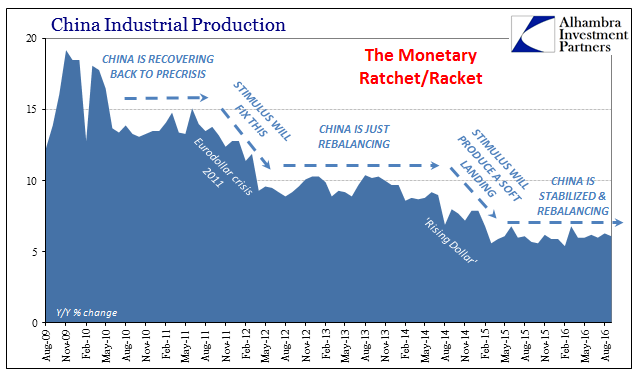

There are those who believe that the Chinese economy has stabilized, as if that was a good thing. Many of these people, mostly economists, said and declared much the same after 2012. That China’s economy might be in 2016 merely as bad as it was in 2015 is a highly negative development, one which requires standards for economic judgment to be still further reduced, starting with “stimulus.”

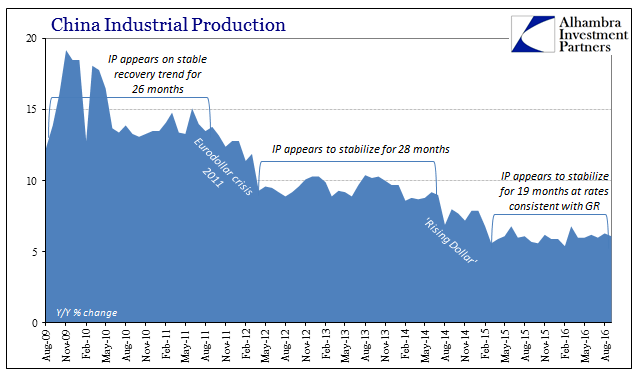

The latest data from across the Pacific shows that nothing has changed, save one factor. Industrial Production grew by just 6.1% in September, down slightly but not really from the 6.3% in August. IP has been at or below 6.3% in all but two of the 19 months dating back to last March. Both of those were temporary jumps to 6.8% that after each found economists trumpeting the value of “stimulus”, especially the second this past March. It was not the expectation that these programs would “stabilize” Chinese growth but rather that stimulus would do what it is supposed to do, meaning restoring acceleration toward a Chinese economy more recognizable to its past miracle that would aid the ailing, flagging global system. To declare stability now is to admit defeat.

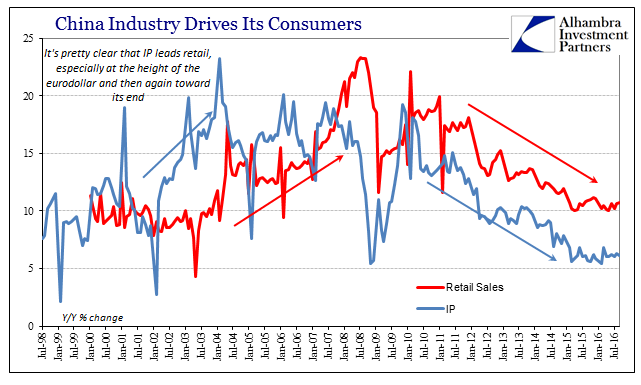

And it is not the first one. This has become a very regular pattern where if lost in the morass of traditional, orthodox perspective the changes in the Chinese economy are obscured along these very lines. In tandem with this supposedly “stabilizing” economy is the Chinese “rebalancing”; where industrial growth predicated on exports was once the driving force of the Chinese “miracle” it shall gently fade in favor of a more modern and benign economy driven as in the West by consumers. This claim first gained serious traction, as excuses always do, the first time the “unexpected” weakness hit.

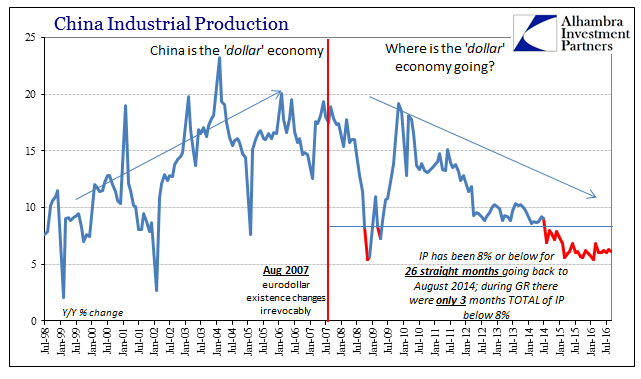

In the years immediately following the Great “Recession”, the Chinese economy seemed to find the same footing it had held all during the later 1990’s and 2000’s. It looked like a recovery in the truest sense of the word, where the idea of rebalancing was ridiculous but from the other end (not needed). It was only when the global economy suddenly and unexpectedly (to economists) fell off after 2011 that Chinese consumers gained any notice.

Part of the reason for that was the fact that the government had undertaken truly massive “stimulus”, both fiscal as well as monetary. To economists, there was just no way it could have been so ineffective as it appeared to be by 2012, so this alternate explanation was developed as if that was instead the whole point; “stimulus” still works, it’s just that, apparently, economists didn’t realize the target for it.

The pattern, however, was repeated a second time starting in 2014. Given the narrow focus of mainstream commentary and “analysis”, the actual trajectory gets lost in the orthodox obsession with recession/not recession. In other words, the Chinese economy, as the US and global economy, ratchets lower after each of these monetary episodes before appearing to “stabilize” at that reduced state of activity/growth. Each time this has happened, twice so far, economists struggle to explain the disparity and are forced to reduce their own standards for judgment – as if 6.1% growth in IP is somehow good when it was around 6% all last year and at that time elicited universal concern.

It’s the same misplaced sigh of relief that is focused on all the wrong things; that when China decelerated coincident to the “rising dollar” it didn’t develop into full recession (straight away). But that misses the main point; the Chinese economy is slowly and progressively getting worse because what is being taken for stability is really just steady decay that doesn’t follow a linear evolution.

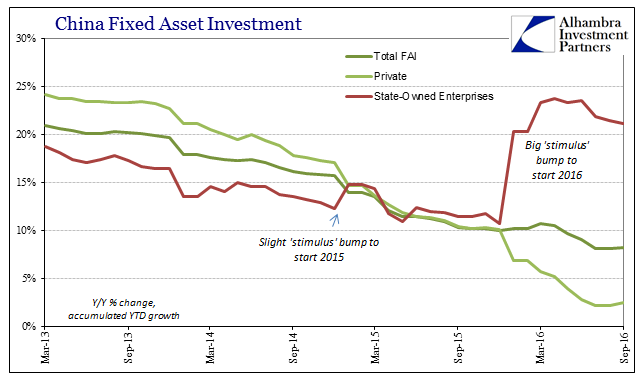

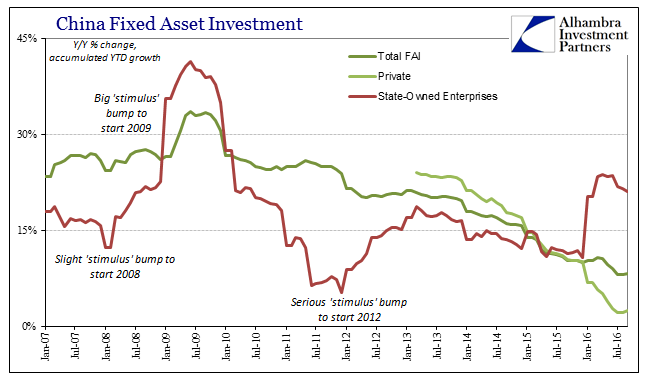

The Chinese government, for its considerable part, hasn’t made the same mistake of interpretation at least so far in 2016. Authorities are clearly very concerned about the state of especially capital investment (so much for top-down rebalancing) and have responded forcefully if not fully panicked by what to them is not at all a stable economy. Where Private Fixed Asset Investment (FAI) has crashed, State-Owned FAI has been restarted exactly along the same lines as in 2009 as well as 2012.

The Chinese may have been more sympathetic to “rebalancing” in 2014, but to start 2015 there was some expressed concern where they stepped up if only slightly at first the contributions of SOE’s to capital investment. In other words, authorities were already slightly wary of the economic environment of the “rising dollar” which quickly turned to, again, almost panic to start 2016.

Like QE in the US and elsewhere, however, it doesn’t work; indeed it hadn’t worked before. These “stimulus” programs don’t actually stimulate the economy, they instead tell us when economic conditions have deteriorated significantly and sufficiently such that policymakers feel compelled to respond. Economists see “stimulus” delivering “stability” (even though it was supposed to lead to actual growth and acceleration) when instead all it does is retroactively confirm the severity of each of these ratcheting periods.

The last two major “stimulus” efforts left China in this precarious state where seven years later the Chinese government still feels compelled into heavy action. In 2009, as you see plainly on the chart above, they greatly ramped up their official efforts in order to combat the effects of what was supposed to be only a temporary if very sharp and deep interruption for the ongoing “miracle.” When it looked like recovery, not rebalancing, those efforts were scaled way back because the usual standards of success appeared to be plausible; only to be reinstituted (along with monetary policy efforts) all over again in 2012.

During each of these “stimulus” periods and their immediate aftermath the Chinese economy appears stable, but only if you don’t consider how “stimulus” didn’t work as it was supposed to, leaving the economy in an appreciably weaker state each time. “Stability” has much different connotations under these conditions; if a fire starts in your house you are not happy that the fire department has it only contained each time it flares up and consumes an additional room or two, especially since each expansion of the conflagration increases the risk of further spreading no matter how stable the blaze might appear in the interim.

That is what economics has become, a shell of its former confident self. When the global economy including China fell off at the end of 2014, it was declared “transitory” weakness that would soon enough dissipate. The expectation was not, then, that such weakness would extend into another full year. Claiming that now as a success is actually the same as admitting “transitory” was wrong; and indeed it was, an entirely predictable outcome that is very clear by taking realistic account of these past seven years.

Stay In Touch