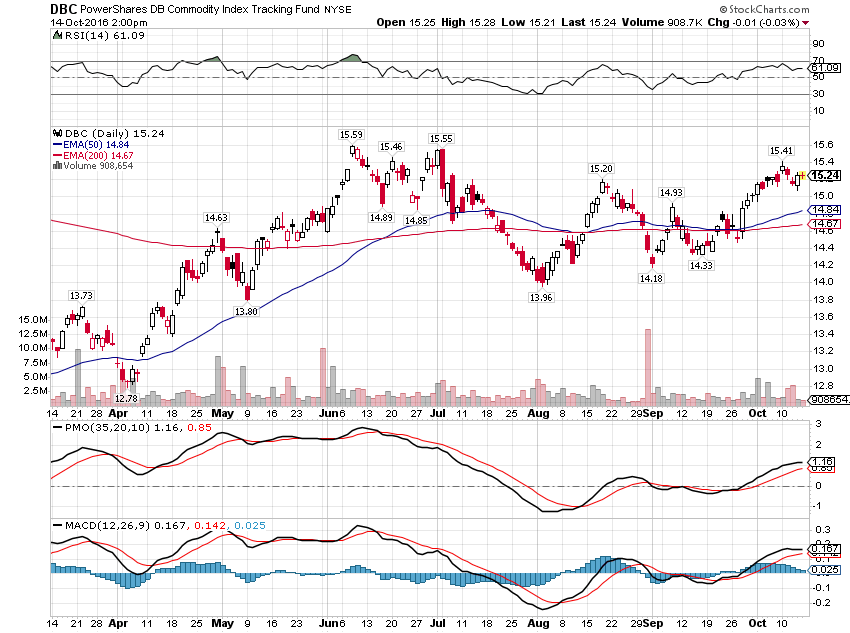

Commodity prices remained firm:

While gold pulled back:

I generally place more emphasis on market indicators for the economy but at some point the data has to back up the market moves. So far, I haven’t seen anything to support the market expectations of better growth but there is a bit of a self-fulfilling prophecy effect that may start to kick in. Improving credit spreads are a positive for growth as well as an indication of rising risk appetite. A steeper yield curve is a positive for any company borrowing short and lending long. A firmer dollar, not taken too far, can be a positive for growth as it attracts capital that has to be invested. So it is certainly possible and plausible that growth could improve in the near future. But the moves so far are hesitant and that won’t change until we start getting some genuinely improving data. In the meantime, the narrative about the economy and markets will likely be dictated by the evolution of the election cycle.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch