Does anyone actually believe the employment statistics?

Here's @DonnaBrazile's PUBLIC position on the awesome U.S. economy vs her PRIVATE position 2 @HillaryClinton camp chair #PodestaEmails14 pic.twitter.com/32IVB8r7Da

— Jordan (@JordanChariton) October 21, 2016

In one public tweet, the current head of the DNC plays up the BLS numbers as if they alone indicated something significantly positive. Privately, the same head of the DNC appears very sympathetic to the idea that there really is nothing much to them.

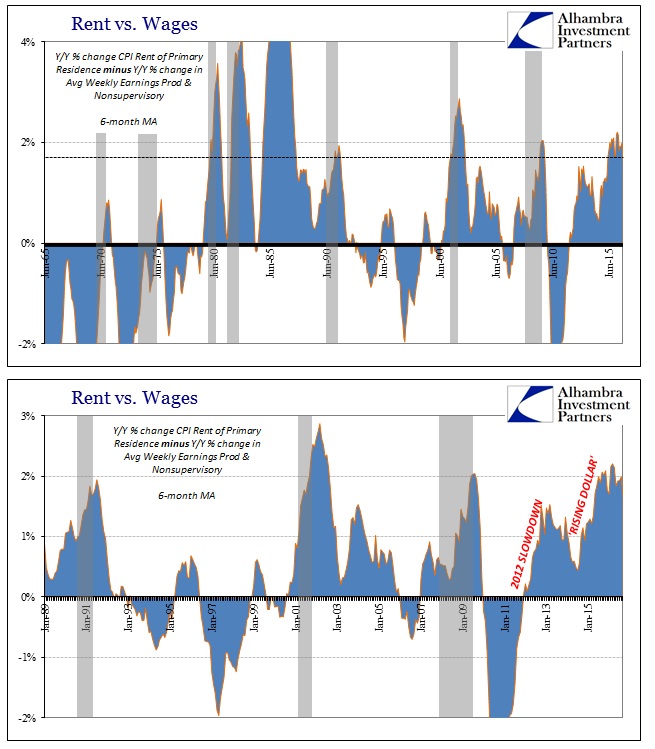

I think people are more in despair about how things are – yes new jobs but they are low wage jobs. HOUSING is a huge issue. Most people pay half of what they make to rent…

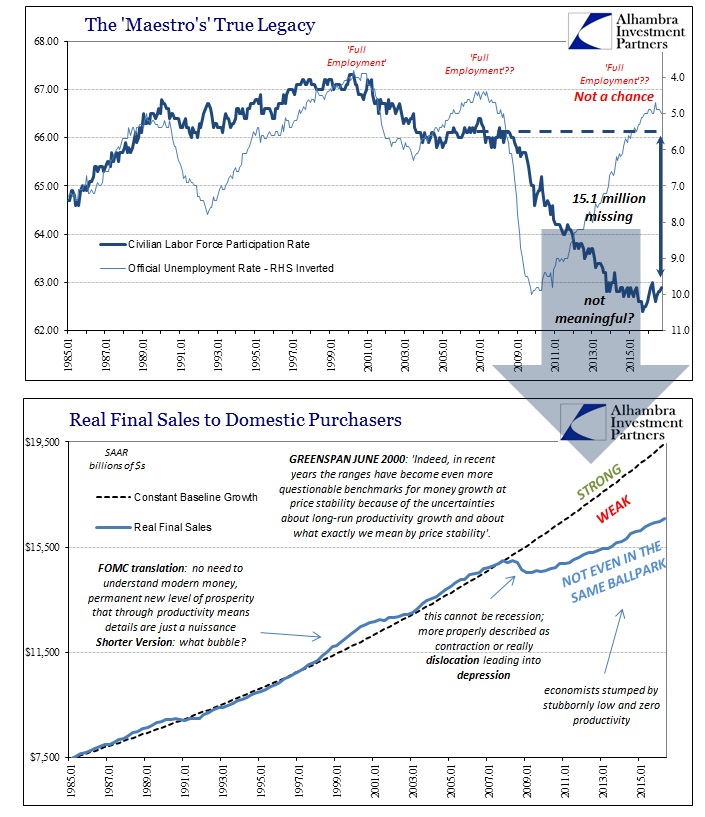

Given their own actions, it doesn’t seem as if the FOMC thinks much of the unemployment rate, either, beyond what it might someday indicate for our possible future economy.

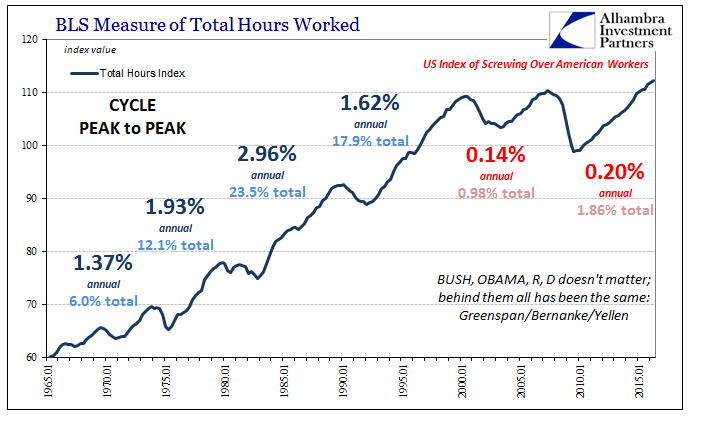

This is not a failing or duplicitous conduct specific to one party; Republicans engaged in the same type of spin during the dot-com recovery, one in which D’s charged was initially as “jobless” as it was. Nobody on either side bothered to figure why, leaving the whole global economy especially vulnerable to the Great “Recession” that has been proven neither great nor a recession. If Donna Brazile is suddenly suspicious of the BLS statistics and how they clearly don’t comport with everyday reality it is because there has been “something” wrong about the economy for years, decades even.

It’s just her turn to be on the hook for what was and remains thoroughly bipartisan failure. Nobody bothered to ask Alan Greenspan any serious questions even though he admitted in the public record he had no idea what the Fed was actually doing to start the 21st century.

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition.

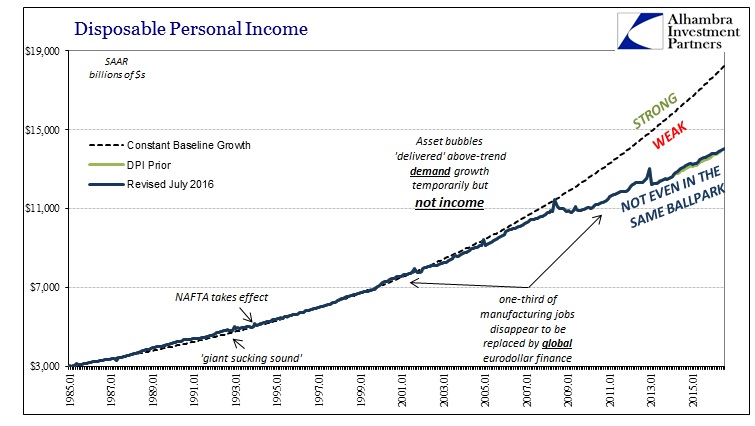

The central bank, charged with the nation’s monetary conditions, didn’t bother to figure out the nation’s monetary condition even though by that point it had seen an epic stock bubble with another even larger housing one right behind it. It was just left to Ben Bernanke because he had all the right credentials and sounded arrogantly confident about some math that politicians were deathly afraid to challenge. And, as you would expect from a common sense perspective, the math was just as useless and worthless as Bernanke’s Princeton pedigree.

Was he ever challenged by either side? Not once, even though what had happened by 2009 had been before declared by him among so many others as all but impossible. Instead, rather than being hoisted to account for the catastrophic failure of the Fed’ s first and primary task, he was somehow proclaimed a courageous inspiration to us all; a shining example of the best America has to offer the world, embraced by majority to this day on both sides of the aisle. To all politicians, it is just coincidence that the economy starts to malfunction just as the asset bubbles show up because Bernanke, as Greenspan, who has the most to lose by admitting what really happened, says so.

Since the unemployment rate is all that is left of his word, it is especially damning that those who have the most to gain this turn can’t even abide by it in private. Maybe there aren’t too many low paying jobs; maybe there just aren’t enough jobs at all. As I wrote on Friday, the issue is really monkeys, M&M’s, and chaos theory, or what passes for technocracy nowadays.

Economics is where technocracy was tried in widescale fashion first, and where it was thought at one time perhaps perfected. The Greenspan Fed, before the dot-com bust it needs to be pointed out, was believed by far too many the Socratic Ideal brought at long last to our world. So enthralling was the arrogance that it has been rationalized down by reality to what looks more like a cult than anything. Don’t believe market warnings, continue to believe The Fed Chair even though she finally confessed that economists can’t afford to keep assuming how little they know is enough.

It all adds up to the same thing all around; Yellen admits economists like her, Bernanke, and Greenspan have depended too much on too slim models crafted of too dubious theory; public officials lament in private that economists haven’t really accomplished that much even though they have been too supportive of them; and the rest of us are left wondering what choice there has been in a republican democracy where the entire political apparatus defers time and again to the same incompetents no matter how “great” and obvious their incompetence.

For the economy and the “dollar”, elections haven’t mattered one bit. You might even get the impression economists, as politicians, prefer it that way.

Stay In Touch