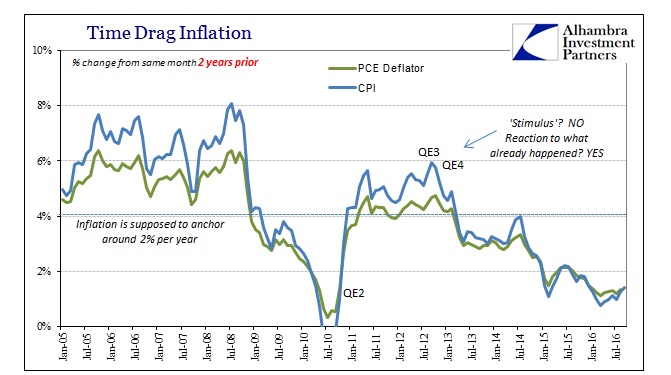

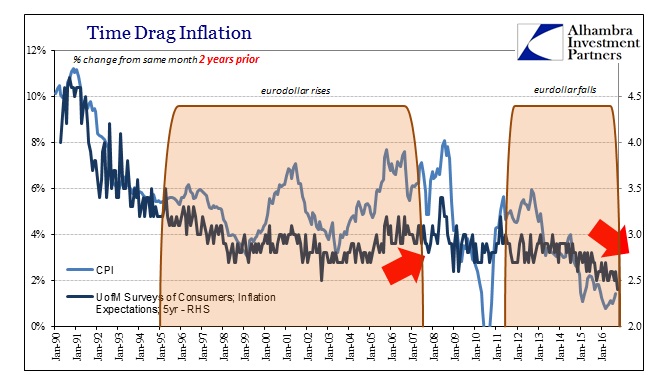

As I argued earlier, the 2-year change in the CPI (or PCE Deflator) is a useful assessment of not just inflation but money in general. It verifies in no uncertain terms what we suspect about “stimulus.” It is not just rare but practically unheard of where the inflation rate drops and then stays there. Yet, inflation has done so now twice just since 2011, an important distinction that cannot be overstated.

The CPI in its traditional one-year comparison hit its most recent high of 3.87% for September 2011; a month that needs no special explanation for anyone paying attention to global “dollars.” The 2-year change lingered around and above 5% until September of the following year, 2012. That month also needs no introduction. The CPI in that latter September was 1.99%, meaning that for a two-year change it was well above target at a smoking 5.94%.

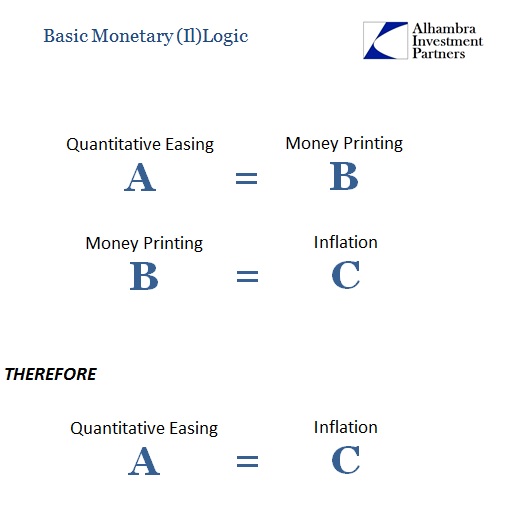

This establishes the fact that these inflation measures are far more often than not backward looking. After all, the CPI by the middle of 2012 had already decelerated sharply, from near 4% to just 1.41% the next July. According to convention, the high rate of inflation prior to the middle of 2011 was due to so much “stimulus”, especially QE2 that entered in early November 2010. Since QE is thought of as “money printing” this would seem perhaps beyond plausible.

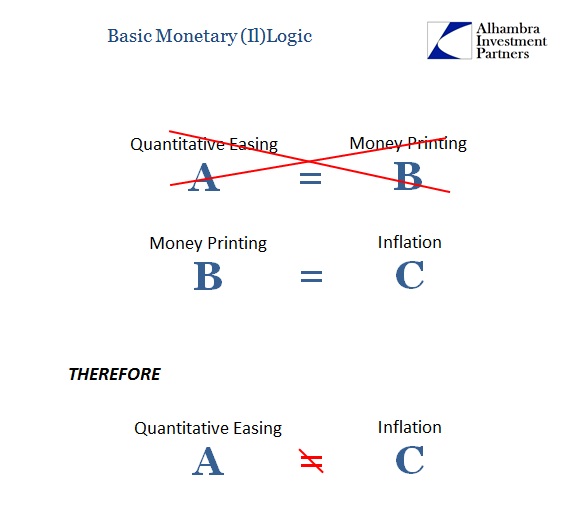

But what happens after QE3 in September 2012 of inflation leaves no doubt as to what QE actually was – and it wasn’t money printing or even stimulus. As you can see plainly on the 2-year chart for the CPI, as PCE Deflator, from the very month the last rounds of QE were inaugurated the calculated inflation rates longer-term declined rather than exploded or at the very least regained acceleration as before.

Again, as noted earlier, this is highly, highly unusual for any two-year period even without so much “stimulus” and “money printing.” Even during periods where inflation would decline for recession, it had always rebounded in sharp fashion. But at the end of 2012, not only does the Fed add two more QE’s (the third of MBS purchases; the fourth of UST’s) the inflation rate also fails out of this surefire historical template. In short, monetary policy had everything going for it at that time and yet it still broke down in historic fashion. That it did so right at the moment the third QE was getting underway is embarrassing as well as rejecting of central bank theory and a very important clue about what QE actually was.

As with the first two QE’s, Ben Bernanke’s Fed believed that additional “stimulus” was warranted by threats to the economic as well as financial condition. The events of 2011 were more so the latter, leaving the economy of 2012 appearing especially dangerous and vulnerable. It was the sharp decline in economic accounts all through that summer that ultimately convinced the FOMC it “needed” to act though it was almost certainly reluctant to do so (and why, I believe, they were relatively quick to offer taper early the following year). Bernanke surely thought, as did most if not all economists, that QE3 and then QE4 were insurance policies on continued recovery against what appeared to be renewed or gathering (negative) cyclical forces.

This was, however, the exact wrong diagnosis of both condition and response. Thus, those QE’s were not additional “stimulus” but rather signals that “something” had changed sufficiently disturbing that even central banks (it wasn’t just the Fed) believed “it” demanded a forceful response. The trajectory of inflation thereafter proved both that “it” was a real event/factor but also that QE had no influence whatsoever over its outcome. The latter cannot be more clear and unambiguous.

We are left to understand that Ben Bernanke did see what we all did at that time, though he never truly admitted it publicly (the release of the 2012 transcripts should clear that up), and thought it nothing more than the same “somehow” recalcitrant “recovery” atypically prone to severe setbacks. From that view, all the QE’s have to be re-evaluated with that in mind; that none of them were ever “stimulus” at all. They were instead but the same as QE3, the important signposts that officially declared even economist policymakers knew that there was great trouble ahead.

The high degree of inflation immediately following the Great Recession was not due to “stimulus” then, rather it was the combined effects of mean reversion (after any severe contraction) with the partial restoration of eurodollar money. To attribute the CPI or PCE Deflator at those times to QE, either of the first ones, is wholly inconsistent with the utter absence of any effect after the last two. In other words, Bernanke did as Greenspan did before him; he was the accidental if brief beneficiary of monetary conditions far beyond his control or even understanding.

It didn’t last nearly so long as Greenspan, of course, because the eurodollar era had already begun its terminal phase years before in 2007. Again, the “dollar” was only incompletely reinstated after 2009 before being buffeted by shocks in 2010 and then more heavily in 2011 – leading to its (still) drawn out decline that is almost perfectly reflected, as it should be as actual money, by the inflation rates.

Bernanke expected QE3 and QE4 to “work” like QE2 supposedly did because, to use the Latin yet again, post hoc ergo propter hoc. It didn’t and economists have been wondering what the hell happened ever since. It’s not a mystery but a microcosm of everything that has been wrong with monetary policy theory and philosophy for decades. They really don’t know what they are doing, and without any further exogenous money coincidences in their favor they finally have to come to terms with all that.

Stay In Touch