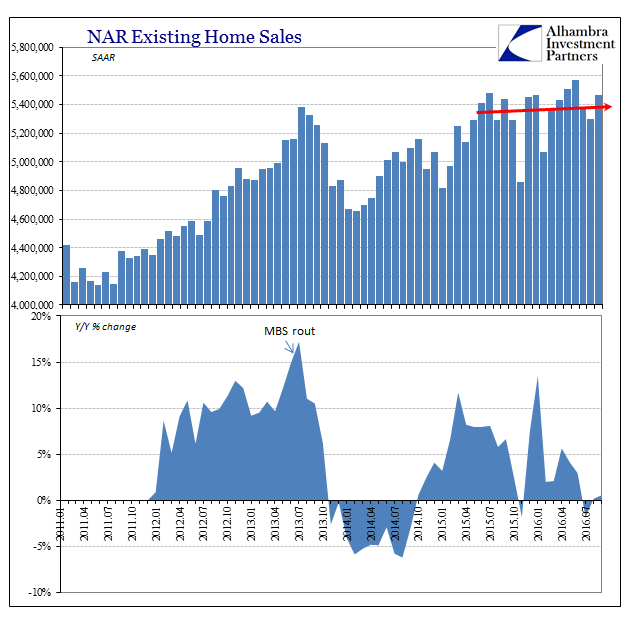

Home resales rebounded in September according to the National Association of Realtors (NAR) from an admittedly lackluster summer. Outside of that narrow view of just the past three months, resales, however, really haven’t grown at all going back to last summer. Year-over-year, sales were down 1.8% in July, up just 0.2% in August, and only 0.6% in September. Like Ford’s contention for auto sales, home sales have similarly stalled or plateaued.

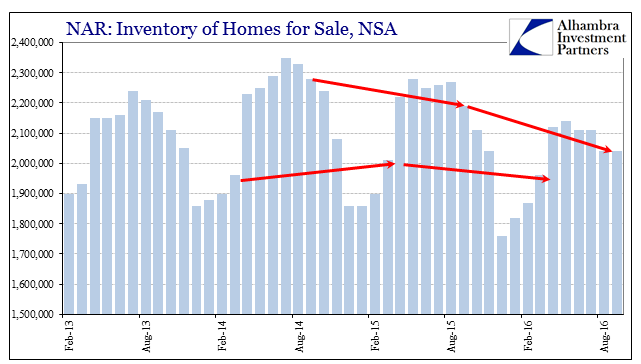

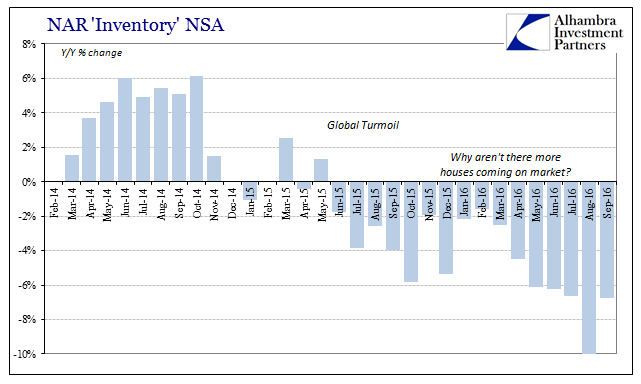

As with the rest of the real estate market, however, what is economically relevant is not what sold but what didn’t – and why. It has been a recurring theme without mainstream answer. In September 2016, once again for-sale inventory declined sharply. Year-over-year, NAR figures that the inventory of homes on the market fell by almost 7%. The level in September 2016 is more than 10% less than what was offered in September 2014.

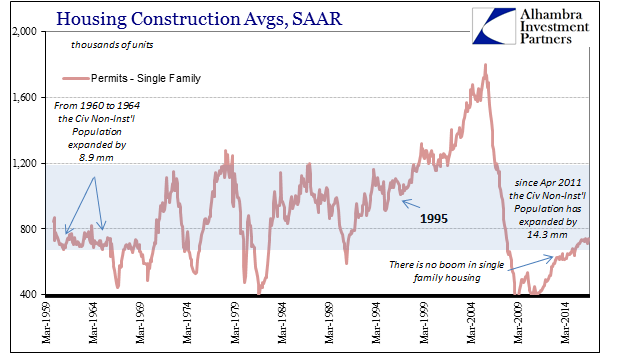

It’s the same “something” that seems to have prevented a boom in new home construction. By simple economics of prices and economy, both resales and new sales should be sharply rising. They are not, so we are left questioning economy – a place that most commentary will not touch because of the unemployment rate. With apartment construction also down or at best flat, where is the real estate momentum?

This imbalance in multi-family has not led to dramatic gains in single family, a segment of the housing stock that should, independent of what is going on in apartments, be already booming. Though there has been often seriously positive growth in construction, it remains highly subdued in historical terms but not to mention given the huge decline in activity during and since the bust. It has been a decade since the top in 2006, and despite population growth construction levels are just nowhere near keeping pace.

It’s a “conundrum” that is shared by NAR’s chief economist Larry Yun, who still subscribes to the positive economic picture (which is why it is for him a mystery).

Inventory has been extremely tight all year and is unlikely to improve now that the seasonal decline in listings is about to kick in. Unfortunately, there won’t be much relief from new home construction, which continues to be grossly inadequate in relation to demand.

I would have to agree that construction is grossly if not blatantly inadequate, but it cannot be in terms of actual demand. I think home builders know better about what is actually going on out there in the real economy and are forced to deal with it as it is rather than how economists continue to see it as it “should” be. If prices are up as is demand because of a robust labor market, then builders as well as resales should be, again, booming. Prices are up, so the fact that sales aren’t leads to uncomfortable conclusions.

The unemployment rate, as well as QE, has skewed analysis like this into the nonsensical. What should be obvious as a matter of basic economics (small “e”) and logic is construed instead as some cryptic enigma to be left unanswered no matter how long it goes on.

Stay In Touch